| From | Minnesota Department of Revenue <[email protected]> |

| Subject | Minnesota Credits to Reduce Tax or Increase a Refund! |

| Date | August 15, 2024 1:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax professionals

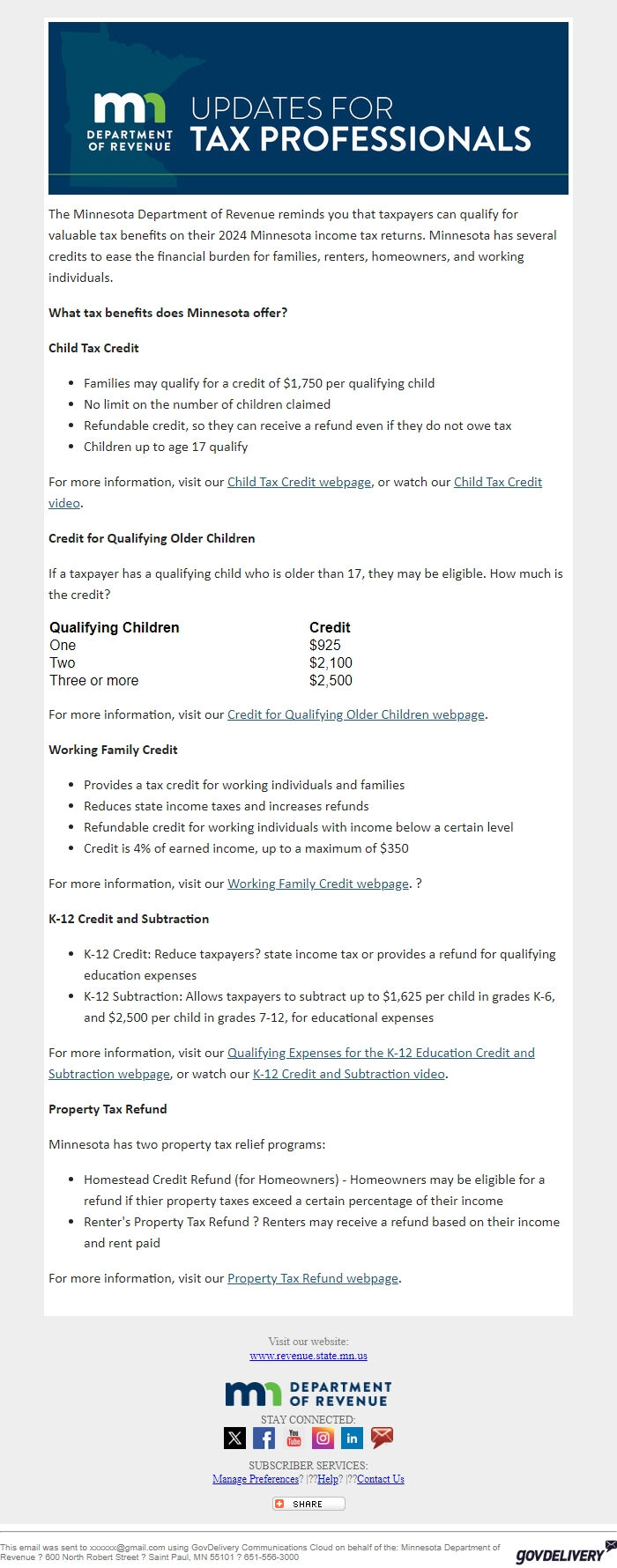

The Minnesota Department of Revenue reminds you that taxpayers can qualify for valuable tax benefits on their 2024 Minnesota income tax returns. Minnesota has several credits to ease the financial burden for families, renters, homeowners, and working individuals.

*What tax benefits does Minnesota offer?*

*Child Tax Credit*

* Families may qualify for a credit of $1,750 per qualifying child

* No limit on the number of children claimed

* Refundable credit, so they can receive a refund even if they do not owe tax

* Children up to age 17 qualify

For more information, visit our Child Tax Credit webpage [ [link removed] ], or watch our Child Tax Credit video [ [link removed] ].

*Credit for Qualifying Older Children*

If a taxpayer has a qualifying child who is older than 17, they may be eligible. How much is the credit?

*Qualifying Children* *Credit* One $925 Two $2,100 Three or more $2,500

For more information, visit our Credit for Qualifying Older Children webpage [ [link removed] ].

*Working Family Credit*

* Provides a tax credit for working individuals and families

* Reduces state income taxes and increases refunds

* Refundable credit for working individuals with income below a certain level

* Credit is 4% of earned income, up to a maximum of $350

For more information, visit our Working Family Credit webpage [ [link removed] ]. ?

*K-12 Credit and Subtraction*

* K-12 Credit: Reduce taxpayers? state income tax or provides a refund for qualifying education expenses

* K-12 Subtraction: Allows taxpayers to subtract up to $1,625 per child in grades K-6, and $2,500 per child in grades 7-12, for educational expenses

For more information, visit our Qualifying Expenses for the K-12 Education Credit and Subtraction webpage [ [link removed] ], or watch our K-12 Credit and Subtraction video [ [link removed] ].__

*Property Tax Refund*

Minnesota has two property tax relief programs:

* Homestead Credit Refund (for Homeowners) - Homeowners may be eligible for a refund if thier property taxes exceed a certain percentage of their income

* Renter's Property Tax Refund ? Renters may receive a refund based on their income and rent paid

For more information, visit our Property Tax Refund webpage [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

The Minnesota Department of Revenue reminds you that taxpayers can qualify for valuable tax benefits on their 2024 Minnesota income tax returns. Minnesota has several credits to ease the financial burden for families, renters, homeowners, and working individuals.

*What tax benefits does Minnesota offer?*

*Child Tax Credit*

* Families may qualify for a credit of $1,750 per qualifying child

* No limit on the number of children claimed

* Refundable credit, so they can receive a refund even if they do not owe tax

* Children up to age 17 qualify

For more information, visit our Child Tax Credit webpage [ [link removed] ], or watch our Child Tax Credit video [ [link removed] ].

*Credit for Qualifying Older Children*

If a taxpayer has a qualifying child who is older than 17, they may be eligible. How much is the credit?

*Qualifying Children* *Credit* One $925 Two $2,100 Three or more $2,500

For more information, visit our Credit for Qualifying Older Children webpage [ [link removed] ].

*Working Family Credit*

* Provides a tax credit for working individuals and families

* Reduces state income taxes and increases refunds

* Refundable credit for working individuals with income below a certain level

* Credit is 4% of earned income, up to a maximum of $350

For more information, visit our Working Family Credit webpage [ [link removed] ]. ?

*K-12 Credit and Subtraction*

* K-12 Credit: Reduce taxpayers? state income tax or provides a refund for qualifying education expenses

* K-12 Subtraction: Allows taxpayers to subtract up to $1,625 per child in grades K-6, and $2,500 per child in grades 7-12, for educational expenses

For more information, visit our Qualifying Expenses for the K-12 Education Credit and Subtraction webpage [ [link removed] ], or watch our K-12 Credit and Subtraction video [ [link removed] ].__

*Property Tax Refund*

Minnesota has two property tax relief programs:

* Homestead Credit Refund (for Homeowners) - Homeowners may be eligible for a refund if thier property taxes exceed a certain percentage of their income

* Renter's Property Tax Refund ? Renters may receive a refund based on their income and rent paid

For more information, visit our Property Tax Refund webpage [ [link removed] ].

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Instagram [ [link removed] ] LinkedIn [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery