Better Off? Kamala Can’t Say.

September 11, 2024

Permission to republish original opeds and cartoons granted.

Harris couldn’t say whether we are better off than we were four years ago. The American people know the answer.

|

|

|

On the economy, the post-debate CNN flash poll showed former President Donald Trump led Vice President Kamala Harris by 20 points, 55 percent to 35 percent. If the election boils down to bread-and-butter household budgets — as it occasionally does — Harris could be in real trouble. It is little wonder. The very first question out of the gates was on the economy, where Harris was pressed, “When it comes to the economy, do you believe Americans are better off than they were four years ago?” Harris couldn’t answer. Or wouldn’t, since the answer is obvious. By every measure, Americans’ wages and incomes have simply not kept up with the cost of consumer goods. Overall consumer prices for everything are up 18.9 percent. Personal incomes, which include government transfer payments from all the printed money, are only up 18.6 percent. Median nominal weekly earnings for wage and salary workers are only up 17 percent. Instead, Harris opted to start out by proclaiming herself the product of a middle-class household and acknowledging some of the pain: “the cost of housing is too expensive for far too many people.” We know. Shelter is up 21.8 percent. Interest rates have surged, including 30-year mortgage interest rates, from 2.7 percent in Feb. 2021 to 6.35 percent today. Harris also admitted: “We know that young families need support to raise their children.” We know. Food is still up 21.8 percent since Feb. 2021. Electricity is still up 27.3 percent in that time. The American people cannot keep up with their monthly household bills. In other words, we are not better off than we were four years ago, and Harris all but admitted it. The American people are concerned — and they should be. Unemployment is rising once again, up 1.4 million since Dec. 2022, underscoring that the worst remains ahead. |

Rurals, Young People, and Hispanics Revert Back Toward Trump after Harris Surge in July

|

|

|

A New York Times/Siena College poll from July shows Harris earning 59 percent of voters under 30 to former President Donald Trump’s 38 percent among the likely electorate, placing her nearly at the same level (60 percent) as Biden won four years ago. However, youth enthusiasm has largely fizzled for Harris since the thrill of her “Brat” campaign has worn off. Economic reality has set in, and the latest Times poll from September places Harris at just 51 percent among voters under age 30. This represents an eight-point decline since she announced her candidacy and has nearly erased the gains she briefly held over Biden’s campaign. Trump, meanwhile, has scrambled back up to 43 percent of the youth vote over the past seven weeks, a five-point gain since Harris became the nominee. Harris’ eight-point decline looks even worse when compared to the total share of the youth vote Biden won in 2020. According to CNN exit polls, Biden won young voters 60 percent to Trump’s 36 percent, meaning Harris is trailing Biden’s 2020 numbers by nine points, while Trump has gained seven points compared to 2020. |

Federal Reserve Proposed Action Increases Consumer Banking Costs

|

|

|

Debit cards are ubiquitous in America. Virtually everyone with a bank account has them as a convenience to allow relatively easy access to one’s own money. Obviously, these cards cost the issuer money to service each transaction with the Federal Reserve Board designated under the 2010 Dodd-Frank law to set these costs. But somewhere in the translation, the Fed has lost track of its actual mission. Look at their currently proposed regulation to change the debit card transaction fee formula. To be clear, this is not referring to the fee some independent money machines charge to use debit cards, or the amount charged by some banks on transactions originating out of their banking system. Instead, the fees affected by the proposed Federal Reserve regulation are the small underlying processing fee that your bank collects with each debit card transaction known as the Debit Card Interchange Rate fee. destabilizing revenues to the detriment of consumers is directly counter to the Fed’s stated mission. Yet that is exactly what the Fed’s new proposed regulation would do. A new White Paper entitled “How Proposed Interchange Fee Caps Will Affect Consumer Costs, by the former Director of Consumer Finance at the liberal Pew Charitable Trusts, puts a possible $2 billion increased consumer cost if this rule is finalized. |

Harris fails to make her case on inflation, real wages and fundamental freedoms

|

|

|

Americans for Limited Government President Rick Manning: “America finally got to hear Kamala Harris as she once again failed to address the critical issues facing our nation, providing no answers to the continued high costs of food and housing and the decline in America’s real wages. The Harris-Biden inflation has destroyed many Americans’ hope to achieve the American dream. Continuing the Harris economic policy for another four years will result in higher taxes and bigger deficits that already have us on the brink of recession. Continuing with open borders endangers public safety, our schools and communities. And an expansion of the weaponized administrative state threatens our fundamental constitutional freedoms. Americans who care about their children’s future will vote to return Donald Trump to the Oval Office, after all, weak and stupid is no way to run a country.” |

Harris couldn’t say whether we are better off than we were four years ago. The American people know the answer.

By Robert Romano

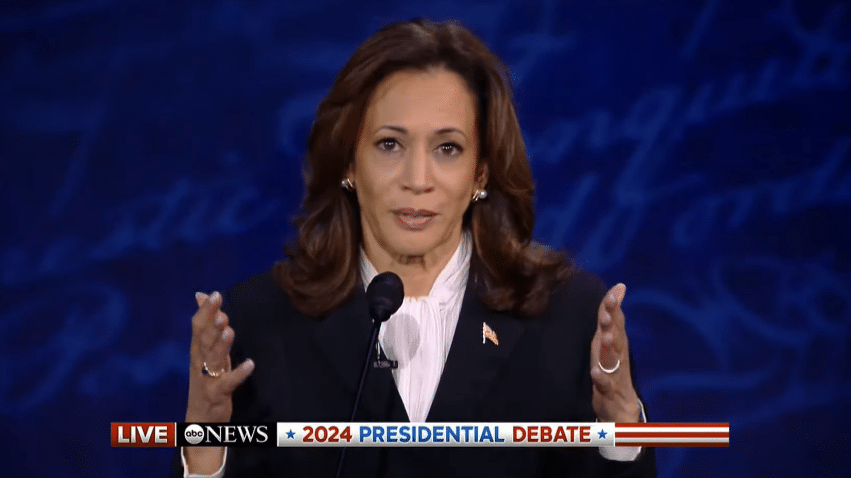

The first fifteen minutes of the Sept. 10 ABC News debate — roughly 16 percent of the airtime — between Vice President Kamala Harris and former President Donald Trump was devoted to the economy and inflation, by far the top concern of voters in poll after poll taken nationally this election cycle.

And on the economy, the post-debate CNN flash poll showed Trump led by 20 points, 55 percent to 35 percent, based on what the American people saw in the debate. If the election boils down to bread-and-butter household budgets — as it occasionally does — Harris could be in real trouble.

It is little wonder. The very first question out of the gates was on the economy, where Harris was pressed, “When it comes to the economy, do you believe Americans are better off than they were four years ago?”

Harris couldn’t answer. Or wouldn’t, since the answer is obvious. By every measure, Americans’ wages and incomes have simply not kept up with the cost of consumer goods. Overall consumer prices for everything are up 18.9 percent. Personal incomes, which include government transfer payments from all the printed money, are only up 18.6 percent. Median nominal weekly earnings for wage and salary workers are only up 17 percent.

Instead, Harris opted to start out by proclaiming herself the product of a middle-class household and acknowledging some of the pain: “the cost of housing is too expensive for far too many people.” We know. Shelter is up 21.8 percent. Interest rates have surged, including 30-year mortgage interest rates, from 2.7 percent in Feb. 2021 to 6.35 percent today.

Harris also admitted: “We know that young families need support to raise their children.” We know. Food is still up 21.8 percent since Feb. 2021. Electricity is still up 27.3 percent in that time. The American people cannot keep up with their monthly household bills.

In other words, we are not better off than we were four years ago, and Harris all but admitted it. The American people are concerned — and they should be. Unemployment is rising once again, up 1.4 million since Dec. 2022, underscoring that the worst remains ahead.

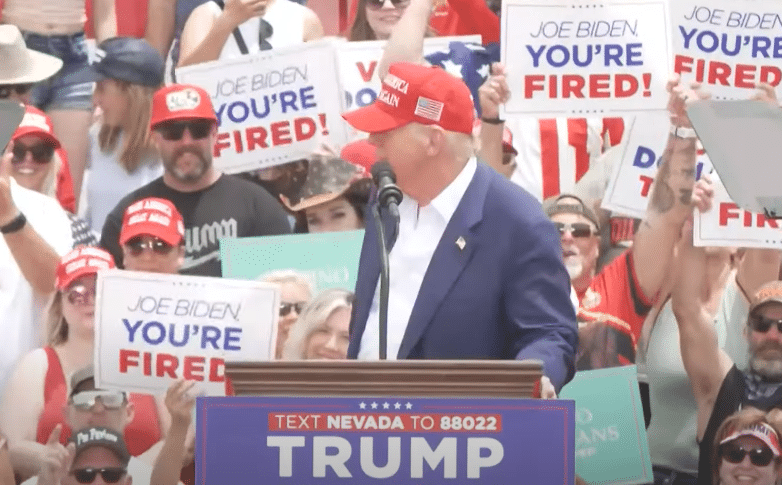

And Trump reminded voters of that reality, stating, “we've had a terrible economy because inflation has — which is really known as a country buster. It breaks up countries. We have inflation like very few people have ever seen before. Probably the worst in our nation's history. We were at 21%. But that's being generous because many things are 50, 60, 70, and 80% higher than they were just a few years ago. This has been a disaster for people, for the middle class, but for every class.”

Later, Trump expounded on the harsh reality, stating, “I had no inflation, virtually no inflation, they had the highest inflation, perhaps in the history of our country because I've never seen a worse period of time. People can't go out and buy cereal bacon or eggs or anything else. These the people of our country are absolutely dying with what they've done. They've destroyed the economy…”

Harris tried to spin the economy by stating that Trump’s tariffs on international trade, one of the issues that helped Trump win in 2016 in Pennsylvania, Michigan and Wisconsin, were some sort of national sales tax, which Trump swiftly dealt with by reminding the audience that President Joe Biden and Harris had done nothing to remove the tariffs on China that Trump had put into place: “if she doesn't like 'em they should have gone out and they should have immediately cut the tariffs but those tariffs are there three and a half years now under their administration.” And yet, Trump did it without inflation in contrast to Harris and Biden: "they never took the tariff off because it was so much money, they can't. It would totally destroy everything that they've set out to do. They've taken in billions of dollars from China and other places. They've left the tariffs on. When I had it, I had tariffs and yet I had no inflation."

Harris also tried to claim that unemployment when she and Biden took office in 2021 was the worst since the 1930s: “Donald Trump left us the worst unemployment since the Great Depression…” But that was not even remotely true.

The unemployment rate was 6.4 percent in Jan. 2021, about where it was in May 2014 at 6.3 percent following the Great Recession that took years to recover from. By contrast, the recovery Trump orchestrated from Covid was rapid. Although during Covid unemployment did spike upwards temporarily amid the economic lockdowns, by the end of 2020, 16 million of the 25 million jobs lost had already been recovered when Trump left office, and the rest followed within the next year.

So, on the economy, the top issue in the campaign, Trump had a story to tell.

Trump turned in a similar performance on his signature issue, immigration, crushing Harris 56 percent to 33 percent. And they gave Trump an edge on being commander-in-chief, 49 percent to 43 percent, as Trump hammered home the world being in a state of chaos, with wars in Ukraine and Gaza, the botched withdrawal of Afghanistan that Trump said emboldened America’s adversaries and Iran being on the brink of achieving nuclear weapons (if they haven’t already done so).

So what did Harris do well on? Per the CNN poll, abortion, 52 percent to 31 percent, and protecting democracy (whatever that means), 49 percent to 40 percent.

These were the candidates’ strengths and weaknesses headed into the debate, and so, unsurprisingly, each chose to emphasize those issues as much as they could.

Trump’s advantage, with less than two months to go, is that monthly household bills will continue to come in that Americans cannot afford, reminding them that Trump was right. Inflation was lower when he left office. Again, if the election boils down to the economy, Trump closed the deal and Harris, who is now demanding another debate, could be in very real trouble. She didn’t make the sale. The economy still stinks — and the American people know it.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2024/09/harris-couldnt-say-whether-we-are-better-off-than-we-were-four-years-ago-the-american-people-know-the-answer/

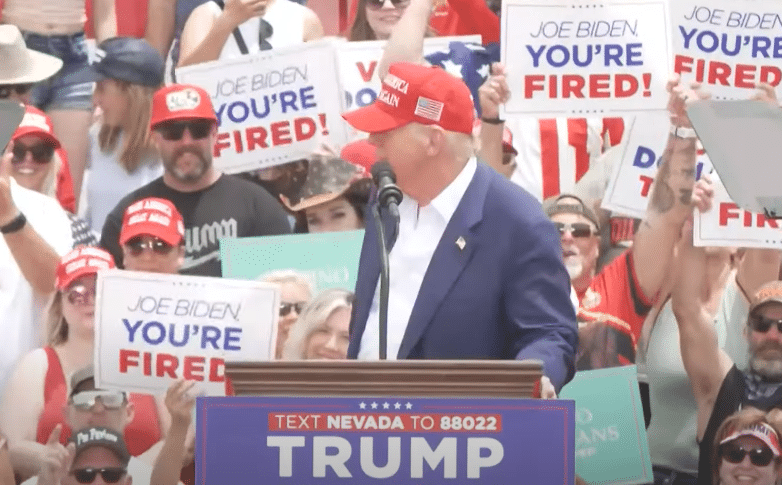

Rurals, Young People, and Hispanics Revert Back Toward Trump after Harris Surge in July

By Manzanita Miller

After an initial surge of support for Kamala Harris after President Joe Biden exited the race in July, the polls have narrowed significantly.

Immediately upon announcing her candidacy seven weeks ago, Harris received a bump in support – particularly among key factions of the Democratic base that Biden had been steadily losing ground with for well over a year. Young people, independents, and minorities all appeared more interested in Harris than they were in Biden seven weeks ago, but that picture has shifted, with Harris suffering relatively large declines since early July.

The most striking decline for Harris has been among young people. Young voters had been steadily distancing themselves from Biden for well over a year by the time the president announced his retirement, and for a brief snapshot in time, Harris appeared to be activating at least a portion of young voters, namely young women.

That picture has shifted over the past seven weeks. A New York Times/Siena College poll from July shows Harris earning 59 percent of voters under 30 to former President Donald Trump’s 38 percent among the likely electorate, placing her nearly at the same level (60 percent) as Biden won four years ago.

However, youth enthusiasm has largely fizzled for Harris since the thrill of her “Brat” campaign has worn off. Economic reality has set in, and the latest Times poll from September places Harris at just 51 percent among voters under age 30. This represents an eight-point decline since she announced her candidacy and has nearly erased the gains she briefly held over Biden’s campaign.

Trump, meanwhile, has scrambled back up to 43 percent of the youth vote over the past seven weeks, a five-point gain since Harris became the nominee. Harris’ eight-point decline looks even worse when compared to the total share of the youth vote Biden won in 2020. According to CNN exit polls, Biden won young voters 60 percent to Trump’s 36 percent, meaning Harris is trailing Biden’s 2020 numbers by nine points, while Trump has gained seven points compared to 2020.

Harris’ brief “blip” in youth support right after Biden exited the race does not appear to be sustainable. Trump, however, has been polling around ten points above what he gained in 2020 with young people for over a year now. Democrats are on track to face the November election with a much-reduced pool of youth support compared to 2020, while Republicans have made incremental gains, despite an onslaught of attempts to portray Trump as a dictator. Among all other age groups, Harris’ numbers have stayed relatively stable since she entered the race with only marginal one or two points shifts.

While it isn’t as large of a decline as the numbers among young people, Hispanics have also reduced their support for Harris since she entered the race seven weeks ago, ousting Biden. According to the same Times poll looking at the likely electorate, 60 percent of Hispanics planned to support Harris shortly after she became the nominee, while 36 percent planned to support Trump.

The latest Times poll shows a five-point decline for Harris, with just 55 percent of Hispanics now intending to support her, while 41 percent plan to support Trump. This amounts to a five-point decline for Harris and a five-point gain for Trump over the past seven weeks.

Again, for reference compare Harris’ current standing in the polls to the share of the electorate Biden won in 2020, and the picture is even worse for Democrats. Biden won 65 percent of the Latino vote in 2020, while Trump earned 32 percent. As polls stand seven weeks after Harris announced her candidacy, she is on track to fall short of Biden’s 2020 numbers by ten points, while Trump is expected to gain nine points.

Where else is Harris in trouble? Harris may be suffering a decline in support among rural voters, after earning a small blip in July. Rural voters have increasingly skewed Republican, but just after Biden was ousted Harris was earning around 36 percent of the vote from rural areas to Trump’s 59 percent.

However, seven weeks later she is earning around 31 percent of the rural vote, while Trump has skyrocketed up to 65 percent of the vote. Compared to 2020, this is an eight-point gain for Trump in rural areas, with Trump winning 57 percent of the rural vote four years ago.

For Harris, this represents an eleven-point decline compared to the share of the rural vote (42 percent) Joe Biden earned four years ago. This isn’t that surprising. Biden attempted to portray himself as a simple blue-collar Democrat from Scranton, Pennsylvania, while Harris is a coastal elitist from deep-blue California who is not even attempting to resonate with middle America.

That said, just because Trump has regained footing among groups that were already on the way out the door for Democrats doesn’t mean Harris isn’t seeing an increase in support among certain demographics. City folks and Black voters have flocked to her side in larger numbers over the past seven weeks.

As of July, Harris was having difficulty attracting support from Black voters, but she appears to be gaining. She is up six points with Black voters, going from 72 percent of their vote in July to 78 percent as of early September. While this is a relatively large gain for Harris, she is still polling nine points below the 87 percent of the Black vote Biden won in 2020.

Trump, for his part, is polling at 14 percent of the Black vote in the latest Times poll, which would constitute a modest two-to-three-point gain compared to 2020. It isn’t much, but against a candidate that is being sold to the public as the “first Black female president”, it is worth noting she is doing slightly worse than Biden.

Then, there are city dwellers, another group that appears to be consolidating their support behind Harris. July’s poll had Harris earning a comfortable 59 percent of the city-folk vote, but that number has climbed to 63 percent. This represents a slight gain over the 60 percent of the city vote Biden earned in 2020, indicating Harris could beat Biden’s numbers among city dwellers.

In short, the longstanding demographic losses for Democrats among young voters and Hispanics which Americans for Limited Government and others have been covering for well over a year now appear to be “real” at least according to polls.

Young voters and Hispanics have been shifting away from Democrats over the past four years due to the Biden Administration’s mishandling of key issues like inflation and immigration, and they do not appear to be circling back just because Kamala Harris is heading the ticket now.

The urban/rural divide is likely to be even larger this election than it was in 2020, with Trump further consolidating support among rural Americans and Harris gaining over Biden’s numbers among urbanites. Black voters like Harris more than they liked Biden seven weeks ago as he teetered out of the race, but they still like her less than they liked the Biden of 2020.

Manzanita Miller is the senior political analyst at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2024/09/rurals-young-people-and-hispanics-revert-back-toward-trump-after-harris-surge-in-july/

Federal Reserve Proposed Action Increases Consumer Banking Costs

By Rick Manning

Debit cards are ubiquitous in America. Virtually everyone with a bank account has them as a convenience to allow relatively easy access to one’s own money.

Obviously, these cards cost the issuer money to service each transaction with the Federal Reserve Board designated under the 2010 Dodd-Frank law to set these costs. But somewhere in the translation, the Fed has lost track of its actual mission. Take a look at their currently proposed regulation to change the debit card transaction fee formula.

To be clear, this is not referring to the fee some independent money machines charge to use debit cards, or the amount charged by some banks on transactions originating out of their banking system. Instead, the fees affected by the proposed Federal Reserve regulation are the small underlying processing fee that your bank collects with each debit card transaction known as the Debit Card Interchange Rate fee.

The Federal Reserve’s website lays out the governing mission of the Board with “conducting the nation’s monetary policy to promote maximum employment, stable prices and moderate long-term interest rates” listed first as one of its functions.

The other four functions of the Federal Reserve are to “promote the stability of the financial system and seek to minimize and contain systemic risks…”, ‘promote the safety and soundness of individual financial institutions…”, foster ‘payment and settlement system safety and efficiency through services to the banking industry…” and ‘promote consumer protection and community development…”.

Nowhere does it list changing banking fee structures to the detriment of small and mid-size banks financial stability to benefit retailers ultimately harming consumers. In fact, destabilizing revenues to the detriment of consumers is directly counter to the Fed’s stated mission.

Yet that is exactly what the Fed’s new proposed regulation would do.

A new White Paper entitled “How Proposed Interchange Fee Caps Will Affect Consumer Costs, by the former Director of Consumer Finance at the liberal Pew Charitable Trusts, puts a possible $2 billion increased consumer cost if this rule is finalized.

It is hard to imagine how those working at the Federal Reserve thought that changing the interchange fees helped ‘promote the safety and soundness of individual financial institutions” or promoted the stability of the financial system, let alone benefitted consumers. After all, the reason that the above mentioned study concludes that consumers will have additional costs is because the revenues lost by the banks due to this new regulation would have to be recovered through making banking more expensive for consumers. Just another inflationary cost increase that could be blamed on businesses, which were directly the result of regulatory malfeasance.

And as is the case with most of these types of ‘ideas that sound too good to be true’ which come from Washington, D.C., it is. Bank customers with large balances are unlikely to feel the brunt of these costs, instead it will be those who are struggling to make ends meet whose cost of banking will go up through higher bank fees to cover the Biden Federal Reserve’s mandated lost revenues.

The fact is that Congress has been battling for years over the question of whether these fees should go to the banks or if the retailers should get a taste of them as well. It is a major political battle, and one which Congress has so far decided to leave the status quo intact.

Now with the proposed Regulation II, the Federal Reserve has decided that rather than being neutral and just managing the banking system, they are going to try to put their thumb on the scales against the very entities which they are entrusted to make certain are financially stable.

The regulation itself admits that the proposed transaction fee price mandates are only the result of consultation with major banks, most of whom have been deemed ‘too big to fail.”

But it has been small to mid-sized banks who have most felt the financial pressures of rising interest rates with some like the former Silicon Valley Bank failing outright last year, creating a banking crisis.

Consumer Bankers Association President and CEO Lindsey Johnson sounded the alarm stating, “The Federal Reserve Board’s proposal would boost revenue for merchants at the expense of consumers.”

Johnson further warned that the proposed rule would only lead to higher costs for consumers and less access to banking services.”

The Federal Reserve’s job is to worry about interest rates and keep the banking system stable while watching out for consumers. Their latest proposal is an expensive swing and miss, and should be withdrawn and tossed on the trash heap of bad ideas that never should have gotten as far as they did.

Rick Manning is the President of Americans for Limited Government.

To view online: https://dailytorch.com/2024/09/federal-reserve-proposed-action-increases-consumer-banking-costs/

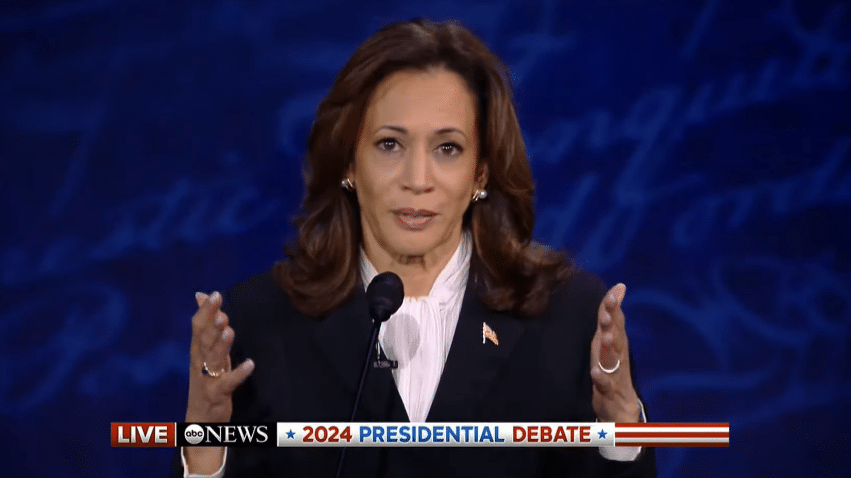

Harris fails to make her case on inflation, real wages and fundamental freedoms

Sept. 10, 2024, Fairfax, Va.—Americans for Limited Government President Rick Manning today issued the following statement commenting on tonight’s presidential debate:

“America finally got to hear Kamala Harris as she once again failed to address the critical issues facing our nation, providing no answers to the continued high costs of food and housing and the decline in America’s real wages. The Harris-Biden inflation has destroyed many Americans’ hope to achieve the American dream. Continuing the Harris economic policy for another four years will result in higher taxes and bigger deficits that already have us on the brink of recession. Continuing with open borders endangers public safety, our schools and communities. And an expansion of the weaponized administrative state threatens our fundamental constitutional freedoms. Americans who care about their children’s future will vote to return Donald Trump to the Oval Office, after all, weak and stupid is no way to run a country.”

To view online: https://getliberty.org/2024/09/harris-fails-to-make-her-case-on-inflation-real-wages-and-fundamental-freedoms/