| From | Fraser Institute <[email protected]> |

| Subject | Implications of decarbonization, and Imperative for internal free trade |

| Date | November 2, 2024 2:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

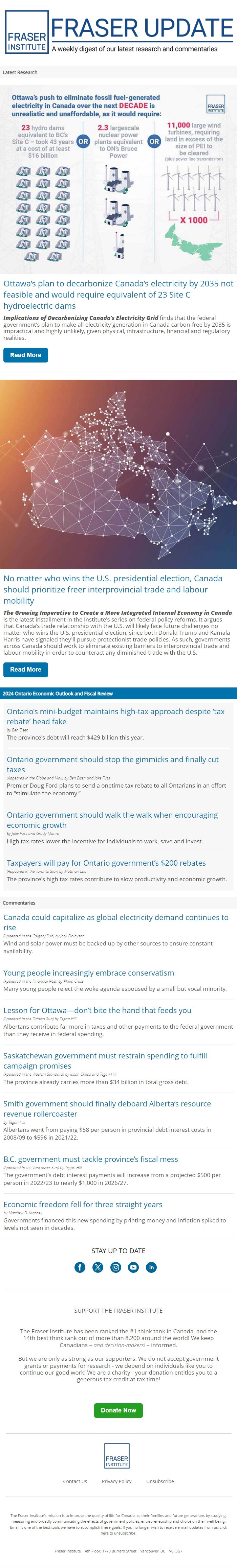

Latest Research Ottawa’s plan to decarbonize Canada’s electricity by 2035 not feasible and would require equivalent of 23 Site C hydroelectric dams [[link removed]]

Implications of Decarbonizing Canada’s Electricity Grid finds that the federal government’s plan to make all electricity generation in Canada carbon-free by 2035 is impractical and highly unlikely, given physical, infrastructure, financial and regulatory realities.

Read More [[link removed]] No matter who wins the U.S. presidential election, Canada should prioritize freer interprovincial trade and labour mobility [[link removed]]

The Growing Imperative to Create a More Integrated Internal Economy in Canada is the latest installment in the Institute's series on federal policy reforms. It argues that Canada's trade relationship with the U.S. will likely face future challenges no matter who wins the U.S. presidential election, since both Donald Trump and Kamala Harris have signaled they'll pursue protectionist trade policies. As such, governments across Canada should work to eliminate existing barriers to interprovincial trade and labour mobility in order to counteract any diminished trade with the U.S.

Read More [[link removed]] 2024 Ontario Economic Outlook and Fiscal Review Ontario’s mini-budget maintains high-tax approach despite ‘tax rebate’ head fake [[link removed]] by Ben Eisen

The province's debt will reach $429 billion this year.

Ontario government should stop the gimmicks and finally cut taxes [[link removed]] (Appeared in the Globe and Mail) by Ben Eisen and Jake Fuss

Premier Doug Ford plans to send a onetime tax rebate to all Ontarians in an effort to “stimulate the economy.”

Ontario government should walk the walk when encouraging economic growth [[link removed]] by Jake Fuss and Grady Munro

High tax rates lower the incentive for individuals to work, save and invest.

Taxpayers will pay for Ontario government’s $200 rebates [[link removed]] (Appeared in the Toronto Star) by Matthew Lau

The province's high tax rates contribute to slow productivity and economic growth.

Commentaries Canada could capitalize as global electricity demand continues to rise [[link removed]] (Appeared in the Calgary Sun) by Jock Finlayson

Wind and solar power must be backed up by other sources to ensure constant availability.

Young people increasingly embrace conservatism [[link removed]] (Appeared in the Financial Post) by Philip Cross

Many young people reject the woke agenda espoused by a small but vocal minority.

Lesson for Ottawa—don’t bite the hand that feeds you [[link removed]] (Appeared in the Ottawa Sun) by Tegan Hill

Albertans contribute far more in taxes and other payments to the federal government than they receive in federal spending.

Saskatchewan government must restrain spending to fulfill campaign promises [[link removed]] (Appeared in the Western Standard) by Jason Childs and Tegan Hill

The province already carries more than $34 billion in total gross debt.

Smith government should finally deboard Alberta’s resource revenue rollercoaster [[link removed]] by Tegan Hill

Albertans went from paying $58 per person in provincial debt interest costs in 2008/09 to $596 in 2021/22.

B.C. government must tackle province’s fiscal mess [[link removed]] (Appeared in the Vancouver Sun) by Tegan Hill

The government's debt interest payments will increase from a projected $500 per person in 2022/23 to nearly $1,000 in 2026/27.

Economic freedom fell for three straight years [[link removed]] by Matthew D. Mitchell

Governments financed this new spending by printing money and inflation spiked to levels not seen in decades.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Implications of Decarbonizing Canada’s Electricity Grid finds that the federal government’s plan to make all electricity generation in Canada carbon-free by 2035 is impractical and highly unlikely, given physical, infrastructure, financial and regulatory realities.

Read More [[link removed]] No matter who wins the U.S. presidential election, Canada should prioritize freer interprovincial trade and labour mobility [[link removed]]

The Growing Imperative to Create a More Integrated Internal Economy in Canada is the latest installment in the Institute's series on federal policy reforms. It argues that Canada's trade relationship with the U.S. will likely face future challenges no matter who wins the U.S. presidential election, since both Donald Trump and Kamala Harris have signaled they'll pursue protectionist trade policies. As such, governments across Canada should work to eliminate existing barriers to interprovincial trade and labour mobility in order to counteract any diminished trade with the U.S.

Read More [[link removed]] 2024 Ontario Economic Outlook and Fiscal Review Ontario’s mini-budget maintains high-tax approach despite ‘tax rebate’ head fake [[link removed]] by Ben Eisen

The province's debt will reach $429 billion this year.

Ontario government should stop the gimmicks and finally cut taxes [[link removed]] (Appeared in the Globe and Mail) by Ben Eisen and Jake Fuss

Premier Doug Ford plans to send a onetime tax rebate to all Ontarians in an effort to “stimulate the economy.”

Ontario government should walk the walk when encouraging economic growth [[link removed]] by Jake Fuss and Grady Munro

High tax rates lower the incentive for individuals to work, save and invest.

Taxpayers will pay for Ontario government’s $200 rebates [[link removed]] (Appeared in the Toronto Star) by Matthew Lau

The province's high tax rates contribute to slow productivity and economic growth.

Commentaries Canada could capitalize as global electricity demand continues to rise [[link removed]] (Appeared in the Calgary Sun) by Jock Finlayson

Wind and solar power must be backed up by other sources to ensure constant availability.

Young people increasingly embrace conservatism [[link removed]] (Appeared in the Financial Post) by Philip Cross

Many young people reject the woke agenda espoused by a small but vocal minority.

Lesson for Ottawa—don’t bite the hand that feeds you [[link removed]] (Appeared in the Ottawa Sun) by Tegan Hill

Albertans contribute far more in taxes and other payments to the federal government than they receive in federal spending.

Saskatchewan government must restrain spending to fulfill campaign promises [[link removed]] (Appeared in the Western Standard) by Jason Childs and Tegan Hill

The province already carries more than $34 billion in total gross debt.

Smith government should finally deboard Alberta’s resource revenue rollercoaster [[link removed]] by Tegan Hill

Albertans went from paying $58 per person in provincial debt interest costs in 2008/09 to $596 in 2021/22.

B.C. government must tackle province’s fiscal mess [[link removed]] (Appeared in the Vancouver Sun) by Tegan Hill

The government's debt interest payments will increase from a projected $500 per person in 2022/23 to nearly $1,000 in 2026/27.

Economic freedom fell for three straight years [[link removed]] by Matthew D. Mitchell

Governments financed this new spending by printing money and inflation spiked to levels not seen in decades.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor