| From | Stephen Moore <[email protected]> |

| Subject | Unleash Prosperity Hotline #1073 |

| Date | August 1, 2024 2:34 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

More Evidence that Making the Trump Tax Cuts Permanent is PRO-GROWTH

In Order To Ensure You Can View All The Graphics, Click Here To View The Hotline In Your Browser ([link removed])

[link removed]

Unleash Prosperity Hotline

Issue #1073

08/01/2024

New to the Hotline? Click ([link removed]) here ([link removed]) to subscribe–it's free. ([link removed])

1) More Evidence that Making the Trump Tax Cuts Permanent is PRO-GROWTH

It’s a simple truism that uncertainty about the future is bad for growth and investment.

That’s why the “temporary” - rather than permanent - status of the Trump business tax cut is hampering growth. This message is amplified by a new survey of 500 senior business leaders conducted by Ernst & Young, which finds big economic gains from making the tax cuts permanent as soon as possible:

Complete elimination of tax policy uncertainty is estimated to have the following effects (relative to the size of the 2024 US economy):

* Increase US jobs by 2.9% (4.7 million jobs), on average, in each of the next 5 years and by 1.1% (1.8 million jobs) each year thereafter.

* Increase US capital expenditures by 1.9% ($71 billion), on average, in each of the next 5 years and 0.7% ($28 billion) each year thereafter.

* Increase US company revenue by 2.0% ($1.1 trillion), on average, in each of the next 5 years and 0.8% ($439 billion) thereafter.

* The increase in federal tax revenue associated with this increased economic activity is estimated to be more than $800 billion over the 10-year budget window (2025-2034).

[link removed]

The one thing standing in the way of all this good news is the fear that Trump's Tax cuts will expire next year – as the Left has promised.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fmore-evidence-that-making-the-trump-tax-cuts-permanent-is-pro-growth%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fmore-evidence-that-making-the-trump-tax-cuts-permanent-is-pro-growth%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

2) Trump’s Good Idea to Stop Taxing Social Security Benefits

Seniors who continue to work and invest, pay the highest tax rates. Those rates can reach above 50% when including the taxation of their Social Security benefits – which were already taxed via the payroll tax on earnings.

America should be incentivizing – not punishing – seniors for continuing to work past 64. We have many members of Unleash Prosperity who are working in their 80s and 90s. Why should they pay a higher tax rate than everyone else? Demographics make it imperative that we don’t impede seniors from working. Once there were 15 workers for every retiree. Now there are 2.5. And soon, that will be down to just two workers supporting one Social Security recipient.

Also, working longer leads to better health and longer life spans.

Right now, the Social Security Administration estimates that about half of seniors on Social Security pay taxes on their benefits because of other income. That's millions of seniors ensnared in this anti-work tax.

The average SS benefit is around $2,000 a month – loosely dependent on how much that person paid in and how much they worked.

Who can live on $2,000 a month?

This is why in addition to this new Trump plan, the most critical and urgent reform of Social Security is to immediately allow young workers the option of putting the 12% tax into a 401k plan that earns a rate of return and they own it. Young workers would get three times the benefit they are scheduled to get when they retire. Social Security is the biggest rip-off ever and simply expands a culture of government dependency.

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ftrumps-good-idea-to-stop-taxing-social-security-benefits%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ftrumps-good-idea-to-stop-taxing-social-security-benefits%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

3) Kamala v. Kamala

Our Vice President has deeply-held principles. It’s just that they are negotiable and twist with the political winds.

We suspect in exactly 97 days the winds may shift back – so stick around.

So, until she flips back, enjoy these flops:

[link removed]

According to The Hill, people on the right are mean villains for calling her out on her flips and flops.

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fkamala-v-kamala%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fkamala-v-kamala%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

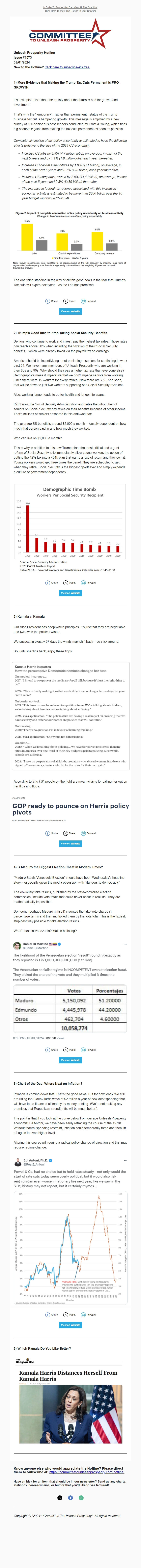

4) Is Maduro the Biggest Election Cheat in Modern Times?

“Maduro Steals Venezuela Election” should have been Wednesday's headline story – especially given the media obsession with “dangers to democracy.”

The obviously fake results, published by the state-controlled election commission, include vote totals that could never occur in real life. They are mathematically impossible.

Someone (perhaps Maduro himself) invented the fake vote shares in percentage terms and then multiplied them by the vote total. This is the laziest, stupidest way possible to fake election results.

What’s next in Venezuela? Mail-in balloting?

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fis-maduro-the-biggest-election-cheat-in-modern-times%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fis-maduro-the-biggest-election-cheat-in-modern-times%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

5) Chart of the Day: Where Next on Inflation?

Inflation is coming down fast. That’s the good news. But for how long? We still are riding the Biden-Harris wave of $2 trillion a year of new debt spending that will have to be financed ultimately by money-printing. (We’re not making any promises that Republican spendthrifts will be much better.).

The point is that if you look at the curve below from our ace Unleash Prosperity economist EJ Antoni, we have been eerily retracing the course of the 1970s. Without federal spending restraint, inflation could temporarily tame and then lift off again to even higher levels.

Altering this course will require a radical policy change of direction and that may require regime change.

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fchart-of-the-day-where-next-on-inflation%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fchart-of-the-day-where-next-on-inflation%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

6) Which Kamala Do You Like Better?

[link removed]

============================================================

Know anyone else who would appreciate the Hotline? Please direct them to subscribe at: ** [link removed] ([link removed])

Have an idea for an item that should be in our newsletter? Send us any charts, statistics, heroes/villains, or humor that you’d like to see featured!

** Twitter ([link removed])

** Facebook ([link removed])

** [link removed] ([link removed])

Copyright © *2024* *Committee To Unleash Prosperity*, All rights reserved.

This email was sent to [email protected] (mailto:[email protected])

why did I get this? ([link removed]) unsubscribe from this list ([link removed]) update subscription preferences ([link removed])

Committee to Unleash Prosperity . 1155 15th St NW Ste 525 . Washington, DC xxxxxx-2706 . USA

In Order To Ensure You Can View All The Graphics, Click Here To View The Hotline In Your Browser ([link removed])

[link removed]

Unleash Prosperity Hotline

Issue #1073

08/01/2024

New to the Hotline? Click ([link removed]) here ([link removed]) to subscribe–it's free. ([link removed])

1) More Evidence that Making the Trump Tax Cuts Permanent is PRO-GROWTH

It’s a simple truism that uncertainty about the future is bad for growth and investment.

That’s why the “temporary” - rather than permanent - status of the Trump business tax cut is hampering growth. This message is amplified by a new survey of 500 senior business leaders conducted by Ernst & Young, which finds big economic gains from making the tax cuts permanent as soon as possible:

Complete elimination of tax policy uncertainty is estimated to have the following effects (relative to the size of the 2024 US economy):

* Increase US jobs by 2.9% (4.7 million jobs), on average, in each of the next 5 years and by 1.1% (1.8 million jobs) each year thereafter.

* Increase US capital expenditures by 1.9% ($71 billion), on average, in each of the next 5 years and 0.7% ($28 billion) each year thereafter.

* Increase US company revenue by 2.0% ($1.1 trillion), on average, in each of the next 5 years and 0.8% ($439 billion) thereafter.

* The increase in federal tax revenue associated with this increased economic activity is estimated to be more than $800 billion over the 10-year budget window (2025-2034).

[link removed]

The one thing standing in the way of all this good news is the fear that Trump's Tax cuts will expire next year – as the Left has promised.

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fmore-evidence-that-making-the-trump-tax-cuts-permanent-is-pro-growth%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fmore-evidence-that-making-the-trump-tax-cuts-permanent-is-pro-growth%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

2) Trump’s Good Idea to Stop Taxing Social Security Benefits

Seniors who continue to work and invest, pay the highest tax rates. Those rates can reach above 50% when including the taxation of their Social Security benefits – which were already taxed via the payroll tax on earnings.

