|

|

|

|

|

|

|

Money Metals News Alert

|

January 6th, 2025

– Strong performance by both gold and silver over the past year – all

happening while the dollar held up well has been unusual.

|

|

|

A reversal lower in the

dollar would create a real tailwind for gold, silver, and commodities in

general... and that???s something we do foresee happening in 2025.

At the moment, all markets

are without a clear direction – they???re essentially in a ???wait and see??? mode

while the new Donald Trump administration is installed this month.

|

|

|

|

|

|

Gold : Silver Ratio (as of

Friday's closing prices) – 89 to

1

|

|

|

|

Just How Good Was Gold in 2024?

|

|

|

|

|

|

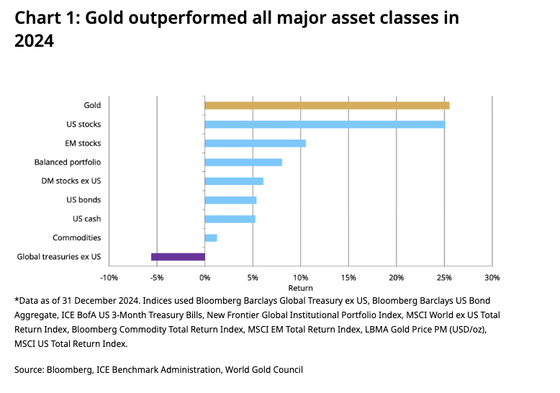

Gold was one of the best-performing

asset classes in 2024, outgaining the red-hot U.S. stock market.

|

|

|

People who follow

financial news know that gold had a great year.

Despite its typical apathy

toward gold, even the mainstream was forced to sit up and take notice. But you may

not realize just how well gold did.

The

gold price rose 26.5 percent in 2024, setting several new price records along

the way.

|

|

|

|

It was the biggest annual percentage

gain since 2010 during the quantitative

easing (money printing) years in the wake of the 2008 financial crisis.

During its sustained rally, gold set

40 new all-time highs based on the afternoon London Bullion Market Association

p.m. price. The most recent was $2,777.80 per ounce on Oct. 30.

Gold also set a

record in real terms, cracking the inflation-adjusted price all-tome high set

back in 1980.

|

|

|

|

|

Most people fixated on the red-hot

U.S. stock market last year. Gold was better.

The yellow metal edged out U.S. stocks

to rank first among traditional asset classes. Gold also performed better than

U.S. bonds, dollars, commodities, and global treasuries.

|

|

|

|

|

With its huge post-election surge,

Bitcoin was the only asset to beat out gold. The cryptocurrency

price more than doubled, rising 111.5 percent.

The World Gold Council pinpointed

three factors driving gold???s impressive bull run.

- Strong central bank and

investor demand, which offset declining consumer demand

- Heightened geopolitical risk

due to increased conflicts, along with a busy electoral year across the world

- Periods of opportunity costs

when markets saw lower yields and a weakening U.S. dollar.

|

|

|

|

|

Silver remained well below its

all-time high throughout 2024, creating the impression that it underperformed.

However, it had a pretty solid year as well.

Silver kicked

off 2024 at $23.99 per ounce and closed out the year at $28.91, a 20.5 percent

gain.

|

|

|

Silver???s gains weren???t

quite as beefy as U.S. stocks, but it still outperformed emerging market stocks,

U.S. bonds, commodities, and global treasuries.

Investors will want to

keep a close eye on silver as we move into 2025. Historically, silver has lagged

behind gold in the early stages of a gold bull run but outperforms the yellow

metal in the later stages of the rally.

|

|

|

|

There are also several signs that

silver is underpriced.

Analysts project that there was a

fourth straight supply deficit in the silver market, meaning there was more

silver consumed than was pulled out of the ground or reclaimed through recycling.

This market deficit is expected to come in at around 182 million ounces.

The gold-silver

ratio also indicates silver is underpriced. The current gold-silver ratio is

over 88-1. That means it takes 88 ounces of silver to buy one ounce of gold.

In the modern era, the gold-silver

ratio has averaged between 40-1 and 60-1. When the gold-silver ratio gets far

above the high end of that historical average, it tends to return to the mean with

a vengeance.

For instance, in 2020, the gold-silver

ratio set a record of 123-1 as Covid hysteria gripped the world and then plunged

to around 60-1 as central banks around the world cranked up the money creation

machine to cope with governments shutting down economies.

|

|

|

|

|

Most mainstream

analysts expect the gold bulls to keep running in 2025.

Goldman Sachs and JP Morgan both

project gold will crack the $3,000 level this year.

A JP Morgan analyst wrote, ???We

maintain our multi-year bullish outlook on gold for a third year in a row. ...

Gold still looks well situated to hedge the elevated levels of uncertainty around

the macro landscape heading into the initial stages of the Trump administration in

2025.???

Central banks and Asian demand drove

the 2024 gold rally, with Western retail investors largely remaining on the

sidelines. If they jump into the market this year, we could see another strong

upward price surge.

|

|

|

|

|

If there is a major economic crisis,

(and that is entirely possible given the massive level of debt and the large

number of bubbles in the economy) the Federal Reserve will most likely slash rates

back to zero and start running QE After all, that's the fork it knows.

In this scenario, the price of gold

would likely blow through the roof.

|

|

|

|

|

|

|

|

This week's Market Update was

authored by Money Metals Writer Mike Maharrey.

|

|

|

|

|

|

|

|

|

|

This copyrighted material may not

be republished without express permission. Offer only available through email

promotion. Offer does not apply to previous orders and may not be combined with

any other offer or program. Special shipping rates or other restrictions may apply

to international orders. The information presented here is for general educational

purposes only. Money Metals Exchange and its staff do not act as personal

investment advisors. Nor do we advocate the purchase or sale of any regulated

security listed on any exchange for any specific individual. While our track

record is excellent, investment markets have inherent risks and there can be no

assurance of future profits. You are responsible for your investment decisions,

and they should be made in consultation with your own advisors. By purchasing from

Money Metals, you understand our company is not responsible for any losses caused

by your investment decisions, nor do we have any claim to any market gains you may

enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by

the CFTC and the SEC.

|

|

|