| From | Stephen Moore <[email protected]> |

| Subject | Unleash Prosperity Hotline #1074 – Weekend Edition |

| Date | August 2, 2024 3:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Fed Rate Cuts May Not Be the Cure-All Wall Street Is Hoping For

In Order To Ensure You Can View All The Graphics, Click Here To View The Hotline In Your Browser ([link removed])

[link removed]

Unleash Prosperity Hotline – Weekend Edition

Issue #1074

08/02/2024 – 08/04/2024

New to the Hotline? Click ([link removed]) here ([link removed]) to subscribe–it's free. ([link removed])

1) Fed Rate Cuts May Not Be the Cure-All Wall Street Is Hoping For

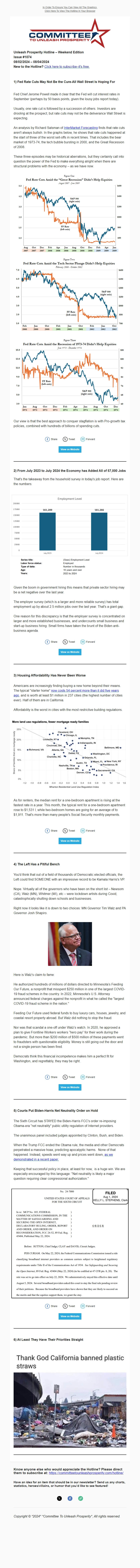

Fed Chief Jerome Powell made it clear that the Fed will cut interest rates in September (perhaps by 50 basis points, given the lousy jobs report today).

Usually, one rate cut is followed by a succession of others. Investors are drooling at the prospect, but rate cuts may not be the deliverance Wall Street is expecting.

An analysis by Richard Salsman of InterMarket Forecasting ([link removed]) finds that rate cuts aren't always bullish. In the graphs below, he shows that rate cuts happened at the start of three of the worst sell-offs in recent times. That includes the bear market of 1973-74, the tech bubble bursting in 2000, and the Great Recession of 2008.

These three episodes may be historical aberrations, but they certainly call into question the power of the Fed to make everything alright when there are structural problems with the economy – as we have now.

[link removed]

[link removed]

[link removed]

Our view is that the best approach to conquer stagflation is with Pro-growth tax policies, combined with hundreds of billions of spending cuts.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ffed-rate-cuts-may-not-be-the-cure-all-wall-street-is-hoping-for%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ffed-rate-cuts-may-not-be-the-cure-all-wall-street-is-hoping-for%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

2) From July 2023 to July 2024 the Economy has Added All of 57,000 Jobs

That's the takeaway from the household survey in today's job report. Here are the numbers:

Given the boom in government hiring this means that private sector hiring may be a net negative over the last year.

The employer survey (which is a larger and more reliable survey) has total employment up by about 2.5 million jobs over the last year. That's a giant gap.

One reason for this discrepancy is that the employer survey is concentrated on larger and more established businesses, and undercounts small business and start-up business hiring. Small firms have taken the brunt of the Biden anti-business agenda.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ffrom-july-2023-to-july-2024-the-economy-has-added-all-of-57000-jobs%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ffrom-july-2023-to-july-2024-the-economy-has-added-all-of-57000-jobs%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

3) Housing Affordability Has Never Been Worse

Americans are increasingly finding buying a new home beyond their means. The typical "starter home" now costs 54 percent more than it did five years ago ([link removed]) , and is worth at least $1 million in 237 cities (the highest number of cities ever). Half of them are in California.

Affordability is the worst in cities with the most restrictive building regulations.

[link removed]

As for renters, the median rent for a one-bedroom apartment is rising at the fastest rate in a year. This month, the typical rent for a one-bedroom apartment rose to $1,531 l, while two-bedroom homes are going for an average of to $1,911. That's more than many people's Social Security monthly payments.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fhousing-affordability-has-never-been-worse%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fhousing-affordability-has-never-been-worse%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

4) The Left Has a Pitiful Bench

You'd think that out of a field of thousands of Democratic elected officials, the Left could find SOMEONE with an impressive record to be Kamala Harris's VP.

Nope. Virtually all of the governors who have been on the short list – Newsom (CA), Walz (MN), Whitmer (MI), etc – were lockdown artists during Covid, catastrophically shutting down schools and businesses.

Right now it looks like it is down to two choices: MN Governor Tim Walz and PA Governor Josh Shapiro.

[link removed]

Here is Walz’s claim to fame:

He authorized hundreds of millions of dollars directed to Minnesota’s Feeding Our Future, a nonprofit that misspent $250 million in one of the largest COVID-19 fraud schemes in the country. In 2022, Minnesota's U.S. Attorney announced federal charges against the nonprofit in what he called the "largest COVID-19 fraud scheme in the nation."

Feeding Our Future used federal funds to buy luxury cars, houses, jewelry, and coastal resort property abroad. But Walz did nothing to stop the fraud.

Nor was that scandal a one-off under Walz’s watch. In 2020, he approved a plan to give Frontline Workers workers “hero pay” for their work during the pandemic. But more than $200 million of $500 million of these payments went to fraudsters with questionable eligibility. Money is still going out the door and not a single person has been fired.

Democrats think this financial incompetence makes him a perfect fit for Washington, and regrettably, they may be right.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fdemocrats-have-a-pitiful-bench%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fdemocrats-have-a-pitiful-bench%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

5) Courts Put Biden-Harris Net Neutrality Order on Hold

The Sixth Circuit has STAYED the Biden-Harris FCC's order re-imposing Obama-era "net neutrality" public utility regulation of Internet providers.

The unanimous panel included judges appointed by Clinton, Bush, and Biden.

When the Trump FCC ended the Obama rule, the media and other Democrats perpetrated a massive hoax, predicting apocalyptic harms. None of that happened. Instead, speeds went way up and prices went down, as we demonstrated in a recent paper. ([link removed])

Keeping that successful policy in place, at least for now, is a huge win. We are especially encouraged by this language: "Net neutrality is likely a major question requiring clear congressional authorization."

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fcourts-put-biden-harris-net-neutrality-order-on-hold%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fcourts-put-biden-harris-net-neutrality-order-on-hold%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

6) At Least They Have Their Priorities Straight

============================================================

Know anyone else who would appreciate the Hotline? Please direct them to subscribe at: ** [link removed] ([link removed])

Have an idea for an item that should be in our newsletter? Send us any charts, statistics, heroes/villains, or humor that you’d like to see featured!

** Twitter ([link removed])

** Facebook ([link removed])

** [link removed] ([link removed])

Copyright © *2024* *Committee To Unleash Prosperity*, All rights reserved.

This email was sent to [email protected] (mailto:[email protected])

why did I get this? ([link removed]) unsubscribe from this list ([link removed]) update subscription preferences ([link removed])

Committee to Unleash Prosperity . 1155 15th St NW Ste 525 . Washington, DC xxxxxx-2706 . USA

In Order To Ensure You Can View All The Graphics, Click Here To View The Hotline In Your Browser ([link removed])

[link removed]

Unleash Prosperity Hotline – Weekend Edition

Issue #1074

08/02/2024 – 08/04/2024

New to the Hotline? Click ([link removed]) here ([link removed]) to subscribe–it's free. ([link removed])

1) Fed Rate Cuts May Not Be the Cure-All Wall Street Is Hoping For

Fed Chief Jerome Powell made it clear that the Fed will cut interest rates in September (perhaps by 50 basis points, given the lousy jobs report today).

Usually, one rate cut is followed by a succession of others. Investors are drooling at the prospect, but rate cuts may not be the deliverance Wall Street is expecting.

An analysis by Richard Salsman of InterMarket Forecasting ([link removed]) finds that rate cuts aren't always bullish. In the graphs below, he shows that rate cuts happened at the start of three of the worst sell-offs in recent times. That includes the bear market of 1973-74, the tech bubble bursting in 2000, and the Great Recession of 2008.

These three episodes may be historical aberrations, but they certainly call into question the power of the Fed to make everything alright when there are structural problems with the economy – as we have now.

[link removed]

[link removed]

[link removed]

Our view is that the best approach to conquer stagflation is with Pro-growth tax policies, combined with hundreds of billions of spending cuts.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ffed-rate-cuts-may-not-be-the-cure-all-wall-street-is-hoping-for%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ffed-rate-cuts-may-not-be-the-cure-all-wall-street-is-hoping-for%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

2) From July 2023 to July 2024 the Economy has Added All of 57,000 Jobs

That's the takeaway from the household survey in today's job report. Here are the numbers:

Given the boom in government hiring this means that private sector hiring may be a net negative over the last year.

The employer survey (which is a larger and more reliable survey) has total employment up by about 2.5 million jobs over the last year. That's a giant gap.

One reason for this discrepancy is that the employer survey is concentrated on larger and more established businesses, and undercounts small business and start-up business hiring. Small firms have taken the brunt of the Biden anti-business agenda.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ffrom-july-2023-to-july-2024-the-economy-has-added-all-of-57000-jobs%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ffrom-july-2023-to-july-2024-the-economy-has-added-all-of-57000-jobs%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

3) Housing Affordability Has Never Been Worse

Americans are increasingly finding buying a new home beyond their means. The typical "starter home" now costs 54 percent more than it did five years ago ([link removed]) , and is worth at least $1 million in 237 cities (the highest number of cities ever). Half of them are in California.

Affordability is the worst in cities with the most restrictive building regulations.

[link removed]

As for renters, the median rent for a one-bedroom apartment is rising at the fastest rate in a year. This month, the typical rent for a one-bedroom apartment rose to $1,531 l, while two-bedroom homes are going for an average of to $1,911. That's more than many people's Social Security monthly payments.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fhousing-affordability-has-never-been-worse%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fhousing-affordability-has-never-been-worse%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

4) The Left Has a Pitiful Bench

You'd think that out of a field of thousands of Democratic elected officials, the Left could find SOMEONE with an impressive record to be Kamala Harris's VP.

Nope. Virtually all of the governors who have been on the short list – Newsom (CA), Walz (MN), Whitmer (MI), etc – were lockdown artists during Covid, catastrophically shutting down schools and businesses.

Right now it looks like it is down to two choices: MN Governor Tim Walz and PA Governor Josh Shapiro.

[link removed]

Here is Walz’s claim to fame:

He authorized hundreds of millions of dollars directed to Minnesota’s Feeding Our Future, a nonprofit that misspent $250 million in one of the largest COVID-19 fraud schemes in the country. In 2022, Minnesota's U.S. Attorney announced federal charges against the nonprofit in what he called the "largest COVID-19 fraud scheme in the nation."

Feeding Our Future used federal funds to buy luxury cars, houses, jewelry, and coastal resort property abroad. But Walz did nothing to stop the fraud.

Nor was that scandal a one-off under Walz’s watch. In 2020, he approved a plan to give Frontline Workers workers “hero pay” for their work during the pandemic. But more than $200 million of $500 million of these payments went to fraudsters with questionable eligibility. Money is still going out the door and not a single person has been fired.

Democrats think this financial incompetence makes him a perfect fit for Washington, and regrettably, they may be right.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fdemocrats-have-a-pitiful-bench%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fdemocrats-have-a-pitiful-bench%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

5) Courts Put Biden-Harris Net Neutrality Order on Hold

The Sixth Circuit has STAYED the Biden-Harris FCC's order re-imposing Obama-era "net neutrality" public utility regulation of Internet providers.

The unanimous panel included judges appointed by Clinton, Bush, and Biden.

When the Trump FCC ended the Obama rule, the media and other Democrats perpetrated a massive hoax, predicting apocalyptic harms. None of that happened. Instead, speeds went way up and prices went down, as we demonstrated in a recent paper. ([link removed])

Keeping that successful policy in place, at least for now, is a huge win. We are especially encouraged by this language: "Net neutrality is likely a major question requiring clear congressional authorization."

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fcourts-put-biden-harris-net-neutrality-order-on-hold%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fcourts-put-biden-harris-net-neutrality-order-on-hold%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

6) At Least They Have Their Priorities Straight

============================================================

Know anyone else who would appreciate the Hotline? Please direct them to subscribe at: ** [link removed] ([link removed])

Have an idea for an item that should be in our newsletter? Send us any charts, statistics, heroes/villains, or humor that you’d like to see featured!

** Twitter ([link removed])

** Facebook ([link removed])

** [link removed] ([link removed])

Copyright © *2024* *Committee To Unleash Prosperity*, All rights reserved.

This email was sent to [email protected] (mailto:[email protected])

why did I get this? ([link removed]) unsubscribe from this list ([link removed]) update subscription preferences ([link removed])

Committee to Unleash Prosperity . 1155 15th St NW Ste 525 . Washington, DC xxxxxx-2706 . USA

Message Analysis

- Sender: Committee to Unleash Prosperity

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp