| From | TaxPayers' Alliance <[email protected]> |

| Subject | 📰 Weekly bulletin |

| Date | December 15, 2024 11:00 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser ([link removed])

It’s been quite the year

Welcome to the last TaxPayers’ Alliance bulletin of 2024. To those of you who have been with us all the way through and those who joined along the way, we hope you’ve enjoyed the ride and the news we’ve brought you each week hasn’t been too depressing.

From agenda-setting research to local campaigning to making the case on the airwaves and in the papers, standing up for taxpayers has been front and centre of everything we’ve done. Here are some of the highlights.

a nation of taxpayers

Let's start with a big one. Earlier this year we launched our new podcast, a nation of taxpayers ([link removed]) . While every pundit and his dog may have a podcast nowadays, all too often it’s the same tired takes and soft-left thinking that dominate. But not this one. Out is the ‘centrist dad’ dribble and the constant calls for more government spending. A nation of taxpayers offers straight talking, no nonsense analysis of the big issues that matter to taxpayers, updates on our campaigns, and the latest research.

This week's episode really isn’t one to be missed. Elliot Keck, our head of campaigns, and podcast host, Duncan Barkes, are joined by Reform MP, Rupert Lowe. Covering everything from the calibre of MPs to HMRC to the planned football regulator, this is an absolute corker of an episode. You can catch the conversation on Apple Podcasts ([link removed]) , Spotify ([link removed]) , and YouTube ([link removed]) .

[link removed]

[link removed]

First class research

Lifetime tax

In March, landmark analysis from the TPA researchers revealed that the average household will pay over £1.2 million in tax in their lifetime ([link removed]) , meaning they would have to work for 19.5 years just to pay off the taxman. The bottom 20 per cent of households, or families with a household gross income of £19,599, will work for almost 23.4 years to pay off their lifetime tax bill, the longest of any group.

Over a lifetime, an average household will pay £587,760 in income tax; £181,590 of VAT; £173,235 of employee’s national insurance contributions; £91,230 of council tax; and £40,350 of employers’ national insurance contributions. With the tax rises announced in October’s budget, the situation will only have got worse.

Facing down facility time

As new ministers got settled into their departments, we were on hand to help explain why we don’t get the public services we pay for. For starters, tens of thousands of those employed across the public sector are actually moonlighting as trade union officials ([link removed]) . Our analysis of the latest figures showed that in 2022-23 there were 23,592 public sector trade union representatives, an increase of 468 from 2021-22.

Worse still, over 1,000 of them spent 100 per cent of their time on union duties. To be absolutely clear, over 1,000 people employed in roles across the public sector spent none of their time actually doing the jobs they were employed for.

It’s only right that public sector officials are focussed on the job they’re hired to do and it’s high time ministers clamped down on this questionable practice so public sector employees are actually working for the public, not the unions that hold the country to ransom!

What a load of rubbish… bins

One of the most fundamental responsibilities of town halls is the collection of rubbish. It is probably the service most of us interact with most often, and one of the most frustrating when it goes wrong. It’s also one that’s become far more complicated in recent years. The proliferation of bins that councils force their residents to sort rubbish into was laid bare by the TPA wonks in August. ([link removed])

Blaenau Gwent, Cotswold and Merthyr Tydfil, all force residents to sort their rubbish into 10 different types of bin while across the country, we identified 11 different types of bin issued by local authorities.

We were delighted to see someone in the department for environment, food, and rural affairs paying attention to our research ([link removed]) as ministers have now announced plans to make councils cap the number of bins they issue at four.

Hitting the road

What really sets the TPA apart from other groups is our commitment to taking our message out of Westminster and into high streets across the country and 2024 was no exception.

When we got wind that Pembrokeshire county council planned a 16.31 per cent council tax increase, the largest in the country, our team leapt into action. Over the course of three days, we delivered thousands of leaflets, and urged residents to use our dedicated campaign website to contact council bosses and voice their opposition to the increase. This short, sharp campaign saw the town hall big wigs back down and slash the tax rise, sparing residents from the worst of the council’s greed.

When we launched our online debt clock ([link removed]) showing how the UK’s national debt relentlessly ticks up, we knew we needed to do more to force this issue up the agenda.

Plastering the horrifying numbers on the side of a van, we took the clock from the computer screen and into the streets. Wherever we went, the reaction was the same - shock. Shock at the sheer scale of the debt, shock at how quickly it goes up, shock at the amount spent just servicing the interest each year (over £100 billion) and shock that so few of the politicians in Westminster seem interested in talking about it, let alone dealing with it.

While the debt is still rising, our efforts kicked off a national conversation. First up, the House of Lords economic affairs committee published a report ([link removed]) which raised a “big red flag” about the state of the finances. Chairman of the committee, Lord Bridges, even said: “This report highlights a grim reality: our national debt risks developing on an unsustainable path. This has not received the attention it deserves.” You can say that again. This was followed by the chairman of the OBR ([link removed]) warning that the debt could “spiral” out of control. While Rachel Reeves is yet to get to grips with the debt, it’s now become a key consideration whenever someone demands more spending or higher taxes.

There's much more to do

As we look ahead to 2025, you can be in no doubt that the TPA will always stand up for hard-working taxpayers like you. Can you help spread the word by forwarding this email to your family and friends?

Thank you for all your support over the last year!

Benjamin Elks

Grassroots Development Manager

[link removed]

============================================================

** Twitter ([link removed])

** [link removed] ([link removed])

** YouTube ([link removed])

** Website ([link removed])

Copyright © 2024 The TaxPayers' Alliance, All rights reserved.

You are receiving this email because you opted in to receiving our updates, or we have a legitimate interest to contact you about our work.

TaxPayers' Alliance is a trading name of The TaxPayers' Alliance Limited, a company incorporated in England & Wales under company registration no. 04873888 and whose registered office is at 55 Tufton Street, London SW1P 3QL.

You can read our privacy notice here: [link removed]

Our mailing address is:

The TaxPayers' Alliance

55 Tufton Street

London, London SW1P 3QL

United Kingdom

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

It’s been quite the year

Welcome to the last TaxPayers’ Alliance bulletin of 2024. To those of you who have been with us all the way through and those who joined along the way, we hope you’ve enjoyed the ride and the news we’ve brought you each week hasn’t been too depressing.

From agenda-setting research to local campaigning to making the case on the airwaves and in the papers, standing up for taxpayers has been front and centre of everything we’ve done. Here are some of the highlights.

a nation of taxpayers

Let's start with a big one. Earlier this year we launched our new podcast, a nation of taxpayers ([link removed]) . While every pundit and his dog may have a podcast nowadays, all too often it’s the same tired takes and soft-left thinking that dominate. But not this one. Out is the ‘centrist dad’ dribble and the constant calls for more government spending. A nation of taxpayers offers straight talking, no nonsense analysis of the big issues that matter to taxpayers, updates on our campaigns, and the latest research.

This week's episode really isn’t one to be missed. Elliot Keck, our head of campaigns, and podcast host, Duncan Barkes, are joined by Reform MP, Rupert Lowe. Covering everything from the calibre of MPs to HMRC to the planned football regulator, this is an absolute corker of an episode. You can catch the conversation on Apple Podcasts ([link removed]) , Spotify ([link removed]) , and YouTube ([link removed]) .

[link removed]

[link removed]

First class research

Lifetime tax

In March, landmark analysis from the TPA researchers revealed that the average household will pay over £1.2 million in tax in their lifetime ([link removed]) , meaning they would have to work for 19.5 years just to pay off the taxman. The bottom 20 per cent of households, or families with a household gross income of £19,599, will work for almost 23.4 years to pay off their lifetime tax bill, the longest of any group.

Over a lifetime, an average household will pay £587,760 in income tax; £181,590 of VAT; £173,235 of employee’s national insurance contributions; £91,230 of council tax; and £40,350 of employers’ national insurance contributions. With the tax rises announced in October’s budget, the situation will only have got worse.

Facing down facility time

As new ministers got settled into their departments, we were on hand to help explain why we don’t get the public services we pay for. For starters, tens of thousands of those employed across the public sector are actually moonlighting as trade union officials ([link removed]) . Our analysis of the latest figures showed that in 2022-23 there were 23,592 public sector trade union representatives, an increase of 468 from 2021-22.

Worse still, over 1,000 of them spent 100 per cent of their time on union duties. To be absolutely clear, over 1,000 people employed in roles across the public sector spent none of their time actually doing the jobs they were employed for.

It’s only right that public sector officials are focussed on the job they’re hired to do and it’s high time ministers clamped down on this questionable practice so public sector employees are actually working for the public, not the unions that hold the country to ransom!

What a load of rubbish… bins

One of the most fundamental responsibilities of town halls is the collection of rubbish. It is probably the service most of us interact with most often, and one of the most frustrating when it goes wrong. It’s also one that’s become far more complicated in recent years. The proliferation of bins that councils force their residents to sort rubbish into was laid bare by the TPA wonks in August. ([link removed])

Blaenau Gwent, Cotswold and Merthyr Tydfil, all force residents to sort their rubbish into 10 different types of bin while across the country, we identified 11 different types of bin issued by local authorities.

We were delighted to see someone in the department for environment, food, and rural affairs paying attention to our research ([link removed]) as ministers have now announced plans to make councils cap the number of bins they issue at four.

Hitting the road

What really sets the TPA apart from other groups is our commitment to taking our message out of Westminster and into high streets across the country and 2024 was no exception.

When we got wind that Pembrokeshire county council planned a 16.31 per cent council tax increase, the largest in the country, our team leapt into action. Over the course of three days, we delivered thousands of leaflets, and urged residents to use our dedicated campaign website to contact council bosses and voice their opposition to the increase. This short, sharp campaign saw the town hall big wigs back down and slash the tax rise, sparing residents from the worst of the council’s greed.

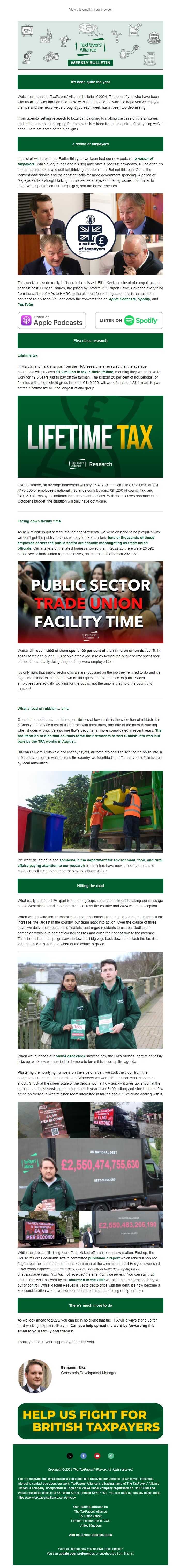

When we launched our online debt clock ([link removed]) showing how the UK’s national debt relentlessly ticks up, we knew we needed to do more to force this issue up the agenda.

Plastering the horrifying numbers on the side of a van, we took the clock from the computer screen and into the streets. Wherever we went, the reaction was the same - shock. Shock at the sheer scale of the debt, shock at how quickly it goes up, shock at the amount spent just servicing the interest each year (over £100 billion) and shock that so few of the politicians in Westminster seem interested in talking about it, let alone dealing with it.

While the debt is still rising, our efforts kicked off a national conversation. First up, the House of Lords economic affairs committee published a report ([link removed]) which raised a “big red flag” about the state of the finances. Chairman of the committee, Lord Bridges, even said: “This report highlights a grim reality: our national debt risks developing on an unsustainable path. This has not received the attention it deserves.” You can say that again. This was followed by the chairman of the OBR ([link removed]) warning that the debt could “spiral” out of control. While Rachel Reeves is yet to get to grips with the debt, it’s now become a key consideration whenever someone demands more spending or higher taxes.

There's much more to do

As we look ahead to 2025, you can be in no doubt that the TPA will always stand up for hard-working taxpayers like you. Can you help spread the word by forwarding this email to your family and friends?

Thank you for all your support over the last year!

Benjamin Elks

Grassroots Development Manager

[link removed]

============================================================

** Twitter ([link removed])

** [link removed] ([link removed])

** YouTube ([link removed])

** Website ([link removed])

Copyright © 2024 The TaxPayers' Alliance, All rights reserved.

You are receiving this email because you opted in to receiving our updates, or we have a legitimate interest to contact you about our work.

TaxPayers' Alliance is a trading name of The TaxPayers' Alliance Limited, a company incorporated in England & Wales under company registration no. 04873888 and whose registered office is at 55 Tufton Street, London SW1P 3QL.

You can read our privacy notice here: [link removed]

Our mailing address is:

The TaxPayers' Alliance

55 Tufton Street

London, London SW1P 3QL

United Kingdom

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Message Analysis

- Sender: TaxPayers' Alliance

- Political Party: n/a

- Country: United Kingdom

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp