August 8, 2024

Permission to republish original opeds and cartoons granted.

Non-seasonal unemployment continued claims increased 116,000 in July as markets struggle to regain prior highs. The worst remains ahead.

|

|

|

Non-seasonally adjusted unemployment continued claims increased almost 116,000 in July to 1.91 million according to the latest data compiled by the Department of Labor. That’s up 711,000 from its Oct. 2022 low. But overall unemployment has increased by 1.47 million from its Dec. 2022 low of 5.69 million to July’s level of 7.16 million, according to Bureau of Labor Statistics data. As the numbers came in, markets initiated a selloff in July and August that has taken major market indices significantly off of their recent highs, for which they are struggling to regain. Now, market sentiment has shifted with increased expectations that the Federal Reserve will begin cutting interest rates in September to deal with the generally rising unemployment level, but investors might be more careful of what they wish for. When the Fed cuts rates, in every single recorded instance in the postwar era, usually the worst of the unemployment remained on the horizon. Meaning, sadly, the worst may yet be ahead. That’s likely bad news for Vice President Kamala Harris’ election bid in November against former President Donald Trump, but maybe if the Fed had hiked interest rates in 2021 when inflation was rising, instead of waiting until 2022 when it was already 7.5 percent before Russia invaded Ukraine, the worst would already be behind us. |

Non-seasonal unemployment continued claims increased 116,000 in July as markets struggle to regain prior highs. The worst remains ahead.

By Robert Romano

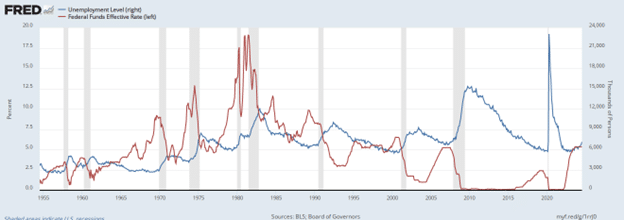

Non-seasonally adjusted unemployment continued claims increased almost 116,000 in July to 1.91 million according to the latest data compiled by the Department of Labor.

That’s up 711,000 from its Oct. 2022 low. But overall unemployment has increased by 1.47 million from its Dec. 2022 low of 5.69 million to July’s level of 7.16 million, according to Bureau of Labor Statistics data, indicating about half of those who found themselves unemployed since that time have had their benefits already run out.

Additionally, the overall increase in unemployment in July was 352,000 on a seasonally adjusted basis. As the numbers came in, markets initiated a selloff in July and August that has taken major market indices significantly off of their recent highs, for which they are struggling to regain.

On an unadjusted basis, it was 452,000. Either way, this indicates far more Americans are becoming unemployed than show up in the unemployment claims filed at state and local offices.

The reason is that generally, during recessions, both the measured unemployment level and continued unemployment claims can slightly understate the amount of jobs that are lost in the overall economy. For example, during the Covid recession 25.5 million fewer Americans reported having jobs at the peak of the lockdowns in April 2020. But the number of those unemployed in the Bureau of Labor Statistics household survey increased 17 million from 5.7 million to 23 million, while unemployment continued claims increased 21 million from 2 million to 23 million. Those dropped rapidly as the economy reopened, with more than 16 million jobs recovered by the time President Joe Biden took office.

Part of the reason is 8.4 million Americans left the labor force altogether during Covid by May 2020, from 95.2 million to 103.6 million. But in July 2024, those not in the labor force decreased by 214,000, whereas the civilian labor force level increased by 420,000. This indicated Americans seeking to enter the labor force but not finding work, and so were booked as unemployed that month (those not in labor force are not counted as unemployed if they give up looking for work or retire).

This is unsurprising. Since March 2022, job openings have dropped significantly 3.99 million from their 12.18 million peak to their current June level of 8.18 million. And the pain might not be over yet. In the 2001 recession, job openings decreased 43 percent from their measured Jan. 2021 peak of 5.2 million. In the 2007-2009 recession, job openings fell 55 percent from their March 2007 peak of 4.9 million. And during the Covid recession, they fell 38 percent from their Nov. 2018 peak of 7.6 million.

So far, job openings are down 32.8 percent from their March 2022 peak. They might be down even more, and unemployment even greater, but the number of Americans not in the labor force 65 years old and older has increased dramatically since the last two recessions, from 19 million in Aug. 2008 to 32.6 million in July 2024 as Baby Boomers continue retiring en masse.

As people retire, this increases the amount of job openings generally, and as firms consider layoffs, those are also mitigated when voluntary retirements are occurring. As it is, the current generation of workers has not filled in the gap left by Baby Boomers leaving the labor force, even as the amount of job openings is still generally trending downward.

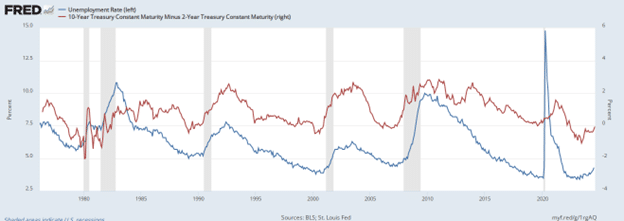

To see ahead, an excellent indicator appears to be the 10-year, 2-year treasuries spread. When it inverts, as investors opt for longer term bonds, short term rates are higher than long term rates and it signals trouble ahead. And when it uninverts, as investors move back into short term paper, it signals trouble is at hand. Well, with yield curves beginning to normalize itself, that usually predicts more unemployment on the horizon as the correction ensues.

Now, market sentiment has shifted with increased expectations that the Federal Reserve will begin cutting interest rates in September to deal with the generally rising unemployment level, but investors might be more careful of what they wish for. When the Fed cuts rates, in every single recorded instance in the postwar era, usually the worst of the unemployment remained on the horizon.

Usually, the Fed will keep rates high for as long as possible towards the end of the economic cycle in order to temper whatever inflation there is overheating the economy, just as it has this cycle. And then when it begins cutting, usually because employment has peaked and has begun falling, labor markets tend to capitulate. Then, the Fed keeps cutting rates until labor markets bottom out, however long that takes. Additional measures could include quantitative easing in the zero-bound environment seen the 2007-2009 and 2020 recessions.

Meaning, sadly, the worst may yet be ahead. That’s likely bad news for Vice President Kamala Harris’ election bid in November against former President Donald Trump, but maybe if the Fed had hiked interest rates in 2021 when inflation was rising, instead of waiting until 2022 when it was already 7.5 percent before Russia invaded Ukraine, the worst would already be behind us. Or maybe we’d be in the thick of the labor markets bottoming and it really wouldn’t make a difference politically. Who knows? Either way, the other shoe may be about to drop. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2024/08/non-seasonal-unemployment-continued-claims-increased-116000-in-july-as-markets-struggle-to-regain-prior-highs-the-worst-remains-ahead/

Video: Kamala Harris: BE MORE WOKE

To view online: https://www.youtube.com/watch?v=yMoBlxLjKR8