Email

NEWS RELEASE: Village Board approves 5% decrease in property tax rate

| From | Village of Oswego <[email protected]> |

| Subject | NEWS RELEASE: Village Board approves 5% decrease in property tax rate |

| Date | December 16, 2024 9:40 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Lowest tax rate on record

Having trouble viewing this email? View it as a Web page [ [link removed] ].

Village of Oswego logo [ [link removed] ]

Village Board approves 5% decrease

in property tax rate

"Lowest tax rate on record"

________________________________________________________________________

Oswego property owners will see a 5% decrease in the Village of Oswego’s property tax rate on their upcoming tax bills.

On November 19, the Village Board approved a tax levy (total amount of property taxes collected) of $1,842,240 or a rate of $0.13222. This represents a 5% decrease in the Village’s tax rate for all properties within the Village. It is the lowest tax rate for the Village of Oswego on record since 2007 when the rate was $0.13370.

“It’s incredible we are able to reduce the Village’s property tax rate to the lowest rate in our Village’s history,” Village President Ryan Kauffman said. The Village Board is keenly aware property taxes are a burden for our residents, and we remain committed to identifying opportunities for relief. I’m extremely proud our prudent financial management allows us to cut the tax rate again this year.”

The Village’s property taxes are among various revenue sources that support the Village’s operations. Over the past two years the Village has managed to achieve surpluses of $3.6 and $5.6 million through a combination of reduced expenditures and strong revenues in the general fund.

The Village continues to prioritize capital investment including water infrastructure, road maintenance and improvements, as well as reducing long-term liabilities by strengthening investment in the Village’s Police Pension fund.

The Village’s overall equalized assessed value, the total value of properties within the Village, increased approximately 13% percent over the previous year, due in part to new development within the Village. Since property values increased, a home valued at $300,400 this year would have been valued at $265,840 last year. Due to increased property value, the property tax increase year over year is $125,986.

Here’s an example of the 2024 property tax rate on the owner of a $300,400 home in Oswego.

The formula is *Equalized Assessed Value / 100 x Tax Rate = Taxes Owed*

or $94,133-$6000/100 x 0.13222=$124.46.

*2024 Property Tax Rate*

$300,400 Home Value

$100,133 @Equalized Assessed Value (33%)

($6,000) Less Homeowners Exemption

$94,133 Taxable EAV

_0.13222 Tax Rate _

*$124.46 Village Tax Owed

* [ [link removed] ]

________________________________________________________________________

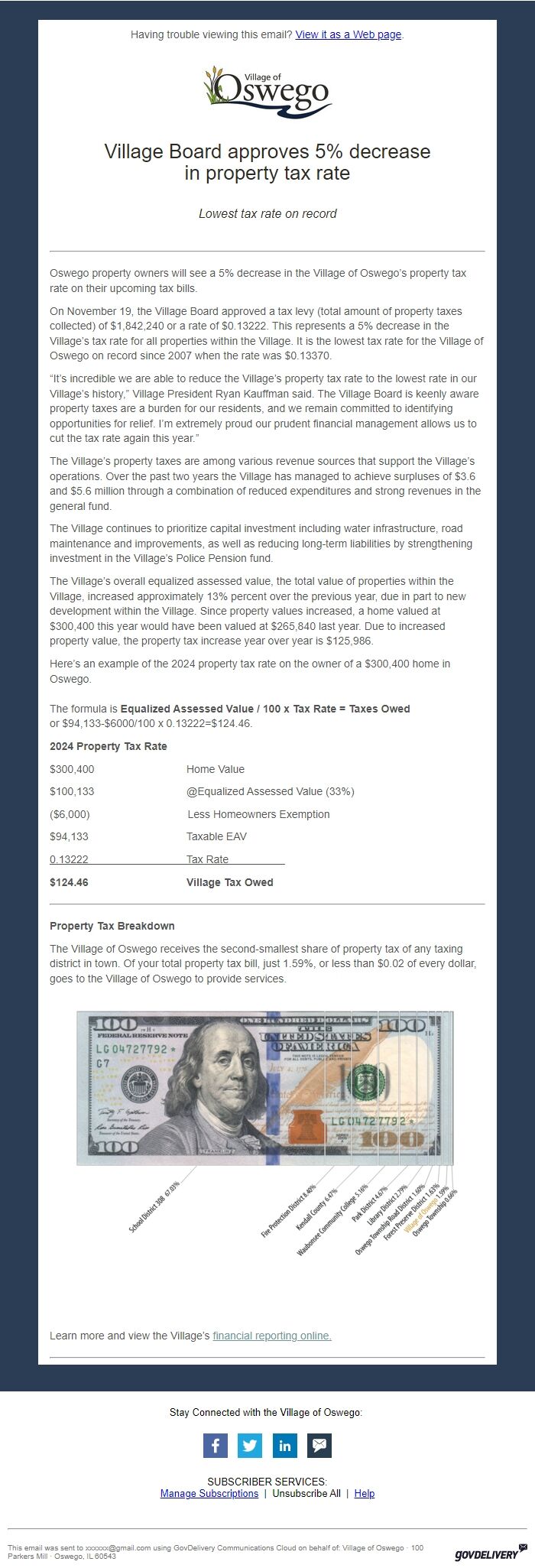

*Property Tax Breakdown*

The Village of Oswego receives the second-smallest share of property tax of any taxing district in town. Of your total property tax bill, just 1.59%, or less than $0.02 of every dollar, goes to the Village of Oswego to provide services.

Property tax bill percentage with dollar bill graphic [ [link removed] ]

Learn more and view the Village’s financial reporting online. [ [link removed] ]

________________________________________________________________________

Stay Connected with the Village of Oswego: Facebook [ [link removed] ] Twitter [ [link removed] ] LinkedIn [ [link removed] ] Govdelivery [ [link removed] ] SUBSCRIBER SERVICES:

Manage Subscriptions [ [link removed] ] | Unsubscribe All [ [link removed] ] | Help [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Village of Oswego · 100 Parkers Mill · Oswego, IL 60543 GovDelivery logo [ [link removed] ]

Having trouble viewing this email? View it as a Web page [ [link removed] ].

Village of Oswego logo [ [link removed] ]

Village Board approves 5% decrease

in property tax rate

"Lowest tax rate on record"

________________________________________________________________________

Oswego property owners will see a 5% decrease in the Village of Oswego’s property tax rate on their upcoming tax bills.

On November 19, the Village Board approved a tax levy (total amount of property taxes collected) of $1,842,240 or a rate of $0.13222. This represents a 5% decrease in the Village’s tax rate for all properties within the Village. It is the lowest tax rate for the Village of Oswego on record since 2007 when the rate was $0.13370.

“It’s incredible we are able to reduce the Village’s property tax rate to the lowest rate in our Village’s history,” Village President Ryan Kauffman said. The Village Board is keenly aware property taxes are a burden for our residents, and we remain committed to identifying opportunities for relief. I’m extremely proud our prudent financial management allows us to cut the tax rate again this year.”

The Village’s property taxes are among various revenue sources that support the Village’s operations. Over the past two years the Village has managed to achieve surpluses of $3.6 and $5.6 million through a combination of reduced expenditures and strong revenues in the general fund.

The Village continues to prioritize capital investment including water infrastructure, road maintenance and improvements, as well as reducing long-term liabilities by strengthening investment in the Village’s Police Pension fund.

The Village’s overall equalized assessed value, the total value of properties within the Village, increased approximately 13% percent over the previous year, due in part to new development within the Village. Since property values increased, a home valued at $300,400 this year would have been valued at $265,840 last year. Due to increased property value, the property tax increase year over year is $125,986.

Here’s an example of the 2024 property tax rate on the owner of a $300,400 home in Oswego.

The formula is *Equalized Assessed Value / 100 x Tax Rate = Taxes Owed*

or $94,133-$6000/100 x 0.13222=$124.46.

*2024 Property Tax Rate*

$300,400 Home Value

$100,133 @Equalized Assessed Value (33%)

($6,000) Less Homeowners Exemption

$94,133 Taxable EAV

_0.13222 Tax Rate _

*$124.46 Village Tax Owed

* [ [link removed] ]

________________________________________________________________________

*Property Tax Breakdown*

The Village of Oswego receives the second-smallest share of property tax of any taxing district in town. Of your total property tax bill, just 1.59%, or less than $0.02 of every dollar, goes to the Village of Oswego to provide services.

Property tax bill percentage with dollar bill graphic [ [link removed] ]

Learn more and view the Village’s financial reporting online. [ [link removed] ]

________________________________________________________________________

Stay Connected with the Village of Oswego: Facebook [ [link removed] ] Twitter [ [link removed] ] LinkedIn [ [link removed] ] Govdelivery [ [link removed] ] SUBSCRIBER SERVICES:

Manage Subscriptions [ [link removed] ] | Unsubscribe All [ [link removed] ] | Help [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Village of Oswego · 100 Parkers Mill · Oswego, IL 60543 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Village of Oswego, Illinois

- Political Party: n/a

- Country: United States

- State/Locality: Illinois Oswego, Illinois

- Office: n/a

-

Email Providers:

- govDelivery