Email

Inflation Isn’t Likely to Go Away

| From | Money Metals Exchange <[email protected]> |

| Subject | Inflation Isn’t Likely to Go Away |

| Date | November 18, 2024 5:14 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Breaking News from America's #1 Precious Metals Dealer

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

November 18, 2024 Gold and silver prices slid lower for a third week in a row but are rebounding today. The October rally in prices ended just before Election Day, and markets are still adjusting to Donald Trump???s victory.

Stock prices, which took a big jump immediately following the election, sold off last week. The U.S. dollar Index rallied from just under 103.42 on Nov. 5th to 106.67 at Friday???s close. 10-year treasury yields rose to 4.44% the highest weekly close since June.

For now, monetary policy and the impact of the Fed???s November 7th rate cut are taking a back seat to politics.

1 Oz Silver Walking Liberty Rounds [link removed] " style="max-width: 186px; display:block;"> [link removed]

Shop Now >> [link removed]

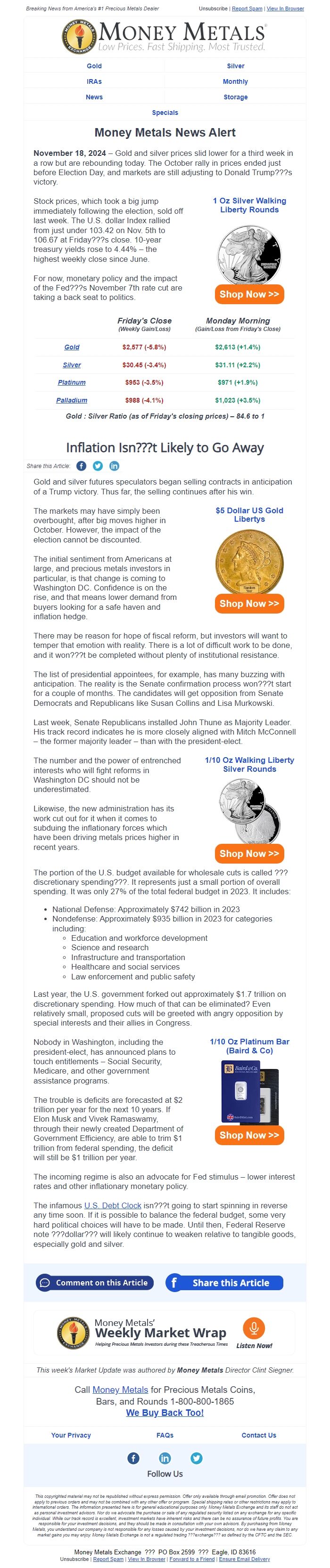

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$2,577 (-5.8%) [link removed]

$2,613 (+1.4%) [link removed]

Silver [link removed]

$30.45 (-3.4%) [link removed]

$31.11 (+2.2%) [link removed]

Platinum [link removed]

$953 (-3.5%) [link removed]

$971 (+1.9%) [link removed]

Palladium [link removed]

$988 (-4.1%) [link removed]

$1,023 (+3.5%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 84.6 to 1

Inflation Isn???t Likely to Go Away

Share this Article: [link removed] [link removed] [link removed]

Gold and silver futures speculators began selling contracts in anticipation of a Trump victory. Thus far, the selling continues after his win.

The markets may have simply been overbought, after big moves higher in October. However, the impact of the election cannot be discounted.

The initial sentiment from Americans at large, and precious metals investors in particular, is that change is coming to Washington DC. Confidence is on the rise, and that means lower demand from buyers looking for a safe haven and inflation hedge.

$5 Dollar US Gold Libertys [link removed] " style="max-width: 186px; display:block;"> [link removed]

Shop Now >> [link removed]

There may be reason for hope of fiscal reform, but investors will want to temper that emotion with reality. There is a lot of difficult work to be done, and it won???t be completed without plenty of institutional resistance.

The list of presidential appointees, for example, has many buzzing with anticipation. The reality is the Senate confirmation process won???t start for a couple of months. The candidates will get opposition from Senate Democrats and Republicans like Susan Collins and Lisa Murkowski.

Last week, Senate Republicans installed John Thune as Majority Leader. His track record indicates he is more closely aligned with Mitch McConnell the former majority leader than with the president-elect.

The number and the power of entrenched interests who will fight reforms in Washington DC should not be underestimated.

Likewise, the new administration has its work cut out for it when it comes to subduing the inflationary forces which have been driving metals prices higher in recent years.

1/10 Oz Walking Liberty Silver Rounds [link removed] " style="max-width: 186px; display:block;"> [link removed]

Shop Now >> [link removed]

The portion of the U.S. budget available for wholesale cuts is called ???discretionary spending???. It represents just a small portion of overall spending. It was only 27% of the total federal budget in 2023. It includes:

National Defense: Approximately $742 billion in 2023

Nondefense: Approximately $935 billion in 2023 for categories including:

Education and workforce development

Science and research

Infrastructure and transportation

Healthcare and social services

Law enforcement and public safety Last year, the U.S. government forked out approximately $1.7 trillion on discretionary spending. How much of that can be eliminated? Even relatively small, proposed cuts will be greeted with angry opposition by special interests and their allies in Congress.

Nobody in Washington, including the president-elect, has announced plans to touch entitlements Social Security, Medicare, and other government assistance programs.

The trouble is deficits are forecasted at $2 trillion per year for the next 10 years. If Elon Musk and Vivek Ramaswamy, through their newly created Department of Government Efficiency, are able to trim $1 trillion from federal spending, the deficit will still be $1 trillion per year.

1/10 Oz Platinum Bar (Baird & Co) [link removed] " style="max-width: 186px; display:block;"> [link removed]

Shop Now >> [link removed]

The incoming regime is also an advocate for Fed stimulus lower interest rates and other inflationary monetary policy.

The infamous U.S. Debt Clock [link removed] isn???t going to start spinning in reverse any time soon. If it is possible to balance the federal budget, some very hard political choices will have to be made. Until then, Federal Reserve note ???dollar??? will likely continue to weaken relative to tangible goods, especially gold and silver.

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Director Clint Siegner.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser

[link removed]

[link removed]

Gold [link removed] Silver [link removed] IRAs [link removed] Monthly [link removed] News [link removed] Storage [link removed] Specials [link removed]

Money Metals News Alert

November 18, 2024 Gold and silver prices slid lower for a third week in a row but are rebounding today. The October rally in prices ended just before Election Day, and markets are still adjusting to Donald Trump???s victory.

Stock prices, which took a big jump immediately following the election, sold off last week. The U.S. dollar Index rallied from just under 103.42 on Nov. 5th to 106.67 at Friday???s close. 10-year treasury yields rose to 4.44% the highest weekly close since June.

For now, monetary policy and the impact of the Fed???s November 7th rate cut are taking a back seat to politics.

1 Oz Silver Walking Liberty Rounds [link removed] " style="max-width: 186px; display:block;"> [link removed]

Shop Now >> [link removed]

Friday's Close

(Weekly Gain/Loss)

Monday Morning

(Gain/Loss from Friday's Close)

Gold [link removed]

$2,577 (-5.8%) [link removed]

$2,613 (+1.4%) [link removed]

Silver [link removed]

$30.45 (-3.4%) [link removed]

$31.11 (+2.2%) [link removed]

Platinum [link removed]

$953 (-3.5%) [link removed]

$971 (+1.9%) [link removed]

Palladium [link removed]

$988 (-4.1%) [link removed]

$1,023 (+3.5%) [link removed]

Gold : Silver Ratio (as of Friday's closing prices) 84.6 to 1

Inflation Isn???t Likely to Go Away

Share this Article: [link removed] [link removed] [link removed]

Gold and silver futures speculators began selling contracts in anticipation of a Trump victory. Thus far, the selling continues after his win.

The markets may have simply been overbought, after big moves higher in October. However, the impact of the election cannot be discounted.

The initial sentiment from Americans at large, and precious metals investors in particular, is that change is coming to Washington DC. Confidence is on the rise, and that means lower demand from buyers looking for a safe haven and inflation hedge.

$5 Dollar US Gold Libertys [link removed] " style="max-width: 186px; display:block;"> [link removed]

Shop Now >> [link removed]

There may be reason for hope of fiscal reform, but investors will want to temper that emotion with reality. There is a lot of difficult work to be done, and it won???t be completed without plenty of institutional resistance.

The list of presidential appointees, for example, has many buzzing with anticipation. The reality is the Senate confirmation process won???t start for a couple of months. The candidates will get opposition from Senate Democrats and Republicans like Susan Collins and Lisa Murkowski.

Last week, Senate Republicans installed John Thune as Majority Leader. His track record indicates he is more closely aligned with Mitch McConnell the former majority leader than with the president-elect.

The number and the power of entrenched interests who will fight reforms in Washington DC should not be underestimated.

Likewise, the new administration has its work cut out for it when it comes to subduing the inflationary forces which have been driving metals prices higher in recent years.

1/10 Oz Walking Liberty Silver Rounds [link removed] " style="max-width: 186px; display:block;"> [link removed]

Shop Now >> [link removed]

The portion of the U.S. budget available for wholesale cuts is called ???discretionary spending???. It represents just a small portion of overall spending. It was only 27% of the total federal budget in 2023. It includes:

National Defense: Approximately $742 billion in 2023

Nondefense: Approximately $935 billion in 2023 for categories including:

Education and workforce development

Science and research

Infrastructure and transportation

Healthcare and social services

Law enforcement and public safety Last year, the U.S. government forked out approximately $1.7 trillion on discretionary spending. How much of that can be eliminated? Even relatively small, proposed cuts will be greeted with angry opposition by special interests and their allies in Congress.

Nobody in Washington, including the president-elect, has announced plans to touch entitlements Social Security, Medicare, and other government assistance programs.

The trouble is deficits are forecasted at $2 trillion per year for the next 10 years. If Elon Musk and Vivek Ramaswamy, through their newly created Department of Government Efficiency, are able to trim $1 trillion from federal spending, the deficit will still be $1 trillion per year.

1/10 Oz Platinum Bar (Baird & Co) [link removed] " style="max-width: 186px; display:block;"> [link removed]

Shop Now >> [link removed]

The incoming regime is also an advocate for Fed stimulus lower interest rates and other inflationary monetary policy.

The infamous U.S. Debt Clock [link removed] isn???t going to start spinning in reverse any time soon. If it is possible to balance the federal budget, some very hard political choices will have to be made. Until then, Federal Reserve note ???dollar??? will likely continue to weaken relative to tangible goods, especially gold and silver.

[link removed]

[link removed]

[link removed]

This week's Market Update was authored by Money Metals Director Clint Siegner.

Call Money Metals [link removed] for Precious Metals Coins,

Bars, and Rounds 1-800-800-1865

We Buy Back Too! [link removed]

Your Privacy [link removed] FAQs [link removed] Contact Us [link removed]

[link removed] [link removed] [link removed]

Follow Us

This copyrighted material may not be republished without express permission. Offer only available through email promotion. Offer does not apply to previous orders and may not be combined with any other offer or program. Special shipping rates or other restrictions may apply to international orders. The information presented here is for general educational purposes only. Money Metals Exchange and its staff do not act as personal investment advisors. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. While our track record is excellent, investment markets have inherent risks and there can be no assurance of future profits. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing from Money Metals, you understand our company is not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. Money Metals Exchange is not a regulated trading ???exchange??? as defined by the CFTC and the SEC.

Money Metals Exchange

PO Box 2599

Eagle, ID 83616

[link removed] style="" Unsubscribe | [link removed] style="" Report Spam | [link removed] style="" View In Browser | [link removed] style="" Forward to a Friend | Ensure Email Delivery [link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a