Email

Mega-Cap Mania: How 6 Tech Giants Drove Wall Street’s Latest Rally (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Mega-Cap Mania: How 6 Tech Giants Drove Wall Street’s Latest Rally (Weekly Cheat Sheet) |

| Date | December 9, 2024 5:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good afternoon,

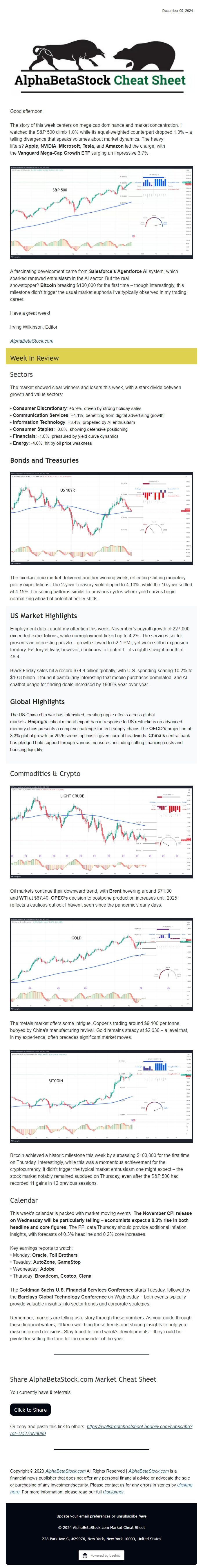

The story of this week centers on mega-cap dominance and market concentration. I watched the S&P 500 climb 1.0% while its equal-weighted counterpart dropped 1.3% – a telling divergence that speaks volumes about market dynamics. The heavy lifters? **Apple**, **NVIDIA**, **Microsoft**, **Tesla**, and **Amazon** led the charge, with the **Vanguard Mega-Cap Growth ETF** surging an impressive 3.7%.

View image: ([link removed])

Caption:

A fascinating development came from **Salesforce’s** **Agentforce AI** system, which sparked renewed enthusiasm in the AI sector. But the real showstopper? **Bitcoin** breaking $100,000 for the first time – though interestingly, this milestone didn’t trigger the usual market euphoria I’ve typically observed in my trading career.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

----------## Sectors

The market showed clear winners and losers this week, with a stark divide between growth and value sectors:

• **Consumer Discretionary**: +5.9%, driven by strong holiday sales

• **Communication Services**: +4.1%, benefiting from digital advertising growth

• **Information Technology**: +3.4%, propelled by AI enthusiasm

• **Consumer Staples**: -0.8%, showing defensive positioning

• **Financials**: -1.8%, pressured by yield curve dynamics

• **Energy**: -4.6%, hit by oil price weakness

## **Bonds and Treasuries**

View image: ([link removed])

Caption:

The fixed-income market delivered another winning week, reflecting shifting monetary policy expectations. The 2-year Treasury yield dipped to 4.10%, while the 10-year settled at 4.15%. I’m seeing patterns similar to previous cycles where yield curves begin normalizing ahead of potential policy shifts.

----------

## **US Market Highlights**

Employment data caught my attention this week. November’s payroll growth of 227,000 exceeded expectations, while unemployment ticked up to 4.2%. The services sector presents an interesting puzzle – growth slowed to 52.1 PMI, yet we’re still in expansion territory. Factory activity, however, continues to contract – its eighth straight month at 48.4.

Black Friday sales hit a record $74.4 billion globally, with U.S. spending soaring 10.2% to $10.8 billion. I found it particularly interesting that mobile purchases dominated, and AI chatbot usage for finding deals increased by 1800% year-over-year.

## **Global Highlights**

The US-China chip war has intensified, creating ripple effects across global markets. **Beijing’s** critical mineral export ban in response to US restrictions on advanced memory chips presents a complex challenge for tech supply chains.The **OECD’s** projection of 3.3% global growth for 2025 seems optimistic given current headwinds. **China’s** central bank has pledged bold support through various measures, including cutting financing costs and boosting liquidity.

----------## Commodities & Crypto

View image: ([link removed])

Caption:

Oil markets continue their downward trend, with **Brent** hovering around $71.30 and **WTI** at $67.40. **OPEC’s** decision to postpone production increases until 2025 reflects a cautious outlook I haven’t seen since the pandemic’s early days.

View image: ([link removed])

Caption:

The metals market offers some intrigue. Copper’s trading around $9,100 per tonne, buoyed by China’s manufacturing revival. Gold remains steady at $2,630 – a level that, in my experience, often precedes significant market moves.

View image: ([link removed])

Caption:

Bitcoin achieved a historic milestone this week by surpassing $100,000 for the first time on Thursday. Interestingly, while this was a momentous achievement for the cryptocurrency, it didn’t trigger the typical market enthusiasm one might expect – the stock market notably remained subdued on Thursday, even after the S&P 500 had recorded 11 gains in 12 previous sessions.

## Calendar

This week’s calendar is packed with market-moving events.** The November CPI release on Wednesday will be particularly telling – economists expect a 0.3% rise in both headline and core figures.** The PPI data Thursday should provide additional inflation insights, with forecasts of 0.3% headline and 0.2% core increases.

Key earnings reports to watch:

• Monday: **Oracle**, **Toll Brothers**

• Tuesday: **AutoZone**, **GameStop**

• Wednesday: **Adobe**

• Thursday: **Broadcom**, **Costco**, **Ciena**

The **Goldman Sachs U.S. Financial Services Conference** starts Tuesday, followed by the **Barclays Global Technology Conference** on Wednesday – both events typically provide valuable insights into sector trends and corporate strategies.

Remember, markets are telling us a story through these numbers. As your guide through these financial waters, I’ll keep watching these trends and sharing insights to help you make informed decisions. Stay tuned for next week’s developments – they could be pivotal for setting the tone for the remainder of the year.

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good afternoon,

The story of this week centers on mega-cap dominance and market concentration. I watched the S&P 500 climb 1.0% while its equal-weighted counterpart dropped 1.3% – a telling divergence that speaks volumes about market dynamics. The heavy lifters? **Apple**, **NVIDIA**, **Microsoft**, **Tesla**, and **Amazon** led the charge, with the **Vanguard Mega-Cap Growth ETF** surging an impressive 3.7%.

View image: ([link removed])

Caption:

A fascinating development came from **Salesforce’s** **Agentforce AI** system, which sparked renewed enthusiasm in the AI sector. But the real showstopper? **Bitcoin** breaking $100,000 for the first time – though interestingly, this milestone didn’t trigger the usual market euphoria I’ve typically observed in my trading career.

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

----------## Sectors

The market showed clear winners and losers this week, with a stark divide between growth and value sectors:

• **Consumer Discretionary**: +5.9%, driven by strong holiday sales

• **Communication Services**: +4.1%, benefiting from digital advertising growth

• **Information Technology**: +3.4%, propelled by AI enthusiasm

• **Consumer Staples**: -0.8%, showing defensive positioning

• **Financials**: -1.8%, pressured by yield curve dynamics

• **Energy**: -4.6%, hit by oil price weakness

## **Bonds and Treasuries**

View image: ([link removed])

Caption:

The fixed-income market delivered another winning week, reflecting shifting monetary policy expectations. The 2-year Treasury yield dipped to 4.10%, while the 10-year settled at 4.15%. I’m seeing patterns similar to previous cycles where yield curves begin normalizing ahead of potential policy shifts.

----------

## **US Market Highlights**

Employment data caught my attention this week. November’s payroll growth of 227,000 exceeded expectations, while unemployment ticked up to 4.2%. The services sector presents an interesting puzzle – growth slowed to 52.1 PMI, yet we’re still in expansion territory. Factory activity, however, continues to contract – its eighth straight month at 48.4.

Black Friday sales hit a record $74.4 billion globally, with U.S. spending soaring 10.2% to $10.8 billion. I found it particularly interesting that mobile purchases dominated, and AI chatbot usage for finding deals increased by 1800% year-over-year.

## **Global Highlights**

The US-China chip war has intensified, creating ripple effects across global markets. **Beijing’s** critical mineral export ban in response to US restrictions on advanced memory chips presents a complex challenge for tech supply chains.The **OECD’s** projection of 3.3% global growth for 2025 seems optimistic given current headwinds. **China’s** central bank has pledged bold support through various measures, including cutting financing costs and boosting liquidity.

----------## Commodities & Crypto

View image: ([link removed])

Caption:

Oil markets continue their downward trend, with **Brent** hovering around $71.30 and **WTI** at $67.40. **OPEC’s** decision to postpone production increases until 2025 reflects a cautious outlook I haven’t seen since the pandemic’s early days.

View image: ([link removed])

Caption:

The metals market offers some intrigue. Copper’s trading around $9,100 per tonne, buoyed by China’s manufacturing revival. Gold remains steady at $2,630 – a level that, in my experience, often precedes significant market moves.

View image: ([link removed])

Caption:

Bitcoin achieved a historic milestone this week by surpassing $100,000 for the first time on Thursday. Interestingly, while this was a momentous achievement for the cryptocurrency, it didn’t trigger the typical market enthusiasm one might expect – the stock market notably remained subdued on Thursday, even after the S&P 500 had recorded 11 gains in 12 previous sessions.

## Calendar

This week’s calendar is packed with market-moving events.** The November CPI release on Wednesday will be particularly telling – economists expect a 0.3% rise in both headline and core figures.** The PPI data Thursday should provide additional inflation insights, with forecasts of 0.3% headline and 0.2% core increases.

Key earnings reports to watch:

• Monday: **Oracle**, **Toll Brothers**

• Tuesday: **AutoZone**, **GameStop**

• Wednesday: **Adobe**

• Thursday: **Broadcom**, **Costco**, **Ciena**

The **Goldman Sachs U.S. Financial Services Conference** starts Tuesday, followed by the **Barclays Global Technology Conference** on Wednesday – both events typically provide valuable insights into sector trends and corporate strategies.

Remember, markets are telling us a story through these numbers. As your guide through these financial waters, I’ll keep watching these trends and sharing insights to help you make informed decisions. Stay tuned for next week’s developments – they could be pivotal for setting the tone for the remainder of the year.

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a