| From | Urban Institute :: Research Update <[email protected]> |

| Subject | How household health care spending would surge if enhanced PTC’s expire |

| Date | December 13, 2024 5:39 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Urban Institute Update

Web Version: [link removed]

----------------------------------------

[link removed]

[link removed]

Household spending on premiums would surge if enhanced premium tax credits expire

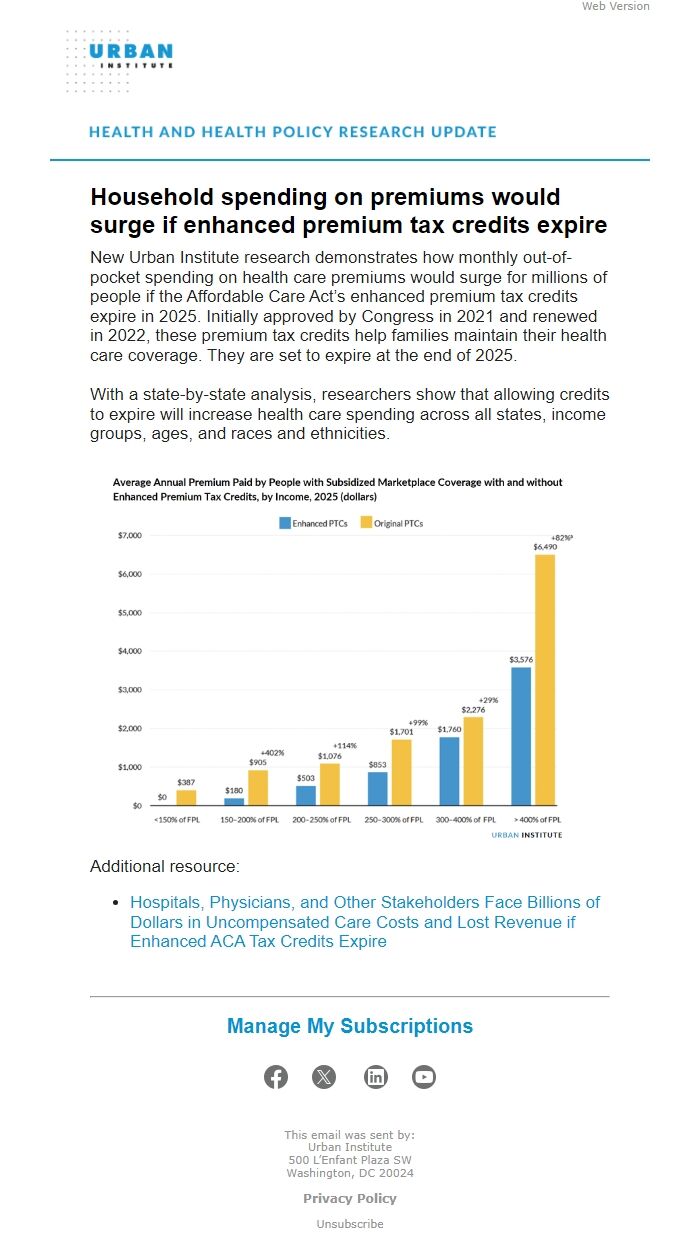

New Urban Institute research demonstrates how monthly out-of-pocket spending on health care premiums would surge for millions of people if the Affordable Care Act’s enhanced premium tax credits expire in 2025. Initially approved by Congress in 2021 and renewed in 2022, these premium tax credits help families maintain their health care coverage. They are set to expire at the end of 2025.

With a state-by-state analysis, researchers show that allowing credits to expire will increase health care spending across all states, income groups, ages, and races and ethnicities.

[link removed]

Additional resource:

-

[link removed]

Hospitals, Physicians, and Other Stakeholders Face Billions of Dollars in Uncompensated Care Costs and Lost Revenue if Enhanced ACA Tax Credits Expire

[link removed]

Manage My Subscriptions

[link removed]

[link removed]

[link removed]

[link removed]

----------------------------------------

This email was sent by: Urban Institute

500 L’Enfant Plaza SW,

Washington, DC, 20024

Privacy Policy: [link removed]

Update Profile: [link removed]

Manage Subscriptions: [link removed]

Unsubscribe: [link removed]

Web Version: [link removed]

----------------------------------------

[link removed]

[link removed]

Household spending on premiums would surge if enhanced premium tax credits expire

New Urban Institute research demonstrates how monthly out-of-pocket spending on health care premiums would surge for millions of people if the Affordable Care Act’s enhanced premium tax credits expire in 2025. Initially approved by Congress in 2021 and renewed in 2022, these premium tax credits help families maintain their health care coverage. They are set to expire at the end of 2025.

With a state-by-state analysis, researchers show that allowing credits to expire will increase health care spending across all states, income groups, ages, and races and ethnicities.

[link removed]

Additional resource:

-

[link removed]

Hospitals, Physicians, and Other Stakeholders Face Billions of Dollars in Uncompensated Care Costs and Lost Revenue if Enhanced ACA Tax Credits Expire

[link removed]

Manage My Subscriptions

[link removed]

[link removed]

[link removed]

[link removed]

----------------------------------------

This email was sent by: Urban Institute

500 L’Enfant Plaza SW,

Washington, DC, 20024

Privacy Policy: [link removed]

Update Profile: [link removed]

Manage Subscriptions: [link removed]

Unsubscribe: [link removed]

Message Analysis

- Sender: Urban Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Salesforce Email Studio (ExactTarget)