| From | American Energy Alliance <[email protected]> |

| Subject | No escape |

| Date | November 21, 2024 6:10 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Your Daily Energy News

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 11/21/2024

Subscribe Now ([link removed])

** Governor Gavin doesn’t want you driving a car, period.

------------------------------------------------------------

Center Square ([link removed]) (11/19/24) reports: "California gas prices could rise up to $1.15 per gallon next year thanks to the state’s new carbon credit system, taxes, refinery regulations, and refinery shutdown. This would require the typical Californian to make up to $1,000 per year more in pre-tax income to 'break even,' according to an analysis from a professor at the USC Marshall School of Business. 'The increase contributes to inflation, the high cost of living in California, and has a disproportionate and adverse impact on lower income Californians,' wrote Professor Michael A. Mische. 'To compensate for the increases, the average Californian driving an internal combustion vehicle will have to earn an additional $600.00 to $1,000.00 a year in pre-tax income in order to 'breakeven' with 2024 prices, depending on the grade of gas they purchase.' Days after the November election, the California Air

Resources Board — a regulatory commission almost entirely appointed by the governor — passed new updates to the state’s Low Carbon Fuel Standard, requiring producers of 'dirty' transportation fuel to purchase more credits from producers of “clean” transportation fuel. The new LCFS will provide an estimated $105 billion in EV charging credits and $8 billion of hydrogen credits largely paid for by fees on gasoline and diesel, which the state estimated would be passed on to drivers and consumers. Mische first estimated that the state’s newly passed carbon credit requirement will increase retail prices for regular grade gasoline in 2025 somewhere between 40 and 65 cents per gallon — similar to that estimated by the University of Pennsylvania Kleinman Center for Energy Policy."

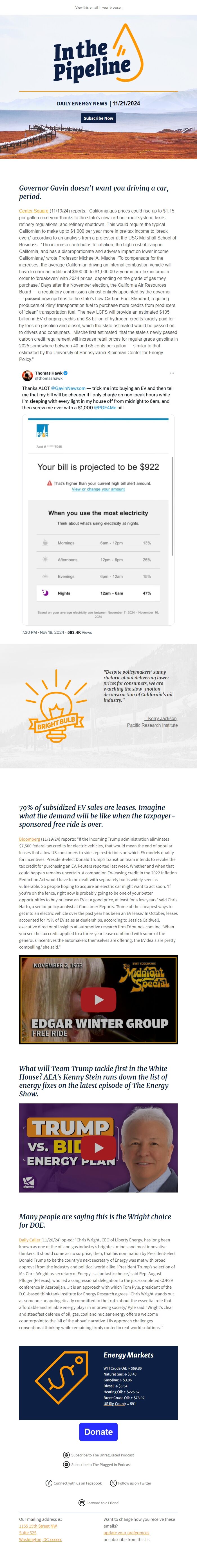

[link removed]

[link removed]

** "Despite policymakers’ sunny rhetoric about delivering lower prices for consumers, we are watching the slow-motion deconstruction of California’s oil industry."

------------------------------------------------------------

– Kerry Jackson, Pacific Research Institute ([link removed])

============================================================

79% of subsidized EV sales are leases. Imagine what the demand will be like when the taxpayer-sponsored free ride is over.

** Bloomberg ([link removed])

(11/19/24) reports: "If the incoming Trump administration eliminates $7,500 federal tax credits for electric vehicles, that would mean the end of popular leases that allow US consumers to sidestep restrictions on which EV models qualify for incentives. President-elect Donald Trump’s transition team intends to revoke the tax credit for purchasing an EV, Reuters reported last week. Whether and when that could happen remains uncertain. A companion EV-leasing credit in the 2022 Inflation Reduction Act would have to be dealt with separately but is widely seen as vulnerable. So people hoping to acquire an electric car might want to act soon. 'If you’re on the fence, right now is probably going to be one of your better opportunities to buy or lease an EV at a good price, at least for a few years,' said Chris Harto, a senior policy analyst at Consumer Reports. 'Some of the cheapest ways to get into an electric vehicle over the past year has been an EV lease.' In October, leases accounted for 79% of

EV sales at dealerships, according to Jessica Caldwell, executive director of insights at automotive research firm Edmunds.com Inc. 'When you see the tax credit applied to a three-year lease combined with some of the generous incentives the automakers themselves are offering, the EV deals are pretty compelling,' she said."

** ([link removed])

What will Team Trump tackle first in the White House? AEA's Kenny Stein runs down the list of energy fixes on the latest episode of The Energy Show.

** ([link removed])

Many people are saying this is the Wright choice for DOE.

** Daily Caller ([link removed])

(11/20/24) op-ed: "Chris Wright, CEO of Liberty Energy, has long been known as one of the oil and gas industry’s brightest minds and most innovative thinkers. It should come as no surprise, then, that his nomination by President-elect Donald Trump to be the country’s next secretary of Energy was met with broad approval from the industry and political world alike. ‘President Trump’s selection of Mr. Chris Wright as secretary of Energy is a fantastic choice,’ said Rep. August Pfluger (R-Texas), who led a congressional delegation to the just-completed COP29 conference in Azerbaijan…It is an approach with which Tom Pyle, president of the D.C.-based think tank Institute for Energy Research agrees. ‘Chris Wright stands out as someone unapologetically committed to the truth about the essential role that affordable and reliable energy plays in improving society,’ Pyle said. ‘Wright’s clear and steadfast defense of oil, gas, coal and nuclear energy offers a welcome counterpoint to the ‘all of th

e above’ narrative. His approach challenges conventional thinking while remaining firmly rooted in real-world solutions.’"

Energy Markets

WTI Crude Oil: ↑ $69.86

Natural Gas: ↑ $3.43

Gasoline: ↑ $3.06

Diesel: ↓ $3.54

Heating Oil: ↑ $225.62

Brent Crude Oil: ↑ $73.92

** US Rig Count ([link removed])

: ↓ 591

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 11/21/2024

Subscribe Now ([link removed])

** Governor Gavin doesn’t want you driving a car, period.

------------------------------------------------------------

Center Square ([link removed]) (11/19/24) reports: "California gas prices could rise up to $1.15 per gallon next year thanks to the state’s new carbon credit system, taxes, refinery regulations, and refinery shutdown. This would require the typical Californian to make up to $1,000 per year more in pre-tax income to 'break even,' according to an analysis from a professor at the USC Marshall School of Business. 'The increase contributes to inflation, the high cost of living in California, and has a disproportionate and adverse impact on lower income Californians,' wrote Professor Michael A. Mische. 'To compensate for the increases, the average Californian driving an internal combustion vehicle will have to earn an additional $600.00 to $1,000.00 a year in pre-tax income in order to 'breakeven' with 2024 prices, depending on the grade of gas they purchase.' Days after the November election, the California Air

Resources Board — a regulatory commission almost entirely appointed by the governor — passed new updates to the state’s Low Carbon Fuel Standard, requiring producers of 'dirty' transportation fuel to purchase more credits from producers of “clean” transportation fuel. The new LCFS will provide an estimated $105 billion in EV charging credits and $8 billion of hydrogen credits largely paid for by fees on gasoline and diesel, which the state estimated would be passed on to drivers and consumers. Mische first estimated that the state’s newly passed carbon credit requirement will increase retail prices for regular grade gasoline in 2025 somewhere between 40 and 65 cents per gallon — similar to that estimated by the University of Pennsylvania Kleinman Center for Energy Policy."

[link removed]

[link removed]

** "Despite policymakers’ sunny rhetoric about delivering lower prices for consumers, we are watching the slow-motion deconstruction of California’s oil industry."

------------------------------------------------------------

– Kerry Jackson, Pacific Research Institute ([link removed])

============================================================

79% of subsidized EV sales are leases. Imagine what the demand will be like when the taxpayer-sponsored free ride is over.

** Bloomberg ([link removed])

(11/19/24) reports: "If the incoming Trump administration eliminates $7,500 federal tax credits for electric vehicles, that would mean the end of popular leases that allow US consumers to sidestep restrictions on which EV models qualify for incentives. President-elect Donald Trump’s transition team intends to revoke the tax credit for purchasing an EV, Reuters reported last week. Whether and when that could happen remains uncertain. A companion EV-leasing credit in the 2022 Inflation Reduction Act would have to be dealt with separately but is widely seen as vulnerable. So people hoping to acquire an electric car might want to act soon. 'If you’re on the fence, right now is probably going to be one of your better opportunities to buy or lease an EV at a good price, at least for a few years,' said Chris Harto, a senior policy analyst at Consumer Reports. 'Some of the cheapest ways to get into an electric vehicle over the past year has been an EV lease.' In October, leases accounted for 79% of

EV sales at dealerships, according to Jessica Caldwell, executive director of insights at automotive research firm Edmunds.com Inc. 'When you see the tax credit applied to a three-year lease combined with some of the generous incentives the automakers themselves are offering, the EV deals are pretty compelling,' she said."

** ([link removed])

What will Team Trump tackle first in the White House? AEA's Kenny Stein runs down the list of energy fixes on the latest episode of The Energy Show.

** ([link removed])

Many people are saying this is the Wright choice for DOE.

** Daily Caller ([link removed])

(11/20/24) op-ed: "Chris Wright, CEO of Liberty Energy, has long been known as one of the oil and gas industry’s brightest minds and most innovative thinkers. It should come as no surprise, then, that his nomination by President-elect Donald Trump to be the country’s next secretary of Energy was met with broad approval from the industry and political world alike. ‘President Trump’s selection of Mr. Chris Wright as secretary of Energy is a fantastic choice,’ said Rep. August Pfluger (R-Texas), who led a congressional delegation to the just-completed COP29 conference in Azerbaijan…It is an approach with which Tom Pyle, president of the D.C.-based think tank Institute for Energy Research agrees. ‘Chris Wright stands out as someone unapologetically committed to the truth about the essential role that affordable and reliable energy plays in improving society,’ Pyle said. ‘Wright’s clear and steadfast defense of oil, gas, coal and nuclear energy offers a welcome counterpoint to the ‘all of th

e above’ narrative. His approach challenges conventional thinking while remaining firmly rooted in real-world solutions.’"

Energy Markets

WTI Crude Oil: ↑ $69.86

Natural Gas: ↑ $3.43

Gasoline: ↑ $3.06

Diesel: ↓ $3.54

Heating Oil: ↑ $225.62

Brent Crude Oil: ↑ $73.92

** US Rig Count ([link removed])

: ↓ 591

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp