Email

You're Probably Getting Screwed by Mergers (Part 3,819)

| From | You're Probably Getting Screwed <[email protected]> |

| Subject | You're Probably Getting Screwed by Mergers (Part 3,819) |

| Date | September 19, 2024 7:07 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this post on the web at [link removed]

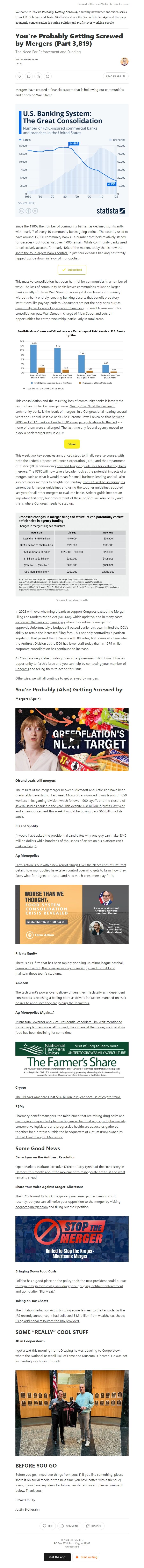

Mergers have created a financial system that is hollowing out communities and enriching Wall Street.

Since the 1980s the number of community banks has declined significantly [ [link removed] ] with nearly 7 of every 10 community banks going extinct. The country used to have around 15,000 community banks - a number that held relatively steady for decades - but today just over 4,000 remain. While community banks used to collectively account for nearly 40% of the market, today that is now the share the four largest banks control. [ [link removed] ] In just four decades banking has totally flipped upside down in favor of monopolies.

This massive consolidation has been harmful for communities [ [link removed] ] in a number of ways. The loss of community banks leaves communities reliant on larger banks mostly run from Wall Street or worse yet it can leave a community without a bank entirely, creating banking deserts that benefit predatory institutions like payday lenders [ [link removed] ]. Consumers are not the only ones hurt as community banks are a key source of financing [ [link removed] ] for small businesses. This consolidation puts Wall Street in charge of Main Street and cuts off opportunities for entrepreneurship, particularly in rural areas.

This consolidation and the resulting loss of community banks is largely the result of an unchecked merger wave. Nearly 70-75% of the decline in community banks is the result of mergers. [ [link removed] ] In a Congressional hearing several years ago Federal Reserve Bank Chair Jerome Powell revealed that between 2006 and 2017, banks submitted 3,819 merger applications to the Fed [ [link removed] ] and none of them were challenged. The last time any federal agency moved to block a bank merger was in 2003!

This week two key agencies announced steps to finally reverse course, with both the Federal Deposit Insurance Corporation (FDIC) and the Department of Justice (DOJ) announcing new and tougher guidelines for evaluating bank mergers [ [link removed] ]. The FDIC will now take a broader look at the potential impacts of a merger, such as what it would mean for small business lending and will also subject larger mergers to heightened scrutiny. The DOJ will be scrapping its current bank merger guidelines and using the tougher guidelines adopted last year for all other mergers to evaluate banks. [ [link removed] ] Stricter guidelines are an important first step, but enforcement of these policies will also be key and this is where Congress needs to step up.

In 2022 with overwhelming bipartisan support Congress passed the Merger Filing Fee Modernization Act (MFFMA), which updated, and in many cases increased, the fees companies pay [ [link removed] ] when they submit a merger for approval. Unfortunately a budget bill passed earlier this year limited the DOJ’s ability [ [link removed] ] to retain the increased filing fees. This not only contradicts bipartisan legislation that passed the US Senate with 88 votes, but comes at a time when the Antitrust Division at the DOJ has fewer staff today than in 1979 while corporate consolidation has continued to increase.

As Congress negotiates funding to avoid a government shutdown, it has an opportunity to fix this issue and you can help by contacting your member of Congress [ [link removed] ] and telling them to act on this issue.

Otherwise, we will all continue to get screwed by mergers.

You’re Probably (Also) Getting Screwed by:

Mergers (Again)

Oh and yeah, still mergers

The results of the megamerger between Microsoft and Activision have been predictably devastating. Last week Microsoft announced it was laying off 650 workers in its gaming division which follows 1,900 layoffs and the closure of several studios earlier in the year. This despite $88 billion in profits last year and an announcement this week it would be buying back $60 billion of its stock [ [link removed] ].

CEO of Spotify

“I would have asked the presidential candidates why one guy can make $345 million dollars while hundreds of thousands of artists on his platform can't make a living.” [ [link removed] ]

Ag Monopolies

Farm Action is out with a new report “Kings Over the Necessities of Life” that details how monopolies have taken control over who gets to farm, how they farm, what food gets produced and how much consumers pay for it. [ [link removed] ]

Private Equity

There is a PE firm that has been rapidly gobbling up minor league baseball teams and with it, the taxpayer money increasingly used to build and maintain those team’s stadiums. [ [link removed] ]

Amazon

The tech giant’s power over delivery drivers they misclassify as independent contractors is reaching a boiling point as drivers in Queens marched on their bosses to announce they are joining the Teamsters. [ [link removed], New York, marched on their bosses today to announce they are joining the Teamsters ]

Ag Monopolies (Again…)

Minnesota Governor and Vice Presidential candidate Tim Walz mentioned something farmers know all too well, their share of the money we spend on food has been declining for some time. [ [link removed] ]

Crypto

The FBI says Americans lost $5.6 billion last year because of crypto fraud. [ [link removed] ]

PBMs

Pharmacy benefit managers, the middlemen that are raising drug costs and destroying independent pharmacies, are so bad that a group of pharmacists, conservative legislators and progressive healthcare advocates gathered together for a protest outside the headquarters of Optum (PBM owned by United Healthcare) in Minnesota. [ [link removed] ]

Some Good News

Barry Lynn on the Antitrust Revolution

Open Markets Institute Executive Director Barry Lynn had the cover story in Harper’s this month about the movement to reinvigorate antitrust and what remains ahead. [ [link removed] ]

Share Your Voice Against Kroger-Albertsons

The FTC’s lawsuit to block the grocery megamerger has been in court recently, but you can still voice your opposition to the merger by visiting nogrocerymerger.com [ [link removed] ] and filling out their petition.

Bringing Down Food Costs

Politico has a good piece on the policy tools the next president could pursue to reign in high food costs, including price gouging, antitrust enforcement and going after “Big Meat.” [ [link removed] ]

Taking on Tax Cheats

The Inflation Reduction Act is bringing some fairness to the tax code, as the IRS recently announced it had collected $1.3 billion from wealthy tax cheats using additional resources the IRA provided. [ [link removed] ]

SOME “REALLY” COOL STUFF

JD in Cooperstown

I got a text this morning from JD saying he was traveling to Cooperstown where the National Baseball Hall of Fame and Museum is located. He was not just visiting as a tourist though.

BEFORE YOU GO

Before you go, I need two things from you: 1) if you like something, please share it on social media or the next time you have coffee with a friend. 2) Ideas, if you have any ideas for future newsletter content please comment below. Thank you.

Break ‘Em Up,

Justin Stofferahn

Unsubscribe [link removed]?

Mergers have created a financial system that is hollowing out communities and enriching Wall Street.

Since the 1980s the number of community banks has declined significantly [ [link removed] ] with nearly 7 of every 10 community banks going extinct. The country used to have around 15,000 community banks - a number that held relatively steady for decades - but today just over 4,000 remain. While community banks used to collectively account for nearly 40% of the market, today that is now the share the four largest banks control. [ [link removed] ] In just four decades banking has totally flipped upside down in favor of monopolies.

This massive consolidation has been harmful for communities [ [link removed] ] in a number of ways. The loss of community banks leaves communities reliant on larger banks mostly run from Wall Street or worse yet it can leave a community without a bank entirely, creating banking deserts that benefit predatory institutions like payday lenders [ [link removed] ]. Consumers are not the only ones hurt as community banks are a key source of financing [ [link removed] ] for small businesses. This consolidation puts Wall Street in charge of Main Street and cuts off opportunities for entrepreneurship, particularly in rural areas.

This consolidation and the resulting loss of community banks is largely the result of an unchecked merger wave. Nearly 70-75% of the decline in community banks is the result of mergers. [ [link removed] ] In a Congressional hearing several years ago Federal Reserve Bank Chair Jerome Powell revealed that between 2006 and 2017, banks submitted 3,819 merger applications to the Fed [ [link removed] ] and none of them were challenged. The last time any federal agency moved to block a bank merger was in 2003!

This week two key agencies announced steps to finally reverse course, with both the Federal Deposit Insurance Corporation (FDIC) and the Department of Justice (DOJ) announcing new and tougher guidelines for evaluating bank mergers [ [link removed] ]. The FDIC will now take a broader look at the potential impacts of a merger, such as what it would mean for small business lending and will also subject larger mergers to heightened scrutiny. The DOJ will be scrapping its current bank merger guidelines and using the tougher guidelines adopted last year for all other mergers to evaluate banks. [ [link removed] ] Stricter guidelines are an important first step, but enforcement of these policies will also be key and this is where Congress needs to step up.

In 2022 with overwhelming bipartisan support Congress passed the Merger Filing Fee Modernization Act (MFFMA), which updated, and in many cases increased, the fees companies pay [ [link removed] ] when they submit a merger for approval. Unfortunately a budget bill passed earlier this year limited the DOJ’s ability [ [link removed] ] to retain the increased filing fees. This not only contradicts bipartisan legislation that passed the US Senate with 88 votes, but comes at a time when the Antitrust Division at the DOJ has fewer staff today than in 1979 while corporate consolidation has continued to increase.

As Congress negotiates funding to avoid a government shutdown, it has an opportunity to fix this issue and you can help by contacting your member of Congress [ [link removed] ] and telling them to act on this issue.

Otherwise, we will all continue to get screwed by mergers.

You’re Probably (Also) Getting Screwed by:

Mergers (Again)

Oh and yeah, still mergers

The results of the megamerger between Microsoft and Activision have been predictably devastating. Last week Microsoft announced it was laying off 650 workers in its gaming division which follows 1,900 layoffs and the closure of several studios earlier in the year. This despite $88 billion in profits last year and an announcement this week it would be buying back $60 billion of its stock [ [link removed] ].

CEO of Spotify

“I would have asked the presidential candidates why one guy can make $345 million dollars while hundreds of thousands of artists on his platform can't make a living.” [ [link removed] ]

Ag Monopolies

Farm Action is out with a new report “Kings Over the Necessities of Life” that details how monopolies have taken control over who gets to farm, how they farm, what food gets produced and how much consumers pay for it. [ [link removed] ]

Private Equity

There is a PE firm that has been rapidly gobbling up minor league baseball teams and with it, the taxpayer money increasingly used to build and maintain those team’s stadiums. [ [link removed] ]

Amazon

The tech giant’s power over delivery drivers they misclassify as independent contractors is reaching a boiling point as drivers in Queens marched on their bosses to announce they are joining the Teamsters. [ [link removed], New York, marched on their bosses today to announce they are joining the Teamsters ]

Ag Monopolies (Again…)

Minnesota Governor and Vice Presidential candidate Tim Walz mentioned something farmers know all too well, their share of the money we spend on food has been declining for some time. [ [link removed] ]

Crypto

The FBI says Americans lost $5.6 billion last year because of crypto fraud. [ [link removed] ]

PBMs

Pharmacy benefit managers, the middlemen that are raising drug costs and destroying independent pharmacies, are so bad that a group of pharmacists, conservative legislators and progressive healthcare advocates gathered together for a protest outside the headquarters of Optum (PBM owned by United Healthcare) in Minnesota. [ [link removed] ]

Some Good News

Barry Lynn on the Antitrust Revolution

Open Markets Institute Executive Director Barry Lynn had the cover story in Harper’s this month about the movement to reinvigorate antitrust and what remains ahead. [ [link removed] ]

Share Your Voice Against Kroger-Albertsons

The FTC’s lawsuit to block the grocery megamerger has been in court recently, but you can still voice your opposition to the merger by visiting nogrocerymerger.com [ [link removed] ] and filling out their petition.

Bringing Down Food Costs

Politico has a good piece on the policy tools the next president could pursue to reign in high food costs, including price gouging, antitrust enforcement and going after “Big Meat.” [ [link removed] ]

Taking on Tax Cheats

The Inflation Reduction Act is bringing some fairness to the tax code, as the IRS recently announced it had collected $1.3 billion from wealthy tax cheats using additional resources the IRA provided. [ [link removed] ]

SOME “REALLY” COOL STUFF

JD in Cooperstown

I got a text this morning from JD saying he was traveling to Cooperstown where the National Baseball Hall of Fame and Museum is located. He was not just visiting as a tourist though.

BEFORE YOU GO

Before you go, I need two things from you: 1) if you like something, please share it on social media or the next time you have coffee with a friend. 2) Ideas, if you have any ideas for future newsletter content please comment below. Thank you.

Break ‘Em Up,

Justin Stofferahn

Unsubscribe [link removed]?

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a