Email

The Price of “Kamalanomics”

| From | AEI DataPoints <[email protected]> |

| Subject | The Price of “Kamalanomics” |

| Date | August 22, 2024 11:01 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Breaking down the news with data, charts, and maps.

Happy Thursday! In today’s newsletter, we explore the impact of the Biden-Harris economy on American households, the rapid decline of global birth rates, and the danger of overdependence on China.

Edited by Sutton Houser and James Desio

Did a friend send you this email? Subscribe <[link removed]> today! For inquiries, email [email protected] <[link removed]>.

1. The Price of “Kamalanomics”

Topline: AEI’s Marc Thiessen argues <[link removed]> that Vice President Kamala Harris’s economic agenda will lead to the same hardships that households are facing under the Biden-Harris administration. He points out that inflation (caused by high government spending) has forced Americans to deplete their savings and accumulate unprecedented debt.Rising Household Debt: In 2021, US households had record-high savings, but after the $1.9 trillion American Rescue Plan—which Harris helped pass with her tiebreaking vote—soaring inflation drove them to spend down those savings. Now, household debt has reached a record $17.8 trillion.

How Much Spending? Thiessen warns that if Harris’s proposals are enacted, they will add nearly $2 trillion in new government spending, further fueling inflation.

2. The Global Fertility Crisis

Topline: AEI’s Jesús Fernández-Villaverde explains <[link removed]> that, for the first time in history, global birth rates have dropped below the replacement rate. Countries such as India, China, the US, Bangladesh, and Mexico, as well as all of Europe, are all below the replacement rate.

What Does This

Mean? Fernández-Villaverde predicts that if this trend continues, younger generations will likely see a sustained decrease in the global population for the first time in 60,000 years.

The Solution: He emphasizes that reversing this demographic decline will require strengthening economic and societal support for large

families.

“Creating the conditions for large families to flourish is the only way to reverse the trend in fertility rates. If we fail to do so, then the coming demographic winter will be far harsher than anyone cares to admit.”

—Jesús Fernández-Villaverde

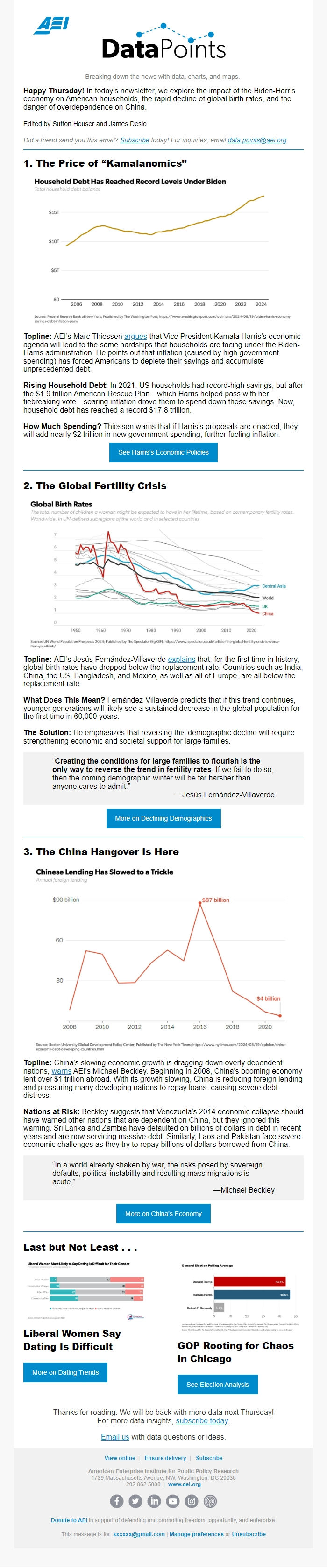

3. The China Hangover Is Here

Topline: China’s slowing economic growth is dragging down overly dependent nations, warns <[link removed]> AEI’s Michael Beckley. Beginning in 2008, China’s booming economy lent over $1 trillion abroad. With its growth slowing, China is reducing foreign lending and pressuring many developing nations to repay loans–causing severe debt distress.

Nations at Risk: Beckley suggests that Venezuela’s 2014 economic collapse should have warned other nations that are dependent on China, but they ignored this warning. Sri Lanka and Zambia have defaulted on billions of dollars in debt in recent years and are now servicing massive debt. Similarly, Laos and Pakistan face severe economic challenges as they try to repay billions of dollars borrowed from China.

“In a world already shaken by war, the risks posed by sovereign defaults, political instability and resulting mass migrations is

acute.”

—Michael Beckley

Last but Not Least . . .

Liberal Women Say Dating Is Difficult <[link removed]>

GOP Rooting for Chaos in Chicago <[link removed]>

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Happy Thursday! In today’s newsletter, we explore the impact of the Biden-Harris economy on American households, the rapid decline of global birth rates, and the danger of overdependence on China.

Edited by Sutton Houser and James Desio

Did a friend send you this email? Subscribe <[link removed]> today! For inquiries, email [email protected] <[link removed]>.

1. The Price of “Kamalanomics”

Topline: AEI’s Marc Thiessen argues <[link removed]> that Vice President Kamala Harris’s economic agenda will lead to the same hardships that households are facing under the Biden-Harris administration. He points out that inflation (caused by high government spending) has forced Americans to deplete their savings and accumulate unprecedented debt.Rising Household Debt: In 2021, US households had record-high savings, but after the $1.9 trillion American Rescue Plan—which Harris helped pass with her tiebreaking vote—soaring inflation drove them to spend down those savings. Now, household debt has reached a record $17.8 trillion.

How Much Spending? Thiessen warns that if Harris’s proposals are enacted, they will add nearly $2 trillion in new government spending, further fueling inflation.

2. The Global Fertility Crisis

Topline: AEI’s Jesús Fernández-Villaverde explains <[link removed]> that, for the first time in history, global birth rates have dropped below the replacement rate. Countries such as India, China, the US, Bangladesh, and Mexico, as well as all of Europe, are all below the replacement rate.

What Does This

Mean? Fernández-Villaverde predicts that if this trend continues, younger generations will likely see a sustained decrease in the global population for the first time in 60,000 years.

The Solution: He emphasizes that reversing this demographic decline will require strengthening economic and societal support for large

families.

“Creating the conditions for large families to flourish is the only way to reverse the trend in fertility rates. If we fail to do so, then the coming demographic winter will be far harsher than anyone cares to admit.”

—Jesús Fernández-Villaverde

3. The China Hangover Is Here

Topline: China’s slowing economic growth is dragging down overly dependent nations, warns <[link removed]> AEI’s Michael Beckley. Beginning in 2008, China’s booming economy lent over $1 trillion abroad. With its growth slowing, China is reducing foreign lending and pressuring many developing nations to repay loans–causing severe debt distress.

Nations at Risk: Beckley suggests that Venezuela’s 2014 economic collapse should have warned other nations that are dependent on China, but they ignored this warning. Sri Lanka and Zambia have defaulted on billions of dollars in debt in recent years and are now servicing massive debt. Similarly, Laos and Pakistan face severe economic challenges as they try to repay billions of dollars borrowed from China.

“In a world already shaken by war, the risks posed by sovereign defaults, political instability and resulting mass migrations is

acute.”

—Michael Beckley

Last but Not Least . . .

Liberal Women Say Dating Is Difficult <[link removed]>

GOP Rooting for Chaos in Chicago <[link removed]>

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo