| From | USAFacts <[email protected]> |

| Subject | How much does your degree earn? |

| Date | October 8, 2024 1:34 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[View in Your Browser]([link removed])

[USAFacts]([link removed])

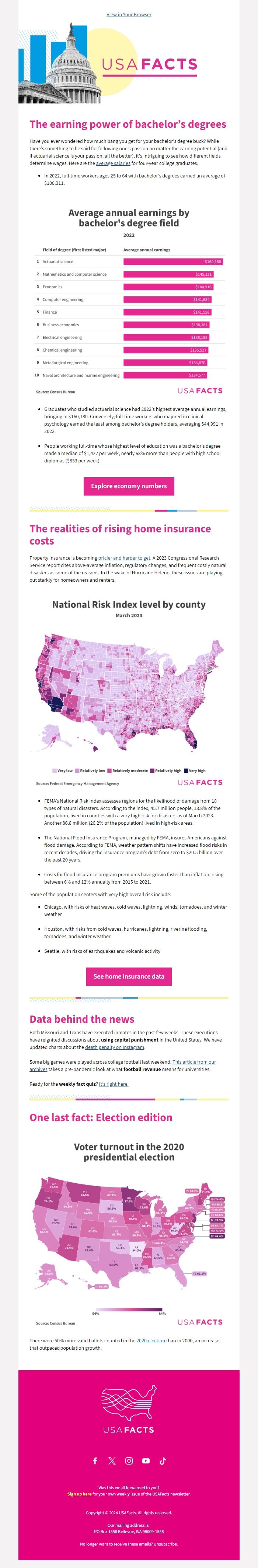

The earning power of bachelor’s degrees

Have you ever wondered how much bang you get for your bachelor’s degree buck? While there’s something to be said for following one’s passion no matter the earning potential (and if actuarial science is your passion, all the better), it's intriguing to see how different fields determine wages. Here are the [average salaries]([link removed]) for four-year college graduates.

- In 2022, full-time workers ages 25 to 64 with bachelor’s degrees earned an average of $100,311.

[Average annual earnings by bachelor degree field]([link removed])

- Graduates who studied actuarial science had 2022’s highest average annual earnings, bringing in $160,180. Conversely, full-time workers who majored in clinical psychology earned the least among bachelor's degree holders, averaging $44,991 in 2022.

- People working full-time whose highest level of education was a bachelor’s degree made a median of $1,432 per week, nearly 68% more than people with high school diplomas ($853 per week).

[Explore economy numbers]([link removed])

The realities of rising home insurance costs

Property insurance is becoming [pricier and harder to get]([link removed]). A 2023 Congressional Research Service report cites above-average inflation, regulatory changes, and frequent costly natural disasters as some of the reasons. In the wake of Hurricane Helene, these issues are playing out starkly for homeowners and renters.

[National risk level map]([link removed])

- FEMA’s National Risk Index assesses regions for the likelihood of damage from 18 types of natural disasters. According to the index, 45.7 million people, 13.8% of the population, lived in counties with a very high risk for disasters as of March 2023. Another 86.8 million (26.2% of the population) lived in high-risk areas.

- The National Flood Insurance Program, managed by FEMA, insures Americans against flood damage. According to FEMA, weather pattern shifts have increased flood risks in recent decades, driving the insurance program’s debt from zero to $20.5 billion over the past 20 years.

- Costs for flood insurance program premiums have grown faster than inflation, rising between 6% and 12% annually from 2015 to 2021.

Some of the population centers with very high overall risk include:

- Chicago, with risks of heat waves, cold waves, lightning, winds, tornadoes, and winter weather

- Houston, with risks from cold waves, hurricanes, lightning, riverine flooding, tornadoes, and winter weather

- Seattle, with risks of earthquakes and volcanic activity

[See home insurance data]([link removed])

Data behind the news

Both Missouri and Texas have executed inmates in the past few weeks. These executions have reignited discussions about using capital punishment in the United States. We have updated charts about the [death penalty on Instagram]([link removed]).

Some big games were played across college football last weekend. [This article from our archives]([link removed]) takes a pre-pandemic look at what football revenue means for universities.

Ready for the weekly fact quiz? [It’s right here.]([link removed])

One last fact: Election edition

[Map showing voter turnout]([link removed])

There were 50% more valid ballots counted in the [2020 election]([link removed]) than in 2000, an increase that outpaced population growth.

[USAFacts]([link removed])

[Facebook]([link removed])

[X]([link removed])

[Instagram]([link removed])

[YouTube]([link removed])

[Tiktok]([link removed])

Was this email forwarded to you?

[Sign up here]([link removed]) for your own weekly issue of the USAFacts newsletter.

Copyright © 2024 USAFacts. All rights reserved.

Our mailing address is:

PO Box 1558 Bellevue, WA 98009-1558

No longer want to receive these emails? [Unsubscribe]([link removed]).

[USAFacts]([link removed])

The earning power of bachelor’s degrees

Have you ever wondered how much bang you get for your bachelor’s degree buck? While there’s something to be said for following one’s passion no matter the earning potential (and if actuarial science is your passion, all the better), it's intriguing to see how different fields determine wages. Here are the [average salaries]([link removed]) for four-year college graduates.

- In 2022, full-time workers ages 25 to 64 with bachelor’s degrees earned an average of $100,311.

[Average annual earnings by bachelor degree field]([link removed])

- Graduates who studied actuarial science had 2022’s highest average annual earnings, bringing in $160,180. Conversely, full-time workers who majored in clinical psychology earned the least among bachelor's degree holders, averaging $44,991 in 2022.

- People working full-time whose highest level of education was a bachelor’s degree made a median of $1,432 per week, nearly 68% more than people with high school diplomas ($853 per week).

[Explore economy numbers]([link removed])

The realities of rising home insurance costs

Property insurance is becoming [pricier and harder to get]([link removed]). A 2023 Congressional Research Service report cites above-average inflation, regulatory changes, and frequent costly natural disasters as some of the reasons. In the wake of Hurricane Helene, these issues are playing out starkly for homeowners and renters.

[National risk level map]([link removed])

- FEMA’s National Risk Index assesses regions for the likelihood of damage from 18 types of natural disasters. According to the index, 45.7 million people, 13.8% of the population, lived in counties with a very high risk for disasters as of March 2023. Another 86.8 million (26.2% of the population) lived in high-risk areas.

- The National Flood Insurance Program, managed by FEMA, insures Americans against flood damage. According to FEMA, weather pattern shifts have increased flood risks in recent decades, driving the insurance program’s debt from zero to $20.5 billion over the past 20 years.

- Costs for flood insurance program premiums have grown faster than inflation, rising between 6% and 12% annually from 2015 to 2021.

Some of the population centers with very high overall risk include:

- Chicago, with risks of heat waves, cold waves, lightning, winds, tornadoes, and winter weather

- Houston, with risks from cold waves, hurricanes, lightning, riverine flooding, tornadoes, and winter weather

- Seattle, with risks of earthquakes and volcanic activity

[See home insurance data]([link removed])

Data behind the news

Both Missouri and Texas have executed inmates in the past few weeks. These executions have reignited discussions about using capital punishment in the United States. We have updated charts about the [death penalty on Instagram]([link removed]).

Some big games were played across college football last weekend. [This article from our archives]([link removed]) takes a pre-pandemic look at what football revenue means for universities.

Ready for the weekly fact quiz? [It’s right here.]([link removed])

One last fact: Election edition

[Map showing voter turnout]([link removed])

There were 50% more valid ballots counted in the [2020 election]([link removed]) than in 2000, an increase that outpaced population growth.

[USAFacts]([link removed])

[Facebook]([link removed])

[X]([link removed])

[Instagram]([link removed])

[YouTube]([link removed])

[Tiktok]([link removed])

Was this email forwarded to you?

[Sign up here]([link removed]) for your own weekly issue of the USAFacts newsletter.

Copyright © 2024 USAFacts. All rights reserved.

Our mailing address is:

PO Box 1558 Bellevue, WA 98009-1558

No longer want to receive these emails? [Unsubscribe]([link removed]).

Message Analysis

- Sender: USAFacts

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Klaviyo