Email

UPDATED FACT CHECK: New Data Shows California Lost 7.1k Fast Food Jobs in the 1st Quarter

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | UPDATED FACT CHECK: New Data Shows California Lost 7.1k Fast Food Jobs in the 1st Quarter |

| Date | September 5, 2024 6:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] UPDATED FACT CHECK:

New Data Shows California Lost 7,100 Fast Food Jobs in the 1st Quarter

The recent release of the 2024 First Quarter results from the Quarterly Census of Employment & Wages (QCEW) again confirms the job loss effect coming from the state’s new fast food minimum wage. The actual job counts for March show an annual loss of 7,084 jobs in the QCEW equivalent groupings to the monthly Limited Service Restaurants reporting. Because they hire from essentially the same labor pool, Full Service Restaurants also showed a job loss in March, bringing the total losses to 12,840 jobs. In contrast to the model-based estimates reported each month, the QCEW numbers report actual job counts from employment tax filings. The March results will also be the base for the revisions to the monthly numbers that will be released early next year.

As we previously reported, the monthly job estimates have been used by some to claim that California’s new fast food minimum wage has had no effect on jobs, primarily relying on the preliminary estimates for July showing an additional 3,800 jobs in Limited Service Restaurants when compared to July 2023. Note that the US data for July is not yet available and is not shown in the chart.

That data, however, is not adjusted for the strong seasonal factors affecting job levels in this industry. The seasonally adjusted series available from the St. Louis Federal Reserve Bank instead shows the number of jobs in this industry are down 2,800 from their peak, although with an uptick in the July number.

Which chart is correct? Neither—the July number is preliminary and will be revised in the upcoming release for August. Both series are also estimates from the Current Employment Statistics (CES) series based on surveys and modeling. They will be revised again early next year based on the actual job numbers in the 1st Quarter counts from the Quarterly Census of Employment & Wages (QCEW) that was just released.

The QCEW results indicate this industry was already slowing new hires substantially at the end of 2023 and began shedding jobs in the 1st Quarter in anticipation of the higher labor costs that took effect the beginning of April. Again using a comparison of the same month in each year to show an annual change accounting for seasonal factors, jobs in the QCEW industries equivalent to the CES reporting (NAICS 722513 through 722515) were down by 7,084 in March. Job losses also are not restricted to the limited-service component. Because they hire from essentially the same labor pool, full-service restaurants are also facing wage pressures that produced an additional job loss (annual) of 5,756 in the March numbers, for a total loss of 12,840 jobs.

This chart shows the actual job losses. In contrast, the national numbers show this industry continued to grow in the other states. Other than a brief surge in January, California has also experienced a significant opportunity cost related to the overall job dampening effect.

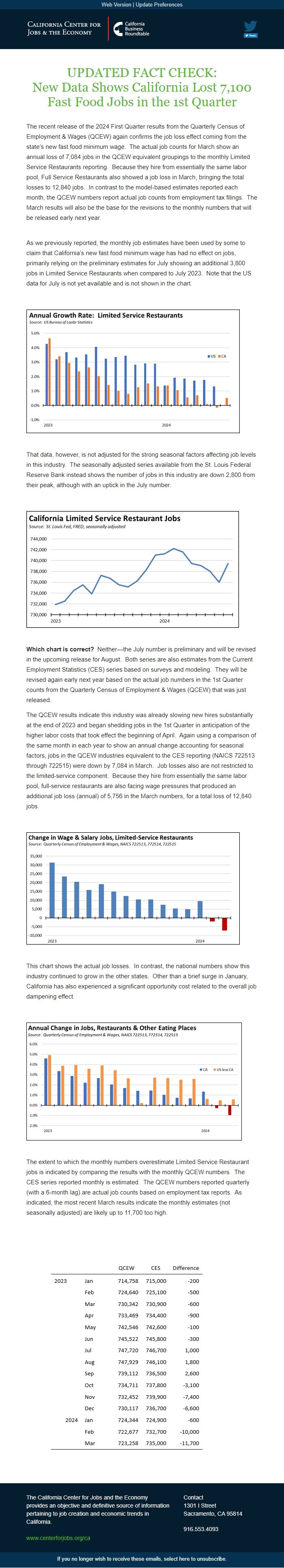

The extent to which the monthly numbers overestimate Limited Service Restaurant jobs is indicated by comparing the results with the monthly QCEW numbers. The CES series reported monthly is estimated. The QCEW numbers reported quarterly (with a 6-month lag) are actual job counts based on employment tax reports. As indicated, the most recent March results indicate the monthly estimates (not seasonally adjusted) are likely up to 11,700 too high.

The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

New Data Shows California Lost 7,100 Fast Food Jobs in the 1st Quarter

The recent release of the 2024 First Quarter results from the Quarterly Census of Employment & Wages (QCEW) again confirms the job loss effect coming from the state’s new fast food minimum wage. The actual job counts for March show an annual loss of 7,084 jobs in the QCEW equivalent groupings to the monthly Limited Service Restaurants reporting. Because they hire from essentially the same labor pool, Full Service Restaurants also showed a job loss in March, bringing the total losses to 12,840 jobs. In contrast to the model-based estimates reported each month, the QCEW numbers report actual job counts from employment tax filings. The March results will also be the base for the revisions to the monthly numbers that will be released early next year.

As we previously reported, the monthly job estimates have been used by some to claim that California’s new fast food minimum wage has had no effect on jobs, primarily relying on the preliminary estimates for July showing an additional 3,800 jobs in Limited Service Restaurants when compared to July 2023. Note that the US data for July is not yet available and is not shown in the chart.

That data, however, is not adjusted for the strong seasonal factors affecting job levels in this industry. The seasonally adjusted series available from the St. Louis Federal Reserve Bank instead shows the number of jobs in this industry are down 2,800 from their peak, although with an uptick in the July number.

Which chart is correct? Neither—the July number is preliminary and will be revised in the upcoming release for August. Both series are also estimates from the Current Employment Statistics (CES) series based on surveys and modeling. They will be revised again early next year based on the actual job numbers in the 1st Quarter counts from the Quarterly Census of Employment & Wages (QCEW) that was just released.

The QCEW results indicate this industry was already slowing new hires substantially at the end of 2023 and began shedding jobs in the 1st Quarter in anticipation of the higher labor costs that took effect the beginning of April. Again using a comparison of the same month in each year to show an annual change accounting for seasonal factors, jobs in the QCEW industries equivalent to the CES reporting (NAICS 722513 through 722515) were down by 7,084 in March. Job losses also are not restricted to the limited-service component. Because they hire from essentially the same labor pool, full-service restaurants are also facing wage pressures that produced an additional job loss (annual) of 5,756 in the March numbers, for a total loss of 12,840 jobs.

This chart shows the actual job losses. In contrast, the national numbers show this industry continued to grow in the other states. Other than a brief surge in January, California has also experienced a significant opportunity cost related to the overall job dampening effect.

The extent to which the monthly numbers overestimate Limited Service Restaurant jobs is indicated by comparing the results with the monthly QCEW numbers. The CES series reported monthly is estimated. The QCEW numbers reported quarterly (with a 6-month lag) are actual job counts based on employment tax reports. As indicated, the most recent March results indicate the monthly estimates (not seasonally adjusted) are likely up to 11,700 too high.

The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor