| From | Fraser Institute <[email protected]> |

| Subject | Alberta's net contribution to Ottawa |

| Date | May 2, 2020 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

---------------------

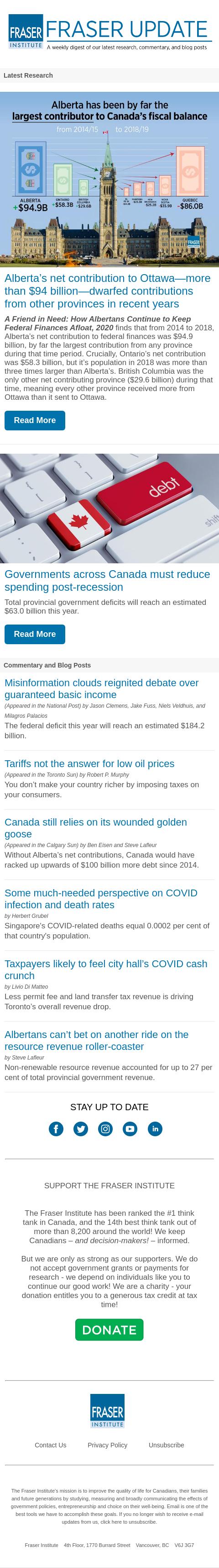

Alberta’s net contribution to Ottawa—more than $94 billion—dwarfed contributions from other provinces in recent years

A Friend in Need: How Albertans Continue to Keep Federal Finances Afloat, 2020 finds that from 2014 to 2018, Alberta’s net contribution to federal finances was $94.9 billion, by far the largest contribution from any province during that time period. Crucially, Ontario’s net contribution was $58.3 billion, but it’s population in 2018 was more than three times larger than Alberta’s. British Columbia was the only other net contributing province ($29.6 billion) during that time, meaning every other province received more from Ottawa than it sent to Ottawa.

Read More [[link removed]]

Governments across Canada must reduce spending post-recession

Total provincial government deficits will reach an estimated $63.0 billion this year.

Read More [[link removed]]

Commentary and Blog Posts

----------------------

Misinformation clouds reignited debate over guaranteed basic income [[link removed]]

(Appeared in the National Post) by Jason Clemens, Jake Fuss, Niels Veldhuis, and Milagros Palacios

The federal deficit this year will reach an estimated $184.2 billion.

Tariffs not the answer for low oil prices [[link removed]] (Appeared in the Toronto Sun) by Robert P. Murphy

You don’t make your country richer by imposing taxes on your consumers.

Canada still relies on its wounded golden goose ([link removed])

(Appeared in the Calgary Sun) by Ben Eisen and Steve Lafleur

Without Alberta’s net contributions, Canada would have racked up upwards of $100 billion more debt since 2014.

Some much-needed perspective on COVID infection and death rates [[link removed]]

by Herbert Grubel

Singapore's COVID-related deaths equal 0.0002 per cent of that country's population.

Taxpayers likely to feel city hall’s COVID cash crunch [[link removed]]

by Livio Di Matteo

Less permit fee and land transfer tax revenue is driving Toronto’s overall revenue drop.

Albertans can’t bet on another ride on the resource revenue roller-coaster [[link removed]]

by Steve Lafleur

Non-renewable resource revenue accounted for up to 27 per cent of total provincial government revenue.

SUPPORT THE FRASER INSTITUTE

----------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

---------------------

Alberta’s net contribution to Ottawa—more than $94 billion—dwarfed contributions from other provinces in recent years

A Friend in Need: How Albertans Continue to Keep Federal Finances Afloat, 2020 finds that from 2014 to 2018, Alberta’s net contribution to federal finances was $94.9 billion, by far the largest contribution from any province during that time period. Crucially, Ontario’s net contribution was $58.3 billion, but it’s population in 2018 was more than three times larger than Alberta’s. British Columbia was the only other net contributing province ($29.6 billion) during that time, meaning every other province received more from Ottawa than it sent to Ottawa.

Read More [[link removed]]

Governments across Canada must reduce spending post-recession

Total provincial government deficits will reach an estimated $63.0 billion this year.

Read More [[link removed]]

Commentary and Blog Posts

----------------------

Misinformation clouds reignited debate over guaranteed basic income [[link removed]]

(Appeared in the National Post) by Jason Clemens, Jake Fuss, Niels Veldhuis, and Milagros Palacios

The federal deficit this year will reach an estimated $184.2 billion.

Tariffs not the answer for low oil prices [[link removed]] (Appeared in the Toronto Sun) by Robert P. Murphy

You don’t make your country richer by imposing taxes on your consumers.

Canada still relies on its wounded golden goose ([link removed])

(Appeared in the Calgary Sun) by Ben Eisen and Steve Lafleur

Without Alberta’s net contributions, Canada would have racked up upwards of $100 billion more debt since 2014.

Some much-needed perspective on COVID infection and death rates [[link removed]]

by Herbert Grubel

Singapore's COVID-related deaths equal 0.0002 per cent of that country's population.

Taxpayers likely to feel city hall’s COVID cash crunch [[link removed]]

by Livio Di Matteo

Less permit fee and land transfer tax revenue is driving Toronto’s overall revenue drop.

Albertans can’t bet on another ride on the resource revenue roller-coaster [[link removed]]

by Steve Lafleur

Non-renewable resource revenue accounted for up to 27 per cent of total provincial government revenue.

SUPPORT THE FRASER INSTITUTE

----------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor