| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2024-36 |

| Date | September 6, 2024 8:10 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Over $1 billion recovered in collections; BTA focus groups; third estimated tax payments; and more

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;gt;

IRS.gov Banner

e-News for Tax Professionals September 6, 2024

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2024-36

Inside This Issue

* Treasury, IRS announce over $1 billion recovered in collections from wealthy non-filers under IRA initiatives [ #First ]

* Register for the IRS Business Tax Account Virtual Focus Groups; first registration deadline is Sept. 6 [ #Second ]

* Deadline to submit third estimated tax payment is Sept. 16; more time may be granted to taxpayers in disaster-affected areas [ #Third ]

* IRA funding continues to modernize online tools, improve taxpayer service [ #Fourth ]

* September is National Preparedness Month; taxpayers encouraged to prepare for natural disasters [ #Fifth ]

* Upcoming webinars for tax professionals [ #Sixth ]

* Technical Guidance [ #Seventh ]

________________________________________________________________________

*1. Treasury, IRS announce over $1 billion recovered in collections from wealthy non-filers under IRA initiatives*

________________________________________________________________________

The U.S. Secretary of Treasury and the IRS Commissioner made remarks at the IRS campus in Austin, Texas, to announce new initiatives [ [link removed] ] under the Inflation Reduction Act that will ensure wealthy individuals pay their taxes, enhance taxpayer service through the Digital First Initiative and modernize essential technology. Approximately $1.1 billion have been recovered because of the nearly 80% of 1,600 millionaires having paid their outstanding tax debt. This is an additional $100 million just since July, when Treasury and IRS announced reaching the $1 billion milestone.

Through the Digital First Initiative, the IRS is pursuing a vision where taxpayers can do all their transactions with the IRS digitally if they prefer. Thanks to Inflation Reduction Act resources, the IRS has launched more digital tools to provide improved digital experience for taxpayers:

* More than two dozen new features and enhancements to Individual and Tax Professional Online Account;

* The launch of Business Tax Account;

* The release of 30 digital mobile-adaptive forms;

* The ability for taxpayers to receive their refund status via a conversational hotline;

* A mobile-friendly web tool for Where’s My Refund; and

* Direct File, a new tool that allows taxpayers to file for free, directly with the IRS.

Back to top [ #top ]

________________________________________________________________________

*2. Register for the IRS Business Tax Account Virtual Focus Groups; first registration deadline is Sept. 6*

________________________________________________________________________

Tax pros: The IRS is conducting virtual focus groups to gather feedback on the Business Tax Account (BTA) authorization process. We are looking for comments and suggestions from stakeholders who will use the BTA online platform. BTA was created to allow business entities to communicate and transact business with the IRS. If you are a CEO, shareholder, partner, designated official or can legally bind your organization, this focus group is for you. To register, send an email with “Focus Group Volunteer: Business Tax Account” in the subject line to *[email protected]*. Include the following information in the email body:

* Name

* Type of Entity (i.e., Partnership, S Corporation, etc.)

* Position Title

* State

* Email Address

* Phone Number

* Session Date

* Special accommodations

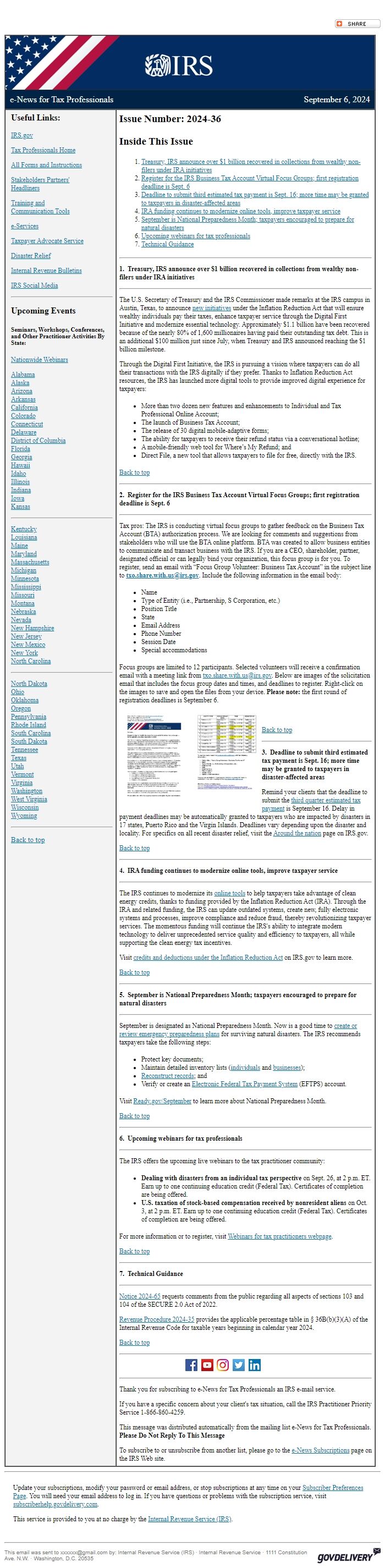

Focus groups are limited to 12 participants. Selected volunteers will receive a confirmation email with a meeting link from [email protected]. Below are images of the solicitation email that includes the focus group dates and times, and deadlines to register. Right-click on the images to save and open the files from your device.* Please note:* the first round of registration deadlines is September 6.

Image of email page one - BTA focus group solicitation

Image of email page 2 - BTA focus group solicitation

Back to top [ #top ]

________________________________________________________________________

*3. **Deadline to submit third estimated tax payment is Sept. 16; more time may be granted to taxpayers in disaster-affected areas*

Remind your clients that the deadline to submit the third quarter estimated tax payment [ [link removed] ] is September 16. Delay in payment deadlines may be automatically granted to taxpayers who are impacted by disasters in 17 states, Puerto Rico and the Virgin Islands. Deadlines vary depending upon the disaster and locality. For specifics on all recent disaster relief, visit the Around the nation [ [link removed] ] page on IRS.gov.

Back to top [ #top ]

________________________________________________________________________

*4. IRA funding continues to modernize online tools, improve taxpayer service*

________________________________________________________________________

The IRS continues to modernize its online tools [ [link removed] ] to help taxpayers take advantage of clean energy credits, thanks to funding provided by the Inflation Reduction Act (IRA). Through the IRA and related funding, the IRS can update outdated systems, create new, fully electronic systems and processes, improve compliance and reduce fraud, thereby revolutionizing taxpayer services. The momentous funding will continue the IRS's ability to integrate modern technology to deliver unprecedented service quality and efficiency to taxpayers, all while supporting the clean energy tax incentives.

Visit credits and deductions under the Inflation Reduction Act [ [link removed] ] on IRS.gov to learn more.

Back to top [ #top ]

________________________________________________________________________

*5. September is National Preparedness Month; taxpayers encouraged to prepare for natural disasters*

________________________________________________________________________

September is designated as National Preparedness Month. Now is a good time to create or review emergency preparedness plans [ [link removed] ] for surviving natural disasters. The IRS recommends taxpayers take the following steps:

* Protect key documents;

* Maintain detailed inventory lists (individuals [ [link removed] ] and businesses [ [link removed] ]);

* Reconstruct records [ [link removed] ]; and

* Verify or create an Electronic Federal Tax Payment System [ [link removed] ] (EFTPS) account.

Visit Ready.gov/September [ [link removed] ] to learn more about National Preparedness Month.

Back to top [ #top ]

________________________________________________________________________

*6. Upcoming webinars for tax professionals*

________________________________________________________________________

The IRS offers the upcoming live webinars to the tax practitioner community:

* *Dealing with disasters from an individual tax perspective* on Sept. 26, at 2 p.m. ET. Earn up to one continuing education credit (Federal Tax). Certificates of completion are being offered.

* *U.S. taxation of stock-based compensation received by nonresident aliens* on Oct. 3, at 2 p.m. ET. Earn up to one continuing education credit (Federal Tax). Certificates of completion are being offered.

For more information or to register, visit Webinars for tax practitioners webpage [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*7. Technical Guidance*

________________________________________________________________________

Notice 2024-65 [ [link removed] ] requests comments from the public regarding all aspects of sections 103 and 104 of the SECURE 2.0 Act of 2022.

Revenue Procedure 2024-35 [ [link removed] ] provides the applicable percentage table in § 36B(b)(3)(A) of the Internal Revenue Code for taxable years beginning in calendar year 2024.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;} &amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;lt;!-- body { font-family: arial; } p { font-size: 12px; } li { font-size: 12px; } h2 { font-size: 24px; font-style: italic;} --&amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;amp;gt;

IRS.gov Banner

e-News for Tax Professionals September 6, 2024

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2024-36

Inside This Issue

* Treasury, IRS announce over $1 billion recovered in collections from wealthy non-filers under IRA initiatives [ #First ]

* Register for the IRS Business Tax Account Virtual Focus Groups; first registration deadline is Sept. 6 [ #Second ]

* Deadline to submit third estimated tax payment is Sept. 16; more time may be granted to taxpayers in disaster-affected areas [ #Third ]

* IRA funding continues to modernize online tools, improve taxpayer service [ #Fourth ]

* September is National Preparedness Month; taxpayers encouraged to prepare for natural disasters [ #Fifth ]

* Upcoming webinars for tax professionals [ #Sixth ]

* Technical Guidance [ #Seventh ]

________________________________________________________________________

*1. Treasury, IRS announce over $1 billion recovered in collections from wealthy non-filers under IRA initiatives*

________________________________________________________________________

The U.S. Secretary of Treasury and the IRS Commissioner made remarks at the IRS campus in Austin, Texas, to announce new initiatives [ [link removed] ] under the Inflation Reduction Act that will ensure wealthy individuals pay their taxes, enhance taxpayer service through the Digital First Initiative and modernize essential technology. Approximately $1.1 billion have been recovered because of the nearly 80% of 1,600 millionaires having paid their outstanding tax debt. This is an additional $100 million just since July, when Treasury and IRS announced reaching the $1 billion milestone.

Through the Digital First Initiative, the IRS is pursuing a vision where taxpayers can do all their transactions with the IRS digitally if they prefer. Thanks to Inflation Reduction Act resources, the IRS has launched more digital tools to provide improved digital experience for taxpayers:

* More than two dozen new features and enhancements to Individual and Tax Professional Online Account;

* The launch of Business Tax Account;

* The release of 30 digital mobile-adaptive forms;

* The ability for taxpayers to receive their refund status via a conversational hotline;

* A mobile-friendly web tool for Where’s My Refund; and

* Direct File, a new tool that allows taxpayers to file for free, directly with the IRS.

Back to top [ #top ]

________________________________________________________________________

*2. Register for the IRS Business Tax Account Virtual Focus Groups; first registration deadline is Sept. 6*

________________________________________________________________________

Tax pros: The IRS is conducting virtual focus groups to gather feedback on the Business Tax Account (BTA) authorization process. We are looking for comments and suggestions from stakeholders who will use the BTA online platform. BTA was created to allow business entities to communicate and transact business with the IRS. If you are a CEO, shareholder, partner, designated official or can legally bind your organization, this focus group is for you. To register, send an email with “Focus Group Volunteer: Business Tax Account” in the subject line to *[email protected]*. Include the following information in the email body:

* Name

* Type of Entity (i.e., Partnership, S Corporation, etc.)

* Position Title

* State

* Email Address

* Phone Number

* Session Date

* Special accommodations

Focus groups are limited to 12 participants. Selected volunteers will receive a confirmation email with a meeting link from [email protected]. Below are images of the solicitation email that includes the focus group dates and times, and deadlines to register. Right-click on the images to save and open the files from your device.* Please note:* the first round of registration deadlines is September 6.

Image of email page one - BTA focus group solicitation

Image of email page 2 - BTA focus group solicitation

Back to top [ #top ]

________________________________________________________________________

*3. **Deadline to submit third estimated tax payment is Sept. 16; more time may be granted to taxpayers in disaster-affected areas*

Remind your clients that the deadline to submit the third quarter estimated tax payment [ [link removed] ] is September 16. Delay in payment deadlines may be automatically granted to taxpayers who are impacted by disasters in 17 states, Puerto Rico and the Virgin Islands. Deadlines vary depending upon the disaster and locality. For specifics on all recent disaster relief, visit the Around the nation [ [link removed] ] page on IRS.gov.

Back to top [ #top ]

________________________________________________________________________

*4. IRA funding continues to modernize online tools, improve taxpayer service*

________________________________________________________________________

The IRS continues to modernize its online tools [ [link removed] ] to help taxpayers take advantage of clean energy credits, thanks to funding provided by the Inflation Reduction Act (IRA). Through the IRA and related funding, the IRS can update outdated systems, create new, fully electronic systems and processes, improve compliance and reduce fraud, thereby revolutionizing taxpayer services. The momentous funding will continue the IRS's ability to integrate modern technology to deliver unprecedented service quality and efficiency to taxpayers, all while supporting the clean energy tax incentives.

Visit credits and deductions under the Inflation Reduction Act [ [link removed] ] on IRS.gov to learn more.

Back to top [ #top ]

________________________________________________________________________

*5. September is National Preparedness Month; taxpayers encouraged to prepare for natural disasters*

________________________________________________________________________

September is designated as National Preparedness Month. Now is a good time to create or review emergency preparedness plans [ [link removed] ] for surviving natural disasters. The IRS recommends taxpayers take the following steps:

* Protect key documents;

* Maintain detailed inventory lists (individuals [ [link removed] ] and businesses [ [link removed] ]);

* Reconstruct records [ [link removed] ]; and

* Verify or create an Electronic Federal Tax Payment System [ [link removed] ] (EFTPS) account.

Visit Ready.gov/September [ [link removed] ] to learn more about National Preparedness Month.

Back to top [ #top ]

________________________________________________________________________

*6. Upcoming webinars for tax professionals*

________________________________________________________________________

The IRS offers the upcoming live webinars to the tax practitioner community:

* *Dealing with disasters from an individual tax perspective* on Sept. 26, at 2 p.m. ET. Earn up to one continuing education credit (Federal Tax). Certificates of completion are being offered.

* *U.S. taxation of stock-based compensation received by nonresident aliens* on Oct. 3, at 2 p.m. ET. Earn up to one continuing education credit (Federal Tax). Certificates of completion are being offered.

For more information or to register, visit Webinars for tax practitioners webpage [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*7. Technical Guidance*

________________________________________________________________________

Notice 2024-65 [ [link removed] ] requests comments from the public regarding all aspects of sections 103 and 104 of the SECURE 2.0 Act of 2022.

Revenue Procedure 2024-35 [ [link removed] ] provides the applicable percentage table in § 36B(b)(3)(A) of the Internal Revenue Code for taxable years beginning in calendar year 2024.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ] YouTube Logo [ [link removed] ] Instagram Logo [ [link removed] ] Twitter Logo [ [link removed] ] LinkedIn Logo [ [link removed] ]________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need your email address to log in. If you have questions or problems with the subscription service, visit subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) · Internal Revenue Service · 1111 Constitution Ave. N.W. · Washington, D.C. 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery