Email

Fed Watch 2024: The Last Dance of Interest Rates (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Fed Watch 2024: The Last Dance of Interest Rates (Weekly Cheat Sheet) |

| Date | December 16, 2024 5:25 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good afternoon,

Just to remind you, we will not publish next week because of Christmas. We wish you and your family a Merry Christmas!

View image: ([link removed])

Caption:

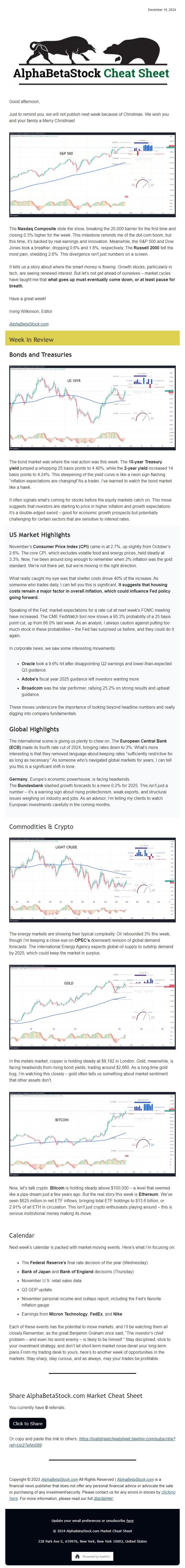

The **Nasdaq Composite** stole the show, breaking the 20,000 barrier for the first time and closing 0.3% higher for the week. This milestone reminds me of the dot-com boom, but this time, it’s backed by real earnings and innovation. Meanwhile, the S&P 500 and Dow Jones took a breather, dropping 0.6% and 1.8%, respectively. The **Russell 2000** felt the most pain, shedding 2.6%. This divergence isn’t just numbers on a screen.

It tells us a story about where the smart money is flowing. Growth stocks, particularly in tech, are seeing renewed interest. But let’s not get ahead of ourselves – market cycles have taught me that **what goes up must eventually come down, or at least pause for breath.**

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

----------## **Bonds and Treasuries**

View image: ([link removed])

Caption:

The bond market was where the real action was this week. The **10-year Treasury yield** jumped a whopping 25 basis points to 4.40%, while the **2-year yield** increased 14 basis points to 4.24%. This steepening of the yield curve is like a neon sign flashing “inflation expectations are changing!”As a trader, I’ve learned to watch the bond market like a hawk.

It often signals what’s coming for stocks before the equity markets catch on. This move suggests that investors are starting to price in higher inflation and growth expectations. It’s a double-edged sword – good for economic growth prospects but potentially challenging for certain sectors that are sensitive to interest rates.

----------

## **US Market Highlights**

November’s **Consumer Price Index (CPI)** came in at 2.7%, up slightly from October’s 2.6%. The core CPI, which excludes volatile food and energy prices, held steady at 3.3%. Now, I’ve been around long enough to remember when 2% inflation was the gold standard. We’re not there yet, but we’re moving in the right direction.

What really caught my eye was that shelter costs drove 40% of the increase. As someone who trades daily, I can tell you this is significant. **It suggests that housing costs remain a major factor in overall inflation, which could influence Fed policy going forward.**

Speaking of the Fed, market expectations for a rate cut at next week’s FOMC meeting have increased. The CME FedWatch tool now shows a 95.3% probability of a 25 basis point cut, up from 86.0% last week. As an analyst, I always caution against putting too much stock in these probabilities – the Fed has surprised us before, and they could do it again.

In corporate news, we saw some interesting movements:

* **Oracle** took a 9.6% hit after disappointing Q2 earnings and lower-than-expected Q3 guidance.

* **Adobe’s** fiscal year 2025 guidance left investors wanting more.

* **Broadcom** was the star performer, rallying 25.2% on strong results and upbeat guidance.

These moves underscore the importance of looking beyond headline numbers and really digging into company fundamentals.

