Email

Inflation Signals Spark Investor Uncertainty (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Inflation Signals Spark Investor Uncertainty (Weekly Cheat Sheet) |

| Date | January 13, 2025 7:53 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good afternoon,

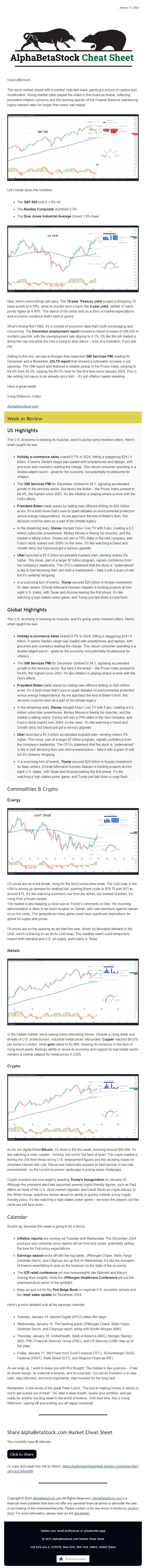

The stock market closed with a somber note last week, painting a picture of caution and recalibration. Rising market rates played the villain in this financial drama, reflecting persistent inflation concerns and the looming specter of the Federal Reserve maintaining higher interest rates for longer than many had hoped.

View image: ([link removed])

Caption:

Let’s break down the numbers:

* The **S&P 500** took a 1.9% hit

* The **Nasdaq Composite** stumbled 2.3%

* The **Dow Jones Industrial Average** closed 1.9% lower

View image: ([link removed])

Caption:

Now, here’s where things get spicy. The **10-year Treasury yield** surged a whopping 18 basis points to 4.78%, while its shorter-term cousin, the **2-year yield**, settled 12 basis points higher at 4.40%. This dance of the yields tells us a story of market expectations and economic resilience that’s hard to ignore.

What’s driving this? Well, it’s a cocktail of economic data that’s both encouraging and concerning. The **December employment report** showed a robust increase of 256,000 in nonfarm payrolls, with the unemployment rate dipping to 4.1%. It’s like the job market is doing the cha-cha while the Fed is trying to slow dance – a bit of a mismatch, if you ask me.

Adding to this mix, we saw a stronger-than-expected **ISM Services PMI** reading for December and a November **JOLTS report** that showed a noticeable increase in job openings. The ISM report also featured a notable pickup in the Prices Index, jumping to 64.4% from 58.2%, topping the 60.0% level for the first time since January 2024. This is like adding hot sauce to an already spicy dish – it’s got inflation hawks sweating.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

The U.S. economy is showing its muscles, and it’s giving some investors jitters. Here’s what caught my eye:

* **Holiday e-commerce sales** soared 8.7% in 2024, hitting a staggering $241.4 billion. It seems Santa’s sleigh was loaded with smartphones and laptops, with groceries and cosmetics leading the charge. This robust consumer spending is a double-edged sword – great for the economy, but potentially troublesome for inflation.

* The **ISM Services PMI** for December climbed to 54.1, signaling accelerated growth in the services sector. But here’s the kicker – the Prices Index jumped to 64.4%, the highest since 2023. It’s like inflation is playing whack-a-mole with the Fed’s efforts.

* **President Biden** made waves by halting new offshore drilling on 625 million acres. It’s a bold move that’s sure to spark debates on environmental protection versus energy independence. As we approach the end of Biden’s term, this decision could be seen as a part of his climate legacy.

* In the streaming wars, **Disney** merged Hulu+ Live TV with Fubo, creating a 6.2 million subscriber powerhouse. Mickey Mouse is flexing his muscles, and the market is taking notice. Disney will own a 70% stake in the new company, and Fubo’s stock soared over 200% on the news. It’s like watching a David and Goliath story, but David just got a serious upgrade.

* **Uber** launched a $1.5 billion accelerated buyback plan, sending shares 5% higher. This move, part of a larger $7 billion program, signals confidence from the company’s leadership. The CFO’s statement that the stock is “undervalued” is like a chef declaring their own dish a masterpiece – take it with a grain of salt, but it’s certainly intriguing.

* In a surprising turn of events, **Trump** secured $20 billion in foreign investment for data centers. Emirati billionaire Hussain Sajwani is funding projects across eight U.S. states, with Texas and Arizona leading the first phase. It’s like watching a high-stakes poker game, and Trump just laid down a royal flush.

## **Global Highlights**

The U.S. economy is showing its muscles, and it’s giving some investors jitters. Here’s what caught my eye:

* **Holiday e-commerce sales** soared 8.7% in 2024, hitting a staggering $241.4 billion. It seems Santa’s sleigh was loaded with smartphones and laptops, with groceries and cosmetics leading the charge. This robust consumer spending is a double-edged sword – great for the economy, but potentially troublesome for inflation.

* The **ISM Services PMI** for December climbed to 54.1, signaling accelerated growth in the services sector. But here’s the kicker – the Prices Index jumped to 64.4%, the highest since 2023. It’s like inflation is playing whack-a-mole with the Fed’s efforts.

* **President Biden** made waves by halting new offshore drilling on 625 million acres. It’s a bold move that’s sure to spark debates on environmental protection versus energy independence. As we approach the end of Biden’s term, this decision could be seen as a part of his climate legacy.

* In the streaming wars, **Disney** merged Hulu+ Live TV with Fubo, creating a 6.2 million subscriber powerhouse. Mickey Mouse is flexing his muscles, and the market is taking notice. Disney will own a 70% stake in the new company, and Fubo’s stock soared over 200% on the news. It’s like watching a David and Goliath story, but David just got a serious upgrade.

* **Uber** launched a $1.5 billion accelerated buyback plan, sending shares 5% higher. This move, part of a larger $7 billion program, signals confidence from the company’s leadership. The CFO’s statement that the stock is “undervalued” is like a chef declaring their own dish a masterpiece – take it with a grain of salt, but it’s certainly intriguing.

* In a surprising turn of events, **Trump** secured $20 billion in foreign investment for data centers. Emirati billionaire Hussain Sajwani is funding projects across eight U.S. states, with Texas and Arizona leading the first phase. It’s like watching a high-stakes poker game, and Trump just laid down a royal flush.

----------## Commodities & Crypto

### **Energy**

View image: ([link removed])

Caption:

Oil prices are on a hot streak, rising for the third consecutive week. The cold snap in the USA is driving up demand for heating fuel, pushing Brent crude to $78.70 and WTI to around $75. It’s like watching a phoenix rise from the ashes, but instead of ashes, it’s rising from a frozen tundra.

The market is also keeping a close eye on Trump’s comments on Iran. His incoming administration is likely to be much tougher on Tehran, with new sanctions against Iranian oil on the cards. This geopolitical chess game could have significant implications for global oil supply and prices.

Oil prices are on the upswing as we start the year, driven by favorable demand in the USA, which is bracing for an Arctic cold snap. This weather event could temporarily impact both demand and U.S. oil supply, particularly in Texas.

### **Metals**

View image: ([link removed])

Caption:

In the metals market, we’re seeing some interesting moves. Despite a rising dollar and threats of U.S. protectionism, industrial metal prices rebounded. **Copper** reached $9,078 per tonne in London, while **gold** rallied to $2,680, showing its resilience in the face of rising bond yields. Beijing’s ability to revive its economy and support its real estate sector remains a central catalyst for metal prices in 2025.

### **Crypto**

View image: ([link removed])

Caption:

As for our digital friend **Bitcoin**, it’s down 4.4% this week, hovering around $94,000. It’s like watching a roller coaster – thrilling, but not for the faint of heart. The crypto market is feeling the chill from those strong U.S. employment figures and the receding hopes for imminent interest rate cuts. Bitcoin has historically enjoyed its best periods in low-rate environments, so the current economic landscape is posing some challenges.

Crypto investors are now eagerly awaiting **Trump’s inauguration** on January 20. Although the president-elect has appointed several crypto-friendly figures, such as Paul Atkins as head of the U.S. stock market regulator and David Sacks as crypto advisor to the White House, questions remain about his ability to quickly institute a truly crypto-friendly policy. It’s like watching a high-stakes poker game – we know the players, but the cards are still face down.

## Calendar

Buckle up, because this week is going to be a doozy:

* **Inflation reports** are coming out Tuesday and Wednesday. The December 2024 producer and consumer price reports will be front and center, potentially setting the tone for Fed policy expectations.

* **Earnings season** kicks off with the big banks. JPMorgan Chase, Wells Fargo, Goldman Sachs, and Citigroup are up first on Wednesday. It’s like the Avengers of finance assembling to give us the lowdown on the state of the economy.

* The **ICR retail conference** will see heavyweights like Walmart and Macy’s sharing their insights, while the **JPMorgan Healthcare Conference** will put the pharmaceutical sector in the spotlight.

* Keep an eye out for the **Fed Beige Book** on regional U.S. economic activity and the **retail sales update** for December 2024.

Here’s a more detailed look at the earnings calendar:

* Tuesday, January 14: Applied Digital (APLD) takes the stage.

* Wednesday, January 15: The banking giants JPMorgan Chase, Wells Fargo, Goldman Sachs, and Citigroup report, along with Kinder Morgan (KMI).

* Thursday, January 16: UnitedHealth, Bank of America (BAC), Morgan Stanley (MS), PNC Financial Services Group (PNC), and US Bancorp (USB) step up to the plate.

* Friday, January 17: We’ll hear from Truist Financial (TFC), Schlumberger (SLB), Fastenal (FAST), State Street (STT), and Regions Financial (RF).

As we wrap up, I want to leave you with this thought: The market is like a person – it has its mood swings, its irrational moments, and its surprises. Our job as investors is to stay calm, stay informed, and most importantly, stay invested for the long haul.

Remember, in the words of the great Peter Lynch, “The key to making money in stocks is not to get scared out of them.” So, take a deep breath, review your portfolio, and get ready for another exciting week in the world of finance. Until next time, this is Irving Wilkinson, signing off and wishing you all happy investing!

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good afternoon,

The stock market closed with a somber note last week, painting a picture of caution and recalibration. Rising market rates played the villain in this financial drama, reflecting persistent inflation concerns and the looming specter of the Federal Reserve maintaining higher interest rates for longer than many had hoped.

View image: ([link removed])

Caption:

Let’s break down the numbers:

* The **S&P 500** took a 1.9% hit

* The **Nasdaq Composite** stumbled 2.3%

* The **Dow Jones Industrial Average** closed 1.9% lower

View image: ([link removed])

Caption:

Now, here’s where things get spicy. The **10-year Treasury yield** surged a whopping 18 basis points to 4.78%, while its shorter-term cousin, the **2-year yield**, settled 12 basis points higher at 4.40%. This dance of the yields tells us a story of market expectations and economic resilience that’s hard to ignore.

What’s driving this? Well, it’s a cocktail of economic data that’s both encouraging and concerning. The **December employment report** showed a robust increase of 256,000 in nonfarm payrolls, with the unemployment rate dipping to 4.1%. It’s like the job market is doing the cha-cha while the Fed is trying to slow dance – a bit of a mismatch, if you ask me.

Adding to this mix, we saw a stronger-than-expected **ISM Services PMI** reading for December and a November **JOLTS report** that showed a noticeable increase in job openings. The ISM report also featured a notable pickup in the Prices Index, jumping to 64.4% from 58.2%, topping the 60.0% level for the first time since January 2024. This is like adding hot sauce to an already spicy dish – it’s got inflation hawks sweating.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

--------------------

## **US Highlights**

The U.S. economy is showing its muscles, and it’s giving some investors jitters. Here’s what caught my eye:

* **Holiday e-commerce sales** soared 8.7% in 2024, hitting a staggering $241.4 billion. It seems Santa’s sleigh was loaded with smartphones and laptops, with groceries and cosmetics leading the charge. This robust consumer spending is a double-edged sword – great for the economy, but potentially troublesome for inflation.

* The **ISM Services PMI** for December climbed to 54.1, signaling accelerated growth in the services sector. But here’s the kicker – the Prices Index jumped to 64.4%, the highest since 2023. It’s like inflation is playing whack-a-mole with the Fed’s efforts.

* **President Biden** made waves by halting new offshore drilling on 625 million acres. It’s a bold move that’s sure to spark debates on environmental protection versus energy independence. As we approach the end of Biden’s term, this decision could be seen as a part of his climate legacy.

* In the streaming wars, **Disney** merged Hulu+ Live TV with Fubo, creating a 6.2 million subscriber powerhouse. Mickey Mouse is flexing his muscles, and the market is taking notice. Disney will own a 70% stake in the new company, and Fubo’s stock soared over 200% on the news. It’s like watching a David and Goliath story, but David just got a serious upgrade.

* **Uber** launched a $1.5 billion accelerated buyback plan, sending shares 5% higher. This move, part of a larger $7 billion program, signals confidence from the company’s leadership. The CFO’s statement that the stock is “undervalued” is like a chef declaring their own dish a masterpiece – take it with a grain of salt, but it’s certainly intriguing.

* In a surprising turn of events, **Trump** secured $20 billion in foreign investment for data centers. Emirati billionaire Hussain Sajwani is funding projects across eight U.S. states, with Texas and Arizona leading the first phase. It’s like watching a high-stakes poker game, and Trump just laid down a royal flush.

## **Global Highlights**

The U.S. economy is showing its muscles, and it’s giving some investors jitters. Here’s what caught my eye:

* **Holiday e-commerce sales** soared 8.7% in 2024, hitting a staggering $241.4 billion. It seems Santa’s sleigh was loaded with smartphones and laptops, with groceries and cosmetics leading the charge. This robust consumer spending is a double-edged sword – great for the economy, but potentially troublesome for inflation.

* The **ISM Services PMI** for December climbed to 54.1, signaling accelerated growth in the services sector. But here’s the kicker – the Prices Index jumped to 64.4%, the highest since 2023. It’s like inflation is playing whack-a-mole with the Fed’s efforts.

* **President Biden** made waves by halting new offshore drilling on 625 million acres. It’s a bold move that’s sure to spark debates on environmental protection versus energy independence. As we approach the end of Biden’s term, this decision could be seen as a part of his climate legacy.

* In the streaming wars, **Disney** merged Hulu+ Live TV with Fubo, creating a 6.2 million subscriber powerhouse. Mickey Mouse is flexing his muscles, and the market is taking notice. Disney will own a 70% stake in the new company, and Fubo’s stock soared over 200% on the news. It’s like watching a David and Goliath story, but David just got a serious upgrade.

* **Uber** launched a $1.5 billion accelerated buyback plan, sending shares 5% higher. This move, part of a larger $7 billion program, signals confidence from the company’s leadership. The CFO’s statement that the stock is “undervalued” is like a chef declaring their own dish a masterpiece – take it with a grain of salt, but it’s certainly intriguing.

* In a surprising turn of events, **Trump** secured $20 billion in foreign investment for data centers. Emirati billionaire Hussain Sajwani is funding projects across eight U.S. states, with Texas and Arizona leading the first phase. It’s like watching a high-stakes poker game, and Trump just laid down a royal flush.

----------## Commodities & Crypto

### **Energy**

View image: ([link removed])

Caption:

Oil prices are on a hot streak, rising for the third consecutive week. The cold snap in the USA is driving up demand for heating fuel, pushing Brent crude to $78.70 and WTI to around $75. It’s like watching a phoenix rise from the ashes, but instead of ashes, it’s rising from a frozen tundra.

The market is also keeping a close eye on Trump’s comments on Iran. His incoming administration is likely to be much tougher on Tehran, with new sanctions against Iranian oil on the cards. This geopolitical chess game could have significant implications for global oil supply and prices.

Oil prices are on the upswing as we start the year, driven by favorable demand in the USA, which is bracing for an Arctic cold snap. This weather event could temporarily impact both demand and U.S. oil supply, particularly in Texas.

### **Metals**

View image: ([link removed])

Caption:

In the metals market, we’re seeing some interesting moves. Despite a rising dollar and threats of U.S. protectionism, industrial metal prices rebounded. **Copper** reached $9,078 per tonne in London, while **gold** rallied to $2,680, showing its resilience in the face of rising bond yields. Beijing’s ability to revive its economy and support its real estate sector remains a central catalyst for metal prices in 2025.

### **Crypto**

View image: ([link removed])

Caption:

As for our digital friend **Bitcoin**, it’s down 4.4% this week, hovering around $94,000. It’s like watching a roller coaster – thrilling, but not for the faint of heart. The crypto market is feeling the chill from those strong U.S. employment figures and the receding hopes for imminent interest rate cuts. Bitcoin has historically enjoyed its best periods in low-rate environments, so the current economic landscape is posing some challenges.

Crypto investors are now eagerly awaiting **Trump’s inauguration** on January 20. Although the president-elect has appointed several crypto-friendly figures, such as Paul Atkins as head of the U.S. stock market regulator and David Sacks as crypto advisor to the White House, questions remain about his ability to quickly institute a truly crypto-friendly policy. It’s like watching a high-stakes poker game – we know the players, but the cards are still face down.

## Calendar

Buckle up, because this week is going to be a doozy:

* **Inflation reports** are coming out Tuesday and Wednesday. The December 2024 producer and consumer price reports will be front and center, potentially setting the tone for Fed policy expectations.

* **Earnings season** kicks off with the big banks. JPMorgan Chase, Wells Fargo, Goldman Sachs, and Citigroup are up first on Wednesday. It’s like the Avengers of finance assembling to give us the lowdown on the state of the economy.

* The **ICR retail conference** will see heavyweights like Walmart and Macy’s sharing their insights, while the **JPMorgan Healthcare Conference** will put the pharmaceutical sector in the spotlight.

* Keep an eye out for the **Fed Beige Book** on regional U.S. economic activity and the **retail sales update** for December 2024.

Here’s a more detailed look at the earnings calendar:

* Tuesday, January 14: Applied Digital (APLD) takes the stage.

* Wednesday, January 15: The banking giants JPMorgan Chase, Wells Fargo, Goldman Sachs, and Citigroup report, along with Kinder Morgan (KMI).

* Thursday, January 16: UnitedHealth, Bank of America (BAC), Morgan Stanley (MS), PNC Financial Services Group (PNC), and US Bancorp (USB) step up to the plate.

* Friday, January 17: We’ll hear from Truist Financial (TFC), Schlumberger (SLB), Fastenal (FAST), State Street (STT), and Regions Financial (RF).

As we wrap up, I want to leave you with this thought: The market is like a person – it has its mood swings, its irrational moments, and its surprises. Our job as investors is to stay calm, stay informed, and most importantly, stay invested for the long haul.

Remember, in the words of the great Peter Lynch, “The key to making money in stocks is not to get scared out of them.” So, take a deep breath, review your portfolio, and get ready for another exciting week in the world of finance. Until next time, this is Irving Wilkinson, signing off and wishing you all happy investing!

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a