August 13, 2024

Permission to republish original opeds and cartoons granted.

Trump and Musk are both right, not enough energy production and too much spending after Covid contributed to the inflation

|

|

|

Former President Donald Trump made a triumphant return to the X (formerly Twitter) platform on Aug. 12 by joining a two-hour X space with X owner Elon Musk that so far 24 million people all over the world have directly tuned into as of this writing, discussing among other issues, the drivers and potential solutions to the sticky post-Covid inflation being experienced by the U.S. and global economy. On one hand, Trump pointed to a lack of energy production as a major contributing factor to the inflation. In 2019, right before the Covid pandemic, U.S. crude oil production averaged 12.3 million barrels per day and global oil production totaled 100.1 million barrels per day but collapsed in 2020 as the global economy shut down. But in 2021, President Joe Biden and Vice President Kamala Harris did not move to restore oil, energy and other production back to its prior levels with leasing and other incentives, instead, oil production was even less than in 2020, at 11.25 million barrels per day. Global oil production similarly remained below its 2019 levels at only 95.7 million barrels per day. But as Musk noted in the conversation, supply and demand was not the only factor contributing to the inflation. After spending $2.2 trillion during Covid, Congress did another $2.8 trillion afterward in 2021 as the Federal Reserve fired off the printing presses and left interest rates too low, too long at near-zero percent even as inflation was skyrocketing in 2021. They’re both right. It was literally too much money chasing too few goods. |

Trump and Musk are both right, not enough energy production and too much spending after Covid contributed to the inflation

By Robert Romano

Former President Donald Trump made a triumphant return to the X (formerly Twitter) platform on Aug. 12 by joining a two-hour X space with X owner Elon Musk that so far 24 million people all over the world have directly tuned into as of this writing, discussing among other issues, the drivers and potential solutions to the sticky post-Covid inflation being experienced by the U.S. and global economy.

On one hand, Trump pointed to a lack of energy production as a major contributing factor to the inflation, saying, “inflation was caused by oil… we have to bring energy prices down. Energy [inflation] started at the price of gasoline… [and] not only gasoline. It’s the cost of heating your house and cooling your house. That has to come down… And we’re going to drill, baby, drill. You know, they stopped drilling and then they went back to drilling because they went back to the Trump policy.”

Here, Trump is right. During and after Covid, in 2020 and 2021, oil, energy and other production ground to a halt amid the economic lockdowns, and after the economy reopened, took too long to get back up to speed, reducing supplies as prices rose.

For example, in 2019, right before the Covid pandemic, U.S. crude oil production averaged 12.3 million barrels per day and global oil production totaled 100.1 million barrels per day. And in 2020, as people stopped driving and flying in airplanes and prices temporarily collapsed below zero, so too did oil production, dropping to an average 11.32 million barrels per day as global oil production dropped to 93.8 million barrels. That was sufficient for 2020, and when Trump left office, oil prices were about $53 a barrel, and more than 16 million of the 25 million jobs temporarily lost to Covid had already been recovered. The economy was most reopened.

But in 2021, President Joe Biden and Vice President Kamala Harris did not move to restore oil, energy and other production back to its prior levels with leasing and other incentives, instead, oil production was even less than in 2020, at 11.25 million barrels per day. Global oil production similarly remained below its 2019 levels at only 95.7 million barrels per day.

As a result, a year later, right before Russia invaded Ukraine, as demand was increasing rapidly and supplies were not keeping up, oil shot up to $83 per barrel, a 56 percent increase. After Russia’s invasion, global energy markets became even tighter, and oil hit $123 per barrel in March 2022.

And yet, on the other hand, simple supply and demand was not the only factor contributing to the inflation, as Musk noted in his conversation with Trump, stating, “A lot of people just don’t understand where inflation comes from. Inflation comes from government overspending because the checks never bounce when it’s written by the government. So … if the government spends far more than it brings in, that increases the money supply. And if the money supply increases faster than the rate of goods and services, that’s inflation… So really, we need to have we need to reduce our government spending and we need to reexamine [it]… I think we need like a government efficiency commission to say, OK, where are we spending money? That’s sensible. Where is it not sensible? And we need to live within our means.”

Here, Musk is right, too. To deal with the Covid economic lockdowns and the 25 million jobs lost, Congress and the Federal Reserve combined spent, borrowed and printed $3.9 trillion in 2020, including the $2.2 trillion spent on the overwhelmingly bipartisan CARES Act in 2020.

And while what was created in 2020 could almost be viewed as a necessary evil — it was embraced on a bipartisan basis — what came in 2021 and 2022 was gratuitous, which only Democrats and President Biden and Vice President Harris supported.

Biden and Harris wanted an economic stimulus of their own to take “credit” for, and so another $1.9 trillion for the very partisan American Rescue Plan Act of 2021 that only Democrats supported was spent by Congress and signed into law by Biden.

Throwing more fuel onto the fire, Biden then proposed and the Democratic-led Congress passed the so-called Inflation Reduction Act with $891 billion of green energy subsidies and other spending included. Biden signed it and Harris supported it.

As a result, there was another $2.8 trillion in 2021 and 2022 added to the M2 money supply, bringing the total created to $7 trillion all told.

And it shows up in the numbers. When Trump left office in Jan. 2021, consumer inflation was just 1.4 percent. But by Jan. 2022, it was already 7.5 percent. Why?

There was no policy in place to curb the what by then was nearly a 40 percent increase in the money supply as the Federal Reserve waited until consumer inflation was already at 7.5 percent in Jan. 2022 and Russia invaded Ukraine in Feb. 2022 exacerbating the global supply chain crisis before it began hiking interest rates in March 2022 to curtail the consequences, intended and unintended, of all the spending. By June 2022, consumer inflation peaked at 9.1 percent.

Within a month of the Fed beginning the interest rate hike cycle, the M2 money supply peaked. But the Fed could have acted much sooner. By June 2021, consumer inflation had already crossed to 5.4 percent after Congress acted again.

The lesson here is that if Congress had not created the additional stimulus in 2021 and the Fed had just begun raising interest rates in the first half of 2021, plus, if global supply production had increased sooner after Covid, much of the pain could have been avoided. By 2022, we had overshot on stimulus and undershot on reopening — and the American people paid the price. It was a double whammy.

Consumer inflation remains at 3 percent (above the Fed’s 2 percent target rate) and overall consumer prices are up 18.76 percent since Feb. 2021, not counting interest rates which have more than doubled since then and are similarly soaking household budgets. It’s a vicious cycle.

Another lesson is that interest rates would have never been driven so high in the first place without all of the extra stimulus, but given that, what usually happens is the Fed hikes rates as the economy overheats until inflation capitulates, unemployment rises and a recession ensues. In this case, the Fed waited far too long to hike rates, perhaps not wishing to spark another recession that would have hampered the new Biden administration.

Now, with unemployment rising, up 1.47 million since Dec. 2022, and a recession appearing on the horizon, the calculus will shift towards cutting interest rates as the economy slows and labor markets capitulate. A recession may in fact be necessary to soak up the rest of the inflation, and politically, it may indeed by Kamala Harris who pays the price at the polls in November.

So, more than one thing can be true. Production was not ramped up soon enough following Covid, and Congress and the Fed kept the printing presses running for far too long after Biden took office. Both of those problems implicate the Biden-Harris failed economic and fiscal policies. Trump and Musk are both right. It was literally too much money chasing too few goods.

Now, that much explains how we got here, but where to go next? Trump said he wants to double electricity production so that the U.S. will be able to compete with China on artificial intelligence, and also drill for more fossil fuels for what he calls energy dominance.

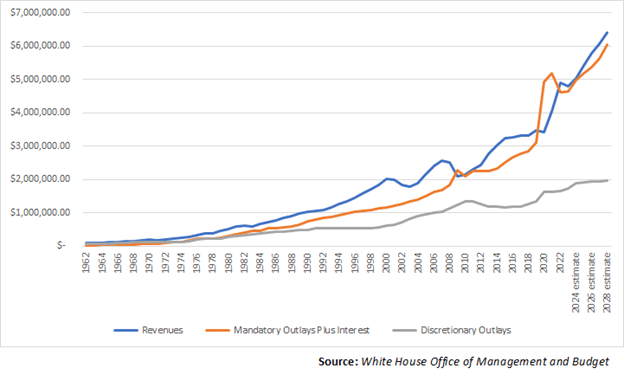

Musk, for his part, believes that government spending needs to be curtailed, although it is worth noting, since 1963 through 2022, the percent growth of revenues has averaged 6.9 percent a year to its present level of $4.65 trillion, according to data compiled by the White House Office of Management and Budget.

In the meantime, mandatory spending including net interest owed on the national debt has grown an average 8.87 percent a year to its current level of $4.64 trillion.

And discretionary spending has grown an average 5.5 percent a year to its current level of $1.735 trillion.

In fact, since 2011, when Republicans took control over the House from Democrats after the financial crisis, and instituted budget sequestration — which will once again go into effect on April 30 after the 2023 debt ceiling deal — discretionary spending has only grown 1.99 percent a year.

Meanwhile, since 2011, mandatory spending grew an average 7.7 percent a year.

And revenues grew an average 7.26 percent.

Therefore, the ballooning budget deficit is not purely a matter of fiscal discipline. When it comes to the spending Congress has control over, the spending it actually votes on, including wars, stimuli and supplementals — so-called discretionary spending — it has grown less on an annual basis than revenues.

The driver of the ballooning deficit — without the Covid and post-Covid helicopter money and without much of a need for a fiscal commission — is Social Security, Medicare and Medicaid spending. Social Security will grow from $1.346 trillion to $2.37 trillion in 2033 amid the Baby Boomer retirement wave, a 76 percent increase. Medicare will grow from $821 billion to $1.84 trillion, a 124 percent increase. Medicaid will grow from $608 billion to $928 billion, a 52 percent increase.

And the budget deficit will grow with it, with OMB projecting it to grow from $1.69 trillion in 2023 to a whopping $2.3 trillion annually by 2033. In fact, you could eliminate every department and agency and fire every federal employee including the military at any point in this decade and you still wouldn’t balance the budget. And slashing Social Security and Medicare, which Trump opposes, particularly would be political suicide. If such a program is not politically sustainable, then it might not be sustainable altogether.

But there is another way. Although it wasn’t discussed in their X conversation, both Trump and Musk know the reason why the debt is exploding so much is because they’ve both spoken about it before: Not enough babies.

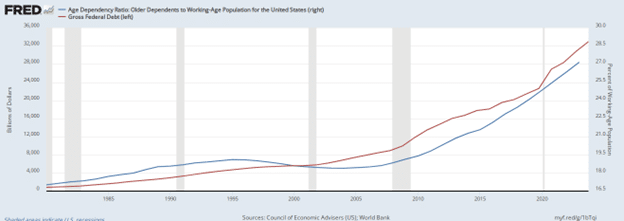

The percentage of the working age population over the age of 65 continues to rapidly increase — since 1960, when the FDA approved birth control, it has gone from 16 percent of the population to 26 percent of the population — and with it the $34.1 trillion (and rising) U.S. national debt, data from the World Bank and the U.S. Treasury shows.

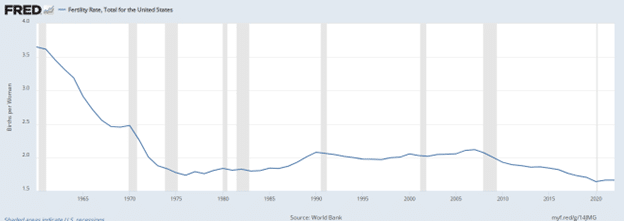

The reason is because there are comparatively fewer taxpayers versus those receiving benefits as the structural deficit widens due to the drop in fertility, from 3.6 babies per woman in 1960 to 1.6 babies per woman in 2023 after birth control was approved by the FDA in 1960.

Fewer babies equals fewer workers who pay taxes. The more people who retire, the more we spend, and the fewer people working per retiree, the more we borrow. It’s that simple.

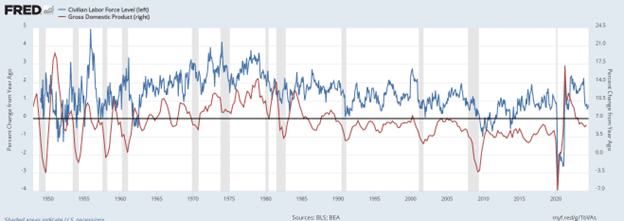

At the same time, as the growth rate of the working age population participating in the civilian labor force has dramatically slowed down thanks to plummeting fertility, so has nominal economic growth, Bureau of Labor Statistics and Bureau of Economic Analysis data shows.

There are two simultaneous outcomes that emerge. First, as the population rapidly ages, so too do Social Security, Medicare and Medicaid expenditures that seniors depend on explode.

In the meantime, thanks to slower growth, revenues will continue not to keep pace with expenditures. Revenues will increase from $4.6 trillion in 2023 to $7.4 trillion, a $2.5 trillion or 51 percent increase over ten years. But expenditures will grow even faster, with outlays growing from $6.37 trillion in 2022 to $9.9 trillion by 2033, a $3.7 trillion or a 55.4 percent increase over the next decade.

The White House Office of Management and Budget projects the national debt to skyrocket to more than $50 trillion by 2033, but that’s low-balling it. The debt has grown by about 8 percent a year since 1980 once recessions and wars are factored. At that rate, it should be about $65 trillion to $70 trillion by 2033 and $100 trillion by 2037 or so, well north of 200 percent debt to GDP.

What does all this mean? If we want to maintain a highly educated workforce and we need a growing population to keep America growing without depending on poorly educated illegal immigrants, we need to boost fertility dramatically. Trump has proposed “baby bucks” in the past. And in 2021 J.D. Vance supported a proposal by Sen. Josh Hawley (R-Mo.) that would dramatically expand the child tax credit to $6,000 per child under the age of 13 for single parents, and $12,000 per child under the age of 13 for married couples. Vance said of Hawley’s proposal at the time, “Lot of ideas out there for how to directly help parents instead of giving them only one option. This is a good one.”

But it could be refined and more targeted to get the baby boom we need, reducing the cost, since doing this could temporarily increase inflation. Instead, the tax credits could be front-loaded into the child’s earlier, pre-school years, for example, $40,000 per baby, with $20,000 upfront and $4,000 a year for each of the following five years. The idea would be to foster a baby boom. Additional consideration could be given to incentivizing marriage, say, an additional $10,000 upfront for married couples having new children. That would be about $450 billion a year for every 10 million new babies, whereas, the Hawley proposal would be $1.17 trillion for every 10 million new babies plus another $450 billion a year for the 50 million children under the age of 13.

As desirable as it might be to reward those who already had children, to keep the costs and inflation down, it might be enough to just focus on incentivizing more children moving forward. Ultimately, those babies will eventually enter the labor force and more than pay for the cost of the program.

So, yes, boost production, curb spending where you can, but realize the structural debt and deficit are directly related to the fertility crisis. To curb future inflation, we need more people now or the production shortages and future deficits will only worsen with haste — and we want them to be highly educated, natural-born citizens. It won’t be cheap, but it must be done.

And then, in the meantime, be ready and willing to wield interest rates to soak up any inflation that pops up moving forward. Ronald Reagan and Paul Volcker took interest rates to the moon after Reagan assumed office in 1981, and a heavy recession ensued in 1981 and 1982, imperiling Reagan’s political future. But he coupled his approach with pro-growth tax relief with the then-largest tax cut in history, Americans kept more of what they earned, the inflation of the 1970s was crushed and by 1984 the economy was booming with millions of jobs being created. Interest rates came down all on their own.

It can be done, but it will take political courage — something we have lacked the past three-and-a-half years. And as Musk noted in his conversation with Trump, bravery and courage is not something Trump is in short supply of.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2024/08/trump-and-musk-are-both-right-not-enough-energy-production-and-too-much-spending-after-covid-contributed-to-the-inflation/