|

John,

The right-wing’s latest attack on tax fairness would be laughable if it weren't so dangerous.

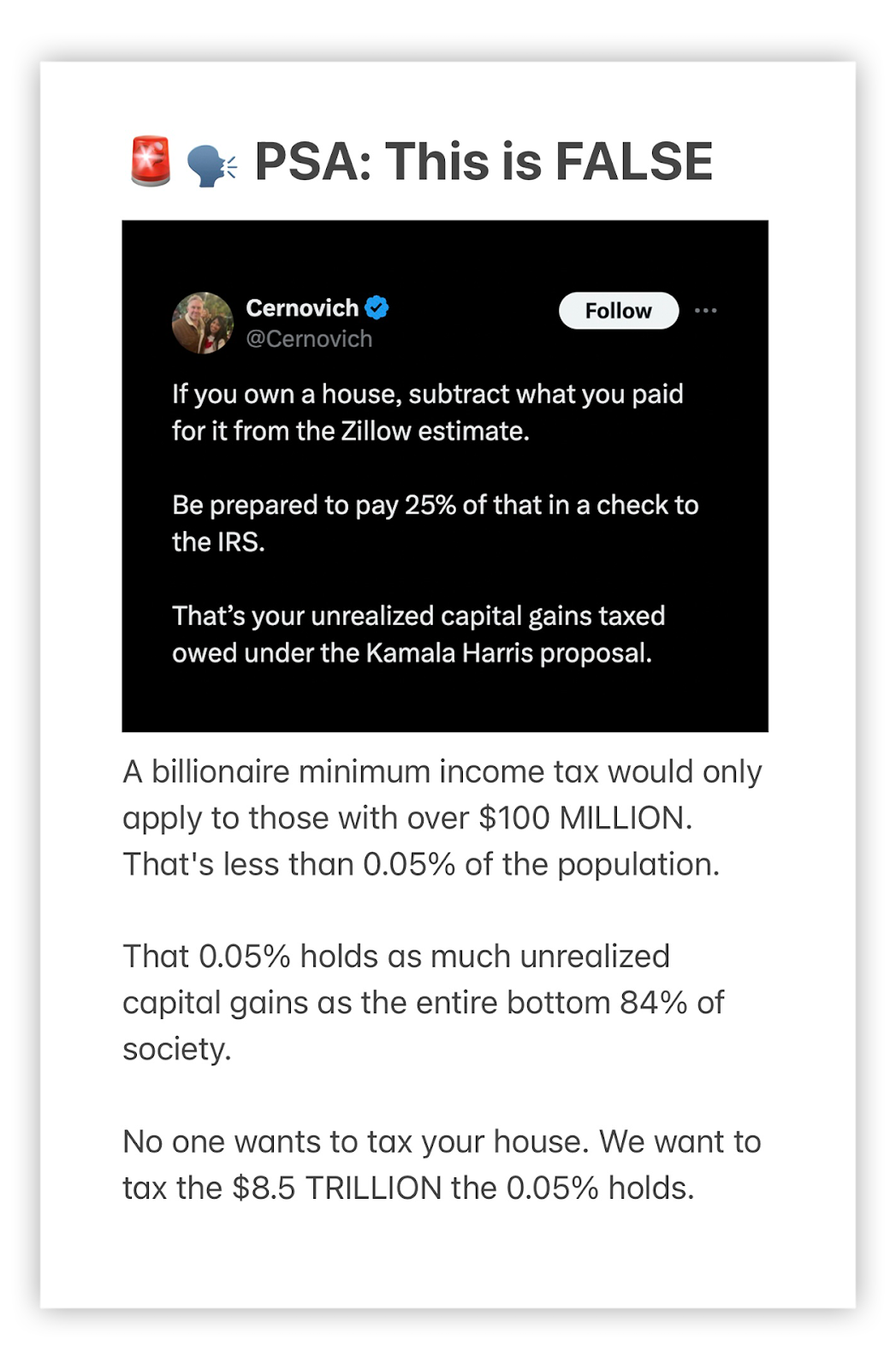

They’re falsely claiming that the Biden-Harris administration wants to tax everyone's unrealized capital gains―including the equity in your house, your 401(k), and other retirement savings.

This is a blatant lie, and we need your help to set the record straight.

The proposal in question is the Billionaire Minimum Income Tax (BMIT). It would only affect households worth over $100 million―about 11,000 ultra-wealthy Americans.[1] 99.95% of Americans would see zero impact on their investments or retirement accounts.

It’s clear that the BMIT is striking fear in the billionaire class. And they’re lashing out with lies in an attempt to scare working people.

We need your support to combat the right-wing misinformation campaign. Will you donate $5 or more to help us spread the truth and fight for a tax system that works for all Americans, not just the ultra-wealthy?

Our current tax system allows the ultra-wealthy to accumulate vast fortunes through asset appreciation without paying taxes, borrow against their assets to fund lavish lifestyles while avoiding taxes, and pass enormous wealth on to their heirs completely tax-free due to loopholes like the "step-up in basis."

The BMIT aims to close these loopholes and ensure billionaires and ultra-millionaires pay at least a 25% tax rate on their true income. It's about fairness, not raiding your retirement account.

The wealth gap in America has reached alarming levels, with the top 0.1% now owning as much wealth as the bottom 90% combined. This extreme concentration of wealth distorts our political system, allowing the ultra-rich to shape policies in their favor at the expense of everyone else.

But make no mistake―the billionaires and their right-wing allies won't give up without a fight. They're pouring millions of dollars into lobbying and propaganda to maintain a tax system and economy that allows them to accumulate vast fortunes while paying lower tax rates than teachers, nurses, and firefighters.

That's why your support today is so critical. Rush a contribution right now to help us counter the right-wing misinformation campaign with the truth about the Billionaire Minimum Income Tax.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

With your help, we can expose right-wing lies and build momentum for real tax reform.

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

[1] Billionaire Minimum Income Tax

[2] The Ultra-Wealthy's $8.5 Trillion of Untaxed Income

-- David's email --

John,

The right-wing propaganda machine is in overdrive, spreading blatant lies about the Biden-Harris tax plans―specifically the Billionaire Minimum Income Tax (BMIT). Their latest scare tactic? Falsely claiming the BMIT would tax everyone's unrealized capital gains, including the equity in their home, and 401(k)s.

Let's be crystal clear: This is a complete fabrication designed to protect billionaires and mislead hard-working Americans into unknowingly supporting the desires of the ultra-wealthy.

The truth is that the Billionaire Minimum Income Tax (BMIT) would only target households worth over $100 million. That's less than 0.05% of Americans―the 11,000 wealthiest individuals in the U.S.[1] The BMIT would ensure billionaires pay at least a 25% tax rate on their total income, including unrealized capital gains. It would not impact 99.95% of Americans or their retirement accounts.

We’re fact checking the right-wing’s lies and bringing the truth about the Biden-Harris tax agenda to the American people.

Help us combat the right-wing misinformation campaign and fight for a fair tax system where billionaires and ultra-millionaires pay their fair share. Rush a donation of $5 or more to help us spread the truth and build support for the Billionaire Minimum Income Tax.

So why is the right-wing lying? Because they're desperate to protect their billionaire donors at your expense. That’s why we need your support to reach more voters with the truth, to pressure lawmakers to stand up for working families, and to build a movement for real, lasting tax reform.

Our reporting found that as of 2022, billionaires and centi-millionaires held a staggering $8.5 trillion in untaxed, unrealized capital gains.[2]

In 2021, the wealthiest 400 American families paid an average federal income tax rate of just 8.2% when including the increased value of their stock holdings.[3] That's lower than the tax rate paid by many middle-class families.

By ensuring that the wealthiest Americans contribute their fair share, we can generate billions in revenue for critical investments that benefit all Americans. This includes funding for education, healthcare, and infrastructure projects that have been chronically underfunded.

But in order to fight back against right-wing misinformation, we need your help. The billionaire class has almost unlimited resources and a vast propaganda machine at its disposal. They're counting on their lies and scare tactics to turn public opinion against common-sense tax reform.

The more people who understand what's really at stake, the stronger our movement becomes. So can you help us spread the truth by making a contribution as we work to debunk right-wing lies about the Billionaire Minimum Income Tax?

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we can build an economy that works for all of us, not just the wealthy elite.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Billionaire Minimum Income Tax

[2] The Ultra-Wealthy's $8.5 Trillion of Untaxed Income

|