| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2024-48 |

| Date | November 27, 2024 7:22 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Transition relief for TPSOs; National Tax Security Awareness Week; Saver's Credit; and more

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;amp;amp;gt;

IRS.gov Banner

e-News for Tax Professionals November 27, 2024

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

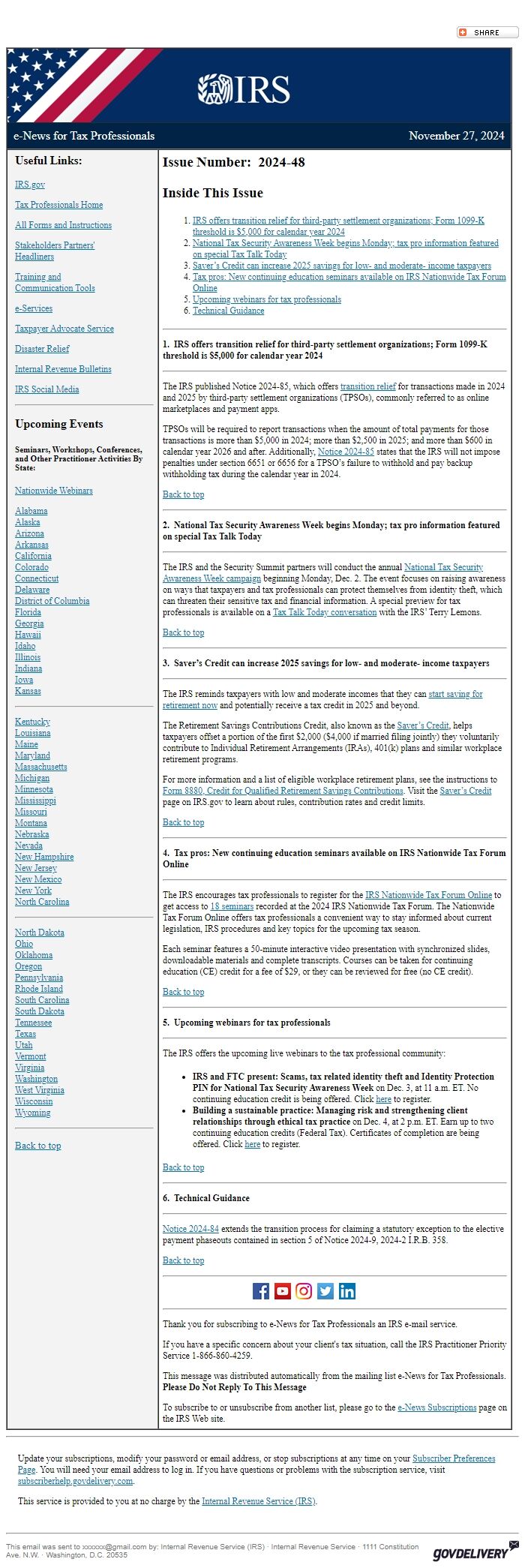

Issue Number: 2024-48

Inside This Issue

* IRS offers transition relief for third-party settlement organizations; Form 1099-K threshold is $5,000 for calendar year 2024 [ #First ]

* National Tax Security Awareness Week begins Monday; tax pro information featured on special Tax Talk Today [ #Second ]

* Saver’s Credit can increase 2025 savings for low- and moderate- income taxpayers [ #Third ]

* Tax pros: New continuing education seminars available on IRS Nationwide Tax Forum Online [ #Fourth ]

* Upcoming webinars for tax professionals [ #Fifth ]

* Technical Guidance [ #Sixth ]

________________________________________________________________________

*1. IRS offers transition relief for third-party settlement organizations; Form 1099-K threshold is $5,000 for calendar year 2024

*

________________________________________________________________________

The IRS published Notice 2024-85, which offers transition relief [ [link removed] ] for transactions made in 2024 and 2025 by third-party settlement organizations (TPSOs), commonly referred to as online marketplaces and payment apps.

TPSOs will be required to report transactions when the amount of total payments for those transactions is more than $5,000 in 2024; more than $2,500 in 2025; and more than $600 in calendar year 2026 and after. Additionally, Notice 2024-85 [ [link removed] ] states that the IRS will not impose penalties under section 6651 or 6656 for a TPSO’s failure to withhold and pay backup withholding tax during the calendar year in 2024.

Back to top [ #top ]

________________________________________________________________________

*2. National Tax Security Awareness Week begins Monday; tax pro information featured on special Tax Talk Today*

________________________________________________________________________

The IRS and the Security Summit partners will conduct the annual National Tax Security Awareness Week campaign [ [link removed] ] beginning Monday, Dec. 2. The event focuses on raising awareness on ways that taxpayers and tax professionals can protect themselves from identity theft, which can threaten their sensitive tax and financial information. A special preview for tax professionals is available on a Tax Talk Today conversation [ [link removed] ] with the IRS’ Terry Lemons.

Back to top [ #top ]

________________________________________________________________________

*3. Saver’s Credit can increase 2025 savings for low- and moderate- income taxpayers*

________________________________________________________________________

The IRS reminds taxpayers with low and moderate incomes that they can start saving for retirement now [ [link removed] ] and potentially receive a tax credit in 2025 and beyond.

The Retirement Savings Contributions Credit, also known as the Saver’s Credit [ [link removed] ], helps taxpayers offset a portion of the first $2,000 ($4,000 if married filing jointly) they voluntarily contribute to Individual Retirement Arrangements (IRAs), 401(k) plans and similar workplace retirement programs.

For more information and a list of eligible workplace retirement plans, see the instructions to Form 8880, Credit for Qualified Retirement Savings Contributions [ [link removed] ]. Visit the Saver’s Credit [ [link removed] ] page on IRS.gov to learn about rules, contribution rates and credit limits.

Back to top [ #top ]

________________________________________________________________________

*4. Tax pros: New continuing education seminars available on IRS Nationwide Tax Forum Online*

________________________________________________________________________

The IRS encourages tax professionals to register for the IRS Nationwide Tax Forum Online [ [link removed] ] to get access to 18 seminars [ [link removed] ] recorded at the 2024 IRS Nationwide Tax Forum. The Nationwide Tax Forum Online offers tax professionals a convenient way to stay informed about current legislation, IRS procedures and key topics for the upcoming tax season.

Each seminar features a 50-minute interactive video presentation with synchronized slides, downloadable materials and complete transcripts. Courses can be taken for continuing education (CE) credit for a fee of $29, or they can be reviewed for free (no CE credit).

Back to top [ #top ]

________________________________________________________________________

*5. Upcoming webinars for tax professionals*

________________________________________________________________________

The IRS offers the upcoming live webinars to the tax professional community:

* *IRS and FTC present: Scams, tax related identity theft and Identity Protection PIN for National Tax Security Awareness Week* on Dec. 3, at 11 a.m. ET. No continuing education credit is being offered. Click here [ [link removed] ] to register.

* *Building a sustainable practice: Managing risk and strengthening client relationships through ethical tax practice* on Dec. 4, at 2 p.m. ET. Earn up to two continuing education credits (Federal Tax). Certificates of completion are being offered. Click here [ [link removed] ] to register.

Back to top [ #top ]

________________________________________________________________________

*6. Technical Guidance*

________________________________________________________________________

Notice 2024-84 [ [link removed] ] extends the transition process for claiming a statutory exception to the elective payment phaseouts contained in section 5 of Notice 2024-9, 2024-2 I.R.B. 358.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;amp;amp;gt;

IRS.gov Banner

e-News for Tax Professionals November 27, 2024

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2024-48

Inside This Issue

* IRS offers transition relief for third-party settlement organizations; Form 1099-K threshold is $5,000 for calendar year 2024 [ #First ]

* National Tax Security Awareness Week begins Monday; tax pro information featured on special Tax Talk Today [ #Second ]

* Saver’s Credit can increase 2025 savings for low- and moderate- income taxpayers [ #Third ]

* Tax pros: New continuing education seminars available on IRS Nationwide Tax Forum Online [ #Fourth ]

* Upcoming webinars for tax professionals [ #Fifth ]

* Technical Guidance [ #Sixth ]

________________________________________________________________________

*1. IRS offers transition relief for third-party settlement organizations; Form 1099-K threshold is $5,000 for calendar year 2024

*

________________________________________________________________________

The IRS published Notice 2024-85, which offers transition relief [ [link removed] ] for transactions made in 2024 and 2025 by third-party settlement organizations (TPSOs), commonly referred to as online marketplaces and payment apps.

TPSOs will be required to report transactions when the amount of total payments for those transactions is more than $5,000 in 2024; more than $2,500 in 2025; and more than $600 in calendar year 2026 and after. Additionally, Notice 2024-85 [ [link removed] ] states that the IRS will not impose penalties under section 6651 or 6656 for a TPSO’s failure to withhold and pay backup withholding tax during the calendar year in 2024.

Back to top [ #top ]

________________________________________________________________________

*2. National Tax Security Awareness Week begins Monday; tax pro information featured on special Tax Talk Today*

________________________________________________________________________

The IRS and the Security Summit partners will conduct the annual National Tax Security Awareness Week campaign [ [link removed] ] beginning Monday, Dec. 2. The event focuses on raising awareness on ways that taxpayers and tax professionals can protect themselves from identity theft, which can threaten their sensitive tax and financial information. A special preview for tax professionals is available on a Tax Talk Today conversation [ [link removed] ] with the IRS’ Terry Lemons.

Back to top [ #top ]

________________________________________________________________________

*3. Saver’s Credit can increase 2025 savings for low- and moderate- income taxpayers*

________________________________________________________________________

The IRS reminds taxpayers with low and moderate incomes that they can start saving for retirement now [ [link removed] ] and potentially receive a tax credit in 2025 and beyond.

The Retirement Savings Contributions Credit, also known as the Saver’s Credit [ [link removed] ], helps taxpayers offset a portion of the first $2,000 ($4,000 if married filing jointly) they voluntarily contribute to Individual Retirement Arrangements (IRAs), 401(k) plans and similar workplace retirement programs.

For more information and a list of eligible workplace retirement plans, see the instructions to Form 8880, Credit for Qualified Retirement Savings Contributions [ [link removed] ]. Visit the Saver’s Credit [ [link removed] ] page on IRS.gov to learn about rules, contribution rates and credit limits.

Back to top [ #top ]

________________________________________________________________________

*4. Tax pros: New continuing education seminars available on IRS Nationwide Tax Forum Online*

________________________________________________________________________

The IRS encourages tax professionals to register for the IRS Nationwide Tax Forum Online [ [link removed] ] to get access to 18 seminars [ [link removed] ] recorded at the 2024 IRS Nationwide Tax Forum. The Nationwide Tax Forum Online offers tax professionals a convenient way to stay informed about current legislation, IRS procedures and key topics for the upcoming tax season.

Each seminar features a 50-minute interactive video presentation with synchronized slides, downloadable materials and complete transcripts. Courses can be taken for continuing education (CE) credit for a fee of $29, or they can be reviewed for free (no CE credit).

Back to top [ #top ]

________________________________________________________________________

*5. Upcoming webinars for tax professionals*

________________________________________________________________________

The IRS offers the upcoming live webinars to the tax professional community:

* *IRS and FTC present: Scams, tax related identity theft and Identity Protection PIN for National Tax Security Awareness Week* on Dec. 3, at 11 a.m. ET. No continuing education credit is being offered. Click here [ [link removed] ] to register.

* *Building a sustainable practice: Managing risk and strengthening client relationships through ethical tax practice* on Dec. 4, at 2 p.m. ET. Earn up to two continuing education credits (Federal Tax). Certificates of completion are being offered. Click here [ [link removed] ] to register.

Back to top [ #top ]

________________________________________________________________________

*6. Technical Guidance*

________________________________________________________________________

Notice 2024-84 [ [link removed] ] extends the transition process for claiming a statutory exception to the elective payment phaseouts contained in section 5 of Notice 2024-9, 2024-2 I.R.B. 358.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery