Email

July CPI Report: Decoding the Fed's Next Move

| From | Irving Wilkinson <[email protected]> |

| Subject | July CPI Report: Decoding the Fed's Next Move |

| Date | August 14, 2024 4:27 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good afternoon,

I'm writing to provide you with an update on the **latest Consumer Price Index (CPI) report** and its potential implications for our investment strategy.

View image: ([link removed])

Caption:

Key Highlights:

1. July CPI Data:

* Headline inflation: 2.9% year-over-year (down from 3.0% in June)

* Core inflation: 3.2% year-over-year (down from 3.3% in June)

2. Market Reaction:

* Stock futures indicate a mixed but generally positive opening

* Treasury yields initially rose, with the 2-year note yield settling at 3.97%

3. Federal Reserve Expectations:

* 100% probability of a 25 basis points rate cut in September

* Reduced likelihood of a larger 50 basis points cut

----------

## **Advertisement**

----------### The Daily Newsletter for Intellectually Curious Readers

View image: ([link removed])

Follow image link: ([link removed])

Caption:

* We scour 100+ sources daily

* Read by CEOs, scientists, business owners and more

* 3.5 million subscribers

[Sign up today!]([link removed])

----------

## Analysis

----------The July CPI report supports the ongoing trend of disinflation, which aligns with our previous projections. This data strengthens the case for a potential Fed rate cut in September, a scenario we've been positioning for in our portfolios.

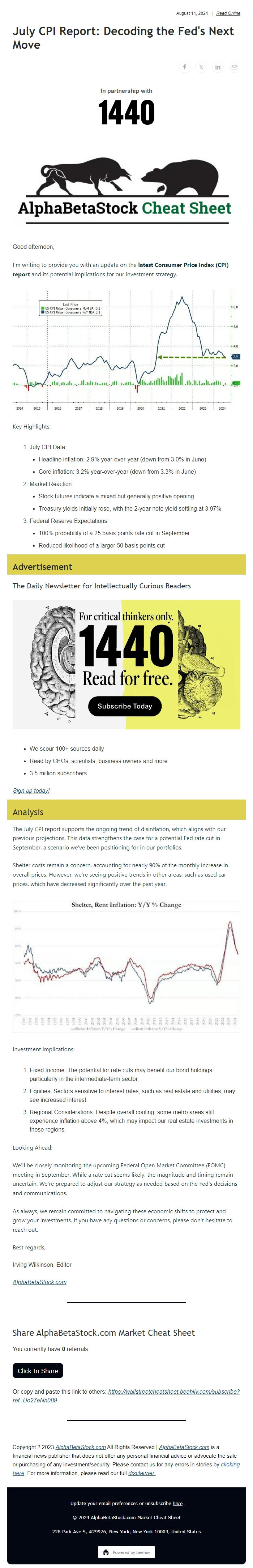

Shelter costs remain a concern, accounting for nearly 90% of the monthly increase in overall prices. However, we're seeing positive trends in other areas, such as used car prices, which have decreased significantly over the past year.

View image: ([link removed])

Caption:

Investment Implications:

1. Fixed Income: The potential for rate cuts may benefit our bond holdings, particularly in the intermediate-term sector.

2. Equities: Sectors sensitive to interest rates, such as real estate and utilities, may see increased interest.

3. Regional Considerations: Despite overall cooling, some metro areas still experience inflation above 4%, which may impact our real estate investments in those regions.

Looking Ahead:

We'll be closely monitoring the upcoming Federal Open Market Committee (FOMC) meeting in September. While a rate cut seems likely, the magnitude and timing remain uncertain. We're prepared to adjust our strategy as needed based on the Fed's decisions and communications.

As always, we remain committed to navigating these economic shifts to protect and grow your investments. If you have any questions or concerns, please don't hesitate to reach out.

Best regards,

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good afternoon,

I'm writing to provide you with an update on the **latest Consumer Price Index (CPI) report** and its potential implications for our investment strategy.

View image: ([link removed])

Caption:

Key Highlights:

1. July CPI Data:

* Headline inflation: 2.9% year-over-year (down from 3.0% in June)

* Core inflation: 3.2% year-over-year (down from 3.3% in June)

2. Market Reaction:

* Stock futures indicate a mixed but generally positive opening

* Treasury yields initially rose, with the 2-year note yield settling at 3.97%

3. Federal Reserve Expectations:

* 100% probability of a 25 basis points rate cut in September

* Reduced likelihood of a larger 50 basis points cut

----------

## **Advertisement**

----------### The Daily Newsletter for Intellectually Curious Readers

View image: ([link removed])

Follow image link: ([link removed])

Caption:

* We scour 100+ sources daily

* Read by CEOs, scientists, business owners and more

* 3.5 million subscribers

[Sign up today!]([link removed])

----------

## Analysis

----------The July CPI report supports the ongoing trend of disinflation, which aligns with our previous projections. This data strengthens the case for a potential Fed rate cut in September, a scenario we've been positioning for in our portfolios.

Shelter costs remain a concern, accounting for nearly 90% of the monthly increase in overall prices. However, we're seeing positive trends in other areas, such as used car prices, which have decreased significantly over the past year.

View image: ([link removed])

Caption:

Investment Implications:

1. Fixed Income: The potential for rate cuts may benefit our bond holdings, particularly in the intermediate-term sector.

2. Equities: Sectors sensitive to interest rates, such as real estate and utilities, may see increased interest.

3. Regional Considerations: Despite overall cooling, some metro areas still experience inflation above 4%, which may impact our real estate investments in those regions.

Looking Ahead:

We'll be closely monitoring the upcoming Federal Open Market Committee (FOMC) meeting in September. While a rate cut seems likely, the magnitude and timing remain uncertain. We're prepared to adjust our strategy as needed based on the Fed's decisions and communications.

As always, we remain committed to navigating these economic shifts to protect and grow your investments. If you have any questions or concerns, please don't hesitate to reach out.

Best regards,

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a