| From | Roosevelt Institute <[email protected]> |

| Subject | 🌡️Why the Fed Should Care about Climate Change |

| Date | August 28, 2024 6:39 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

A central bank shouldn’t ignore the risks that climate poses to price stability.

The Roosevelt Rundown features our top stories of the week.

View this in your browser and share with your friends. ([link removed])

[link removed]

** The Fed Needs to Do Its Homework on Climate Risk

------------------------------------------------------------

[link removed]

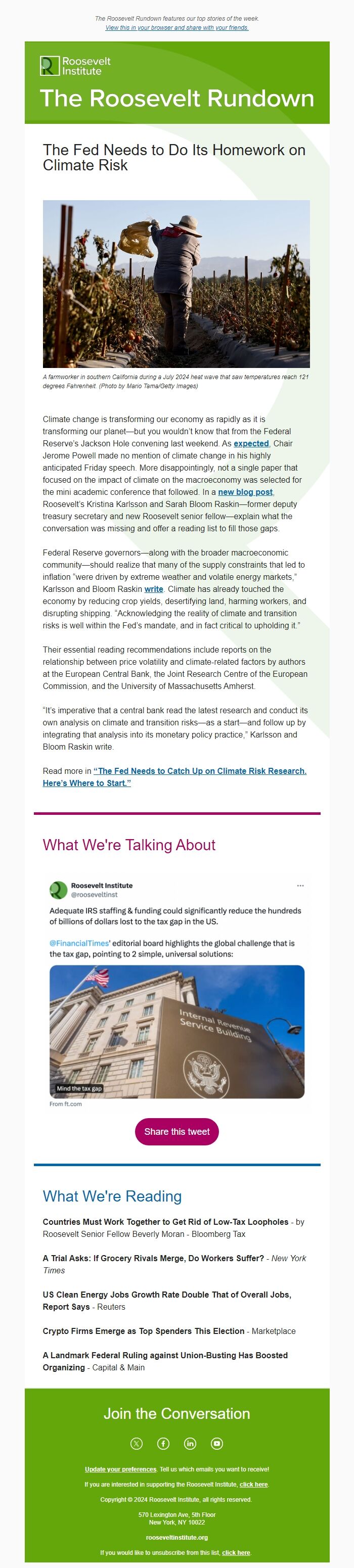

A farmworker in southern California during a July 2024 heat wave that saw temperatures reach 121 degrees Fahrenheit. (Photo by Mario Tama/Getty Images)

Climate change is transforming our economy as rapidly as it is transforming our planet—but you wouldn’t know that from the Federal Reserve’s Jackson Hole convening last weekend. As expected ([link removed]) , Chair Jerome Powell made no mention of climate change in his highly anticipated Friday speech. More disappointingly, not a single paper that focused on the impact of climate on the macroeconomy was selected for the mini academic conference that followed. In a new blog post ([link removed]) , Roosevelt’s Kristina Karlsson and Sarah Bloom Raskin—former deputy treasury secretary and new Roosevelt senior fellow—explain what the conversation was missing and offer a reading list to fill those gaps.

Federal Reserve governors—along with the broader macroeconomic community—should realize that many of the supply constraints that led to inflation “were driven by extreme weather and volatile energy markets,” Karlsson and Bloom Raskin write ([link removed]) . Climate has already touched the economy by reducing crop yields, desertifying land, harming workers, and disrupting shipping. “Acknowledging the reality of climate and transition risks is well within the Fed’s mandate, and in fact critical to upholding it.”

Their essential reading recommendations include reports on the relationship between price volatility and climate-related factors by authors at the European Central Bank, the Joint Research Centre of the European Commission, and the University of Massachusetts Amherst.

“It’s imperative that a central bank read the latest research and conduct its own analysis on climate and transition risks—as a start—and follow up by integrating that analysis into its monetary policy practice,” Karlsson and Bloom Raskin write.

Read more in “The Fed Needs to Catch Up on Climate Risk Research. Here’s Where to Start.” ([link removed])

** What We're Talking About

------------------------------------------------------------

[link removed]

Share this tweet ([link removed])

** What We're Reading

------------------------------------------------------------

Countries Must Work Together to Get Rid of Low-Tax Loopholes ([link removed]) - by Roosevelt Senior Fellow Beverly Moran - Bloomberg Tax

A Trial Asks: If Grocery Rivals Merge, Do Workers Suffer? ([link removed]) - New York Times

US Clean Energy Jobs Growth Rate Double That of Overall Jobs, Report Says ([link removed]) - Reuters

Crypto Firms Emerge as Top Spenders This Election ([link removed]) - Marketplace

A Landmark Federal Ruling against Union-Busting Has Boosted Organizing ([link removed]) - Capital & Main

============================================================

Join the Conversation

** Twitter ([link removed])

** Facebook ([link removed])

** LinkedIn ([link removed])

** YouTube ([link removed])

** Update your preferences ([link removed])

. Tell us which emails you want to receive!

If you are interested in supporting the Roosevelt Institute, ** click here ([link removed])

.

Copyright © 2024 Roosevelt Institute, all rights reserved.

570 Lexington Ave, 5th Floor

New York, NY 10022

rooseveltinstitute.org

If you would like to unsubscribe from this list, ** click here ([link removed])

.

The Roosevelt Rundown features our top stories of the week.

View this in your browser and share with your friends. ([link removed])

[link removed]

** The Fed Needs to Do Its Homework on Climate Risk

------------------------------------------------------------

[link removed]

A farmworker in southern California during a July 2024 heat wave that saw temperatures reach 121 degrees Fahrenheit. (Photo by Mario Tama/Getty Images)

Climate change is transforming our economy as rapidly as it is transforming our planet—but you wouldn’t know that from the Federal Reserve’s Jackson Hole convening last weekend. As expected ([link removed]) , Chair Jerome Powell made no mention of climate change in his highly anticipated Friday speech. More disappointingly, not a single paper that focused on the impact of climate on the macroeconomy was selected for the mini academic conference that followed. In a new blog post ([link removed]) , Roosevelt’s Kristina Karlsson and Sarah Bloom Raskin—former deputy treasury secretary and new Roosevelt senior fellow—explain what the conversation was missing and offer a reading list to fill those gaps.

Federal Reserve governors—along with the broader macroeconomic community—should realize that many of the supply constraints that led to inflation “were driven by extreme weather and volatile energy markets,” Karlsson and Bloom Raskin write ([link removed]) . Climate has already touched the economy by reducing crop yields, desertifying land, harming workers, and disrupting shipping. “Acknowledging the reality of climate and transition risks is well within the Fed’s mandate, and in fact critical to upholding it.”

Their essential reading recommendations include reports on the relationship between price volatility and climate-related factors by authors at the European Central Bank, the Joint Research Centre of the European Commission, and the University of Massachusetts Amherst.

“It’s imperative that a central bank read the latest research and conduct its own analysis on climate and transition risks—as a start—and follow up by integrating that analysis into its monetary policy practice,” Karlsson and Bloom Raskin write.

Read more in “The Fed Needs to Catch Up on Climate Risk Research. Here’s Where to Start.” ([link removed])

** What We're Talking About

------------------------------------------------------------

[link removed]

Share this tweet ([link removed])

** What We're Reading

------------------------------------------------------------

Countries Must Work Together to Get Rid of Low-Tax Loopholes ([link removed]) - by Roosevelt Senior Fellow Beverly Moran - Bloomberg Tax

A Trial Asks: If Grocery Rivals Merge, Do Workers Suffer? ([link removed]) - New York Times

US Clean Energy Jobs Growth Rate Double That of Overall Jobs, Report Says ([link removed]) - Reuters

Crypto Firms Emerge as Top Spenders This Election ([link removed]) - Marketplace

A Landmark Federal Ruling against Union-Busting Has Boosted Organizing ([link removed]) - Capital & Main

============================================================

Join the Conversation

** Twitter ([link removed])

** Facebook ([link removed])

** LinkedIn ([link removed])

** YouTube ([link removed])

** Update your preferences ([link removed])

. Tell us which emails you want to receive!

If you are interested in supporting the Roosevelt Institute, ** click here ([link removed])

.

Copyright © 2024 Roosevelt Institute, all rights reserved.

570 Lexington Ave, 5th Floor

New York, NY 10022

rooseveltinstitute.org

If you would like to unsubscribe from this list, ** click here ([link removed])

.

Message Analysis

- Sender: Roosevelt Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp