July 29, 2024

Permission to republish original opeds and cartoons granted.

J.D. Vance is right, ‘we’re not having enough children’ and plummeting fertility is a ‘civilizational crisis’

By Robert Romano

“There aren’t enough babies being born in our country… This is a civilizational crisis, and if we’re not willing to spend resources to solve it, we’re not serious about the very real problems that we face.”

That was Sen. J.D. Vance (R-Ohio) in 2021 before he was elected in 2022, speaking at the Intercollegiate Studies Institute’s Future of American Political Economy Conference in Alexandria, Virginia, addressing declining fertility rates all around the world that threaten population and economic collapse.

He’s right.

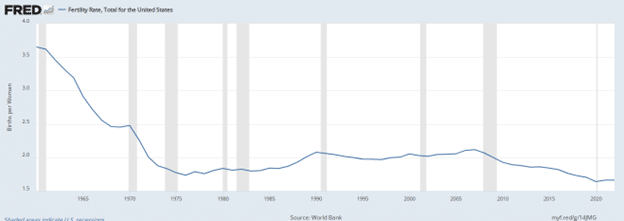

First on the numbers, the amount of newborns is definitely declining, the latest birth rate numbers from the Centers for Disease Control (CDC) shows, to 1.61 live births per woman in 2023.

That’s even lower than it was in 2020 during the Covid pandemic, when it was 1.63 babies per woman, according to CDC data, as the U.S., Japan, South Korea and Europe all continue experiencing significant declines.

The drop in fertility has been a long term trend, from 3.6 babies per woman in 1960 to 1.61 babies per woman now in 2023 after birth control was approved by the FDA in 1960, and combined with women going to college, entering the labor force and deferring child-rearing or foregoing it altogether.

Why is this a problem?

If women have fewer than two babies each, the population has to decline, fewer than one and it collapses, and if they have no babies, within a very short generation the human race will go extinct. It’s that simple.

In the meantime, the collapse of institutions is easy enough to witness, with labor shortages for schools, health care, postal workers and so forth as the Baby Boomer retirement wave continues.

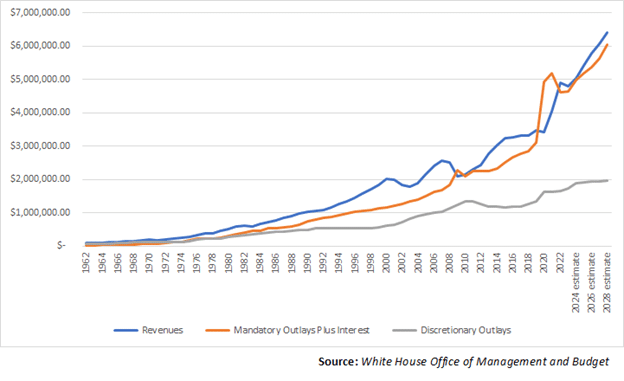

And it’s breaking the budget with comparatively fewer taxpayers, with the explosion of the U.S. national debt, now $34.99 trillion. Since 1963 through 2022, the percent growth of revenues has averaged 6.9 percent a year to its present level of $4.65 trillion, according to data compiled by the White House Office of Management and Budget.

In the meantime, mandatory spending including net interest owed on the national debt has grown an average 8.87 percent a year to its current level of $4.64 trillion.

And discretionary spending has grown an average 5.5 percent a year to its current level of $1.735 trillion.

In fact, since 2011, discretionary spending has only grown 1.99 percent a year.

Meanwhile, since 2011, mandatory spending grew an average 7.7 percent a year.

And revenues grew an average 7.26 percent.

In fact, the entire discretionary budget of $1.736 trillion for 2023 could be eliminated right now — eliminating every department, agency and firing every federal employee including the military — and the budget would still not be balanced as the debt grew by $1.855 trillion in 2023.

In the meantime, Social Security will grow from $1.346 trillion to $2.37 trillion in 2033 amid the Baby Boomer retirement wave, a 76 percent increase.

Medicare will grow from $821 billion to $1.84 trillion, a 124 percent increase.

Medicaid will grow from $608 billion to $928 billion, a 52 percent increase.

These are the drivers of the budget, accounting for 52 percent of all federal spending by 2033. Once interest and other mandatory spending is accounted for, mandatory spending will account 77.8 percent of all federal spending, up from its current level of 72.7 percent.

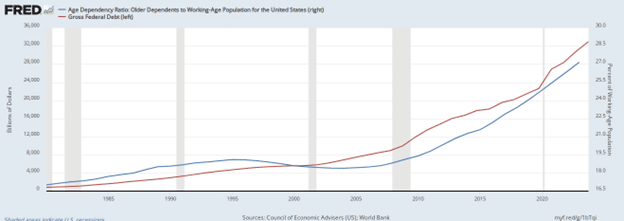

The reason is simple, as the percentage of the working age population over the age of 65 continues to rapidly increase — since 1960, when the FDA approved birth control, it has gone from 16 percent of the population to 26 percent of the population and rising — and with it the $34.5 trillion U.S. national debt, data from the World Bank and the U.S. Treasury shows.

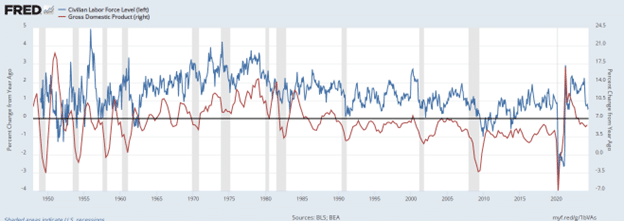

At the same time, as the growth rate of the working age population participating in the civilian labor force has dramatically slowed down thanks to plummeting fertility, so has nominal economic growth, Bureau of Labor Statistics and Bureau of Economic Analysis data shows.

There are two simultaneous outcomes that emerge. First, as the population rapidly ages, so too do Social Security, Medicare and Medicaid expenditures that seniors depend on explode.

In the meantime, thanks to slower growth, revenues will continue not to keep pace with expenditures. Revenues will increase from $4.6 trillion in 2023 to $7.4 trillion, a $2.5 trillion or 51 percent increase over ten years. But expenditures will grow even faster, with outlays growing from $6.37 trillion in 2022 to $9.9 trillion by 2033, a $3.7 trillion or a 55.4 percent increase over the next decade.

The White House Office of Management and Budget projects the national debt to skyrocket to more than $50 trillion by 2033, but that’s low-balling it. The debt has grown by about 8 percent a year since 1980 once recessions and wars are factored. At that rate, it should be about $65 trillion to $70 trillion by 2033 and $100 trillion by 2037 or so, well north of 200 percent debt to GDP.

The reason is because there are comparatively fewer taxpayers versus those receiving benefits as the structural deficit widens due to the drop in fertility.

But that’s enough to make your eyes bleed. Imagine it more simply: If a village has 100 people, 50 men and 50 women, and they only have one child per couple, the next generation will only have 50 people, and 25 the generation after that, who will need to take care of 150 older villagers. It’s unsustainable, and is precisely the trajectory we are headed for.

The saying goes, when you less of something, you tax it, and when you want more of something, you subsidize it.

Towards that end, Vance in 2021 supported a proposal by Sen. Josh Hawley (R-Mo.) that would dramatically expand the child tax credit to $6,000 per child under the age of 13 for single parents, and $12,000 per child under the age of 13 for married couples.

Vance said of Hawley’s proposal at the time, “Lot of ideas out there for how to directly help parents instead of giving them only one option. This is a good one.”

That works out to $78,000 of tax credits for single parents and $156,000 for married parents over the first 13 years of the child’s life, a double incentive not only to have children, but to go further and get married.

And on the Charlie Kirk podcast in 2021, Vance further summarized his thoughts that incentives should be used to encourage family formation, stating, “So, you talk about tax policy, let's tax the things that are bad and not tax the things that are good… If you are making $100,000, $400,000 a year and you've got three kids, you should pay a different, lower tax rate than if you are making the same amount of money and you don't have any kids. It's that simple.”

At the Conservative Political Action Conference in March 2023, former President Donald Trump also expressed support for what he is calling “baby bucks,” stating, “We will support baby bonuses for a new baby boom! I want a baby boom! You men are so lucky out there — you are so lucky, men.”

Another approach might be to simply front-load the tax credits into the child’s earlier, pre-school years, for example, $40,000 per baby, with $20,000 upfront and $4,000 a year for each of the following five years. The idea would be to foster a baby boom. Additional consideration could be given to incentivizing marriage, say, an additional $10,000 upfront for married couples having new children.

That could reduce the overall cost, although it would still be costly, $450 billion for every 10 million new babies, assuming equal amounts of single and married households. But that’d still be cheaper than the Hawley proposal, which might come out to $1.17 trillion for every 10 million new babies. It also might be more effective, if by front-loading the credits it results in immediate attempts at child-rearing.

Either approach would ultimately pay for itself, since individuals who work ultimately end up paying in excess of either $50,000 or $117,000 in taxes over their careers. And what we get in return is a growing, more robust generation of Americans.

Currently, about 3.7 million babies a year are born. But with incentives, that can be increased quickly.

It would be inflationary, for certain, as it was in the postwar baby boom. But so are labor shortages that contribute to supply shortages. Overall, a declining population could be deflationary long term, which has its own set of problems as was seen during the Great Depression. And rather than other proposals for universal basic income so that people can work less to pursue hobbies, by focusing on boosting family formation, the goal is to build the next generation of doctors, engineers, plumbers, farmers and so forth. We need not sacrifice our society’s emphasis on education.

To have a sustainable, highly educated country and economy, we need a sustainably growing population that is not dependent on foreign immigration. And as the average age of immigrants continues increasing — the median age of immigrants in 2022 was 47 — at best it is a temporary offset but ultimately contributes to the aging population.

Other alternatives including banning birth control and defunding colleges and universities might be a political lead balloon, not be successfully implemented and destroy the political party that adopted those policies.

It’s all about incentives. And the consequences for not getting the mix of incentives right appears to have dire consequences. In short, if we want to continue to be a growing, prosperous country, it’s time to get busy!

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2024/07/j-d-vance-is-right-were-not-having-enough-children-and-plummeting-fertility-is-a-civilizational-crisis/

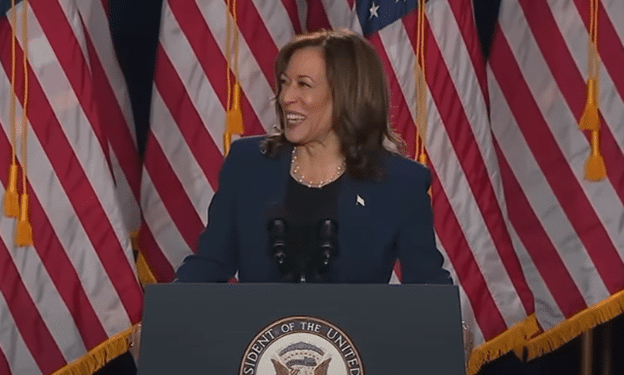

Kamala Harris’ Poisonous Word Salad

By Rick Manning

“I can imagine what can be, unburdened by what has been.” Vice President Kamala Harris

Americans are being subjected to one of the most blatant and obvious brainwashing campaigns in modern history. Utilizing the power of those social media platforms and mass media outlets, the American left is engaged in a true battle for the soul of America. It is a battle that is being fought by destroying the concept of absolute truth and replacing it with situational facts that can be changed to meet the immediate need.

The most obvious current example is the rehabilitation of Vice President Kamala Harris.

Harris is often mocked for one of her favorite sayings as being gibberish, “I can imagine what can be, unburdened by what has been.”

However, when deconstructed, this saying reflects two diametrically opposing philosophical constructs.

The first, on a spiritual level, is a direct reflection on the fundamental element of Christianity — that salvation is offered through the blood of Christ, and your sins are washed away through repentance and acceptance of Jesus’ saving grace. That is a description of a soul unburdened by sins committed.

However, Harris does not mean an eternal Christian perspective when she speaks about being unburdened by the past. Taken in a political/secular sense, this unburdening reflects a complete unmooring of America from our founding and history. It is a rejection of the DNA of America found in the Declaration of Independence, summarized by the immortal words, “We hold these truths to be self-evident, that all men are created equal, endowed by our Creator with certain unalienable rights, among these life, liberty and the pursuit of happiness.”

Harris’ imagined unburdening also undoes the Constitution, which is based upon a system of majority rule with minority rights along with a separation of powers. The left is very fond of referring to our nation as a “democracy,” offending those of us who know it is a republic.

Joe Biden and now Kamala Harris will continue to pretend that “democracy” is facing an existential threat should President Donald Trump be re-elected.

They both know that to have a system of majority rule absent protection for the minority or any semblance of individual rights is a toppling of our Constitutional government, yet they bleat their ‘democracy’ nonsense to an ignorant group of voters who get their information from Chinese controlled TikTok.

As we watch the attempts to unburden Kamala Harris from her past, we should not be surprised. After all, when the ends justify the means and the cause of saving “democracy” is righteous enough, anything can be excused.

In 2021, President Biden tasked Kamala Harris with leading the Biden administration’s border effort. The media in 2021 was filled with references to the Vice President as the “Border Czar.” This term fell into disfavor as a moniker Harris wanted to embrace as the border became little more than a turnstile for those entering our country on false pretenses and illegally.

Harris’ failure to actually visit the border while the crisis was unfolding even drew ire from regularly friendly media outlets for a short time.

Now, the same media which so proudly proclaimed Harris as the “Border Czar” before the total and utter failure of the Biden policies are erasing that term as being conservative misinformation.

Axios, a left-wing news outlet, now has the audacity to deny the use of the description of Kamala Harris as the ‘border czar’ under the guise that she ‘never actually had’ the title. Even though Axios was forced to admit that they wrote in April 2021, “The number of unaccompanied minors crossing the border has reached crisis levels. Harris, appointed by Biden as border czar, said she would be looking at the "root causes" that drive migration.

A March 24, 2021 article by Stef Kight, the same reporter who now seeks to wipe the border stain from Kamala Harris’ resume, is headlined in giant, unambiguous bold letters, “Biden puts Harris in charge of border crisis.”

Now, with more than ten million illegals released into America due to Biden/Harris policies, the establishment media is returning to its Pravda-like role after a month of engaging in some level of journalism during the Biden take-down.

Expect other Harris failings to be similarly worm-holed as the Vice President’s career gets reimagined to the American public in the months ahead.

After all, truth is fungible to those who embrace the Marxist concept of the end justifying the means.

German philosopher Hannah Arendt wrote the following about Nazism in Germany, “This constant lying is not aimed at making the people believe a lie, but at ensuring that no one believes anything anymore.”

She concluded from her observation that the purpose of disconnecting or unburdening the people from the truth is that such people, “deprived of the power to think and judge, is, without knowing and willing it completely subject to the rule of lies. With such a people, you can do whatever you want.”

While Kamala Harris often speaks in word salads, when you actually look at what she is saying, it is less a salad and more a poison disguised as gibberish.

Rick Manning is the President of Americans for Limited Government.

To view online: https://townhall.com/columnists/rickmanning/2024/07/28/kamala-harris-poisonous-word-salad-n2642610

Trump's China Tariffs: Extraordinarily Good for America

This is a contest that the United States cannot lose. In short, trade-surplus countries, such as China, cannot prevail over trade-deficit ones, such as America. Last year, America's merchandise trade deficit with China was $279.4 billion.

That is why, ultimately, China will have to pay the cost of tariffs that Trump — or any other American leader — may impose. Clearly, China's regime knows this. People's Daily, the Communist Party's self-described mouthpiece and therefore the most authoritative publication in China, this month is arguing that America should not raise tariffs.

China steals each year somewhere in the neighborhood of a half trillion dollars of American intellectual property. Critics of tariffs, whether they make valid points or not about increased costs, have an obligation to say how they would eliminate or reduce this criminal practice through other means.

Why should Americans want to decimate the Chinese factory sector? The Communist Party of China sees the U.S. as an enemy and seeks the destruction of the American republic. The struggle, in short, is existential. China's regime cannot wage the fight against America without American money.

So why should Americans supply the cash to their enemy?

"I can't believe how many people are negative on tariffs that are actually smart people," President Donald Trump told Bloomberg in a June 25 interview. "Economically, they're phenomenal."

Since then, a lot of smart people have rushed to the American media to say that, on the contrary, high tariffs are horrible.

Trump is right. Although these levies would increase costs to American consumers, the costs would not be nearly as great as experts say. Moreover, there are other considerations, both economic and national security, favoring raising tariffs now.

"As president, Trump shattered the long-standing Republican orthodoxy of favoring free trade," Bloomberg noted in commentary accompanying the interview, released on July 16th: "He says he'll go further if reelected." Trump talked about increasing tariffs on, among others, China.

Trump happens to be right about China. In February, speaking to Maria Bartiromo on Fox News' Sunday Morning Futures, he suggested he might impose tariffs greater than 60% on Chinese imports.

Critics from the American elite howl. "This is going to add price inflation across the board, all in the name of 'tough guy' election-year politics," said Yael Ossowski of the Consumer Choice Center, in comments carried by Bloomberg.

"The long historical record demonstrates these are borne not by other countries, as Mr. Trump keeps insisting, but by American consumers and industries," writes Steven R. Weisman of the Washington, D.C.-based Peterson Institute for International Economics, about tariffs.

The long historical record might show that, but not the immediate one. In 2018, Trump imposed additional tariffs on China and analysts warned that prices in America would rise. Smart people in America, however, forgot that China had an incentive to effectively pay the tariffs: The Chinese government and exporters absorbed 75% to 81% of the cost of the additional levies. They did so primarily through the government increasing export and other subsidies and factories accepting lower profit margins.

"The Trump tariffs were barely noticed by U.S. businesses or consumers," long-time trade expert Alan Tonelson told Gatestone. "They certainly did not raise inflation, and they certainly did not cut growth."

Trump's additional tariffs topped out at 25%. Now, he is proposing even higher levies. The hit to the American consumer will undoubtedly be greater this time. "The higher tariffs are raised from current levels, the more likely disruptions will occur," says Tonelson, also the founder of public policy blog RealityChek.

At the same time, however, the Chinese have even greater reason to shield consumers from increased costs. The problem for Xi Jinping is that China's growth model is exhausted, and after rejecting stimulating domestic consumption, he is entirely dependent on increasing exports.

Chinese factories, from all indications, are struggling and need to keep customers. For instance, China's Producer Price Index, which measures factory-gate prices, declined for the 21st consecutive month in June. The Wall Street Journal reports low prices have pushed many factories in China "to the brink." With prices declining in China, American consumers will not feel the pinch of new tariffs.

Furthermore, there is one more reason why U.S. consumers will not suffer. High American tariffs will encourage factories to move out of China. When they do, any pressure on consumer prices will disappear.

This is a contest that the United States cannot lose. In short, trade-surplus countries, such as China, cannot prevail over trade-deficit ones, such as America. Last year, America's merchandise trade deficit with China was $279.4 billion.

That is why, ultimately, China will have to pay the cost of tariffs that Trump — or any other American leader — may impose. Clearly, China's regime knows this. People's Daily, the Communist Party's self-described mouthpiece and therefore the most authoritative publication in China, this month is arguing that America should not raise tariffs.

Yet even if American consumers were to pay more because of the tariffs, let us remember why they were imposed in the first place. Trump in 2018 invoked Section 301 of the Trade Act of 1974 and raised tariffs as a remedy for Chinese theft of U.S. intellectual property. China steals each year somewhere in the neighborhood of a half trillion dollars of American intellectual property. Critics of tariffs, whether they make valid points or not about increased costs, have an obligation to say how they would eliminate or reduce this criminal practice through other means.

On a broader point, Americans, after more than four decades of misguided policy, have to realize that they cannot fix their lopsided trade relations with China without bearing pain. Unless they agree to become subservient to the militant Chinese state, they will have to accept the costs of remaining sovereign.

Trump's 60% tariffs would "drastically slow" the Chinese economy, as Fortune reported this month. The hit to China would be far greater than any collateral effects in America. Experience with the 2018 tariffs is a guide. "Overall, the damage to China's gross domestic product from the trade war was three times as high as the hit to the U.S., according to some Chinese economists," the Wall Street Journal reported in May.

Why should Americans want to decimate the Chinese factory sector? The Communist Party of China sees the U.S. as an enemy and seeks the destruction of the American republic. The struggle, in short, is existential. China's regime cannot wage the fight against America without American money.

So why should Americans supply the cash to their enemy?

Gordon G. Chang is the author of The Coming Collapse of China and China Is Going to War, a Gatestone Institute distinguished senior fellow, and a member of its Advisory Board.

https://www.gatestoneinstitute.org/20819/trump-china-tariffs