Email

The Fed’s Chess Game: Why December’s Rate Decision Matters to Your Money (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | The Fed’s Chess Game: Why December’s Rate Decision Matters to Your Money (Weekly Cheat Sheet) |

| Date | December 2, 2024 7:12 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good afternoon,

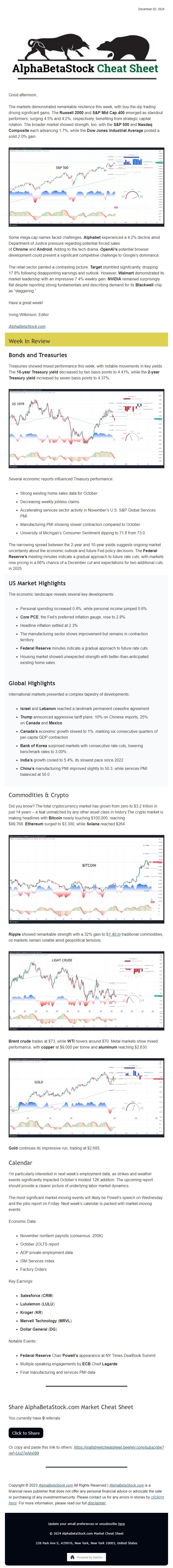

The markets demonstrated remarkable resilience this week, with buy-the-dip trading driving significant gains. The **Russell 2000** and **S&P Mid Cap 400** emerged as standout performers, surging 4.5% and 4.2%, respectively, benefiting from strategic capital rotation. The broader market showed strength, too, with the **S&P 500** and **Nasdaq Composite** each advancing 1.7%, while the **Dow Jones Industrial Average** posted a solid 2.0% gain.

View image: ([link removed])

Caption:

Some mega-cap names faced challenges. **Alphabet** experienced a 4.2% decline amid Department of Justice pressure regarding potential forced sales of **Chrome** and **Android**. Adding to the tech drama, **OpenAI’s** potential browser development could present a significant competitive challenge to Google’s dominance.

The retail sector painted a contrasting picture. **Target** stumbled significantly, dropping 17.8% following disappointing earnings and outlook. However, **Walmart** demonstrated its market leadership with an impressive 7.4% weekly gain. **NVIDIA** remained surprisingly flat despite reporting strong fundamentals and describing demand for its **Blackwell** chip as “staggering.”

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

----------## **Bonds and Treasuries**

Treasuries showed mixed performance this week, with notable movements in key yields. The **10-year Treasury yield** decreased by two basis points to 4.41%, while the **2-year Treasury yield** increased by seven basis points to 4.37%.

View image: ([link removed])

Caption:

Several economic reports influenced Treasury performance:

* Strong existing home sales data for October

* Decreasing weekly jobless claims

* Accelerating services sector activity in November’s U.S. S&P Global Services PMI

* Manufacturing PMI showing slower contraction compared to October

* University of Michigan’s Consumer Sentiment dipping to 71.8 from 73.0

The narrowing spread between the 2-year and 10-year yields suggests ongoing market uncertainty about the economic outlook and future Fed policy decisions. The **Federal Reserve’s** meeting minutes indicate a gradual approach to future rate cuts, with markets now pricing in a 66% chance of a December cut and expectations for two additional cuts in 2025

----------

## **US Market Highlights**

The economic landscape reveals several key developments:

* Personal spending increased 0.4%, while personal income jumped 0.6%

* **Core PCE**, the Fed’s preferred inflation gauge, rose to 2.8%

* Headline inflation settled at 2.3%

* The manufacturing sector shows improvement but remains in contraction territory

* **Federal Reserve** minutes indicate a gradual approach to future rate cuts

* Housing market showed unexpected strength with better-than-anticipated existing home sales

## **Global Highlights**

International markets presented a complex tapestry of developments:

* **Israel** and **Lebanon** reached a landmark permanent ceasefire agreement

* **Trump** announced aggressive tariff plans: 10% on Chinese imports, 25% on **Canada** and **Mexico**

* **Canada’s** economic growth slowed to 1%, marking six consecutive quarters of per-capita GDP contraction

* **Bank of Korea** surprised markets with consecutive rate cuts, lowering benchmark rates to 3.00%

* **India’s** growth cooled to 5.4%, its slowest pace since 2022

* **China’s** manufacturing PMI improved slightly to 50.3, while services PMI balanced at 50.0

----------## Commodities & Crypto

Did you know? The total cryptocurrency market has grown from zero to $3.2 trillion in just 14 years – a feat unmatched by any other asset class in history.The crypto market is making headlines with **Bitcoin** nearly touching $100,000, reaching $99,768. **Ethereum** surged to $3,300, while **Solana** reached $264.

View image: ([link removed])

Caption:

**Ripple** showed remarkable strength with a 32% gain to $[1.40.In]([link removed]) traditional commodities, oil markets remain volatile amid geopolitical tensions.

View image: ([link removed])

Caption:

**Brent crude** trades at $73, while **WTI** hovers around $70. Metal markets show mixed performance, with **copper** at $9,000 per tonne and **aluminum** reaching $2,630.

View image: ([link removed])

Caption:

**Gold** continues its impressive run, trading at $2,685.

## Calendar

I’m particularly interested in next week’s employment data, as strikes and weather events significantly impacted October’s modest 12K addition. The upcoming report should provide a clearer picture of underlying labor market dynamics.

The most significant market-moving events will likely be Powell’s speech on Wednesday and the jobs report on Friday. Next week’s calendar is packed with market-moving events:

Economic Data:

* November nonfarm payrolls (consensus: 200K)

* October JOLTS report

* ADP private employment data

* ISM Services Index

* Factory Orders

Key Earnings:

* **Salesforce** (**CRM**)

* **Lululemon** (**LULU**)

* **Kroger** (**KR**)

* **Marvell Technology** (**MRVL**)

* **Dollar General** (**DG**)

Notable Events:

* **Federal Reserve** Chair **Powell’s** appearance at NY Times DealBook Summit

* Multiple speaking engagements by **ECB** Chief **Lagarde**

* Final manufacturing and services PMI data

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good afternoon,

The markets demonstrated remarkable resilience this week, with buy-the-dip trading driving significant gains. The **Russell 2000** and **S&P Mid Cap 400** emerged as standout performers, surging 4.5% and 4.2%, respectively, benefiting from strategic capital rotation. The broader market showed strength, too, with the **S&P 500** and **Nasdaq Composite** each advancing 1.7%, while the **Dow Jones Industrial Average** posted a solid 2.0% gain.

View image: ([link removed])

Caption:

Some mega-cap names faced challenges. **Alphabet** experienced a 4.2% decline amid Department of Justice pressure regarding potential forced sales of **Chrome** and **Android**. Adding to the tech drama, **OpenAI’s** potential browser development could present a significant competitive challenge to Google’s dominance.

The retail sector painted a contrasting picture. **Target** stumbled significantly, dropping 17.8% following disappointing earnings and outlook. However, **Walmart** demonstrated its market leadership with an impressive 7.4% weekly gain. **NVIDIA** remained surprisingly flat despite reporting strong fundamentals and describing demand for its **Blackwell** chip as “staggering.”

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## Week In Review

----------## **Bonds and Treasuries**

Treasuries showed mixed performance this week, with notable movements in key yields. The **10-year Treasury yield** decreased by two basis points to 4.41%, while the **2-year Treasury yield** increased by seven basis points to 4.37%.

View image: ([link removed])

Caption:

Several economic reports influenced Treasury performance:

* Strong existing home sales data for October

* Decreasing weekly jobless claims

* Accelerating services sector activity in November’s U.S. S&P Global Services PMI

* Manufacturing PMI showing slower contraction compared to October

* University of Michigan’s Consumer Sentiment dipping to 71.8 from 73.0

The narrowing spread between the 2-year and 10-year yields suggests ongoing market uncertainty about the economic outlook and future Fed policy decisions. The **Federal Reserve’s** meeting minutes indicate a gradual approach to future rate cuts, with markets now pricing in a 66% chance of a December cut and expectations for two additional cuts in 2025

----------

## **US Market Highlights**

The economic landscape reveals several key developments:

* Personal spending increased 0.4%, while personal income jumped 0.6%

* **Core PCE**, the Fed’s preferred inflation gauge, rose to 2.8%

* Headline inflation settled at 2.3%

* The manufacturing sector shows improvement but remains in contraction territory

* **Federal Reserve** minutes indicate a gradual approach to future rate cuts

* Housing market showed unexpected strength with better-than-anticipated existing home sales

## **Global Highlights**

International markets presented a complex tapestry of developments:

* **Israel** and **Lebanon** reached a landmark permanent ceasefire agreement

* **Trump** announced aggressive tariff plans: 10% on Chinese imports, 25% on **Canada** and **Mexico**

* **Canada’s** economic growth slowed to 1%, marking six consecutive quarters of per-capita GDP contraction

* **Bank of Korea** surprised markets with consecutive rate cuts, lowering benchmark rates to 3.00%

* **India’s** growth cooled to 5.4%, its slowest pace since 2022

* **China’s** manufacturing PMI improved slightly to 50.3, while services PMI balanced at 50.0

----------## Commodities & Crypto

Did you know? The total cryptocurrency market has grown from zero to $3.2 trillion in just 14 years – a feat unmatched by any other asset class in history.The crypto market is making headlines with **Bitcoin** nearly touching $100,000, reaching $99,768. **Ethereum** surged to $3,300, while **Solana** reached $264.

View image: ([link removed])

Caption:

**Ripple** showed remarkable strength with a 32% gain to $[1.40.In]([link removed]) traditional commodities, oil markets remain volatile amid geopolitical tensions.

View image: ([link removed])

Caption:

**Brent crude** trades at $73, while **WTI** hovers around $70. Metal markets show mixed performance, with **copper** at $9,000 per tonne and **aluminum** reaching $2,630.

View image: ([link removed])

Caption:

**Gold** continues its impressive run, trading at $2,685.

## Calendar

I’m particularly interested in next week’s employment data, as strikes and weather events significantly impacted October’s modest 12K addition. The upcoming report should provide a clearer picture of underlying labor market dynamics.

The most significant market-moving events will likely be Powell’s speech on Wednesday and the jobs report on Friday. Next week’s calendar is packed with market-moving events:

Economic Data:

* November nonfarm payrolls (consensus: 200K)

* October JOLTS report

* ADP private employment data

* ISM Services Index

* Factory Orders

Key Earnings:

* **Salesforce** (**CRM**)

* **Lululemon** (**LULU**)

* **Kroger** (**KR**)

* **Marvell Technology** (**MRVL**)

* **Dollar General** (**DG**)

Notable Events:

* **Federal Reserve** Chair **Powell’s** appearance at NY Times DealBook Summit

* Multiple speaking engagements by **ECB** Chief **Lagarde**

* Final manufacturing and services PMI data

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a