| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2024-45 |

| Date | November 8, 2024 8:54 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Notice of renewal for enrolled agents; 2024 IRS Nationwide Tax Forum Online; and more

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;amp;amp;amp;amp;gt;

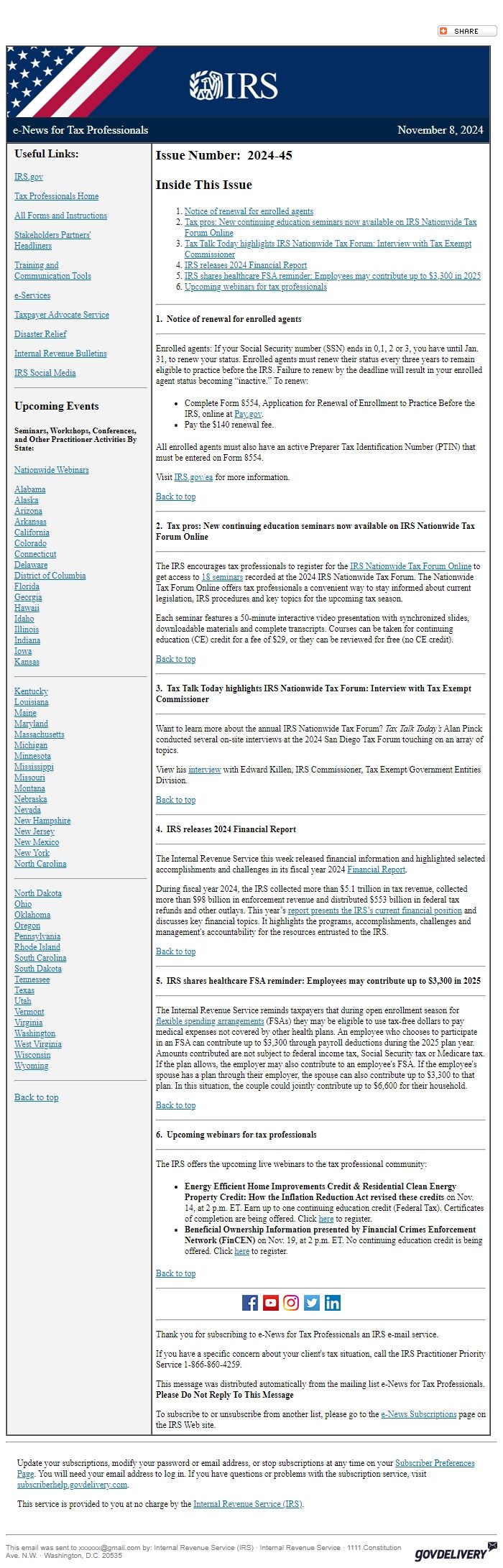

IRS.gov Banner

e-News for Tax Professionals November 8, 2024

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2024-45

Inside This Issue

* Notice of renewal for enrolled agents [ #First ]

* Tax pros: New continuing education seminars now available on IRS Nationwide Tax Forum Online [ #Second ]

* Tax Talk Today highlights IRS Nationwide Tax Forum: Interview with Tax Exempt Commissioner [ #Third ]

* IRS releases 2024 Financial Report [ #Fourth ]

* IRS shares healthcare FSA reminder: Employees may contribute up to $3,300 in 2025 [ #Fifth ]

* Upcoming webinars for tax professionals [ #Sixth ]

________________________________________________________________________

*1. Notice of renewal for enrolled agents*

________________________________________________________________________

Enrolled agents: If your Social Security number (SSN) ends in 0,1, 2 or 3, you have until Jan. 31, to renew your status. Enrolled agents must renew their status every three years to remain eligible to practice before the IRS. Failure to renew by the deadline will result in your enrolled agent status becoming “inactive.” To renew:

* Complete Form 8554, Application for Renewal of Enrollment to Practice Before the IRS, online at Pay.gov [ [link removed] ].

* Pay the $140 renewal fee.

All enrolled agents must also have an active Preparer Tax Identification Number (PTIN) that must be entered on Form 8554.

Visit IRS.gov/ea [ [link removed] ] for more information.

Back to top [ #top ]

________________________________________________________________________

*2. Tax pros: New continuing education seminars now available on IRS Nationwide Tax Forum Online*

________________________________________________________________________

The IRS encourages tax professionals to register for the IRS Nationwide Tax Forum Online [ [link removed] ] to get access to 18 seminars [ [link removed] ] recorded at the 2024 IRS Nationwide Tax Forum. The Nationwide Tax Forum Online offers tax professionals a convenient way to stay informed about current legislation, IRS procedures and key topics for the upcoming tax season.

Each seminar features a 50-minute interactive video presentation with synchronized slides, downloadable materials and complete transcripts. Courses can be taken for continuing education (CE) credit for a fee of $29, or they can be reviewed for free (no CE credit).

Back to top [ #top ]

________________________________________________________________________

*3. Tax Talk Today highlights IRS Nationwide Tax Forum: Interview with Tax Exempt Commissioner*

________________________________________________________________________

Want to learn more about the annual IRS Nationwide Tax Forum? "Tax Talk Today’s" Alan Pinck conducted several on-site interviews at the 2024 San Diego Tax Forum touching on an array of topics.

View his interview [ [link removed] ] with Edward Killen, IRS Commissioner, Tax Exempt/Government Entities Division.

Back to top [ #top ]

________________________________________________________________________

*4. IRS releases 2024 Financial Report*

________________________________________________________________________

The Internal Revenue Service this week released financial information and highlighted selected accomplishments and challenges in its fiscal year 2024 Financial Report [ [link removed] ].

During fiscal year 2024, the IRS collected more than $5.1 trillion in tax revenue, collected more than $98 billion in enforcement revenue and distributed $553 billion in federal tax refunds and other outlays. This year’s report presents the IRS’s current financial position [ [link removed] ] and discusses key financial topics. It highlights the programs, accomplishments, challenges and management's accountability for the resources entrusted to the IRS.

Back to top [ #top ]

________________________________________________________________________

*5. IRS shares healthcare FSA reminder: Employees may contribute up to $3,300 in 2025*

________________________________________________________________________

The Internal Revenue Service reminds taxpayers that during open enrollment season for flexible spending arrangements [ [link removed] ] (FSAs) they may be eligible to use tax-free dollars to pay medical expenses not covered by other health plans. An employee who chooses to participate in an FSA can contribute up to $3,300 through payroll deductions during the 2025 plan year. Amounts contributed are not subject to federal income tax, Social Security tax or Medicare tax. If the plan allows, the employer may also contribute to an employee's FSA. If the employee's spouse has a plan through their employer, the spouse can also contribute up to $3,300 to that plan. In this situation, the couple could jointly contribute up to $6,600 for their household.

Back to top [ #top ]

________________________________________________________________________

*6. Upcoming webinars for tax professionals*

________________________________________________________________________

The IRS offers the upcoming live webinars to the tax professional community:

* *Energy Efficient Home Improvements Credit & Residential Clean Energy Property Credit: How the Inflation Reduction Act revised these credits* on Nov. 14, at 2 p.m. ET. Earn up to one continuing education credit (Federal Tax). Certificates of completion are being offered. Click here [ [link removed] ] to register.

* *Beneficial Ownership Information presented by Financial Crimes Enforcement Network (FinCEN)* on Nov. 19, at 2 p.m. ET. No continuing education credit is being offered. Click here [ [link removed] ] to register.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;amp;amp;amp;amp;gt;

IRS.gov Banner

e-News for Tax Professionals November 8, 2024

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2024-45

Inside This Issue

* Notice of renewal for enrolled agents [ #First ]

* Tax pros: New continuing education seminars now available on IRS Nationwide Tax Forum Online [ #Second ]

* Tax Talk Today highlights IRS Nationwide Tax Forum: Interview with Tax Exempt Commissioner [ #Third ]

* IRS releases 2024 Financial Report [ #Fourth ]

* IRS shares healthcare FSA reminder: Employees may contribute up to $3,300 in 2025 [ #Fifth ]

* Upcoming webinars for tax professionals [ #Sixth ]

________________________________________________________________________

*1. Notice of renewal for enrolled agents*

________________________________________________________________________

Enrolled agents: If your Social Security number (SSN) ends in 0,1, 2 or 3, you have until Jan. 31, to renew your status. Enrolled agents must renew their status every three years to remain eligible to practice before the IRS. Failure to renew by the deadline will result in your enrolled agent status becoming “inactive.” To renew:

* Complete Form 8554, Application for Renewal of Enrollment to Practice Before the IRS, online at Pay.gov [ [link removed] ].

* Pay the $140 renewal fee.

All enrolled agents must also have an active Preparer Tax Identification Number (PTIN) that must be entered on Form 8554.

Visit IRS.gov/ea [ [link removed] ] for more information.

Back to top [ #top ]

________________________________________________________________________

*2. Tax pros: New continuing education seminars now available on IRS Nationwide Tax Forum Online*

________________________________________________________________________

The IRS encourages tax professionals to register for the IRS Nationwide Tax Forum Online [ [link removed] ] to get access to 18 seminars [ [link removed] ] recorded at the 2024 IRS Nationwide Tax Forum. The Nationwide Tax Forum Online offers tax professionals a convenient way to stay informed about current legislation, IRS procedures and key topics for the upcoming tax season.

Each seminar features a 50-minute interactive video presentation with synchronized slides, downloadable materials and complete transcripts. Courses can be taken for continuing education (CE) credit for a fee of $29, or they can be reviewed for free (no CE credit).

Back to top [ #top ]

________________________________________________________________________

*3. Tax Talk Today highlights IRS Nationwide Tax Forum: Interview with Tax Exempt Commissioner*

________________________________________________________________________

Want to learn more about the annual IRS Nationwide Tax Forum? "Tax Talk Today’s" Alan Pinck conducted several on-site interviews at the 2024 San Diego Tax Forum touching on an array of topics.

View his interview [ [link removed] ] with Edward Killen, IRS Commissioner, Tax Exempt/Government Entities Division.

Back to top [ #top ]

________________________________________________________________________

*4. IRS releases 2024 Financial Report*

________________________________________________________________________

The Internal Revenue Service this week released financial information and highlighted selected accomplishments and challenges in its fiscal year 2024 Financial Report [ [link removed] ].

During fiscal year 2024, the IRS collected more than $5.1 trillion in tax revenue, collected more than $98 billion in enforcement revenue and distributed $553 billion in federal tax refunds and other outlays. This year’s report presents the IRS’s current financial position [ [link removed] ] and discusses key financial topics. It highlights the programs, accomplishments, challenges and management's accountability for the resources entrusted to the IRS.

Back to top [ #top ]

________________________________________________________________________

*5. IRS shares healthcare FSA reminder: Employees may contribute up to $3,300 in 2025*

________________________________________________________________________

The Internal Revenue Service reminds taxpayers that during open enrollment season for flexible spending arrangements [ [link removed] ] (FSAs) they may be eligible to use tax-free dollars to pay medical expenses not covered by other health plans. An employee who chooses to participate in an FSA can contribute up to $3,300 through payroll deductions during the 2025 plan year. Amounts contributed are not subject to federal income tax, Social Security tax or Medicare tax. If the plan allows, the employer may also contribute to an employee's FSA. If the employee's spouse has a plan through their employer, the spouse can also contribute up to $3,300 to that plan. In this situation, the couple could jointly contribute up to $6,600 for their household.

Back to top [ #top ]

________________________________________________________________________

*6. Upcoming webinars for tax professionals*

________________________________________________________________________

The IRS offers the upcoming live webinars to the tax professional community:

* *Energy Efficient Home Improvements Credit & Residential Clean Energy Property Credit: How the Inflation Reduction Act revised these credits* on Nov. 14, at 2 p.m. ET. Earn up to one continuing education credit (Federal Tax). Certificates of completion are being offered. Click here [ [link removed] ] to register.

* *Beneficial Ownership Information presented by Financial Crimes Enforcement Network (FinCEN)* on Nov. 19, at 2 p.m. ET. No continuing education credit is being offered. Click here [ [link removed] ] to register.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery