Email

China’s $2.5 Trillion Strategy

| From | AEI DataPoints <[email protected]> |

| Subject | China’s $2.5 Trillion Strategy |

| Date | July 25, 2024 11:00 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Breaking down the news with data, charts, and maps.

Edited by Sutton Houser and James Desio

Happy Thursday!

Today’s Top 3: We examine China’s $2.5 trillion global investment portfolio, why it’s too soon for the Federal Reserve to cut rates, and historical GOP voting trends in key swing states.

Subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

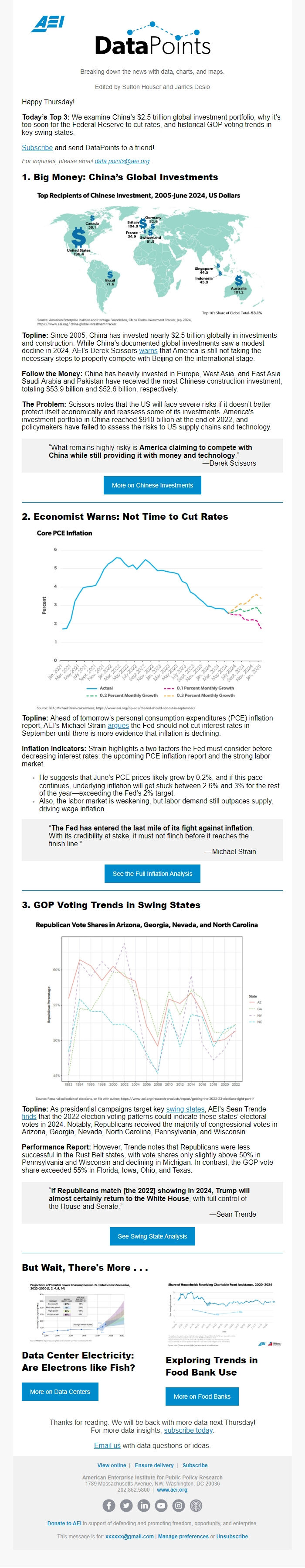

1. Big Money: China’s Global Investments

Topline: Since 2005, China has invested nearly $2.5 trillion globally in investments and construction. While China’s documented global investments saw a modest decline in 2024, AEI’s Derek Scissors warns <[link removed]> that America is still not taking the necessary steps to properly compete with Beijing on the international stage.

Follow the Money: China has heavily invested in Europe, West Asia, and East Asia. Saudi Arabia and Pakistan have received the most Chinese construction investment, totaling $53.9 billion and $52.6 billion, respectively.

The Problem: Scissors notes that the US will face severe risks if it doesn’t better protect itself economically and reassess some of its investments. America's investment portfolio in China reached $910 billion at the end of 2022, and policymakers have failed to assess the risks to US supply chains and technology.

“What remains highly risky is America claiming to compete with China while still providing it with money and

technology.”

—Derek Scissors

2. Economist Warns: Not Time to Cut Rates

Topline: Ahead of tomorrow’s personal consumption expenditures (PCE) inflation report, AEI’s Michael Strain argues <[link removed]> the Fed should not cut interest rates in September until there is more evidence that inflation is declining.

Inflation Indicators: Strain highlights a two factors the Fed must consider before decreasing interest rates: the upcoming PCE inflation report and the strong labor market.

- He suggests that June’s PCE prices likely grew by 0.2%, and if this pace continues, underlying

inflation will get stuck between 2.6% and 3% for the rest of the year—exceeding the Fed’s 2% target.

- Also, the labor market is weakening, but labor demand still outpaces supply, driving wage inflation.

“The Fed has entered the last mile of its fight against inflation. With its credibility at stake, it must not flinch before it reaches the finish line.”

—Michael Strain

3. GOP Voting Trends in Swing States

Topline: As presidential campaigns target key swing states <[link removed]>, AEI’s Sean Trende finds <[link removed]> that the 2022 election voting patterns could indicate these states’ electoral votes in 2024. Notably, Republicans received the majority of congressional votes in Arizona, Georgia, Nevada, North Carolina, Pennsylvania, and Wisconsin.

Performance Report: However, Trende notes that Republicans were less successful in the Rust Belt states, with vote shares only slightly above 50% in Pennsylvania and Wisconsin and declining in Michigan. In contrast, the GOP vote share exceeded 55% in Florida, Iowa, Ohio, and Texas.

“If Republicans match [the 2022] showing in 2024, Trump will almost certainly return to the White House, with full

control of the House and Senate.”

—Sean Trende

But Wait, There's More . . .

Data Center Electricity: Are Electrons like Fish? <[link removed]>

Exploring Trends in Food Bank Use <[link removed]>

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Edited by Sutton Houser and James Desio

Happy Thursday!

Today’s Top 3: We examine China’s $2.5 trillion global investment portfolio, why it’s too soon for the Federal Reserve to cut rates, and historical GOP voting trends in key swing states.

Subscribe <[link removed]> and send DataPoints to a friend!

For inquiries, please email [email protected] <[link removed]>.

1. Big Money: China’s Global Investments

Topline: Since 2005, China has invested nearly $2.5 trillion globally in investments and construction. While China’s documented global investments saw a modest decline in 2024, AEI’s Derek Scissors warns <[link removed]> that America is still not taking the necessary steps to properly compete with Beijing on the international stage.

Follow the Money: China has heavily invested in Europe, West Asia, and East Asia. Saudi Arabia and Pakistan have received the most Chinese construction investment, totaling $53.9 billion and $52.6 billion, respectively.

The Problem: Scissors notes that the US will face severe risks if it doesn’t better protect itself economically and reassess some of its investments. America's investment portfolio in China reached $910 billion at the end of 2022, and policymakers have failed to assess the risks to US supply chains and technology.

“What remains highly risky is America claiming to compete with China while still providing it with money and

technology.”

—Derek Scissors

2. Economist Warns: Not Time to Cut Rates

Topline: Ahead of tomorrow’s personal consumption expenditures (PCE) inflation report, AEI’s Michael Strain argues <[link removed]> the Fed should not cut interest rates in September until there is more evidence that inflation is declining.

Inflation Indicators: Strain highlights a two factors the Fed must consider before decreasing interest rates: the upcoming PCE inflation report and the strong labor market.

- He suggests that June’s PCE prices likely grew by 0.2%, and if this pace continues, underlying

inflation will get stuck between 2.6% and 3% for the rest of the year—exceeding the Fed’s 2% target.

- Also, the labor market is weakening, but labor demand still outpaces supply, driving wage inflation.

“The Fed has entered the last mile of its fight against inflation. With its credibility at stake, it must not flinch before it reaches the finish line.”

—Michael Strain

3. GOP Voting Trends in Swing States

Topline: As presidential campaigns target key swing states <[link removed]>, AEI’s Sean Trende finds <[link removed]> that the 2022 election voting patterns could indicate these states’ electoral votes in 2024. Notably, Republicans received the majority of congressional votes in Arizona, Georgia, Nevada, North Carolina, Pennsylvania, and Wisconsin.

Performance Report: However, Trende notes that Republicans were less successful in the Rust Belt states, with vote shares only slightly above 50% in Pennsylvania and Wisconsin and declining in Michigan. In contrast, the GOP vote share exceeded 55% in Florida, Iowa, Ohio, and Texas.

“If Republicans match [the 2022] showing in 2024, Trump will almost certainly return to the White House, with full

control of the House and Senate.”

—Sean Trende

But Wait, There's More . . .

Data Center Electricity: Are Electrons like Fish? <[link removed]>

Exploring Trends in Food Bank Use <[link removed]>

Thanks for reading. We will be back with more data next Thursday!

For more data insights, subscribe today <[link removed]>.

Email us <[link removed]> with data questions or ideas.

View online <[[[link removed]]]> | Ensure delivery <[link removed]> | Subscribe <[link removed]>

American Enterprise Institute for Public Policy Research

1789 Massachusetts Avenue, NW, Washington, DC 20036

202.862.5800 | www.aei.org <[link removed]>

<[link removed]> <[link removed]> <[link removed]> <[link removed]> <[link removed]>

<[link removed]> Donate to AEI <[link removed]> in support of defending and promoting freedom, opportunity, and enterprise.

This message is for: [email protected] <[email protected]> | Manage preferences <[link removed]> or Unsubscribe <[link removed]>

<!-- This is a comment -->

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Marketo