|

John,

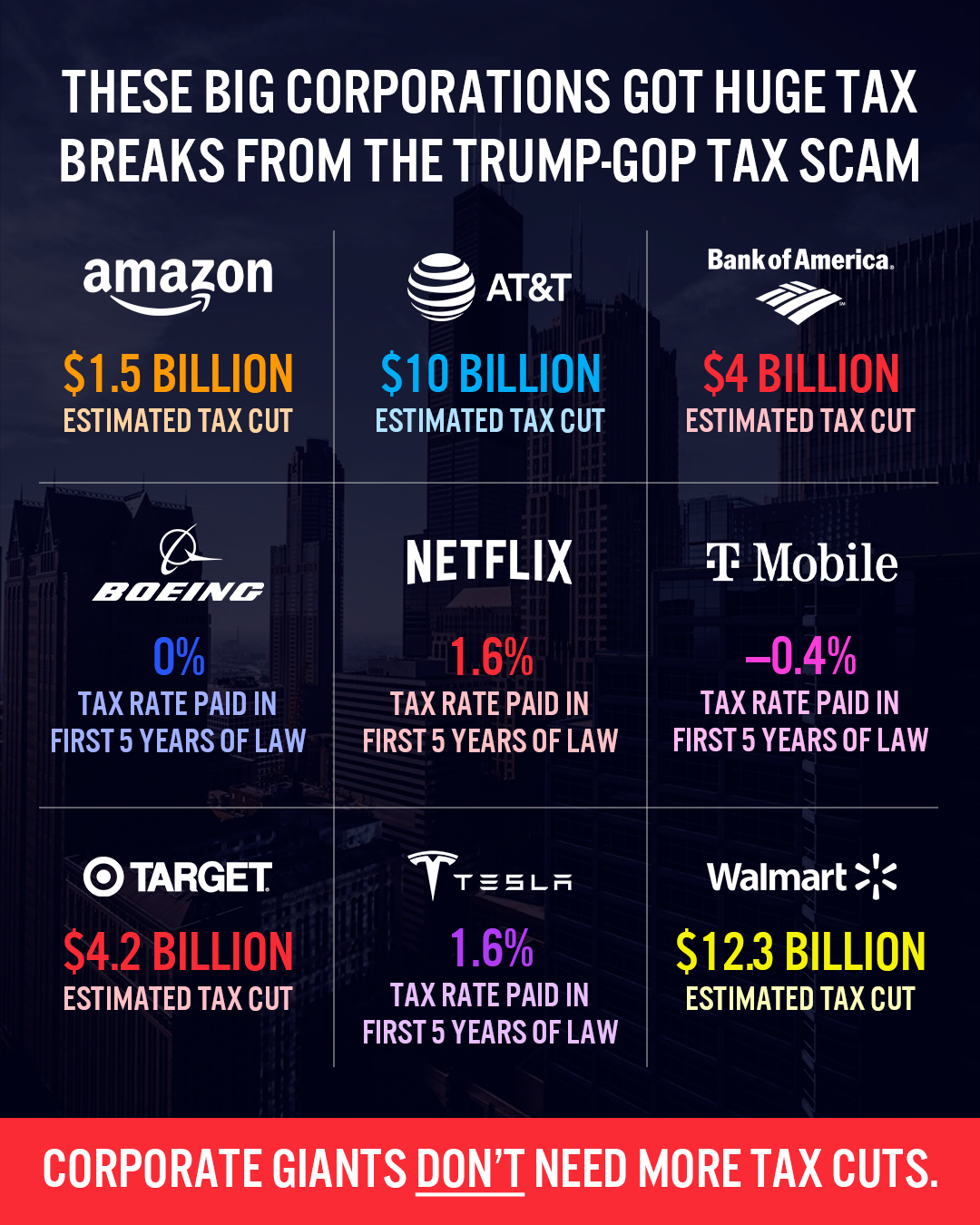

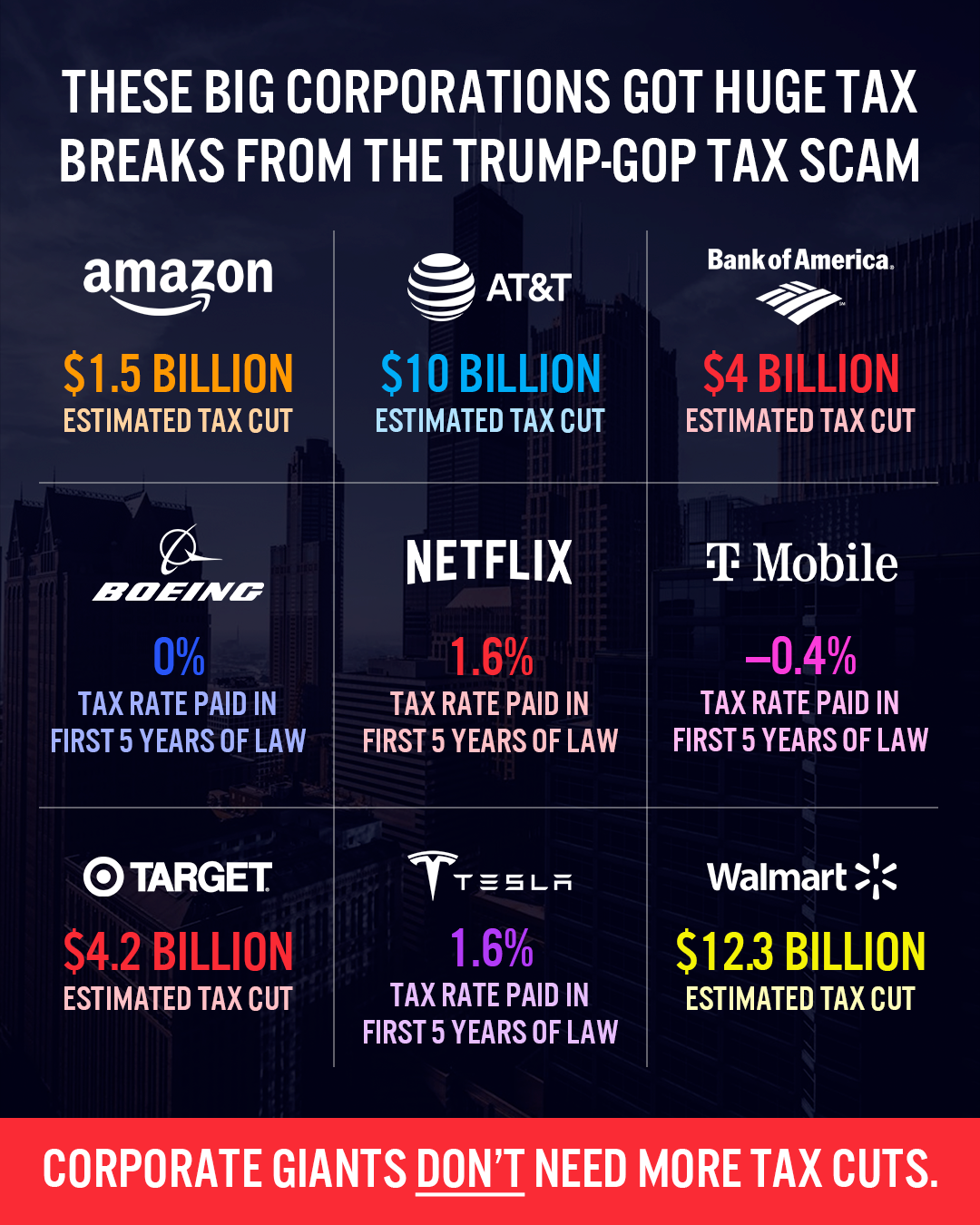

In a new Americans for Tax Fairness Report, A Dirty Dozen of Big Firms That Underpay Their Taxes, we highlight 12 large, profitable corporations that are putting shareholder profits, CEO pay, and corporate tax cuts ahead of working people and consumers.

Exxon Mobil isn’t just pumping dirty fossil fuels. It joins our Dirty Dozen because, even as it raked in $14.8 billion in domestic profits during the first five years of the Trump tax cuts, it paid an effective tax rate of just 10.4%―roughly half of what it should have been paying.

During this same time, Netflix reported $15.1 billion in domestic profits, yet paid an effective tax rate of just 1.6%! In fact, Netflix paid its top five executives nearly double what it paid in federal income taxes during those five years.

Help us bring our latest infographic to voters across the country to hold this Dirty Dozen accountable and demand a tax system where large, profitable corporations pay their fair share in taxes. Donate today.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

When the wealthy and Big Business pay their fair share, we can make critical investments in working people and our future.

Thank you,

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

-- David's email --

John,

The numbers don't lie, but corporations sure do. That’s why we just released a damning new report that pulls back the curtain on 12 of America's largest corporations, exposing a web of tax dodging, executive excess, and worker exploitation.

Take Amazon, the e-commerce giant that's become a fixture in American life. While they paid a paltry 8.9% effective tax rate over a recent five-year span, CEO Jeff Bezos watched his personal fortune explode by $115 billion. That's a 139% increase, all while Amazon workers saw their wages inch up by just 20%. It's a tale as old as time: the rich get richer while the workers get the scraps.

But Amazon isn't alone in this corporate hall of shame. Bank of America, flush with a $4 billion tax cut, decided the best use of that windfall was to help fund a staggering $122.7 billion worth of stock buybacks and dividends. That's 23 times more than they paid in taxes. Let that sink in for a moment. While millions of Americans struggle to make ends meet, Bank of America is playing a high-stakes game of Monopoly with our tax dollars.

We've distilled this mountain of damning data into a powerful, eye-opening infographic that lays bare the greed and excess of corporate America. But creating it was just the first step. Now, we need your help to get it in front of every American voter before it's too late.

Will you donate $5 today to help us spread this shocking infographic to voters nationwide?

The rot in corporate America runs deep, and it's not just about cooking the books. Boeing received $2.6 billion in tax refunds over that same five year period while raking in $148 billion from Pentagon contracts. They're not just avoiding taxes, they're being paid by the government to do it.

Walmart, the self-proclaimed champion of everyday low prices, slashed their tax rate nearly in half, pocketing an estimated $12.3 billion in savings. Did they pass those savings on to consumers? Quite the opposite. They jacked up prices on some items by up to 100%, squeezing every last penny from hard-working Americans.

And now Tesla joins this rogues' gallery of corporate bad actors. As Elon Musk's wealth has skyrocketed, fueled in part by generous government subsidies, Tesla has waged a relentless war against worker unionization efforts. They've faced multiple discrimination lawsuits and have been criticized for unsafe working conditions.

That's why we've created this revealing infographic. It cuts through the corporate doublespeak and PR spin to show exactly how all 12 of these companies are tilting the playing field in their favor, all at the expense of everyday Americans.

But exposing the truth is just the beginning. Now, we need to get this information in front of as many voters as possible. Will you chip in $5 or more right now to power our campaign and spread this vital information far and wide?

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

The stakes couldn't be higher, and we need you with us in this fight.

Thank you for standing up to corporate power,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

|