Email

High-tax states are costing Democrats

| From | Ben Samuels <[email protected]> |

| Subject | High-tax states are costing Democrats |

| Date | January 15, 2025 1:11 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

A lot has been written about why [ [link removed] ] Kamala [ [link removed] ] Harris [ [link removed] ] lost [ [link removed] ] the [ [link removed] ] 2024 [ [link removed] ] Presidential [ [link removed] ] election [ [link removed] ]. The reality, of course, is that there are lots of reasons that she didn’t win.

But all of these articles are missing an important point. The largest states [ [link removed] ] that Democrats consistently control—California, New York, Illinois, and New Jersey—have some of the highest tax burdens in the country.

For all the money its residents pay in taxes, it’s not clear that the quality of life is any better than in places like Texas and Florida, where the tax burden is substantially lower. In many ways, it might be worse.

This is something that Democrats need to seriously grapple with, and I don’t see enough Democrats doing that yet.

Comparing California and New York to Texas and Florida

About 115 million people [ [link removed] ]—more than a third of the country—live in California, Texas, Florida, and New York. But the tax profile of California and New York vs. Texas and Florida could hardly be more different.

In California, top earners pay 13.3% income tax rates [ [link removed] ], on top of federal taxes. In New York, top earners pay 10.9% [ [link removed] ], and that rate is higher if you live in New York City, where top earners can pay as much as 52% in income tax [ [link removed] ] across federal, state, and local taxes.

In Texas and Florida, the income tax rates are 0% and 0%, respectively.

Yes, in California and New York, only the highest earners pay that much in income taxes. But even for the median taxpayer, across all taxes—income tax, property tax, sales tax, etc.—the tax burden in California and New York is high, and the tax burden in Texas and Florida is low.

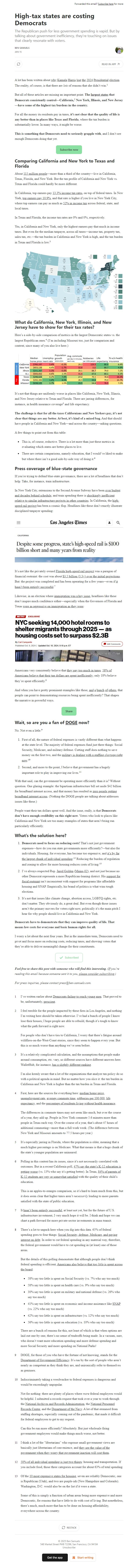

What do California, New York, Illinois, and New Jersey have to show for their tax rates?

Here’s a side-by-side comparison of metrics in the largest Democratic states vs. the largest Republican ones. (I’m including Missouri too, just for comparison and context, since many of you also live here.)

It’s not that things are uniformly worse in places like California, New York, Illinois, and New Jersey relative to Texas and Florida. There are jarring differences, for instance, in health insurance coverage and life expectancy.

The challenge is that for all the taxes Californians and New Yorkers pay, it’s not clear that things are any better. At best, it’s kind of a mixed bag. And that should have people in California and New York—and across the country—asking questions.

A few things to point out from this table:

This is, of course, reductive. There is a lot more than just these metrics in evaluating which states are better places to live.

There are certain comparisons, namely education, that I would’ve liked to make but where there isn’t a good side-by-side way of doing it.

Press coverage of blue-state governance

If you’re trying to defend blue-state governance, there are a lot of headlines that don’t help. Take, for instance, train infrastructure.

In New York City, extensions to the Second Avenue Subway have been over budget and decades behind schedule [ [link removed] ], and train spending there is shockingly inefficient relative to similar infrastructure projects in other countries [ [link removed] ]. In California, the high-speed rail project [ [link removed] ] has been a cosmic flop. Headlines like these don’t exactly illustrate disciplined taxpayer spending:

It’s not like the privately owned Florida high-speed rail project [ [link removed] ] was a paragon of financial restraint: the cost was about $3.5 billion (3.3×) over the initial projections [ [link removed] ]. But: the project was completed and has been operating for a few years—even if it hasn’t been entirely successful [ [link removed] ].

Likewise, in an election where immigration was a key issue [ [link removed] ], headlines like these don’t inspire much confidence either—especially when the Governors of Florida and Texas were as aggressive on immigration as they were [ [link removed] ]:

Americans very consistently believe that they pay too much in taxes [ [link removed] ]. 58% of Americans believe that their tax dollars are spent inefficiently [ [link removed] ]; only 18% believe they’re spent efficiently.

And when you have pretty prominent examples like these, and [ [link removed] ] a [ [link removed] ] bunch [ [link removed] ] of [ [link removed] ] others [ [link removed] ], that people can point to demonstrating resources being spent inefficiently? That shapes the narrative in powerful ways.

Wait, so are you a fan of DOGE [ [link removed] ] now?

No. Not even a little.

First of all, the nature of federal expenses is vastly different than what happens at the state level. The majority of federal expenses fund just three things: Social Security, Medicare, and military/defense. Cutting staff does nothing to save money on the first two, and the military is dealing with a staffing [ [link removed] ]shortage [ [link removed] ] right now [ [link removed] ].

Second, and more to the point, I believe that government has a hugely important role to play in improving our lives.

With that said, can the government be operating more efficiently than it is? Without question. One glaring example: the bipartisan infrastructure bill set aside $42 billion for broadband internet access, and that money has resulted in zero people getting broadband internet access [ [link removed] ]. (Nothing the DOGE people are talking about addresses issues like these.)

People want their tax dollars spent well. And the issue, really, is that Democrats don’t have enough credibility on this right now. Voters who look to places like California and New York see too many examples of states that aren’t being run particularly efficiently.

What’s the solution here?

Democrats need to focus on reducing costs! That’s not just government expenses—how do you run state governments more efficiently?—but also for individuals. Housing, for everyone, has become too expensive, and it’s by far the largest chunk of individual spending [ [link removed] ]. Reducing the burden of regulation and zoning to allow for more housing reduces costs of living.

I’ve always respected Rep. Jared Golden [ [link removed] ] (Maine-02 [ [link removed] ]), and not just because no other Democrat represents a more Republican-leaning district. His support for fiscal restraint [ [link removed] ] isn’t inconsistent with support for programs like affordable housing and SNAP. Empirically, his brand of politics is what wins tough elections.

It’s not that issues like climate change, abortion access, LGBTQ rights, etc. don’t matter. They obviously do, a great deal. But even though those issues aren’t the primary movers for voters right now, politically it’s the main pitch I hear for why people should live in California and New York.

Democrats have to demonstrate that they can improve quality of life. That means low costs for everyone and basic human rights for all.

I worry a lot about the next four years. But in the immediate term, Democrats need to pivot and focus more on reducing costs, reducing taxes, and showing voters that they’re able to deliver meaningful change for their constituents.

Feel free to share this post with someone who will find this interesting. (If you’re reading this email because someone sent it to you, please consider subscribing [ [link removed] ].)

For press inquiries, please contact [email protected].

Unsubscribe [link removed]?

A lot has been written about why [ [link removed] ] Kamala [ [link removed] ] Harris [ [link removed] ] lost [ [link removed] ] the [ [link removed] ] 2024 [ [link removed] ] Presidential [ [link removed] ] election [ [link removed] ]. The reality, of course, is that there are lots of reasons that she didn’t win.

But all of these articles are missing an important point. The largest states [ [link removed] ] that Democrats consistently control—California, New York, Illinois, and New Jersey—have some of the highest tax burdens in the country.

For all the money its residents pay in taxes, it’s not clear that the quality of life is any better than in places like Texas and Florida, where the tax burden is substantially lower. In many ways, it might be worse.

This is something that Democrats need to seriously grapple with, and I don’t see enough Democrats doing that yet.

Comparing California and New York to Texas and Florida

About 115 million people [ [link removed] ]—more than a third of the country—live in California, Texas, Florida, and New York. But the tax profile of California and New York vs. Texas and Florida could hardly be more different.

In California, top earners pay 13.3% income tax rates [ [link removed] ], on top of federal taxes. In New York, top earners pay 10.9% [ [link removed] ], and that rate is higher if you live in New York City, where top earners can pay as much as 52% in income tax [ [link removed] ] across federal, state, and local taxes.

In Texas and Florida, the income tax rates are 0% and 0%, respectively.

Yes, in California and New York, only the highest earners pay that much in income taxes. But even for the median taxpayer, across all taxes—income tax, property tax, sales tax, etc.—the tax burden in California and New York is high, and the tax burden in Texas and Florida is low.

What do California, New York, Illinois, and New Jersey have to show for their tax rates?

Here’s a side-by-side comparison of metrics in the largest Democratic states vs. the largest Republican ones. (I’m including Missouri too, just for comparison and context, since many of you also live here.)

It’s not that things are uniformly worse in places like California, New York, Illinois, and New Jersey relative to Texas and Florida. There are jarring differences, for instance, in health insurance coverage and life expectancy.

The challenge is that for all the taxes Californians and New Yorkers pay, it’s not clear that things are any better. At best, it’s kind of a mixed bag. And that should have people in California and New York—and across the country—asking questions.

A few things to point out from this table:

This is, of course, reductive. There is a lot more than just these metrics in evaluating which states are better places to live.

There are certain comparisons, namely education, that I would’ve liked to make but where there isn’t a good side-by-side way of doing it.

Press coverage of blue-state governance

If you’re trying to defend blue-state governance, there are a lot of headlines that don’t help. Take, for instance, train infrastructure.

In New York City, extensions to the Second Avenue Subway have been over budget and decades behind schedule [ [link removed] ], and train spending there is shockingly inefficient relative to similar infrastructure projects in other countries [ [link removed] ]. In California, the high-speed rail project [ [link removed] ] has been a cosmic flop. Headlines like these don’t exactly illustrate disciplined taxpayer spending:

It’s not like the privately owned Florida high-speed rail project [ [link removed] ] was a paragon of financial restraint: the cost was about $3.5 billion (3.3×) over the initial projections [ [link removed] ]. But: the project was completed and has been operating for a few years—even if it hasn’t been entirely successful [ [link removed] ].

Likewise, in an election where immigration was a key issue [ [link removed] ], headlines like these don’t inspire much confidence either—especially when the Governors of Florida and Texas were as aggressive on immigration as they were [ [link removed] ]:

Americans very consistently believe that they pay too much in taxes [ [link removed] ]. 58% of Americans believe that their tax dollars are spent inefficiently [ [link removed] ]; only 18% believe they’re spent efficiently.

And when you have pretty prominent examples like these, and [ [link removed] ] a [ [link removed] ] bunch [ [link removed] ] of [ [link removed] ] others [ [link removed] ], that people can point to demonstrating resources being spent inefficiently? That shapes the narrative in powerful ways.

Wait, so are you a fan of DOGE [ [link removed] ] now?

No. Not even a little.

First of all, the nature of federal expenses is vastly different than what happens at the state level. The majority of federal expenses fund just three things: Social Security, Medicare, and military/defense. Cutting staff does nothing to save money on the first two, and the military is dealing with a staffing [ [link removed] ]shortage [ [link removed] ] right now [ [link removed] ].

Second, and more to the point, I believe that government has a hugely important role to play in improving our lives.

With that said, can the government be operating more efficiently than it is? Without question. One glaring example: the bipartisan infrastructure bill set aside $42 billion for broadband internet access, and that money has resulted in zero people getting broadband internet access [ [link removed] ]. (Nothing the DOGE people are talking about addresses issues like these.)

People want their tax dollars spent well. And the issue, really, is that Democrats don’t have enough credibility on this right now. Voters who look to places like California and New York see too many examples of states that aren’t being run particularly efficiently.

What’s the solution here?

Democrats need to focus on reducing costs! That’s not just government expenses—how do you run state governments more efficiently?—but also for individuals. Housing, for everyone, has become too expensive, and it’s by far the largest chunk of individual spending [ [link removed] ]. Reducing the burden of regulation and zoning to allow for more housing reduces costs of living.

I’ve always respected Rep. Jared Golden [ [link removed] ] (Maine-02 [ [link removed] ]), and not just because no other Democrat represents a more Republican-leaning district. His support for fiscal restraint [ [link removed] ] isn’t inconsistent with support for programs like affordable housing and SNAP. Empirically, his brand of politics is what wins tough elections.

It’s not that issues like climate change, abortion access, LGBTQ rights, etc. don’t matter. They obviously do, a great deal. But even though those issues aren’t the primary movers for voters right now, politically it’s the main pitch I hear for why people should live in California and New York.

Democrats have to demonstrate that they can improve quality of life. That means low costs for everyone and basic human rights for all.

I worry a lot about the next four years. But in the immediate term, Democrats need to pivot and focus more on reducing costs, reducing taxes, and showing voters that they’re able to deliver meaningful change for their constituents.

Feel free to share this post with someone who will find this interesting. (If you’re reading this email because someone sent it to you, please consider subscribing [ [link removed] ].)

For press inquiries, please contact [email protected].

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a