|

John,

Is this just ancient history?

“There is no office in government touching on more people than the IRS,” said Nixon adviser Pat Buchanan in a memo to Nixon’s chief of staff in 1970. “I have been told that to take effective control of it we need probably 10 men of competence and loyalty to the President.”1

In fact, FBI director James Comey and his deputy, Andrew McCabe were both audited in 2017.2 Now, Project 2025, an independent right-wing project with extensive ties to right-wing politicians, seeks to make weaponizing the IRS for political purposes even easier next time:

Howard Gleckman of the Urban-Brookings Tax Policy Center told Politico:

“Placing politicals in key positions at the IRS while firing career staffers would be highly consequential.”

We’re fighting back against the right-wing Project 2025 and its attempts to weaponize the IRS for political retribution.

Rush a donation today to fight back against Project 2025 and its attacks on the IRS.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for all that you do to defend democracy and our democratic institutions.

Dominique Espinoza

Outreach and Engagement Specialist, CHN Action

1 Tax Notes: Tax History: Nixon Aide Tried to Weaponize the IRS by Pressuring the Commissioner

2 New York Times: Comey and McCabe, Who Infuriated Trump, Both Faced Intensive I.R.S. Audits

-- DEBORAH'S EMAIL --

John,

Thanks to the historic investments in the IRS that we helped make possible through the Inflation Reduction Act, the agency has been able to crack down on ultra-wealthy tax cheats with resounding success.

The IRS reported in July that it has collected $1 billion in back taxes from wealthy tax cheats, early successes in targeting high income people with known tax debt.1 The IRS has also been able to crack down on multi-billion dollar corporations and make them pay what they owe. The agency notified Microsoft that it owes an additional $29 billion in back taxes, and that it is now auditing 60 giant corporations that together make more than $500 billion in profits each year.2,3

When the IRS has the resources to go after wealthy tax cheats, there’s an average $22 return on every $1 spent.4

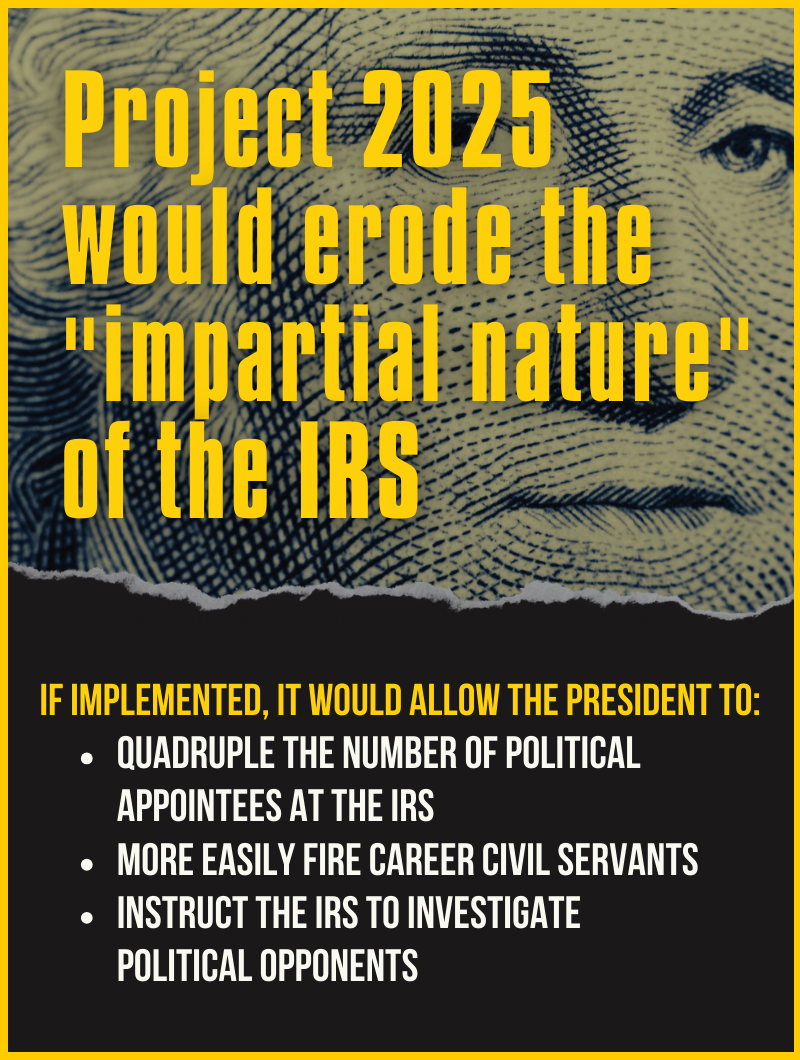

All of these achievements are at risk if the far-right Project 2025 is implemented in a second Trump administration. Project 2025 calls for completely politicizing the IRS, including quadrupling the number of political appointees at the agency.5 Here’s a look at what this right-wing plan would do:

But, if we protect the IRS and its legally required impartiality, we’ll continue to hold wealthy and corporate tax cheats accountable, collecting billions of dollars that can be invested in infrastructure projects in our communities, help pay for childcare subsidies, expand nutrition programs, and more.

We’re fighting back against right-wing attacks on the IRS, but we need your help. Chip in $5 today so we can advocate against Project 2025 on behalf of vulnerable communities.

DONATE TODAY

You know that these proposals are not just talk. Past presidents have tried to politicize the IRS. In fact, both former IRS director James Comey and his deputy Andrew McCabe were subjected to audits of their 2017 and 2019 tax returns, respectively.

This is a gross abuse of power and something we cannot let happen again.

Project 2025 is an authoritarian agenda that is dangerous to the American people and our institutions. The IRS is just one example. Donate $5 today to help us expose Project 2025 and its attacks on important agencies like the IRS.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for all you do,

Deborah Weinstein

Executive Director, CHN Action

1 IRS collects milestone $1 billion in back taxes from high-wealth taxpayers

2 IRS says Microsoft owes an additional $29 billion in back taxes

3 IRS Investment Update: Business Account Launches, Noncompliant US Subsidiaries Targeted

4 CONSERVATIVE EFFORTS TO PAD WEALTHY TAX CHEATS’ POCKETS

5 A Project 2025 target: The IRS

|