America should be incentivizing – not punishing – seniors for continuing to work past 64. We have many members of Unleash Prosperity who are working in their 80s and 90s. Why should they pay a higher tax rate than everyone else? Demographics make it imperative that we don’t impede seniors from working. Once there were 15 workers for every retiree. Now there are 2.5. And soon, that will be down to just two workers supporting one Social Security recipient.

Also, working longer leads to better health and longer life spans.

Right now, the Social Security Administration estimates that about half of seniors on Social Security pay taxes on their benefits because of other income. That's millions of seniors ensnared in this anti-work tax.

The average SS benefit is around $2,000 a month – loosely dependent on how much that person paid in and how much they worked.

Who can live on $2,000 a month?

This is why in addition to this new Trump plan, the most critical and urgent reform of Social Security is to immediately allow young workers the option of putting the 12% tax into a 401k plan that earns a rate of return and they own it. Young workers would get three times the benefit they are scheduled to get when they retire. Social Security is the biggest rip-off ever and simply expands a culture of government dependency.

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ftrumps-good-idea-to-stop-taxing-social-security-benefits%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Ftrumps-good-idea-to-stop-taxing-social-security-benefits%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

3) Kamala v. Kamala

Our Vice President has deeply-held principles. It’s just that they are negotiable and twist with the political winds.

We suspect in exactly 97 days the winds may shift back – so stick around.

So, until she flips back, enjoy these flops:

[link removed]

According to The Hill, people on the right are mean villains for calling her out on her flips and flops.

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fkamala-v-kamala%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fkamala-v-kamala%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

4) Is Maduro the Biggest Election Cheat in Modern Times?

“Maduro Steals Venezuela Election” should have been Wednesday's headline story – especially given the media obsession with “dangers to democracy.”

The obviously fake results, published by the state-controlled election commission, include vote totals that could never occur in real life. They are mathematically impossible.

Someone (perhaps Maduro himself) invented the fake vote shares in percentage terms and then multiplied them by the vote total. This is the laziest, stupidest way possible to fake election results.

What’s next in Venezuela? Mail-in balloting?

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fis-maduro-the-biggest-election-cheat-in-modern-times%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fis-maduro-the-biggest-election-cheat-in-modern-times%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

5) Chart of the Day: Where Next on Inflation?

Inflation is coming down fast. That’s the good news. But for how long? We still are riding the Biden-Harris wave of $2 trillion a year of new debt spending that will have to be financed ultimately by money-printing. (We’re not making any promises that Republican spendthrifts will be much better.).

The point is that if you look at the curve below from our ace Unleash Prosperity economist EJ Antoni, we have been eerily retracing the course of the 1970s. Without federal spending restraint, inflation could temporarily tame and then lift off again to even higher levels.

Altering this course will require a radical policy change of direction and that may require regime change.

[link removed]

[link removed] Share ([link removed])

[link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fchart-of-the-day-where-next-on-inflation%2F Tweet ([link removed]: https%3A%2F%2Fcommitteetounleashprosperity.com%2Fhotlines%2Fchart-of-the-day-where-next-on-inflation%2F)

[link removed] Forward ([link removed])

View on Website ([link removed])

6) Which Kamala Do You Like Better?

[link removed]

============================================================

Know anyone else who would appreciate the Hotline? Please direct them to subscribe at: ** [link removed] ([link removed])

Have an idea for an item that should be in our newsletter? Send us any charts, statistics, heroes/villains, or humor that you’d like to see featured!

** Twitter ([link removed])

** Facebook ([link removed])

** [link removed] ([link removed])

Copyright © *2024* *Committee To Unleash Prosperity*, All rights reserved.

This email was sent to [email protected] (mailto:[email protected])

why did I get this? ([link removed]) unsubscribe from this list ([link removed]) update subscription preferences ([link removed])

Committee to Unleash Prosperity . 1155 15th St NW Ste 525 . Washington, DC xxxxxx-2706 . USA

Message Analysis

- Sender: Committee to Unleash Prosperity

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp