Email

💳 Record-Breaking Debt: Should You Be Worried? (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | 💳 Record-Breaking Debt: Should You Be Worried? (Weekly Cheat Sheet) |

| Date | August 12, 2024 1:13 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good morning,

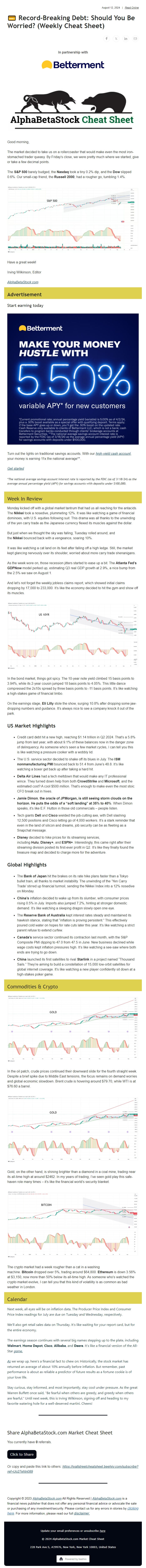

The market decided to take us on a rollercoaster that would make even the most iron-stomached trader queasy. By Friday’s close, we were pretty much where we started, give or take a few decimal points.

The **S&P 500** barely budged, the **Nasdaq** took a tiny 0.2% dip, and the **Dow** slipped 0.6%. Our small-cap friend, the **Russell 2000**, had a rougher go, tumbling 1.4%.

View image: ([link removed])

Caption:

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## **Advertisement**

----------### Start earning today

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Turn out the lights on traditional savings accounts. With our [high-yield cash account]([link removed]), your money is earning 11x the national average**.

[Get started]([link removed])

###### _*The national average savings account interest rate is reported by the FDIC (as of 3/18/24) as the average annual percentage yield (APY) for savings accounts with deposits under $100,000._

----------

## Week In Review

----------Monday kicked off with a global market tantrum that had us all reaching for the antacids. The **Nikkei** took a nosedive, plummeting 12%. It was like watching a game of financial dominoes, with U.S. equities following suit. This drama was all thanks to the unwinding of the yen carry trade as the Japanese currency flexed its muscles against the dollar.

But just when we thought the sky was falling, Tuesday rolled around, and the **Nikkei** bounced back with a vengeance, soaring 10%.

It was like watching a cat land on its feet after falling off a high ledge. Still, the market kept glancing nervously over its shoulder, worried about more carry trade shenanigans.

As the week wore on, those recession jitters started to ease up a bit. The **Atlanta Fed’s GDPNow** model perked up, estimating Q3 real GDP growth at 2.9%, a nice bump from the 2.5% we saw on August 1.

And let’s not forget the weekly jobless claims report, which showed initial claims dropping by 17,000 to 233,000. It’s like the economy decided to hit the gym and show off its muscles.

View image: ([link removed])

Caption:

In the bond market, things got spicy. The 10-year note yield climbed 15 basis points to 3.94%, while its 2-year cousin jumped 18 basis points to 4.05%. This little dance compressed the 2s10s spread by three basis points to -11 basis points. It’s like watching a high-stakes game of financial limbo.

On the earnings stage, **Eli Lilly** stole the show, surging 10.8% after dropping some jaw-dropping numbers and guidance. It’s always nice to see a company knock it out of the park.

## **US Market Highlights**

* Credit card debt hit a new high, reaching $1.14 trillion in Q2 2024. That’s a 5.8% jump from last year, with about 9.1% of these balances now in the danger zone of delinquency. As someone who’s seen a few market cycles, I can tell you this is like watching a pressure cooker with a wobbly lid.

* The U.S. service sector decided to shake off its blues in July. The **ISM nonmanufacturing PMI** bounced back to 51.4 from June’s 48.8. It’s like watching a boxer get back up after taking a hard hit.

* **Delta Air Lines** had a tech meltdown that would make any IT professional wince. They turned down help from both **CrowdStrike** and **Microsoft**, and the estimated cost? A cool $500 million. That’s enough to make even the most stoic CFO break out in hives.

* **Jamie Dimon**, **the oracle of JPMorgan, is still seeing storm clouds on the horizon. He puts the odds of a “soft landing” at 35% to 40%**. When Dimon speaks, it’s like E.F. Hutton in those old commercials – people listen.

* Tech giants **Dell** and **Cisco** wielded the job-cutting axe, with Dell slashing 12,500 positions and Cisco letting go of 4,000 workers. It’s a stark reminder that even in the land of silicon and dreams, job security can be as fleeting as a Snapchat message.

* **Disney** decided to hike prices for its streaming services, including **Hulu**, **Disney+**, and **ESPN+**. Interestingly, this came right after their streaming division posted its first-ever profit in Q2. It’s like they finally found the treasure map and decided to charge more for the adventure.

## **Global Highlights**

* The **Bank of Japan** hit the brakes on its rate hike plans faster than a Tokyo bullet train, all thanks to market instability. The unwinding of the ‘Yen Carry Trade’ stirred up financial turmoil, sending the Nikkei Index into a 12% nosedive on Monday.

* **China’s** inflation decided to wake up from its slumber, with consumer prices rising 0.5% in July. Imports also jumped 7.2%, hinting at stronger domestic demand. It’s like watching a sleeping dragon slowly open one eye.

* The **Reserve Bank of Australia** kept interest rates steady and maintained its hawkish stance, stating that “inflation is proving persistent.” This effectively poured cold water on hopes for rate cuts later this year. It’s like watching a strict parent refuse to extend curfew.

* **Canada’s** service sector continued its contraction last month, with the S&P Composite PMI dipping to 47.0 from 47.5 in June. New business declined while wage costs kept inflation pressures high. It’s like watching a see-saw where both ends are trying to go down.

* **China** launched its first satellites to rival **Starlink** in a project named “Thousand Sails.” They’re aiming to build a constellation of 15,000 low-orbit satellites for global internet coverage. It’s like watching a new player confidently sit down at a high-stakes poker game.

----------

## Commodities & Crypto

----------View image: ([link removed])

Caption:

In the oil patch, crude prices continued their downward slide for the fourth straight week. Despite a brief spike due to Middle East tensions, the focus remains on demand worries and global economic slowdown. Brent crude is hovering around $79.70, while WTI is at $76.60 a barrel.

View image: ([link removed])

Caption:

Gold, on the other hand, is shining brighter than a diamond in a coal mine, trading near its all-time high at around $2462. In my years of trading, I’ve seen gold play this safe-haven role many times – it’s like the financial world’s security blanket.

View image: ([link removed])

Caption:

The crypto market had a week rougher than a cat in a washing machine. **Bitcoin** dropped over 5%, trading around $64,800. **Ethereum** is down 3.56% at $3,150, now more than 50% below its all-time high. As someone who’s watched the crypto market evolve, I can tell you that this kind of volatility is as common as bad weather in London.

----------

## Calendar

----------Next week, all eyes will be on inflation data. The Producer Price Index and Consumer Price Index readings for July are due on Tuesday and Wednesday, respectively.

We'll also get retail sales data on Thursday. It's like waiting for your report card, but for the entire economy.

The earnings season continues with several big names stepping up to the plate, including **Walmart**, **Home Depot**, **Cisco**, **Alibaba**, and **Deere**. It's like a financial version of the All-Star [game.]([link removed])

[As]([link removed]) we wrap up, here's a financial fact to chew on: Historically, the stock market has returned an average of about 10% annually before inflation. But remember, past performance is about as reliable a predictor of future results as a fortune cookie is of your love life.

Stay curious, stay informed, and most importantly, stay cool under pressure. As the great Warren Buffett once said, "Be fearful when others are greedy, and greedy when others are fearful." Until next week, this is Irving Wilkinson, signing off and heading to my favorite watering hole for a well-deserved martini. Cheers!

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

The market decided to take us on a rollercoaster that would make even the most iron-stomached trader queasy. By Friday’s close, we were pretty much where we started, give or take a few decimal points.

The **S&P 500** barely budged, the **Nasdaq** took a tiny 0.2% dip, and the **Dow** slipped 0.6%. Our small-cap friend, the **Russell 2000**, had a rougher go, tumbling 1.4%.

View image: ([link removed])

Caption:

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

## **Advertisement**

----------### Start earning today

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Turn out the lights on traditional savings accounts. With our [high-yield cash account]([link removed]), your money is earning 11x the national average**.

[Get started]([link removed])

###### _*The national average savings account interest rate is reported by the FDIC (as of 3/18/24) as the average annual percentage yield (APY) for savings accounts with deposits under $100,000._

----------

## Week In Review

----------Monday kicked off with a global market tantrum that had us all reaching for the antacids. The **Nikkei** took a nosedive, plummeting 12%. It was like watching a game of financial dominoes, with U.S. equities following suit. This drama was all thanks to the unwinding of the yen carry trade as the Japanese currency flexed its muscles against the dollar.

But just when we thought the sky was falling, Tuesday rolled around, and the **Nikkei** bounced back with a vengeance, soaring 10%.

It was like watching a cat land on its feet after falling off a high ledge. Still, the market kept glancing nervously over its shoulder, worried about more carry trade shenanigans.

As the week wore on, those recession jitters started to ease up a bit. The **Atlanta Fed’s GDPNow** model perked up, estimating Q3 real GDP growth at 2.9%, a nice bump from the 2.5% we saw on August 1.

And let’s not forget the weekly jobless claims report, which showed initial claims dropping by 17,000 to 233,000. It’s like the economy decided to hit the gym and show off its muscles.

View image: ([link removed])

Caption:

In the bond market, things got spicy. The 10-year note yield climbed 15 basis points to 3.94%, while its 2-year cousin jumped 18 basis points to 4.05%. This little dance compressed the 2s10s spread by three basis points to -11 basis points. It’s like watching a high-stakes game of financial limbo.

On the earnings stage, **Eli Lilly** stole the show, surging 10.8% after dropping some jaw-dropping numbers and guidance. It’s always nice to see a company knock it out of the park.

## **US Market Highlights**

* Credit card debt hit a new high, reaching $1.14 trillion in Q2 2024. That’s a 5.8% jump from last year, with about 9.1% of these balances now in the danger zone of delinquency. As someone who’s seen a few market cycles, I can tell you this is like watching a pressure cooker with a wobbly lid.

* The U.S. service sector decided to shake off its blues in July. The **ISM nonmanufacturing PMI** bounced back to 51.4 from June’s 48.8. It’s like watching a boxer get back up after taking a hard hit.

* **Delta Air Lines** had a tech meltdown that would make any IT professional wince. They turned down help from both **CrowdStrike** and **Microsoft**, and the estimated cost? A cool $500 million. That’s enough to make even the most stoic CFO break out in hives.

* **Jamie Dimon**, **the oracle of JPMorgan, is still seeing storm clouds on the horizon. He puts the odds of a “soft landing” at 35% to 40%**. When Dimon speaks, it’s like E.F. Hutton in those old commercials – people listen.

* Tech giants **Dell** and **Cisco** wielded the job-cutting axe, with Dell slashing 12,500 positions and Cisco letting go of 4,000 workers. It’s a stark reminder that even in the land of silicon and dreams, job security can be as fleeting as a Snapchat message.

* **Disney** decided to hike prices for its streaming services, including **Hulu**, **Disney+**, and **ESPN+**. Interestingly, this came right after their streaming division posted its first-ever profit in Q2. It’s like they finally found the treasure map and decided to charge more for the adventure.

## **Global Highlights**

* The **Bank of Japan** hit the brakes on its rate hike plans faster than a Tokyo bullet train, all thanks to market instability. The unwinding of the ‘Yen Carry Trade’ stirred up financial turmoil, sending the Nikkei Index into a 12% nosedive on Monday.

* **China’s** inflation decided to wake up from its slumber, with consumer prices rising 0.5% in July. Imports also jumped 7.2%, hinting at stronger domestic demand. It’s like watching a sleeping dragon slowly open one eye.

* The **Reserve Bank of Australia** kept interest rates steady and maintained its hawkish stance, stating that “inflation is proving persistent.” This effectively poured cold water on hopes for rate cuts later this year. It’s like watching a strict parent refuse to extend curfew.

* **Canada’s** service sector continued its contraction last month, with the S&P Composite PMI dipping to 47.0 from 47.5 in June. New business declined while wage costs kept inflation pressures high. It’s like watching a see-saw where both ends are trying to go down.

* **China** launched its first satellites to rival **Starlink** in a project named “Thousand Sails.” They’re aiming to build a constellation of 15,000 low-orbit satellites for global internet coverage. It’s like watching a new player confidently sit down at a high-stakes poker game.

----------

## Commodities & Crypto

----------View image: ([link removed])

Caption:

In the oil patch, crude prices continued their downward slide for the fourth straight week. Despite a brief spike due to Middle East tensions, the focus remains on demand worries and global economic slowdown. Brent crude is hovering around $79.70, while WTI is at $76.60 a barrel.

View image: ([link removed])

Caption:

Gold, on the other hand, is shining brighter than a diamond in a coal mine, trading near its all-time high at around $2462. In my years of trading, I’ve seen gold play this safe-haven role many times – it’s like the financial world’s security blanket.

View image: ([link removed])

Caption:

The crypto market had a week rougher than a cat in a washing machine. **Bitcoin** dropped over 5%, trading around $64,800. **Ethereum** is down 3.56% at $3,150, now more than 50% below its all-time high. As someone who’s watched the crypto market evolve, I can tell you that this kind of volatility is as common as bad weather in London.

----------

## Calendar

----------Next week, all eyes will be on inflation data. The Producer Price Index and Consumer Price Index readings for July are due on Tuesday and Wednesday, respectively.

We'll also get retail sales data on Thursday. It's like waiting for your report card, but for the entire economy.

The earnings season continues with several big names stepping up to the plate, including **Walmart**, **Home Depot**, **Cisco**, **Alibaba**, and **Deere**. It's like a financial version of the All-Star [game.]([link removed])

[As]([link removed]) we wrap up, here's a financial fact to chew on: Historically, the stock market has returned an average of about 10% annually before inflation. But remember, past performance is about as reliable a predictor of future results as a fortune cookie is of your love life.

Stay curious, stay informed, and most importantly, stay cool under pressure. As the great Warren Buffett once said, "Be fearful when others are greedy, and greedy when others are fearful." Until next week, this is Irving Wilkinson, signing off and heading to my favorite watering hole for a well-deserved martini. Cheers!

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a