Email

QUICK FACTS: California Employment Report for June 2024

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | QUICK FACTS: California Employment Report for June 2024 |

| Date | July 22, 2024 11:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] QUICK FACTS: California Employment Report for June 2024

The Center for Jobs and the Economy has released our initial analysis of the June Employment Report from the California Employment Development Department. For additional information and data about the California economy visit www.centerforjobs.org/ca [[link removed]].

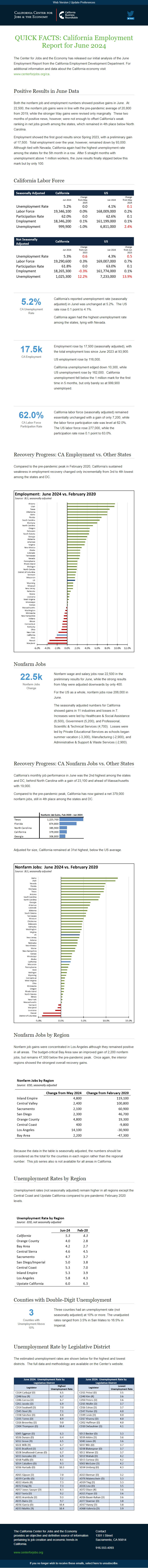

Positive Results in June Data

Both the nonfarm job and employment numbers showed positive gains in June. At 22,500, the nonfarm job gains were in line with the pre-pandemic average of 20,800 from 2019, while the stronger May gains were revised only marginally. These two months of positive news, however, were not enough to offset California’s weak ranking in net jobs growth among the states, which remained in 4th place below North Carolina.

Employment showed the first good results since Spring 2023, with a preliminary gain of 17,500. Total employment over the year, however, remained down by 93,000. Although tied with Nevada, California again had the highest unemployment rate among the states for the 5th month in a row. After 5 straight months with unemployment above 1 million workers, the June results finally slipped below this mark but by only 100.

California Labor Force 5.2% CA Unemployment

Rate

California's reported unemployment rate (seasonally adjusted) in Junel was unchanged at 5.2%. The US rate rose 0.1 point to 4.1%.

California again had the highest unemployment rate among the states, tying with Nevada.

17.5k CA Employment

Employment rose by 17,500 (seasonally adjusted), with the total employment loss since June 2023 at 93,900.

US employment rose by 116,000.

California unemployment edged down 10,300, while US unemployment rose by 162,000. California unemployment fell below the 1 million mark for the first time in 5 months, but only barely so at 999,900 unemployed.

62.0% CA Labor Force

Participation Rate

California labor force (seasonally adjusted) remained essentially unchanged with a gain of only 7,200, while the labor force participation rate was level at 62.0%. The US labor force rose 277,000, while the participation rate rose 0.1 point to 63.0%.

Recovery Progress: CA Employment vs. Other States

Compared to the pre-pandemic peak in February 2020, California’s sustained weakness in employment recovery changed only incrementally from 3rd to 4th lowest among the states and DC.

Nonfarm Jobs 22.5k Nonfarm Jobs

Change

Nonfarm wage and salary jobs rose 22,500 in the preliminary results for June, while the strong results from May were adjusted downwards by only 400.

For the US as a whole, nonfarm jobs rose 206,000 in June.

The seasonally adjusted numbers for California showed gains in 11 industries and losses in 7. Increases were led by Healthcare & Social Assistance (6,500), Government (5,200), and Professional, Scientific & Technical Services (4,700). Losses were led by Private Educational Services as schools began summer vacation (-3,300), Manufacturing (-2,900), and Administrative & Support & Waste Services (-2,900).

Recovery Progress: CA Nonfarm Jobs vs. Other States

California’s monthly job performance in June was the 2nd highest among the states and DC, behind North Carolina with a gain of 23,100 and ahead of Massachusetts with 19,000.

Compared to the pre-pandemic peak, California has now gained a net 379,000 nonfarm jobs, still in 4th place among the states and DC.

Adjusted for size, California remained at 31st highest, below the US average.

Nonfarm Jobs by Region

Nonfarm job gains were concentrated in Los Angeles although they remained positive in all areas. The budget-critical Bay Area saw an improved gain of 2,200 nonfarm jobs, but remains 47,500 below the pre-pandemic peak. Once again, the interior regions showed the strongest overall recovery gains.

Because the data in the table is seasonally adjusted, the numbers should be considered as the total for the counties in each region rather than the regional number. This job series also is not available for all areas in California.

Unemployment Rates by Region

Unemployment rates (not seasonally adjusted) remain higher in all regions except the Central Coast and Upstate California compared to pre-pandemic February 2020 levels.

Counties with Double-Digit Unemployment 3 Counties with

Unemployment Above

10%

Three counties had an unemployment rate (not seasonally adjusted) at 10% or more. The unadjusted rates ranged from 3.5% in San Mateo to 16.5% in Imperial.

Unemployment Rate by Legislative District

The estimated unemployment rates are shown below for the highest and lowest districts. The full data and methodology are available on the Center’s website.

The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

The Center for Jobs and the Economy has released our initial analysis of the June Employment Report from the California Employment Development Department. For additional information and data about the California economy visit www.centerforjobs.org/ca [[link removed]].

Positive Results in June Data

Both the nonfarm job and employment numbers showed positive gains in June. At 22,500, the nonfarm job gains were in line with the pre-pandemic average of 20,800 from 2019, while the stronger May gains were revised only marginally. These two months of positive news, however, were not enough to offset California’s weak ranking in net jobs growth among the states, which remained in 4th place below North Carolina.

Employment showed the first good results since Spring 2023, with a preliminary gain of 17,500. Total employment over the year, however, remained down by 93,000. Although tied with Nevada, California again had the highest unemployment rate among the states for the 5th month in a row. After 5 straight months with unemployment above 1 million workers, the June results finally slipped below this mark but by only 100.

California Labor Force 5.2% CA Unemployment

Rate

California's reported unemployment rate (seasonally adjusted) in Junel was unchanged at 5.2%. The US rate rose 0.1 point to 4.1%.

California again had the highest unemployment rate among the states, tying with Nevada.

17.5k CA Employment

Employment rose by 17,500 (seasonally adjusted), with the total employment loss since June 2023 at 93,900.

US employment rose by 116,000.

California unemployment edged down 10,300, while US unemployment rose by 162,000. California unemployment fell below the 1 million mark for the first time in 5 months, but only barely so at 999,900 unemployed.

62.0% CA Labor Force

Participation Rate

California labor force (seasonally adjusted) remained essentially unchanged with a gain of only 7,200, while the labor force participation rate was level at 62.0%. The US labor force rose 277,000, while the participation rate rose 0.1 point to 63.0%.

Recovery Progress: CA Employment vs. Other States

Compared to the pre-pandemic peak in February 2020, California’s sustained weakness in employment recovery changed only incrementally from 3rd to 4th lowest among the states and DC.

Nonfarm Jobs 22.5k Nonfarm Jobs

Change

Nonfarm wage and salary jobs rose 22,500 in the preliminary results for June, while the strong results from May were adjusted downwards by only 400.

For the US as a whole, nonfarm jobs rose 206,000 in June.

The seasonally adjusted numbers for California showed gains in 11 industries and losses in 7. Increases were led by Healthcare & Social Assistance (6,500), Government (5,200), and Professional, Scientific & Technical Services (4,700). Losses were led by Private Educational Services as schools began summer vacation (-3,300), Manufacturing (-2,900), and Administrative & Support & Waste Services (-2,900).

Recovery Progress: CA Nonfarm Jobs vs. Other States

California’s monthly job performance in June was the 2nd highest among the states and DC, behind North Carolina with a gain of 23,100 and ahead of Massachusetts with 19,000.

Compared to the pre-pandemic peak, California has now gained a net 379,000 nonfarm jobs, still in 4th place among the states and DC.

Adjusted for size, California remained at 31st highest, below the US average.

Nonfarm Jobs by Region

Nonfarm job gains were concentrated in Los Angeles although they remained positive in all areas. The budget-critical Bay Area saw an improved gain of 2,200 nonfarm jobs, but remains 47,500 below the pre-pandemic peak. Once again, the interior regions showed the strongest overall recovery gains.

Because the data in the table is seasonally adjusted, the numbers should be considered as the total for the counties in each region rather than the regional number. This job series also is not available for all areas in California.

Unemployment Rates by Region

Unemployment rates (not seasonally adjusted) remain higher in all regions except the Central Coast and Upstate California compared to pre-pandemic February 2020 levels.

Counties with Double-Digit Unemployment 3 Counties with

Unemployment Above

10%

Three counties had an unemployment rate (not seasonally adjusted) at 10% or more. The unadjusted rates ranged from 3.5% in San Mateo to 16.5% in Imperial.

Unemployment Rate by Legislative District

The estimated unemployment rates are shown below for the highest and lowest districts. The full data and methodology are available on the Center’s website.

The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor