Email

China’s Global Investment Patterns

| From | AEI DataPoints <[email protected]> |

| Subject | China’s Global Investment Patterns |

| Date | January 23, 2025 12:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Expert analysis made easy. Breaking down the news with data, charts, and maps.

Edited by James Desio and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine China’s international investment patterns, the economic importance of high-skilled immigration, and China’s growing role in the semiconductor sphere.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. Accounting for China’s Investment Abroad

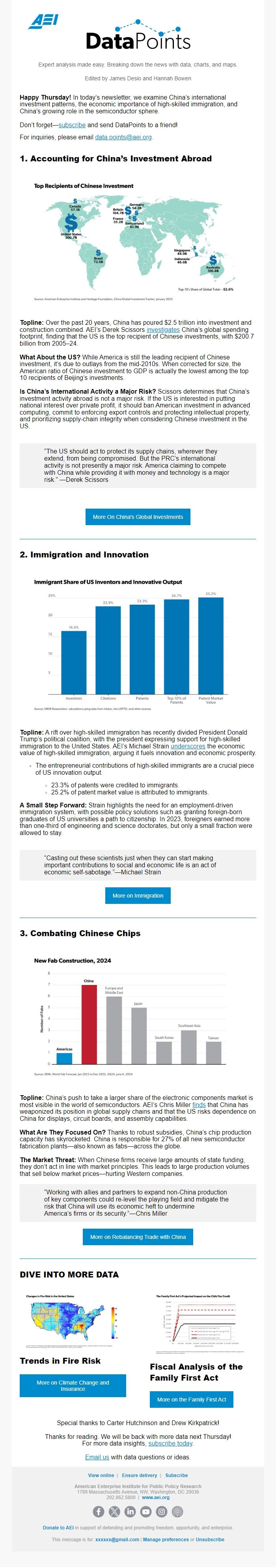

Topline: Over the past 20 years, China has poured $2.5 trillion into investment and construction combined. AEI’s Derek Scissors investigates <[link removed]> China’s global spending footprint, finding that the US is the top recipient of Chinese investments, with $200.7 billion from 2005–24.

What About the US? While America is still the leading recipient of Chinese investment, it’s due to outlays from the mid-2010s. When corrected for size, the American ratio of Chinese investment to GDP is actually the lowest among the top 10 recipients of Beijing’s investments.

Is China’s International Activity a Major Risk? Scissors determines that China’s investment activity abroad is not a major risk. If the US is interested in putting national interest over private profit, it should ban American investment in advanced computing, commit to enforcing export controls and protecting intellectual property, and prioritizing supply-chain integrity when considering Chinese investment in the US.

“The US should act to protect its supply chains, wherever they extend, from being compromised. But the PRC’s international activity is not presently a major risk. America claiming to compete with China while providing it with money and technology is a major risk.” —Derek Scissors

2. Immigration and Innovation

Topline: A rift over high-skilled immigration has recently divided President Donald Trump’s political coalition, with the president expressing support for high-skilled immigration to the United States. AEI’s Michael Strain underscores <[link removed]> the economic value of high-skilled immigration, arguing it fuels innovation and economic prosperity.

- The entrepreneurial contributions of high-skilled immigrants are a crucial piece of US innovation output.

- 23.3% of patents were credited to immigrants.

- 25.2% of patent market value is attributed to immigrants.

A Small Step Forward: Strain highlights the need for an employment-driven immigration system, with possible policy solutions such as granting foreign-born graduates of US universities a path to citizenship. In 2023, foreigners earned more than one-third of engineering and science doctorates, but only a small fraction were allowed to stay.

“Casting out these scientists just when they can start making important contributions to social and economic life is an act of economic self-sabotage.”—Michael Strain

3. Combating Chinese Chips

Topline: China’s push to take a larger share of the electronic components market is most visible in the world of semiconductors. AEI’s Chris Miller finds <[link removed]> that China has weaponized its position in global supply chains and that the US risks dependence on China for displays, circuit boards, and assembly capabilities.

What Are They Focused On? Thanks to robust subsidies, China’s chip production capacity has skyrocketed. China is responsible for 27% of all new semiconductor fabrication plants—also known as fabs—across the globe.

The Market Threat: When Chinese firms receive large amounts of state funding, they don’t act in line with market principles. This leads to large production volumes that sell below market prices—hurting Western companies.

“Working with allies and partners to expand non-China production of key components could re-level the playing field and mitigate the risk that China will use its economic heft to undermine

America’s

firms or its security.”—Chris Miller

DIVE INTO MORE DATA

Trends in Fire Risk <[link removed]>

Fiscal Analysis of the Family First Act <[link removed]>

Special thanks to Carter Hutchinson and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Edited by James Desio and Hannah Bowen

Happy Thursday! In today’s newsletter, we examine China’s international investment patterns, the economic importance of high-skilled immigration, and China’s growing role in the semiconductor sphere.

Don’t forget—subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. Accounting for China’s Investment Abroad

Topline: Over the past 20 years, China has poured $2.5 trillion into investment and construction combined. AEI’s Derek Scissors investigates <[link removed]> China’s global spending footprint, finding that the US is the top recipient of Chinese investments, with $200.7 billion from 2005–24.

What About the US? While America is still the leading recipient of Chinese investment, it’s due to outlays from the mid-2010s. When corrected for size, the American ratio of Chinese investment to GDP is actually the lowest among the top 10 recipients of Beijing’s investments.

Is China’s International Activity a Major Risk? Scissors determines that China’s investment activity abroad is not a major risk. If the US is interested in putting national interest over private profit, it should ban American investment in advanced computing, commit to enforcing export controls and protecting intellectual property, and prioritizing supply-chain integrity when considering Chinese investment in the US.

“The US should act to protect its supply chains, wherever they extend, from being compromised. But the PRC’s international activity is not presently a major risk. America claiming to compete with China while providing it with money and technology is a major risk.” —Derek Scissors

2. Immigration and Innovation

Topline: A rift over high-skilled immigration has recently divided President Donald Trump’s political coalition, with the president expressing support for high-skilled immigration to the United States. AEI’s Michael Strain underscores <[link removed]> the economic value of high-skilled immigration, arguing it fuels innovation and economic prosperity.

- The entrepreneurial contributions of high-skilled immigrants are a crucial piece of US innovation output.

- 23.3% of patents were credited to immigrants.

- 25.2% of patent market value is attributed to immigrants.

A Small Step Forward: Strain highlights the need for an employment-driven immigration system, with possible policy solutions such as granting foreign-born graduates of US universities a path to citizenship. In 2023, foreigners earned more than one-third of engineering and science doctorates, but only a small fraction were allowed to stay.

“Casting out these scientists just when they can start making important contributions to social and economic life is an act of economic self-sabotage.”—Michael Strain

3. Combating Chinese Chips

Topline: China’s push to take a larger share of the electronic components market is most visible in the world of semiconductors. AEI’s Chris Miller finds <[link removed]> that China has weaponized its position in global supply chains and that the US risks dependence on China for displays, circuit boards, and assembly capabilities.

What Are They Focused On? Thanks to robust subsidies, China’s chip production capacity has skyrocketed. China is responsible for 27% of all new semiconductor fabrication plants—also known as fabs—across the globe.

The Market Threat: When Chinese firms receive large amounts of state funding, they don’t act in line with market principles. This leads to large production volumes that sell below market prices—hurting Western companies.

“Working with allies and partners to expand non-China production of key components could re-level the playing field and mitigate the risk that China will use its economic heft to undermine

America’s

firms or its security.”—Chris Miller

DIVE INTO MORE DATA

Trends in Fire Risk <[link removed]>

Fiscal Analysis of the Family First Act <[link removed]>

Special thanks to Carter Hutchinson and Drew Kirkpatrick!

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo