| From | Fraser Institute <[email protected]> |

| Subject | Tax Freedom Day this year is no reason to celebrate |

| Date | May 23, 2020 2:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

---------------------

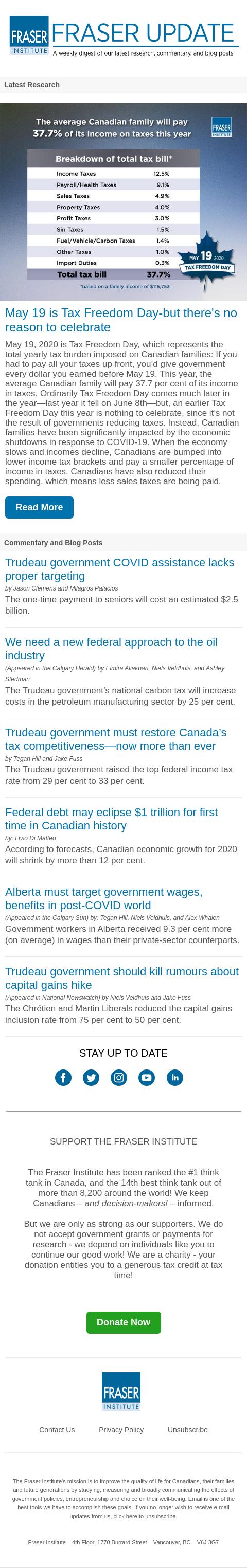

May 19 is Tax Freedom Day-but there's no reason to celebrate

May 19, 2020 is Tax Freedom Day, which represents the total yearly tax burden imposed on Canadian families: If you had to pay all your taxes up front, you’d give government every dollar you earned before May 19. This year, the average Canadian family will pay 37.7 per cent of its income in taxes. Ordinarily Tax Freedom Day comes much later in the year—last year it fell on June 8th—but, an earlier Tax Freedom Day this year is nothing to celebrate, since it’s not the result of governments reducing taxes. Instead, Canadian families have been significantly impacted by the economic shutdowns in response to COVID-19. When the economy slows and incomes decline, Canadians are bumped into lower income tax brackets and pay a smaller percentage of income in taxes. Canadians have also reduced their spending, which means less sales taxes are being paid.

Read More [[link removed]]

Commentary and Blog Posts

------------------------

Trudeau government COVID assistance lacks proper targeting

([link removed])

by Jason Clemens and Milagros Palacios

The one-time payment to seniors will cost an estimated $2.5 billion.

We need a new federal approach to the oil industry [[link removed]]

(Appeared in the Calgary Herald) by Elmira Aliakbari, Niels Veldhuis, and Ashley Stedman

The Trudeau government’s national carbon tax will increase costs in the petroleum manufacturing sector by 25 per cent.

Trudeau government must restore Canada’s tax competitiveness—now more than ever [[link removed]]

by Tegan Hill and Jake Fuss

The Trudeau government raised the top federal income tax rate from 29 per cent to 33 per cent.

Federal debt may eclipse $1 trillion for first time in Canadian history ([link removed])

by Livio Di Matteo

According to forecasts, Canadian economic growth for 2020 will shrink by more than 12 per cent.

Alberta must target government wages, benefits in post-COVID world ([link removed])

(Appeared in the Calgary Sun) by Tegan Hill, Niels Veldhuis, and Alex Whalen

Government workers in Alberta received 9.3 per cent more (on average) in wages than their private-sector counterparts.

Trudeau government should kill rumours about capital gains hike

([link removed])

(Appeared in National Newswatch) by Niels Veldhuis and Jake Fuss

The Chrétien and Martin Liberals reduced the capital gains inclusion rate from 75 per cent to 50 per cent.

SUPPORT THE FRASER INSTITUTE

----------------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

---------------------

May 19 is Tax Freedom Day-but there's no reason to celebrate

May 19, 2020 is Tax Freedom Day, which represents the total yearly tax burden imposed on Canadian families: If you had to pay all your taxes up front, you’d give government every dollar you earned before May 19. This year, the average Canadian family will pay 37.7 per cent of its income in taxes. Ordinarily Tax Freedom Day comes much later in the year—last year it fell on June 8th—but, an earlier Tax Freedom Day this year is nothing to celebrate, since it’s not the result of governments reducing taxes. Instead, Canadian families have been significantly impacted by the economic shutdowns in response to COVID-19. When the economy slows and incomes decline, Canadians are bumped into lower income tax brackets and pay a smaller percentage of income in taxes. Canadians have also reduced their spending, which means less sales taxes are being paid.

Read More [[link removed]]

Commentary and Blog Posts

------------------------

Trudeau government COVID assistance lacks proper targeting

([link removed])

by Jason Clemens and Milagros Palacios

The one-time payment to seniors will cost an estimated $2.5 billion.

We need a new federal approach to the oil industry [[link removed]]

(Appeared in the Calgary Herald) by Elmira Aliakbari, Niels Veldhuis, and Ashley Stedman

The Trudeau government’s national carbon tax will increase costs in the petroleum manufacturing sector by 25 per cent.

Trudeau government must restore Canada’s tax competitiveness—now more than ever [[link removed]]

by Tegan Hill and Jake Fuss

The Trudeau government raised the top federal income tax rate from 29 per cent to 33 per cent.

Federal debt may eclipse $1 trillion for first time in Canadian history ([link removed])

by Livio Di Matteo

According to forecasts, Canadian economic growth for 2020 will shrink by more than 12 per cent.

Alberta must target government wages, benefits in post-COVID world ([link removed])

(Appeared in the Calgary Sun) by Tegan Hill, Niels Veldhuis, and Alex Whalen

Government workers in Alberta received 9.3 per cent more (on average) in wages than their private-sector counterparts.

Trudeau government should kill rumours about capital gains hike

([link removed])

(Appeared in National Newswatch) by Niels Veldhuis and Jake Fuss

The Chrétien and Martin Liberals reduced the capital gains inclusion rate from 75 per cent to 50 per cent.

SUPPORT THE FRASER INSTITUTE

----------------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor