Email

Press Release: ICYMI: Republicans Say Gov. Evers’ $2 Billion Plan to Lower Out-of-Pocket Costs, Provide Tax Relief is “Dead on Arrival”

| From | Gov Evers Press <[email protected]> |

| Subject | Press Release: ICYMI: Republicans Say Gov. Evers’ $2 Billion Plan to Lower Out-of-Pocket Costs, Provide Tax Relief is “Dead on Arrival” |

| Date | February 24, 2025 7:32 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Office of Governor Tony Evers *FOR IMMEDIATE RELEASE:* February 24, 2025 Contact: [email protected] *ICYMI: Republicans Say Gov. Evers’ $2 Billion Plan to Lower Out-of-Pocket Costs, Provide Tax Relief is “Dead on Arrival”* *Republicans Poised to Reject Gov. Evers’ $2 Billion Tax Relief Plan Including $1.45 Billion to Prevent Property Tax Increases for Average Wisconsin Homeowners* "Gov. Evers to travel statewide highlighting comprehensive plan to lower out-of-pocket costs for utility bills, child care, groceries, medication, and doctor visits, cut taxes for working families, seniors, veterans, homeowners, and renters" MADISON — Gov. Evers this week will be traveling across the state to highlight his comprehensive plan to lower everyday, out-of-pocket costs of child care, groceries, utility bills, life-saving medications, and doctor visits while cutting taxes for working families, renters, homeowners, seniors, and veterans. As announced [ [link removed] ] in his 2025-27 Biennial Budget Message last week, Gov. Evers is proposing a comprehensive plan to cut taxes and lower costs for working families. The governor’s budget includes nearly $2 billion in broad-based tax relief across efforts to prevent property tax increases for the average Wisconsin homeowner, exempt many everyday household items and expenses from the sales tax, and cut income taxes for middle-class families, seniors, veterans, renters, and homeowners.

The governor’s visits come in the wake of Legislative Republicans’ statements [ [link removed] ] following the governor’s biennial budget introduction, indicating major provisions of the governor’s budget are “dead on arrival.” Republican lawmakers have signaled they plan to completely gut the governor’s budget as they have previously and will “go back to base,” which would require opposing the governor’s $2 billion in tax relief, the vast majority of which is property tax relief to prevent tax increases for the average Wisconsin homeowner.

The comments represent a sudden reversal by Republicans who, in recent weeks, have repeatedly stated [ [link removed] ] that “all tax cuts are good” and claimed [ [link removed] ] that the primary objective for legislative Republicans this session includes cutting taxes for Wisconsin retirees, holding the line on property taxes, and providing relief for young families.

“I’ll be traveling across Wisconsin this week to meet directly with Wisconsinites about my comprehensive plan to lower everyday, out-of-pocket costs for working families from child care to medication while preventing property tax increases for the average homeowner,” said Gov. Evers. “I’m proposing $2 billion in tax relief for Wisconsinites, including tax cuts for middle-class families, seniors, veterans, homeowners, and renters. It defies logic that Republicans would oppose my plan while having no comprehensive plan of their own to help lower costs for folks across our state. Wisconsinites have made it loud and clear they need a little extra breathing room in their household budgets, so I’ll be making the case for my plan to folks and families across our state, and I urge Republicans to support my comprehensive plan to lower costs and cut taxes for working families.”

*BACKGROUND ON GOV. EVERS’ 2025-27 EXECUTIVE BUDGET PLAN TO LOWER OUT-OF-POCKET COSTS FOR MIDDLE CLASS, WORKING FAMILIES *

Last month, during his 2025-27 State of the State address, Gov. Evers kicked off his budget plan by announcing [ [link removed] ] efforts to cut everyday out-of-pocket costs for working families by reducing the cost of child care and lowering the cost of life-saving medication, including removing the sales tax on over-the-counter medications, capping the cost of insulin copays, and protecting Wisconsinites from price gouging on prescriptions.

Gov. Evers built on these efforts during his 2025-27 Biennial Budget Message last week, by announcing his 2025-27 Executive Budget will also include efforts to hold the line on property taxes, cut taxes for working Wisconsinites, and reduce everyday, out-of-pocket costs for working families by:

* Providing over $1.3 billion in property tax relief to Wisconsinites over the biennium by:

* Preventing property tax increases for the average Wisconsin homeowner in both years of the biennium by making meaningful investments in Wisconsin’s K-12 schools and directing property tax credits to taxpayers through the school levy tax credit;

* Providing more than $1 billion in aid to local governments that agree to freeze property taxes; and

* Increasing property tax relief programs under the individual income tax by $237 million over the biennium for veterans, seniors, individuals with disabilities, and others struggling to afford the property taxes on their homes.

* Eliminating the tax on cash tips, ensuring individuals keep more of their hard-earned money in their pockets to the total of $13.6 million over the biennium;

* Eliminating the sales tax on everyday household items and costs, including over-the-counter medications and utility bills, saving Wisconsinites more than $261 million over the biennium;

* Providing more than $116 million in meaningful tax relief for working families by enhancing the Earned Income Tax Credit (EITC); and

* Nearly doubling the personal tax exemption under the Wisconsin individual income tax, helping Wisconsinites keep $225.9 million more of their money over the biennium.

*PROVIDING PROPERTY TAX RELIEF AND PREVENTING TAX INCREASES FOR THE AVERAGE WISCONSIN HOMEOWNER *

According to a December 2024 report [ [link removed] ] from the Wisconsin Policy Forum, property taxes in Wisconsin are expected to see the largest increase since 2009, and in any given year, K-12 schools make up nearly half of all local property tax levies in Wisconsin.

Therefore, the governor’s 2025-27 Executive Budget will deliver relief to property taxpayers by ensuring that school districts receive meaningful revenue-raising authority while also holding net school property tax impact flat by ensuring the state makes meaningful, substantial investments in K-12 schools statewide. The governor is proposing a $3.1 billion investment in kids and schools, nearly all of which is spendable revenue for schools, as well as $375 million in school levy tax credits to provide direct property tax relief back to property taxpayers. This will bring the state’s total support for school revenues to over 70 percent in both years of the biennium—once again, reaching and surpassing the state’s goal to provide two-thirds funding to public schools statewide.

Additionally, to hold the line on local property taxes and prevent further increases in tax bills on the typical Wisconsin homeowner, Gov. Evers is proposing a more than $1 billion investment in aid to local governments and direct property tax credits to taxpayers over the biennium. The governor’s proposal would create a new county and municipal property tax freeze incentive program by providing aid payments to counties and municipalities that commit to holding the line on property taxes. Communities that do not increase their levy will receive aid payments based on the revenue a three percent levy would have generated, helping them to maintain essential services without raising taxes. The first eligible levies for this incentive will be for the 2026 tax year, delivering meaningful tax relief to Wisconsinites.

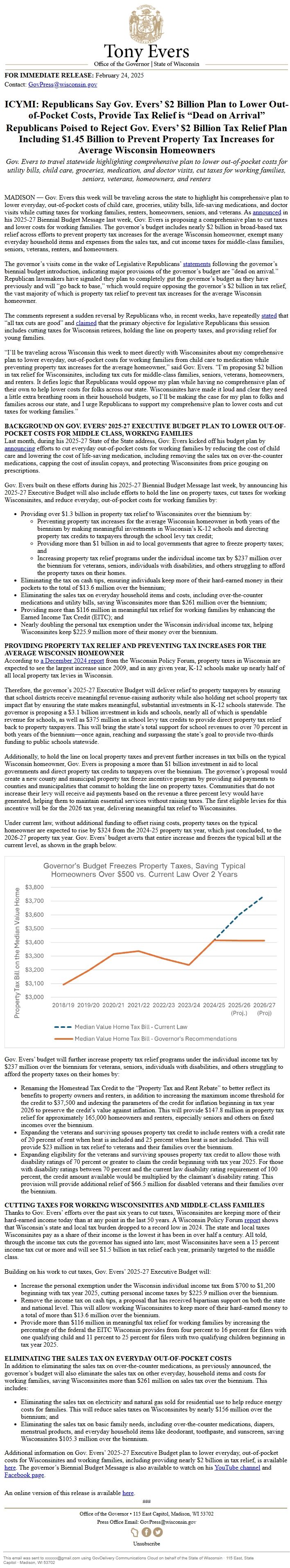

Under current law, without additional funding to offset rising costs, property taxes on the typical homeowner are expected to rise by $324 from the 2024-25 property tax year, which just concluded, to the 2026-27 property tax year. Gov. Evers’ budget averts that entire increase and freezes the typical bill at the current level, as shown in the graph below.

Governor's Budget Freezes Property Taxes, Saving Typical Homeowners Over $500 vs. Current Law Over 2 Years

Gov. Evers’ budget will further increase property tax relief programs under the individual income tax by $237 million over the biennium for veterans, seniors, individuals with disabilities, and others struggling to afford the property taxes on their homes by:

* Renaming the Homestead Tax Credit to the “Property Tax and Rent Rebate” to better reflect its benefits to property owners and renters, in addition to increasing the maximum income threshold for the credit to $37,500 and indexing the parameters of the credit for inflation beginning in tax year 2026 to preserve the credit’s value against inflation. This will provide $147.8 million in property tax relief for approximately 165,000 homeowners and renters, especially seniors and others on fixed incomes over the biennium.

* Expanding the veterans and surviving spouses property tax credit to include renters with a credit rate of 20 percent of rent when heat is included and 25 percent when heat is not included. This will provide $23 million in tax relief to veterans and their families over the biennium.

* Expanding eligibility for the veterans and surviving spouses property tax credit to allow those with disability ratings of 70 percent or greater to claim the credit beginning with tax year 2025. For those with disability ratings between 70 percent and the current law disability rating requirement of 100 percent, the credit amount available would be multiplied by the claimant’s disability rating. This provision will provide additional relief of $66.5 million for disabled veterans and their families over the biennium.

*CUTTING TAXES FOR WORKING WISCONSINITES AND MIDDLE-CLASS FAMILIES*

Thanks to Gov. Evers’ efforts over the past six years to cut taxes, Wisconsinites are keeping more of their hard-earned income today than at any point in the last 50 years. A Wisconsin Policy Forum report [ [link removed] ] shows that Wisconsin’s state and local tax burden dropped to a record low in 2024. The state and local taxes Wisconsinites pay as a share of their income is the lowest it has been in over half a century. All told, through the income tax cuts the governor has signed into law, most Wisconsinites have seen a 15 percent income tax cut or more and will see $1.5 billion in tax relief each year, primarily targeted to the middle class.

Building on his work to cut taxes, Gov. Evers’ 2025-27 Executive Budget will:

* Increase the personal exemption under the Wisconsin individual income tax from $700 to $1,200 beginning with tax year 2025, cutting personal income taxes by $225.9 million over the biennium.

* Remove the income tax on cash tips, a proposal that has received bipartisan support on both the state and national level. This will allow working Wisconsinites to keep more of their hard-earned money to a total of more than $13.6 million over the biennium.

* Provide more than $116 million in meaningful tax relief for working families by increasing the percentage of the federal the EITC Wisconsin provides from four percent to 16 percent for filers with one qualifying child and 11 percent to 25 percent for filers with two qualifying children beginning in tax year 2025.

*ELIMINATING THE SALES TAX ON EVERYDAY OUT-OF-POCKET COSTS*

In addition to eliminating the sales tax on over-the-counter medications, as previously announced, the governor’s budget will also eliminate the sales tax on other everyday, household items and costs for working families, saving Wisconsinites more than $261 million on sales tax over the biennium. This includes:

* Eliminating the sales tax on electricity and natural gas sold for residential use to help reduce energy costs for families. This will reduce sales taxes on Wisconsinites by nearly $156 million over the biennium; and

* Eliminating the sales tax on basic family needs, including over-the-counter medications, diapers, menstrual products, and everyday household items like deodorant, toothpaste, and sunscreen, saving Wisconsinites $105.3 million over the biennium.

Additional information on Gov. Evers’ 2025-27 Executive Budget plan to lower everyday, out-of-pocket costs for Wisconsinites and working families, including providing nearly $2 billion in tax relief, is available here [ [link removed] ]. The governor’s Biennial Budget Message is also available to watch on his YouTube channel [ [link removed] ] and Facebook page [ [link removed] ].

An online version of this release is available here [ [link removed] ]. ###

Gold Horizontal Line Office of the Governor • 115 East Capitol, Madison, WI 53702 Press Office Email: [email protected] https:evers [ [link removed] ] [link removed] [link removed] Unsubscribe [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the State of Wisconsin · 115 East, State Capitol · Madison, WI 53702

The governor’s visits come in the wake of Legislative Republicans’ statements [ [link removed] ] following the governor’s biennial budget introduction, indicating major provisions of the governor’s budget are “dead on arrival.” Republican lawmakers have signaled they plan to completely gut the governor’s budget as they have previously and will “go back to base,” which would require opposing the governor’s $2 billion in tax relief, the vast majority of which is property tax relief to prevent tax increases for the average Wisconsin homeowner.

The comments represent a sudden reversal by Republicans who, in recent weeks, have repeatedly stated [ [link removed] ] that “all tax cuts are good” and claimed [ [link removed] ] that the primary objective for legislative Republicans this session includes cutting taxes for Wisconsin retirees, holding the line on property taxes, and providing relief for young families.

“I’ll be traveling across Wisconsin this week to meet directly with Wisconsinites about my comprehensive plan to lower everyday, out-of-pocket costs for working families from child care to medication while preventing property tax increases for the average homeowner,” said Gov. Evers. “I’m proposing $2 billion in tax relief for Wisconsinites, including tax cuts for middle-class families, seniors, veterans, homeowners, and renters. It defies logic that Republicans would oppose my plan while having no comprehensive plan of their own to help lower costs for folks across our state. Wisconsinites have made it loud and clear they need a little extra breathing room in their household budgets, so I’ll be making the case for my plan to folks and families across our state, and I urge Republicans to support my comprehensive plan to lower costs and cut taxes for working families.”

*BACKGROUND ON GOV. EVERS’ 2025-27 EXECUTIVE BUDGET PLAN TO LOWER OUT-OF-POCKET COSTS FOR MIDDLE CLASS, WORKING FAMILIES *

Last month, during his 2025-27 State of the State address, Gov. Evers kicked off his budget plan by announcing [ [link removed] ] efforts to cut everyday out-of-pocket costs for working families by reducing the cost of child care and lowering the cost of life-saving medication, including removing the sales tax on over-the-counter medications, capping the cost of insulin copays, and protecting Wisconsinites from price gouging on prescriptions.

Gov. Evers built on these efforts during his 2025-27 Biennial Budget Message last week, by announcing his 2025-27 Executive Budget will also include efforts to hold the line on property taxes, cut taxes for working Wisconsinites, and reduce everyday, out-of-pocket costs for working families by:

* Providing over $1.3 billion in property tax relief to Wisconsinites over the biennium by:

* Preventing property tax increases for the average Wisconsin homeowner in both years of the biennium by making meaningful investments in Wisconsin’s K-12 schools and directing property tax credits to taxpayers through the school levy tax credit;

* Providing more than $1 billion in aid to local governments that agree to freeze property taxes; and

* Increasing property tax relief programs under the individual income tax by $237 million over the biennium for veterans, seniors, individuals with disabilities, and others struggling to afford the property taxes on their homes.

* Eliminating the tax on cash tips, ensuring individuals keep more of their hard-earned money in their pockets to the total of $13.6 million over the biennium;

* Eliminating the sales tax on everyday household items and costs, including over-the-counter medications and utility bills, saving Wisconsinites more than $261 million over the biennium;

* Providing more than $116 million in meaningful tax relief for working families by enhancing the Earned Income Tax Credit (EITC); and

* Nearly doubling the personal tax exemption under the Wisconsin individual income tax, helping Wisconsinites keep $225.9 million more of their money over the biennium.

*PROVIDING PROPERTY TAX RELIEF AND PREVENTING TAX INCREASES FOR THE AVERAGE WISCONSIN HOMEOWNER *

According to a December 2024 report [ [link removed] ] from the Wisconsin Policy Forum, property taxes in Wisconsin are expected to see the largest increase since 2009, and in any given year, K-12 schools make up nearly half of all local property tax levies in Wisconsin.

Therefore, the governor’s 2025-27 Executive Budget will deliver relief to property taxpayers by ensuring that school districts receive meaningful revenue-raising authority while also holding net school property tax impact flat by ensuring the state makes meaningful, substantial investments in K-12 schools statewide. The governor is proposing a $3.1 billion investment in kids and schools, nearly all of which is spendable revenue for schools, as well as $375 million in school levy tax credits to provide direct property tax relief back to property taxpayers. This will bring the state’s total support for school revenues to over 70 percent in both years of the biennium—once again, reaching and surpassing the state’s goal to provide two-thirds funding to public schools statewide.

Additionally, to hold the line on local property taxes and prevent further increases in tax bills on the typical Wisconsin homeowner, Gov. Evers is proposing a more than $1 billion investment in aid to local governments and direct property tax credits to taxpayers over the biennium. The governor’s proposal would create a new county and municipal property tax freeze incentive program by providing aid payments to counties and municipalities that commit to holding the line on property taxes. Communities that do not increase their levy will receive aid payments based on the revenue a three percent levy would have generated, helping them to maintain essential services without raising taxes. The first eligible levies for this incentive will be for the 2026 tax year, delivering meaningful tax relief to Wisconsinites.

Under current law, without additional funding to offset rising costs, property taxes on the typical homeowner are expected to rise by $324 from the 2024-25 property tax year, which just concluded, to the 2026-27 property tax year. Gov. Evers’ budget averts that entire increase and freezes the typical bill at the current level, as shown in the graph below.

Governor's Budget Freezes Property Taxes, Saving Typical Homeowners Over $500 vs. Current Law Over 2 Years

Gov. Evers’ budget will further increase property tax relief programs under the individual income tax by $237 million over the biennium for veterans, seniors, individuals with disabilities, and others struggling to afford the property taxes on their homes by:

* Renaming the Homestead Tax Credit to the “Property Tax and Rent Rebate” to better reflect its benefits to property owners and renters, in addition to increasing the maximum income threshold for the credit to $37,500 and indexing the parameters of the credit for inflation beginning in tax year 2026 to preserve the credit’s value against inflation. This will provide $147.8 million in property tax relief for approximately 165,000 homeowners and renters, especially seniors and others on fixed incomes over the biennium.

* Expanding the veterans and surviving spouses property tax credit to include renters with a credit rate of 20 percent of rent when heat is included and 25 percent when heat is not included. This will provide $23 million in tax relief to veterans and their families over the biennium.

* Expanding eligibility for the veterans and surviving spouses property tax credit to allow those with disability ratings of 70 percent or greater to claim the credit beginning with tax year 2025. For those with disability ratings between 70 percent and the current law disability rating requirement of 100 percent, the credit amount available would be multiplied by the claimant’s disability rating. This provision will provide additional relief of $66.5 million for disabled veterans and their families over the biennium.

*CUTTING TAXES FOR WORKING WISCONSINITES AND MIDDLE-CLASS FAMILIES*

Thanks to Gov. Evers’ efforts over the past six years to cut taxes, Wisconsinites are keeping more of their hard-earned income today than at any point in the last 50 years. A Wisconsin Policy Forum report [ [link removed] ] shows that Wisconsin’s state and local tax burden dropped to a record low in 2024. The state and local taxes Wisconsinites pay as a share of their income is the lowest it has been in over half a century. All told, through the income tax cuts the governor has signed into law, most Wisconsinites have seen a 15 percent income tax cut or more and will see $1.5 billion in tax relief each year, primarily targeted to the middle class.

Building on his work to cut taxes, Gov. Evers’ 2025-27 Executive Budget will:

* Increase the personal exemption under the Wisconsin individual income tax from $700 to $1,200 beginning with tax year 2025, cutting personal income taxes by $225.9 million over the biennium.

* Remove the income tax on cash tips, a proposal that has received bipartisan support on both the state and national level. This will allow working Wisconsinites to keep more of their hard-earned money to a total of more than $13.6 million over the biennium.

* Provide more than $116 million in meaningful tax relief for working families by increasing the percentage of the federal the EITC Wisconsin provides from four percent to 16 percent for filers with one qualifying child and 11 percent to 25 percent for filers with two qualifying children beginning in tax year 2025.

*ELIMINATING THE SALES TAX ON EVERYDAY OUT-OF-POCKET COSTS*

In addition to eliminating the sales tax on over-the-counter medications, as previously announced, the governor’s budget will also eliminate the sales tax on other everyday, household items and costs for working families, saving Wisconsinites more than $261 million on sales tax over the biennium. This includes:

* Eliminating the sales tax on electricity and natural gas sold for residential use to help reduce energy costs for families. This will reduce sales taxes on Wisconsinites by nearly $156 million over the biennium; and

* Eliminating the sales tax on basic family needs, including over-the-counter medications, diapers, menstrual products, and everyday household items like deodorant, toothpaste, and sunscreen, saving Wisconsinites $105.3 million over the biennium.

Additional information on Gov. Evers’ 2025-27 Executive Budget plan to lower everyday, out-of-pocket costs for Wisconsinites and working families, including providing nearly $2 billion in tax relief, is available here [ [link removed] ]. The governor’s Biennial Budget Message is also available to watch on his YouTube channel [ [link removed] ] and Facebook page [ [link removed] ].

An online version of this release is available here [ [link removed] ]. ###

Gold Horizontal Line Office of the Governor • 115 East Capitol, Madison, WI 53702 Press Office Email: [email protected] https:evers [ [link removed] ] [link removed] [link removed] Unsubscribe [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the State of Wisconsin · 115 East, State Capitol · Madison, WI 53702

Message Analysis

- Sender: Tony Evers

- Political Party: Democratic

- Country: United States

- State/Locality: Wisconsin

- Office: State Governor

-

Email Providers:

- govDelivery