## **Global Highlights**

The international scene is giving us plenty to chew on. The **European Central Bank (ECB)** made its fourth rate cut of 2024, bringing rates down to 3%. What’s more interesting is that they removed language about keeping rates “sufficiently restrictive for as long as necessary.” As someone who’s navigated global markets for years, I can tell you this is a significant shift in tone.

**Germany**, Europe’s economic powerhouse, is facing headwinds. The **Bundesbank** slashed growth forecasts to a mere 0.2% for 2025. This isn’t just a number – it’s a warning sign about rising protectionism, weak exports, and structural issues weighing on industry and jobs. As an advisor, I’m telling my clients to watch European investments carefully in the coming months.

----------## Commodities & Crypto

View image: ([link removed])

Caption:

The energy markets are showing their typical complexity. Oil rebounded 3% this week, though I’m keeping a close eye on **OPEC’s** downward revision of global demand forecasts. The International Energy Agency expects global oil supply to outstrip demand by 2025, which could keep the market in surplus.

View image: ([link removed])

Caption:

In the metals market, copper is holding steady at $9,192 in London. Gold, meanwhile, is facing headwinds from rising bond yields, trading around $2,660. As a long-time gold bug, I’m watching this closely – gold often tells us something about market sentiment that other assets don’t.

View image: ([link removed])

Caption:

Now, let’s talk crypto. **Bitcoin** is holding steady above $100,000 – a level that seemed like a pipe dream just a few years ago. But the real story this week is **Ethereum**. We’ve seen $825 million in net ETF inflows, bringing total ETF holdings to $13.6 billion, or 2.91% of all ETH in circulation. This isn’t just crypto enthusiasts playing around – this is serious institutional money making its move.

## Calendar

Next week’s calendar is packed with market-moving events. Here’s what I’m focusing on:

* The **Federal Reserve’s** final rate decision of the year (Wednesday)

* **Bank of Japan** and **Bank of England** decisions (Thursday)

* November U.S. retail sales data

* Q3 GDP update

* November personal income and outlays report, including the Fed’s favorite inflation gauge

* Earnings from **Micron Technology**, **FedEx**, and **Nike**

Each of these events has the potential to move markets, and I’ll be watching them all closely.Remember, as the great Benjamin Graham once said, “The investor’s chief problem – and even his worst enemy – is likely to be himself.” Stay disciplined, stick to your investment strategy, and don’t let short-term market noise derail your long-term plans.From my trading desk to yours, here’s to another week of opportunities in the markets. Stay sharp, stay curious, and as always, may your trades be profitable.

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good afternoon,

Just to remind you, we will not publish next week because of Christmas. We wish you and your family a Merry Christmas!

View image: ([link removed])

Caption:

The **Nasdaq Composite** stole the show, breaking the 20,000 barrier for the first time and closing 0.3% higher for the week. This milestone reminds me of the dot-com boom, but this time, it’s backed by real earnings and innovation. Meanwhile, the S&P 500 and Dow Jones took a breather, dropping 0.6% and 1.8%, respectively. The **Russell 2000** felt the most pain, shedding 2.6%. This divergence isn’t just numbers on a screen.

It tells us a story about where the smart money is flowing. Growth stocks, particularly in tech, are seeing renewed interest. But let’s not get ahead of ourselves – market cycles have taught me that **what goes up must eventually come down, or at least pause for breath.**

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

----------## **Bonds and Treasuries**

View image: ([link removed])

Caption:

The bond market was where the real action was this week. The **10-year Treasury yield** jumped a whopping 25 basis points to 4.40%, while the **2-year yield** increased 14 basis points to 4.24%. This steepening of the yield curve is like a neon sign flashing “inflation expectations are changing!”As a trader, I’ve learned to watch the bond market like a hawk.

It often signals what’s coming for stocks before the equity markets catch on. This move suggests that investors are starting to price in higher inflation and growth expectations. It’s a double-edged sword – good for economic growth prospects but potentially challenging for certain sectors that are sensitive to interest rates.

----------

## **US Market Highlights**

November’s **Consumer Price Index (CPI)** came in at 2.7%, up slightly from October’s 2.6%. The core CPI, which excludes volatile food and energy prices, held steady at 3.3%. Now, I’ve been around long enough to remember when 2% inflation was the gold standard. We’re not there yet, but we’re moving in the right direction.

What really caught my eye was that shelter costs drove 40% of the increase. As someone who trades daily, I can tell you this is significant. **It suggests that housing costs remain a major factor in overall inflation, which could influence Fed policy going forward.**

Speaking of the Fed, market expectations for a rate cut at next week’s FOMC meeting have increased. The CME FedWatch tool now shows a 95.3% probability of a 25 basis point cut, up from 86.0% last week. As an analyst, I always caution against putting too much stock in these probabilities – the Fed has surprised us before, and they could do it again.

In corporate news, we saw some interesting movements:

* **Oracle** took a 9.6% hit after disappointing Q2 earnings and lower-than-expected Q3 guidance.

* **Adobe’s** fiscal year 2025 guidance left investors wanting more.

* **Broadcom** was the star performer, rallying 25.2% on strong results and upbeat guidance.

These moves underscore the importance of looking beyond headline numbers and really digging into company fundamentals.

## **Global Highlights**

The international scene is giving us plenty to chew on. The **European Central Bank (ECB)** made its fourth rate cut of 2024, bringing rates down to 3%. What’s more interesting is that they removed language about keeping rates “sufficiently restrictive for as long as necessary.” As someone who’s navigated global markets for years, I can tell you this is a significant shift in tone.

**Germany**, Europe’s economic powerhouse, is facing headwinds. The **Bundesbank** slashed growth forecasts to a mere 0.2% for 2025. This isn’t just a number – it’s a warning sign about rising protectionism, weak exports, and structural issues weighing on industry and jobs. As an advisor, I’m telling my clients to watch European investments carefully in the coming months.

----------## Commodities & Crypto

View image: ([link removed])

Caption:

The energy markets are showing their typical complexity. Oil rebounded 3% this week, though I’m keeping a close eye on **OPEC’s** downward revision of global demand forecasts. The International Energy Agency expects global oil supply to outstrip demand by 2025, which could keep the market in surplus.

View image: ([link removed])

Caption:

In the metals market, copper is holding steady at $9,192 in London. Gold, meanwhile, is facing headwinds from rising bond yields, trading around $2,660. As a long-time gold bug, I’m watching this closely – gold often tells us something about market sentiment that other assets don’t.

View image: ([link removed])

Caption:

Now, let’s talk crypto. **Bitcoin** is holding steady above $100,000 – a level that seemed like a pipe dream just a few years ago. But the real story this week is **Ethereum**. We’ve seen $825 million in net ETF inflows, bringing total ETF holdings to $13.6 billion, or 2.91% of all ETH in circulation. This isn’t just crypto enthusiasts playing around – this is serious institutional money making its move.

## Calendar

Next week’s calendar is packed with market-moving events. Here’s what I’m focusing on:

* The **Federal Reserve’s** final rate decision of the year (Wednesday)

* **Bank of Japan** and **Bank of England** decisions (Thursday)

* November U.S. retail sales data

* Q3 GDP update

* November personal income and outlays report, including the Fed’s favorite inflation gauge

* Earnings from **Micron Technology**, **FedEx**, and **Nike**

Each of these events has the potential to move markets, and I’ll be watching them all closely.Remember, as the great Benjamin Graham once said, “The investor’s chief problem – and even his worst enemy – is likely to be himself.” Stay disciplined, stick to your investment strategy, and don’t let short-term market noise derail your long-term plans.From my trading desk to yours, here’s to another week of opportunities in the markets. Stay sharp, stay curious, and as always, may your trades be profitable.

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a