Email

Investors Wait For Fed Decision (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Investors Wait For Fed Decision (Weekly Cheat Sheet) |

| Date | September 16, 2024 3:53 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

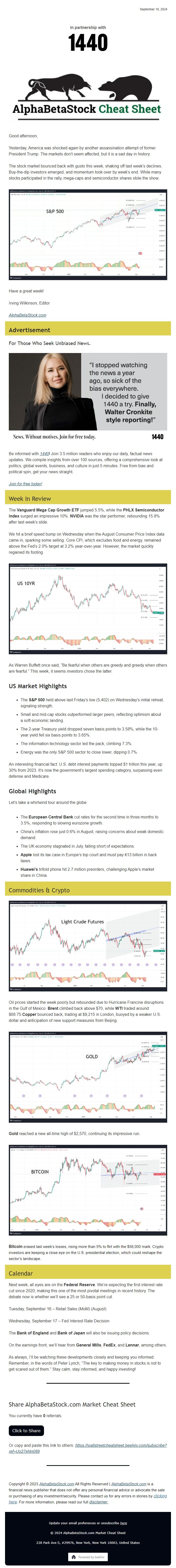

Good afternoon,

Yesterday, America was shocked again by another assassination attempt of former President Trump. The markets don’t seem affected, but it is a sad day in history.

The stock market bounced back with gusto this week, shaking off last week’s declines. Buy-the-dip investors emerged, and momentum took over by week’s end. While many stocks participated in the rally, mega-caps and semiconductor shares stole the show.

View image: ([link removed])

Caption:

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## **Advertisement**

----------### For Those Who Seek Unbiased News.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Be informed with [1440]([link removed])! Join 3.5 million readers who enjoy our daily, factual news updates. We compile insights from over 100 sources, offering a comprehensive look at politics, global events, business, and culture in just 5 minutes. Free from bias and political spin, get your news straight.

[Join for free today!]([link removed])

----------

## Week In Review

----------The **Vanguard Mega Cap Growth ETF** jumped 5.5%, while the **PHLX Semiconductor Index** surged an impressive 10%. **NVIDIA** was the star performer, rebounding 15.8% after last week’s slide.

We hit a brief speed bump on Wednesday when the August Consumer Price Index data came in, sparking some selling. Core CPI, which excludes food and energy, remained above the Fed’s 2.0% target at 3.2% year-over-year. However, the market quickly regained its footing.

View image: ([link removed])

Caption:

As Warren Buffett once said, “Be fearful when others are greedy and greedy when others are fearful.” This week, it seems investors chose the latter.

## **US Market Highlights**

* The **S&P 500** held above last Friday’s low (5,402) on Wednesday’s initial retreat, signaling strength.

* Small and mid-cap stocks outperformed larger peers, reflecting optimism about a soft economic landing.

* The 2-year Treasury yield dropped seven basis points to 3.58%, while the 10-year yield fell six basis points to 3.65%.

* The information technology sector led the pack, climbing 7.3%.

* Energy was the only S&P 500 sector to close lower, dipping 0.7%.

An interesting financial fact: U.S. debt interest payments topped $1 trillion this year, up 30% from 2023. It’s now the government’s largest spending category, surpassing even defense and Medicare.

## **Global Highlights**

Let’s take a whirlwind tour around the globe:

* The **European Central Bank** cut rates for the second time in three months to 3.5%, responding to slowing eurozone growth.

* China’s inflation rose just 0.6% in August, raising concerns about weak domestic demand.

* The UK economy stagnated in July, falling short of expectations.

* **Apple** lost its tax case in Europe’s top court and must pay €13 billion in back taxes.

* **Huawei’s** trifold phone hit 2.7 million preorders, challenging Apple’s market share in China.

----------

## Commodities & Crypto

----------View image: ([link removed])

Caption:

Oil prices started the week poorly but rebounded due to Hurricane Francine disruptions in the Gulf of Mexico. **Brent** climbed back above $70, while **WTI** traded around $68.75.**Copper** bounced back, trading at $9,215 in London, buoyed by a weaker U.S. dollar and anticipation of new support measures from Beijing.

View image: ([link removed])

Caption:

**Gold** reached a new all-time high of $2,570, continuing its impressive run.

View image: ([link removed])

Caption:

**Bitcoin** erased last week’s losses, rising more than 5% to flirt with the $58,000 mark. Crypto investors are keeping a close eye on the U.S. presidential election, which could reshape the sector’s landscape.

----------

## Calendar

----------Next week, all eyes are on the **Federal Reserve**. We’re expecting the first interest rate cut since 2020, making this one of the most pivotal meetings in recent history. The debate now is whether we’ll see a 25 or 50-basis point cut.

Tuesday, September 16 – Retail Sales (MoM) (August)

Wednesday, September 17 – Fed Interest Rate Decision

The **Bank of England** and **Bank of Japan** will also be issuing policy decisions.

On the earnings front, we’ll hear from **General Mills**, **FedEx**, and **Lennar**, among others.

As always, I’ll be watching these developments closely and keeping you informed. Remember, in the words of Peter Lynch, “The key to making money in stocks is not to get scared out of them.” Stay calm, stay informed, and happy investing!

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good afternoon,

Yesterday, America was shocked again by another assassination attempt of former President Trump. The markets don’t seem affected, but it is a sad day in history.

The stock market bounced back with gusto this week, shaking off last week’s declines. Buy-the-dip investors emerged, and momentum took over by week’s end. While many stocks participated in the rally, mega-caps and semiconductor shares stole the show.

View image: ([link removed])

Caption:

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## **Advertisement**

----------### For Those Who Seek Unbiased News.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Be informed with [1440]([link removed])! Join 3.5 million readers who enjoy our daily, factual news updates. We compile insights from over 100 sources, offering a comprehensive look at politics, global events, business, and culture in just 5 minutes. Free from bias and political spin, get your news straight.

[Join for free today!]([link removed])

----------

## Week In Review

----------The **Vanguard Mega Cap Growth ETF** jumped 5.5%, while the **PHLX Semiconductor Index** surged an impressive 10%. **NVIDIA** was the star performer, rebounding 15.8% after last week’s slide.

We hit a brief speed bump on Wednesday when the August Consumer Price Index data came in, sparking some selling. Core CPI, which excludes food and energy, remained above the Fed’s 2.0% target at 3.2% year-over-year. However, the market quickly regained its footing.

View image: ([link removed])

Caption:

As Warren Buffett once said, “Be fearful when others are greedy and greedy when others are fearful.” This week, it seems investors chose the latter.

## **US Market Highlights**

* The **S&P 500** held above last Friday’s low (5,402) on Wednesday’s initial retreat, signaling strength.

* Small and mid-cap stocks outperformed larger peers, reflecting optimism about a soft economic landing.

* The 2-year Treasury yield dropped seven basis points to 3.58%, while the 10-year yield fell six basis points to 3.65%.

* The information technology sector led the pack, climbing 7.3%.

* Energy was the only S&P 500 sector to close lower, dipping 0.7%.

An interesting financial fact: U.S. debt interest payments topped $1 trillion this year, up 30% from 2023. It’s now the government’s largest spending category, surpassing even defense and Medicare.

## **Global Highlights**

Let’s take a whirlwind tour around the globe:

* The **European Central Bank** cut rates for the second time in three months to 3.5%, responding to slowing eurozone growth.

* China’s inflation rose just 0.6% in August, raising concerns about weak domestic demand.

* The UK economy stagnated in July, falling short of expectations.

* **Apple** lost its tax case in Europe’s top court and must pay €13 billion in back taxes.

* **Huawei’s** trifold phone hit 2.7 million preorders, challenging Apple’s market share in China.

----------

## Commodities & Crypto

----------View image: ([link removed])

Caption:

Oil prices started the week poorly but rebounded due to Hurricane Francine disruptions in the Gulf of Mexico. **Brent** climbed back above $70, while **WTI** traded around $68.75.**Copper** bounced back, trading at $9,215 in London, buoyed by a weaker U.S. dollar and anticipation of new support measures from Beijing.

View image: ([link removed])

Caption:

**Gold** reached a new all-time high of $2,570, continuing its impressive run.

View image: ([link removed])

Caption:

**Bitcoin** erased last week’s losses, rising more than 5% to flirt with the $58,000 mark. Crypto investors are keeping a close eye on the U.S. presidential election, which could reshape the sector’s landscape.

----------

## Calendar

----------Next week, all eyes are on the **Federal Reserve**. We’re expecting the first interest rate cut since 2020, making this one of the most pivotal meetings in recent history. The debate now is whether we’ll see a 25 or 50-basis point cut.

Tuesday, September 16 – Retail Sales (MoM) (August)

Wednesday, September 17 – Fed Interest Rate Decision

The **Bank of England** and **Bank of Japan** will also be issuing policy decisions.

On the earnings front, we’ll hear from **General Mills**, **FedEx**, and **Lennar**, among others.

As always, I’ll be watching these developments closely and keeping you informed. Remember, in the words of Peter Lynch, “The key to making money in stocks is not to get scared out of them.” Stay calm, stay informed, and happy investing!

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a