Email

Trump Is, Once Again, Inheriting a Historically Strong Economy. That Wasn’t Guaranteed.

| From | Fireside Stacks <[email protected]> |

| Subject | Trump Is, Once Again, Inheriting a Historically Strong Economy. That Wasn’t Guaranteed. |

| Date | January 25, 2025 2:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

President Donald Trump, having handed off [ [link removed] ] the worst economy of any modern president on his way out four years ago (obviously with a strong assist from COVID), inherited arguably the strongest economy of any president since the 1960s this week. As we wait to see the effects of Trump’s avalanche of executive actions and the fate of his legislative agenda, we should be clear about the baseline from which he is starting.

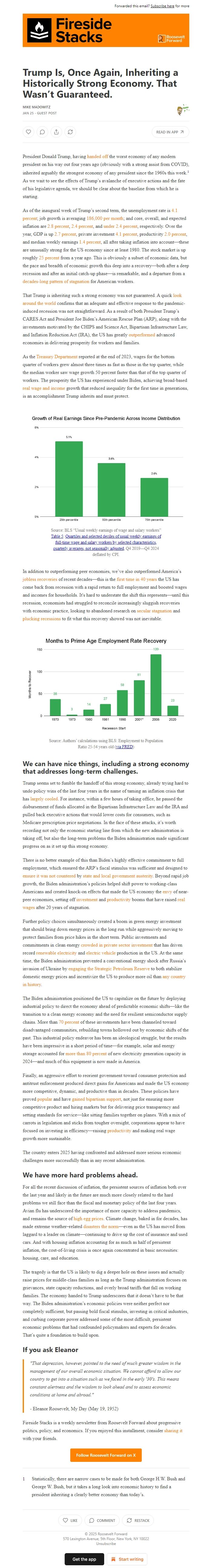

As of the inaugural week of Trump’s second term, the unemployment rate is 4.1 percent [ [link removed] ]; job growth is averaging 186,000 per month [ [link removed] ]; and core, overall, and expected inflation are 2.8 percent [ [link removed] ], 2.4 percent [ [link removed] ], and under 2.4 percent [ [link removed] ], respectively. Over the year, GDP is up 2.7 percent [ [link removed] ], private investment 4.1 percent [ [link removed] ], productivity 2.0 percent [ [link removed] ], and median weekly earnings 1.4 percent [ [link removed] ], all after taking inflation into account—these are unusually strong for the US economy since at least 1980. The stock market is up roughly 25 percent [ [link removed] ] from a year ago. This is obviously a subset of economic data, but the pace and breadth of economic growth this deep into a recovery—both after a deep recession and after an initial catch-up phase—is remarkable, and a departure from a decades-long pattern of stagnation [ [link removed] ] for American workers.

That Trump is inheriting such a strong economy was not guaranteed. A quick look around the world [ [link removed] ] confirms that an adequate and effective response to the pandemic-induced recession was not straightforward. As a result of both President Trump’s CARES Act and President Joe Biden’s American Rescue Plan (ARP), along with the investments motivated by the CHIPS and Science Act, Bipartisan Infrastructure Law, and Inflation Reduction Act (IRA), the US has greatly outperformed [ [link removed] ] advanced economies in delivering prosperity for workers and families.

As the Treasury Department [ [link removed] ] reported at the end of 2023, wages for the bottom quarter of workers grew almost three times as fast as those in the top quarter, while the median worker saw wage growth 50 percent faster than that of the top quarter of workers. The prosperity the US has experienced under Biden, achieving broad-based real wage and income [ [link removed] ] growth that reduced inequality for the first time in generations, is an accomplishment Trump inherits and must protect.

In addition to outperforming peer economies, we’ve also outperformed America’s jobless recoveries [ [link removed] ] of recent decades—this is the first time in 40 years [ [link removed] ] the US has come back from recession with a rapid return to full employment and boosted wages and incomes for households. It's hard to understate the shift this represents—until this recession, economists had struggled to reconcile increasingly sluggish recoveries with economic practice, looking to abandoned research on secular stagnation [ [link removed] ] and plucking recessions [ [link removed] ] to fit what this recovery showed was not inevitable.

We can have nice things, including a strong economy that addresses long-term challenges.

Trump seems set to fumble the handoff of this strong economy, already trying hard to undo policy wins of the last four years in the name of taming an inflation crisis that has largely cooled [ [link removed] ]. For instance, within a few hours of taking office, he paused the disbursement of funds allocated in the Bipartisan Infrastructure Law and the IRA and pulled back executive actions that would lower costs for consumers, such as Medicare prescription price negotiations. In the face of these attacks, it’s worth recording not only the economic starting line from which the new administration is taking off, but also the long-term problems the Biden administration made significant progress on as it set up this strong economy.

There is no better example of this than Biden’s highly effective commitment to full employment, which ensured the ARP’s fiscal stimulus was sufficient and designed to ensure it was not countered [ [link removed] ] by state and local government austerity [ [link removed] ]. Beyond rapid job growth, the Biden administration’s policies helped shift power to working-class Americans and created knock-on effects that made the US economy the envy [ [link removed] ] of near-peer economies, setting off investment [ [link removed] ] and productivity [ [link removed] ] booms that have raised real wages [ [link removed] ] after 20 years of stagnation.

Further policy choices simultaneously created a boom in green energy investment that should bring down energy prices in the long run while aggressively moving to protect families from price hikes in the short term. Public investments and commitments in clean energy crowded in private sector investment [ [link removed] ] that has driven record renewable electricity [ [link removed] ] and electric vehicle [ [link removed] ] production in the US. At the same time, the Biden administration prevented a conventional energy shock after Russia’s invasion of Ukraine by engaging the Strategic Petroleum Reserve [ [link removed] ] to both stabilize domestic energy prices and incentivize the US to produce more oil than any country in history [ [link removed] ].

The Biden administration positioned the US to capitalize on the future by deploying industrial policy to direct the economy ahead of predictable economic shifts—like the transition to a clean energy economy and the need for resilient semiconductor supply chains. More than 70 percent [ [link removed] ] of these investments have been channeled toward disadvantaged communities, rebuilding towns hollowed out by economic shifts of the past. This industrial policy endeavor has been an ideological struggle, but the results have been impressive in a short period of time—for example, solar and energy storage accounted for more than 80 percent [ [link removed] ] of new electricity generation capacity in 2024—and much of this equipment is now made in America.

Finally, an aggressive effort to reorient government toward consumer protection and antitrust enforcement produced direct gains for Americans and made the US economy more competitive, dynamic, and productive than in decades. These policies have proved popular [ [link removed] ] and have gained bipartisan support [ [link removed] ], not just for ensuring more competitive product and hiring markets but for delivering price transparency and setting standards for service—like sitting families together on planes. With a mix of carrots in legislation and sticks from tougher oversight, corporations appear to have focused on investing in efficiency—raising productivity [ [link removed] ] and making real wage growth more sustainable.

The country enters 2025 having confronted and addressed more serious economic challenges more successfully than in any recent administration.

We have more hard problems ahead.

For all the recent discussion of inflation, the persistent sources of inflation both over the last year and likely in the future are much more closely related to the hard problems we still face than the fiscal and monetary policy of the last four years. Avian flu has underscored the importance of more capacity to address pandemics, and remains the source of high egg prices [ [link removed] ]. Climate change, baked in for decades, has made extreme weather–related disasters the norm [ [link removed] ]—even as the US has moved from laggard to a leader on climate—continuing to drive up the cost of insurance and used cars. And with housing inflation accounting for as much as half of persistent inflation, the cost-of-living crisis is once again concentrated in basic necessities: housing, care, and education.

The tragedy is that the US is likely to dig a deeper hole on these issues and actually raise prices for middle-class families as long as the Trump administration focuses on grievances, state capacity reductions, and overly broad tariffs that fall on working families. The economy handed to Trump underscores that it doesn’t have to be that way. The Biden administration’s economic policies were neither perfect nor completely sufficient, but passing bold fiscal stimulus, investing in critical industries, and curbing corporate power addressed some of the most difficult, persistent economic problems that had confounded policymakers and experts for decades. That’s quite a foundation to build upon.

If you ask Eleanor

"That depression, however, pointed to the need of much greater wisdom in the management of our overall economic situation. We cannot afford to allow our country to get into a situation such as we faced in the early '30's. This means constant alertness and the wisdom to look ahead and to assess economic conditions at home and abroad."

- Eleanor Roosevelt, My Day (May 19, 1952)

Fireside Stacks is a weekly newsletter from Roosevelt Forward about progressive politics, policy, and economics. If you enjoyed this installment, consider sharing it [ [link removed] ] with your friends.

Unsubscribe [link removed]?

President Donald Trump, having handed off [ [link removed] ] the worst economy of any modern president on his way out four years ago (obviously with a strong assist from COVID), inherited arguably the strongest economy of any president since the 1960s this week. As we wait to see the effects of Trump’s avalanche of executive actions and the fate of his legislative agenda, we should be clear about the baseline from which he is starting.

As of the inaugural week of Trump’s second term, the unemployment rate is 4.1 percent [ [link removed] ]; job growth is averaging 186,000 per month [ [link removed] ]; and core, overall, and expected inflation are 2.8 percent [ [link removed] ], 2.4 percent [ [link removed] ], and under 2.4 percent [ [link removed] ], respectively. Over the year, GDP is up 2.7 percent [ [link removed] ], private investment 4.1 percent [ [link removed] ], productivity 2.0 percent [ [link removed] ], and median weekly earnings 1.4 percent [ [link removed] ], all after taking inflation into account—these are unusually strong for the US economy since at least 1980. The stock market is up roughly 25 percent [ [link removed] ] from a year ago. This is obviously a subset of economic data, but the pace and breadth of economic growth this deep into a recovery—both after a deep recession and after an initial catch-up phase—is remarkable, and a departure from a decades-long pattern of stagnation [ [link removed] ] for American workers.

That Trump is inheriting such a strong economy was not guaranteed. A quick look around the world [ [link removed] ] confirms that an adequate and effective response to the pandemic-induced recession was not straightforward. As a result of both President Trump’s CARES Act and President Joe Biden’s American Rescue Plan (ARP), along with the investments motivated by the CHIPS and Science Act, Bipartisan Infrastructure Law, and Inflation Reduction Act (IRA), the US has greatly outperformed [ [link removed] ] advanced economies in delivering prosperity for workers and families.

As the Treasury Department [ [link removed] ] reported at the end of 2023, wages for the bottom quarter of workers grew almost three times as fast as those in the top quarter, while the median worker saw wage growth 50 percent faster than that of the top quarter of workers. The prosperity the US has experienced under Biden, achieving broad-based real wage and income [ [link removed] ] growth that reduced inequality for the first time in generations, is an accomplishment Trump inherits and must protect.

In addition to outperforming peer economies, we’ve also outperformed America’s jobless recoveries [ [link removed] ] of recent decades—this is the first time in 40 years [ [link removed] ] the US has come back from recession with a rapid return to full employment and boosted wages and incomes for households. It's hard to understate the shift this represents—until this recession, economists had struggled to reconcile increasingly sluggish recoveries with economic practice, looking to abandoned research on secular stagnation [ [link removed] ] and plucking recessions [ [link removed] ] to fit what this recovery showed was not inevitable.

We can have nice things, including a strong economy that addresses long-term challenges.

Trump seems set to fumble the handoff of this strong economy, already trying hard to undo policy wins of the last four years in the name of taming an inflation crisis that has largely cooled [ [link removed] ]. For instance, within a few hours of taking office, he paused the disbursement of funds allocated in the Bipartisan Infrastructure Law and the IRA and pulled back executive actions that would lower costs for consumers, such as Medicare prescription price negotiations. In the face of these attacks, it’s worth recording not only the economic starting line from which the new administration is taking off, but also the long-term problems the Biden administration made significant progress on as it set up this strong economy.

There is no better example of this than Biden’s highly effective commitment to full employment, which ensured the ARP’s fiscal stimulus was sufficient and designed to ensure it was not countered [ [link removed] ] by state and local government austerity [ [link removed] ]. Beyond rapid job growth, the Biden administration’s policies helped shift power to working-class Americans and created knock-on effects that made the US economy the envy [ [link removed] ] of near-peer economies, setting off investment [ [link removed] ] and productivity [ [link removed] ] booms that have raised real wages [ [link removed] ] after 20 years of stagnation.

Further policy choices simultaneously created a boom in green energy investment that should bring down energy prices in the long run while aggressively moving to protect families from price hikes in the short term. Public investments and commitments in clean energy crowded in private sector investment [ [link removed] ] that has driven record renewable electricity [ [link removed] ] and electric vehicle [ [link removed] ] production in the US. At the same time, the Biden administration prevented a conventional energy shock after Russia’s invasion of Ukraine by engaging the Strategic Petroleum Reserve [ [link removed] ] to both stabilize domestic energy prices and incentivize the US to produce more oil than any country in history [ [link removed] ].

The Biden administration positioned the US to capitalize on the future by deploying industrial policy to direct the economy ahead of predictable economic shifts—like the transition to a clean energy economy and the need for resilient semiconductor supply chains. More than 70 percent [ [link removed] ] of these investments have been channeled toward disadvantaged communities, rebuilding towns hollowed out by economic shifts of the past. This industrial policy endeavor has been an ideological struggle, but the results have been impressive in a short period of time—for example, solar and energy storage accounted for more than 80 percent [ [link removed] ] of new electricity generation capacity in 2024—and much of this equipment is now made in America.

Finally, an aggressive effort to reorient government toward consumer protection and antitrust enforcement produced direct gains for Americans and made the US economy more competitive, dynamic, and productive than in decades. These policies have proved popular [ [link removed] ] and have gained bipartisan support [ [link removed] ], not just for ensuring more competitive product and hiring markets but for delivering price transparency and setting standards for service—like sitting families together on planes. With a mix of carrots in legislation and sticks from tougher oversight, corporations appear to have focused on investing in efficiency—raising productivity [ [link removed] ] and making real wage growth more sustainable.

The country enters 2025 having confronted and addressed more serious economic challenges more successfully than in any recent administration.

We have more hard problems ahead.

For all the recent discussion of inflation, the persistent sources of inflation both over the last year and likely in the future are much more closely related to the hard problems we still face than the fiscal and monetary policy of the last four years. Avian flu has underscored the importance of more capacity to address pandemics, and remains the source of high egg prices [ [link removed] ]. Climate change, baked in for decades, has made extreme weather–related disasters the norm [ [link removed] ]—even as the US has moved from laggard to a leader on climate—continuing to drive up the cost of insurance and used cars. And with housing inflation accounting for as much as half of persistent inflation, the cost-of-living crisis is once again concentrated in basic necessities: housing, care, and education.

The tragedy is that the US is likely to dig a deeper hole on these issues and actually raise prices for middle-class families as long as the Trump administration focuses on grievances, state capacity reductions, and overly broad tariffs that fall on working families. The economy handed to Trump underscores that it doesn’t have to be that way. The Biden administration’s economic policies were neither perfect nor completely sufficient, but passing bold fiscal stimulus, investing in critical industries, and curbing corporate power addressed some of the most difficult, persistent economic problems that had confounded policymakers and experts for decades. That’s quite a foundation to build upon.

If you ask Eleanor

"That depression, however, pointed to the need of much greater wisdom in the management of our overall economic situation. We cannot afford to allow our country to get into a situation such as we faced in the early '30's. This means constant alertness and the wisdom to look ahead and to assess economic conditions at home and abroad."

- Eleanor Roosevelt, My Day (May 19, 1952)

Fireside Stacks is a weekly newsletter from Roosevelt Forward about progressive politics, policy, and economics. If you enjoyed this installment, consider sharing it [ [link removed] ] with your friends.

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a