|

John,

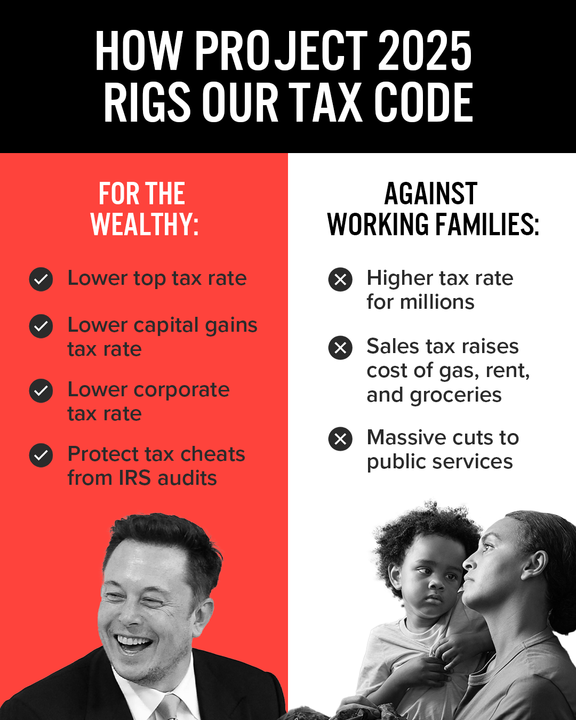

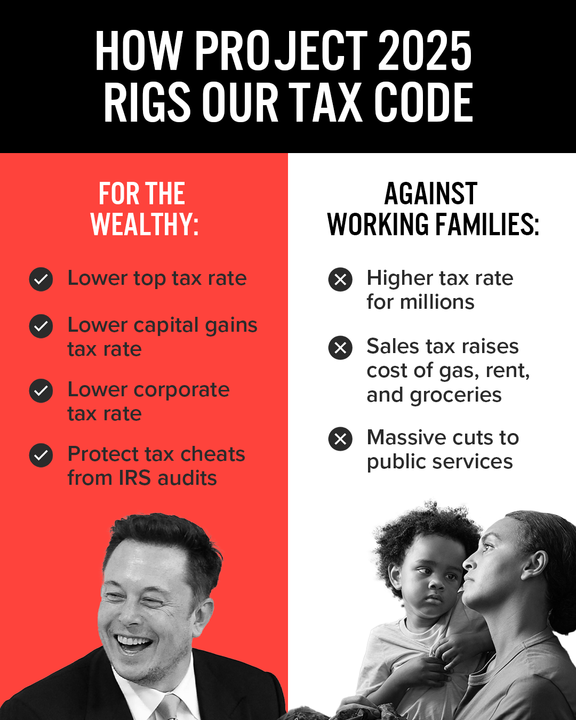

The response to our infographic exposing Project 2025's assault on working families has been overwhelming. But with the stakes so high, we need to double down on our efforts to get this crucial information in front of every voter.

Let's be clear about what Project 2025 is proposing: a tax hike of thousands of dollars on millions of working families making under $168,000 a year, coupled with a massive $325,000 tax cut for families making $5 million a year—and an even bigger cut for higher incomes.[1] They want to slash the corporate tax rate to 18%, at a time when many big corporations are already paying little to nothing in taxes.[2] They're proposing to cut capital gains taxes for wealthy investors. And they're even considering a national sales tax that would raise prices on everyday essentials by 30%.

This plan would flip our economy upside down, rigging it even further against working families while handing huge tax breaks to the wealthy and corporations.

We can't let this happen. That's why we urgently need your help to share our revealing infographic exposing Project 2025's dangerous agenda with voters across the country.

Will you make a donation of $5 today to power our campaign?

Remember, this isn't an abstract policy debate. Project 2025's tax plan would have real, devastating consequences for millions of American families. A family of four making $100,000 could see their taxes go up by $2,600—or even $6,600 if the Child Tax Credit is eliminated, as the plan may well be recommending.

The bottom half of taxpayers, who currently make less than $46,000 a year and pay an effective tax rate of 3.3%, would see their tax rate skyrocket to 15%. Essential goods and services could become 30% more expensive if a national sales tax is implemented.

Meanwhile, the wealthiest Americans and largest corporations would enjoy massive tax cuts, exacerbating the already stark income inequality in our country.

We have a limited window to educate voters about the real impact of Project 2025's agenda before it's too late. Your support right now is crucial in getting our new infographic in front of as many voters as possible.

Can you chip in $5 or more today to help us fight back against Project 2025 and protect working families from this dangerous plan?

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we can build an economy that works for all of us, not just the wealthy few.

Thank you for standing with us in this critical moment,

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

[1] Project 2025 would overhaul the U.S. tax system. Here's how it could impact you.

[2] Corporate Tax Avoidance in the First Five Years of the Trump Tax Law

-- David's email --

John,

Project 2025 is looking to fundamentally reshape our tax system at the expense of working Americans.

At the heart of Project 2025 is a deceptively simple tax plan: change our tax code to two tax brackets that would hit working families hard while rewarding the wealthiest among us.

Here's what this could mean for you:

If you're in a family of four earning $100,000, you could see your taxes jump by $2,600. And if the Child Tax Credit is eliminated, as the plan may envision, that increase could balloon to $6,600. But for those bringing in $5 million a year? They'd enjoy a staggering $325,000 tax cut.[1]

We've distilled the complex implications of this plan into a clear, impactful infographic. Now, we need your help to ensure every voter sees it before it's too late.

Can you contribute $5 today to help us spread this crucial information to voters nationwide?

The two-tax-bracket system is just the beginning. Project 2025 also proposes:

-

Reducing the corporate tax rate to 18%, despite many large corporations already paying minimal taxes

-

Lowering capital gains taxes, a change that primarily benefits wealthy investors

-

Introducing a national sales tax that could increase the cost of everyday essentials by 30%

-

Making these changes nearly irreversible by requiring a congressional supermajority to amend them

This isn't just about numbers on a page. It's about the future of America's working families. Will workers see their paychecks grow or shrink? Will small businesses have a fair shot at success? Will our children inherit a stable economy or be left cleaning up the mess?

That's why we've created this revealing infographic. It cuts through the complexity to show exactly how Project 2025 would impact Americans across the economic spectrum.

But distilling this information down into an infographic was just the first step. Now, we need to get it in front of as many voters as possible. Will you chip in $5 or more right now to power our campaign and spread this vital information?

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we can counter this radical agenda and advocate for a tax system that truly serves all Americans, not just the privileged few.

Thank you for standing with us in this critical moment,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Project 2025 would overhaul the U.S. tax system. Here's how it could impact you.

|