January 15, 2025

Permission to republish original opeds and cartoons granted.

As Inflation Rebounds For Second Month In A Row Crushing American Households, Deficit Already $710 Billion First Quarter Of FY 2025

|

|

|

Consumer inflation has resumed increasing for the second month in a row, rising 0.4 percent in December, or a 2.9 percent annual rate, according to the latest data from the Bureau of Labor Statistics. That is up from its Sept. 2024 annual level of 2.4 percent and came off of increases in energy and food in the latest report. Gasoline and fuel oil were both up 4.4 percent in December alone. Electricity was up 0.3 percent. Utility piped gas service was up 2.4 percent. Food at home and away from home was up 0.3 percent. Since Jan. 2021, consumer prices were up 21 percent total, but average weekly earnings were only up 17.2 percent. The American people were definitely not better off financially when prices and earnings were considered than they were four years earlier, a key factor in President-elect Donald Trump’s 2024 victory over Vice President Kamala Harris. The news comes as the U.S. Treasury reports that for the first three months of Fiscal Year 2025 that began in October, the budget deficit has already hit $710 billion compared to $509 billion the same period last year and is on pace to hit about $1.87 trillion for the entire year compared to $1.61 trillion last year. Of the increased $176 billion spending so far this year, $24.5 billion was for increased defense spending, $20.3 billion was for increased interest payments on the $36.17 trillion debt, $28.8 billion was for increased Social Security payments and $75.3 billion was for Medicare and Medicaid — almost $149 billion, or 84.6 percent of the increase. Overall, the White House Office of Management and Budget forecasts those trends to continue at least for Social Security, Medicare and Medicaid. Social Security will increase from $1.4 trillion in 2024 to $2.4 trillion in 2034, Medicare will increase from $839 billion to $1.76 trillion and Medicaid will increase from $567 billion to $996 billion. As for interest on the debt, that will increase from $890 billion to $1.57 trillion and defense spending will increase $852 billion to $1.1 trillion. By then, the deficit should be about $2.2 trillion — and rising — going forward, and OMB conservatively projects the national debt will be more than $52.6 trillion. What to do? |

Citizens-First Immigration Reform is Top of Mind for Americans

|

|

|

President Donald Trump was elected in 2016 – and again in 2024 – on a mandate from the people to put an end to the illegal immigrant crisis and implement citizens-first immigration reform. The mandate was clear: America is a nation of laws, and illegal immigration violates our laws and presents an array of criminal and economic issues that cannot be ignored. However, there is now an increasing sentiment among many voters that legal immigration is the next challenge that must be tackled. While the United States has a proud early history of offering opportunity to immigrants, data shows that over the past sixty years a growing share of American-born citizens are being displaced from the workforce. The latest report from the Center for Immigration Studies (CIS) shows an alarming correlation between increased immigration levels and decreased levels of employment for American citizens over the past sixty years. Those without a college degree have been displaced at the highest rate.The latest CIS report shows that the share of working-age U.S.-born men who have been left out of the labor force has doubled since 1960. According to the report’s findings, if the current labor participation rate among working-age U.S.-born men today matched the numbers from 1960, a full nine million men – slightly larger than the whole population of Virginia – would be employed today. However, due largely to labor displacement, nine-million men are currently out of the labor force thanks to increases in foreign labor. When the public was asked in a recent Rasmussen poll whether Congress should increase the number of “highly skilled” foreign workers to fill white-collar jobs, Americans largely said “no”. The poll found that by 34 points – 60 percent to 26 percent – Americans said the U.S. already has enough skilled people to train and recruit for jobs and doesn’t need to rely on foreign labor. A mere 26 percent of Americans said the U.S. needs more foreign workers to fill roles. Democrats agreed that the U.S. already has enough talented people to fill most white-collar roles by ten points – 47 percent to 37 percent. Non-partisans agreed by a full 41 points – 63 percent to 22 percent. |

As Inflation Rebounds For Second Month In A Row Crushing American Households, Deficit Already $710 Billion First Quarter Of FY 2025

By Robert Romano

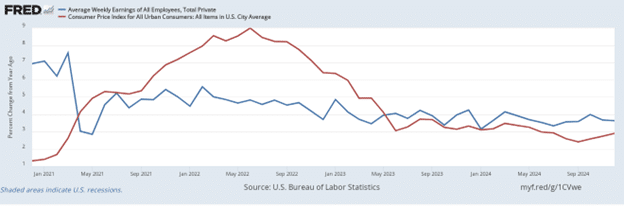

Consumer inflation has resumed increasing for the second month in a row, rising 0.4 percent in December, or a 2.9 percent annual rate, according to the latest data from the Bureau of Labor Statistics. That is up from its Sept. 2024 annual level of 2.4 percent and came off of increases in energy and food in the latest report.

Gasoline and fuel oil were both up 4.4 percent in December alone.

Electricity was up 0.3 percent.

Utility piped gas service was up 2.4 percent.

Food at home and away from home was up 0.3 percent.

Minus food and energy, inflation was up 0.2 percent, or 3.2 percent annually, news that caused markets to rally amid expectations of 3.3 percent instead. That included a 0.5 percent increase in transportation services, a 0.3 percent increase in shelter, a 0.5 percent increase in new cars and a 1.2 percent increase in used cars.

Coupled with unemployment decreasing a bit in December, inflation’s resumption could be worrisome if it continues persisting — the two figures tend to have an inverse relationship — a return to the vicious cycle seen since 2021, wherein inflation has outpaced earnings.

Since Jan. 2021, consumer prices were up 21 percent total, but average weekly earnings were only up 17.2 percent. The American people were definitely not better off financially when prices and earnings were considered than they were four years earlier, a key factor in President-elect Donald Trump’s 2024 victory over Vice President Kamala Harris.

The silver lining is that since June 2023, earnings have kept trend above consumer inflation — overall earnings were up 3.65 percent in 2024 compared to the inflation rate of 2.95 percent — it just was not enough to save either outgoing President Joe Biden or Harris’ failed campaign. By the time everyone voted, they were still feeling the pain.

Looked at another way, the ratio of the Consumer Price Index to average weekly earnings — a measure of purchasing power — was 25.9 in 2024, whereas in 2020 as Trump was leaving office, it was 25.13.

The good news is that if earnings and inflation just kept their current levels, by 2028, the ratio would be back down to 25.18, about where it was when Biden began his term of office. The bad news is that in just December, inflation outpaced earnings 0.39 percent to 0.28 percent.

The news comes as the U.S. Treasury reports that for the first three months of Fiscal Year 2025 that began in October, the budget deficit has already hit $710 billion compared to $509 billion the same period last year and is on pace to hit about $1.87 trillion for the entire year compared to $1.61 trillion last year.

The increases mostly come off of increased outlays at $1.79 trillion the first three months versus $1.62 trillion a year ago, an increase of $176 billion. For the entire year, outlays are expected to hit $7.4 trillion compared to $6.7 trillion last year.

Of the increased $176 billion spending so far this year, $24.5 billion was for increased defense spending, $20.3 billion was for increased interest payments on the $36.17 trillion debt, $28.8 billion was for increased Social Security payments and $75.3 billion was for Medicare and Medicaid — almost $149 billion, or 84.6 percent of the increase.

Overall, the White House Office of Management and Budget forecasts those trends to continue at least for Social Security, Medicare and Medicaid. Social Security will increase from $1.4 trillion in 2024 to $2.4 trillion in 2034, Medicare will increase from $839 billion to $1.76 trillion and Medicaid will increase from $567 billion to $996 billion.

As for interest on the debt, that will increase from $890 billion to $1.57 trillion and defense spending will increase $852 billion to $1.1 trillion.

By then, the deficit should be about $2.2 trillion — and rising — going forward, and OMB conservatively projects the national debt will be more than $52.6 trillion.

Of the three largest expenditure increases, Social Security, Medicare and interest on the debt, those have to be paid by law. That’s why they’re called “mandatory” spending. There’s defense, which while not technically mandatory from a legal perspective is certainly necessary from a sovereign perspective to deter a devastating attack, and nevertheless Congress’ usual inclination is to increase military spending, albeit at a slower rate than entitlements that are being driven by the Baby Boomer retirement wave now about halfway done.

To accommodate all that new debt, U.S. financial institutions will buy most of the new treasuries that are issued, which will naturally be fueled by a form of quantitative easing and increased monetary supply.

That’s all baked into the cake, that is, these are the baseline numbers going forward. The certainty is we will print trillions of dollars to meet these obligations.

So what to do? Four options, and likely some combination of them might be attempted: cut spending where it can be, increase revenue where it can be, get a better rate of return on government trust funds and boost production of goods and services to cool prices.

For the first, Trump will be appointing Elon Musk and Vivek Ramaswamy to head up the Department of Government Efficiency, and with a Republican-led Congress, some cuts might be found.

To raise revenue, Trump has proposed an External Revenue Service to do a better job of collecting tariffs from foreign trade.

Thanks to lower fertility, the ratio of taxpayers to retirees is much lower than it was decades ago, and the American people have already had their fill of unrestricted illegal immigration. As for legal immigration, it should be noted that the same drops in fertility are being experienced almost everywhere, and so the average age of immigrants will keep increasing. Barring a baby boom, that situation looks to only be worsening.

As for the trust funds, the average interest rate earned by Social Security was 4.1 percent, well below the rate of return that for example equities markets earn. Could the trust funds last longer or into perpetuity if they were more diversified?

Another way to look at it is by the government’s holdings of treasuries that include the trust funds. In 2001 intragovernmental holdings stood at $2.48 trillion and today they are $7.3 trillion, a 194 percent increase.

Whereas, the S&P 500 stood at about $1,290 in 2001 and now is at $5,944, a 360 percent increase. If the government had just bought equities instead of government paper, all things being equal, the intergovernmental holdings would be $20.8 trillion today instead of $7.3 trillion. Nobody would be worried about the Social Security and Medicare trust funds being depleted, as they are now projected to do so in 2035 and 2036, respectively.

Finally, there are economic incentives that could be put into place to boost energy, food and other production, which certainly factors into Trump’s proposed budget bill that will extend tax cuts, slash regulations and presumably find a way to increase energy production in particular. The current bout of inflation is too much money chasing too few goods, so if you know there’s still going to be too much money, then we need a lot more goods to offset — and critically the American people’s earnings need to keep pace.

A wild card factor is that all previous bouts of inflation in the U.S. were ultimately curtailed by high interest rates and recessions. Choose your poison, Mr. President.

Over the course of the next three presidencies, the dire state of affairs fiscally for the U.S. will be coming due. Earlier, I noted that OMB conservatively projects the national debt will be more than $52 trillion by 2034. It also assumes no new wars or recessions but aren’t those inevitable? But the truth is, when wars and recessions are factored in, the national debt has been growing by more than 8 percent annually since 1980 on an average basis. If that keeps happening, by 2034, it might be more like $74 trillion and by 2038 it will crest over $100 trillion.

In short, time’s up.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2025/01/as-inflation-rebounds-for-second-month-in-a-row-crushing-american-households-deficit-already-710-billion-first-quarter-of-fy-2025/

Cartoon: Head Scratcher

By A.F. Branco

Click here for a higher level resolution version.

To view online: https://dailytorch.com/2025/01/cartoon-head-scratcher/

Citizens-First Immigration Reform is Top of Mind for Americans

By Manzanita Miller

President Donald Trump was elected in 2016 – and again in 2024 – on a mandate from the people to put an end to the illegal immigrant crisis and implement citizens-first immigration reform.

The mandate was clear: America is a nation of laws, and illegal immigration violates our laws and presents an array of criminal and economic issues that cannot be ignored.

However, there is now an increasing sentiment among many voters that legal immigration is the next challenge that must be tackled.

While the United States has a proud early history of offering opportunity to immigrants, data shows that over the past sixty years a growing share of American-born citizens are being displaced from the workforce.

The latest report from the Center for Immigration Studies (CIS) shows an alarming correlation between increased immigration levels and decreased levels of employment for American citizens over the past sixty years. Those without a college degree have been displaced at the highest rate.

The latest CIS report shows that the share of working-age U.S.-born men who have been left out of the labor force has doubled since 1960.

According to the report’s findings, if the current labor participation rate among working-age U.S.-born men today matched the numbers from 1960, a full nine million men – slightly larger than the whole population of Virginia – would be employed today. However, due largely to labor displacement, nine-million men are currently out of the labor force.

The study’s lead author summed up the dark reality of relying on foreign labor: “Relying on immigrant workers has allowed our country to ignore the decades-long decline in labor force participation,” said Steven Camarota, the Center’s Director of Research and the report’s lead author. “Reducing immigration would cause wages to rise, incentivizing work and compelling policymakers to undertake much-needed reforms in welfare and disability programs.”

Americans tend to agree. When the public was asked in a recent Rasmussen poll whether Congress should increase the number of “highly skilled” foreign workers to fill white-collar jobs, Americans largely said “no”.

The poll found that by 34 points – 60 percent to 26 percent – Americans said the U.S. already has enough skilled people to train and recruit for jobs and doesn’t need to rely on foreign labor. A mere 26 percent of Americans said the U.S. needs more foreign workers to fill roles.

Democrats agreed that the U.S. already has enough talented people to fill most white-collar roles by ten points – 47 percent to 37 percent. Non-partisans agreed by a full 41 points – 63 percent to 22 percent.

While the immigration reform landscape is both nuanced and delicate – because it touches on not only economic destiny but also culture and crime – Americans are increasingly voicing their desire to see immigration put on pause, at least for a period of time.

The latest YouGov survey shows that the largest share of Americans – 31 percent – want to see immigration decreased, and Americans say by 24 points – 41 percent to 17 percent – they either want immigration decreased or reduced to zero rather than increased.

Hispanics show the greatest interest in decreasing immigration levels, with 37 percent of Hispanics compared to 31 percent of both Black and white voters favoring reduced immigration levels.

While Trump voters show the largest interest in decreasing or halting immigration – 61 percent – nearly a quarter of Harris voters feel the same way – 24 percent.

When asked whether immigration generally makes the country better or worse off, the largest share of Americans – 34 percent – say immigration generally makes the country worse off in the modern era.

While the radical left largely attempts to portray immigration critics as bigoted or otherwise driven by ill will, the reality is there are a myriad of logical reasons to be concerned about the unsustainable level of immigration that has become normalized. A broad coalition of voters seek citizens-first reforms to the immigration system.

Manzanita Miller is the senior political analyst at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2025/01/citizens-first-immigration-reform-is-top-of-mind-for-americans/