| From | Dr. Tasha Green Cruzat <[email protected]> |

| Subject | Children's Advocates for Change Newsletter |

| Date | July 18, 2024 6:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

<[link removed]>

View this email in a browser

Championing the Well-Being of Illinois' Children

<[link removed]>

www.childrensadvocates.org

2024 Spring/Summer Newsletter

Message from the President

Dr. Tasha Green Cruzat

Dear Friends,

It really does take a village to raise a child.

I’m writing to you from just outside Knoxville, Tennessee where I am attending a meeting of the Children’s Defense Fund this week and made a presentation on the needs of pregnant mothers and children up to age three.

Many of the participants at the meeting represent religious and community institutions around the country. It should remind us of the fact that in working for the benefit of our children, it is not just the government’s responsibility but the responsibility of everyone in the community including parents, guardians, neighbors, teachers, community program staff, and, of course, our elected officials.

Furthermore, community does not just include those living on the neighborhood block. In Illinois, our community includes children from Rockford in northern Illinois to Cairo in southern Illinois, from Quincy on our western border to Danville on our eastern border, and from large cities such as Chicago to small communities such as Valley City in Pike County (population 14 according to the 2020 census). It is our responsibility to see that each child in the state has the necessary health, educational, and economic resources to thrive.

To the last point, I am happy to report the 2024 Illinois spring legislative session ended with the creation of a state Child Tax Credit. This was a measure Children’s Advocates for Change and others worked hard on during the session. It will provided needed economic support to hundreds of thousands of Illinois households. More information about the credit’s structure is listed below.

In addition, the approved Fiscal Year 2025 (FY25) state budget continues to make additional investments in pre-school education and the K-12 system as well as Department of Children and Family Services staff. These were important steps in a difficult budget environment. Yet, the work continues.

Not only are there areas of the state still in need of quality early childhood programs, but the state needs to improve the level of access to those programs.

We need to get additional economic support to extremely low-income families to break the cycle of poverty.

While more than 96% of Illinois children have health insurance, access to health care services is still an issue for many families. Work is underway on the certification process for community health workers. The state needs to ensure there are robust community and public health care systems to mitigate any health issues children may face growing up.

Of course, it takes money but the rate of return is well worth it. The state enacted a series of revenue measures and fund transfers to put together the revenue for the FY25 budget. However, moving forward, with the items noted above as well as other issues such as transit funding, it’s important to take a hard look at the state’s income tax rates as well as sales tax structure and untaxed services.

It will be a busy time, and I welcome you to join us in our advocacy efforts. We have a responsibility to all the children in this state. With your resolve and determination, we can improve our statewide community with our attention to our children and their needs.

Tax Credit

As noted above, the state legislature approved a new state Child Tax Credit in the final days of the spring legislative session. This is a measure Children’s Advocates for Change (CAFC) has worked on for several years. As part of this year’s effort, we worked with a coalition of 50 organizations from across the state. Illinois now joins 14 other states with such a credit.

The credit will be effective for the current tax year (on taxes due next year), available to taxpayers who qualify for the state Earned Income Tax Credit, and have at least one qualifying child (as defined by the Internal Revenue Service) under the age of 12. The state Earned Income Tax Credit (EITC) is equal to 20% of the federal EITC.

The Illinois Department of Revenue estimates approximately 374,000 Illinois taxpayers that claimed the state EITC had at least one dependent under the age of 12. (The credit is per taxpayer not per child.)

For the tax year beginning on January 1, 2024, the credit will be equal to 20% of the value of the taxpayer’s available Illinois EITC.

For the tax year beginning on January 1, 2025, and each year thereafter, the credit will be equal to 40% of the value of the taxpayer’s available Illinois EITC.

The credit is refundable. If the amount of the credit exceeds the taxpayer’s income tax liability for the year, the state will refund the excess amount to the taxpayer. The actual credit amount received by a taxpayer will vary depending on the household income and number of children in the household.

As I noted in a

<[link removed]>

statement I released along with the President of Family Focus, the credit is ultimately built on the structure of the federal tax credit that is designed in a fashion that gets to the maximum credit level only after a taxpayer reaches an income level of approximately $11,750 for a single tax filer with one child and $16,500 for married filing jointly taxpayers with three or more children. Therefore, work remains to provide greater assistance to those below these income thresholds.

The state estimates the total value of child tax credits taken by all taxpayers for the current tax year will be $50 million and $100 million dollars in Tax Year 2025. We have more about the

<[link removed]>

credit on our website.

Fiscal Year 2025 Budget

A new budget for Illinois’ FY25 (which runs from July 1, 2024 to June 30, 2025) is in place after several votes in the Illinois House to secure additional revenue of approximately $1 billion to fund it.

Early Childhood

The budget contains an additional $75 million for the state’s early childhood block grant program. This amount is one element of the second year of the Governor’s Smart Start Program to improve the state’s early childhood education and care system. There is also:

$5 million to expand the home visiting program run by the Department of Human Services

a $36.5 million increase to the Child Care Assistance Program to handle an anticipated caseload increase

an additional $6 million for the early intervention services

$110 million for early childhood workforce compensation contracts (which includes staff wage increases) and

$14 million for start-up costs related to a new Department of Early Childhood. While it will be two years before transferring certain programs from the State Board of Education, Department of Human Services, and Department of Children and Family Services to the new agency, this funding allows the state to hire an initial staff, open office space, and hire consultants to help with the planning for that effort.

K12, Higher Education, and DCFS

The budget appropriates an additional $350 million for the K-12 evidence-based school funding formula and $45 million for the second year of a three-year pilot to fill teacher vacancies. The state’s public universities received an average increase of about 2% for operations. The budget also contains funding for an additional 392 staff positions.

You can read more in our

<[link removed]>

review of the new state budget on our blog.

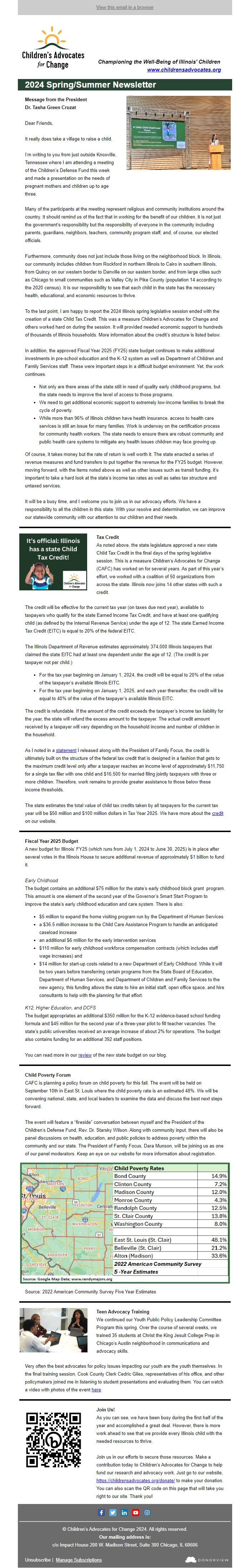

Child Poverty Forum

CAFC is planning a policy forum on child poverty for this fall. The event will be held on September 10th in East St. Louis where the child poverty rate is an estimated 48%. We will be convening national, state, and local leaders to examine the data and discuss the best next steps forward.

The event will feature a “fireside” conversation between myself and the President of the Children’s Defense Fund, Rev. Dr. Starsky Wilson. Along with community input, there will also be panel discussions on health, education, and public policies to address poverty within the community and our state. The President of Family Focus, Dara Munson, will be joining us as one of our panel moderators. Keep an eye on our website for more information about registration.

Source: 2022 American Community Survey Five Year Estimates

Teen Advocacy Training

We continued our Youth Public Policy Leadership Committee Program this spring. Over the course of several weeks, we trained 35 students at Christ the King Jesuit College Prep in Chicago’s Austin neighborhood in communications and advocacy skills.

Very often the best advocates for policy issues impacting our youth are the youth themselves. In the final training session, Cook County Clerk Cedric Giles, representatives of his office, and other policymakers joined me in listening to student presentations and evaluating them. You can watch a video with photos of the event

<[link removed]>

here.

Join Us!

As you can see, we have been busy during the first half of the year and accomplished a great deal. However, there is more work ahead to see that we provide every Illinois child with the needed resources to thrive.

Join us in our efforts to secure those resources. Make a contribution today to Children’s Advocates for Change to help fund our research and advocacy work. Just go to our website,

<[link removed]>

[link removed] to make your donation. You can also scan the QR code on this page that will take you right to our site. Thank you!

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

© Children’s Advocates for Change 2024. All rights reserved.

Our mailing address is:

c/o Impact House 200 W. Madison Street, Suite 300 Chicago, IL 60606

<[link removed]>

Unsubscribe |

<[link removed]>

Manage Subscriptions

<[link removed]>

View this email in a browser

Championing the Well-Being of Illinois' Children

<[link removed]>

www.childrensadvocates.org

2024 Spring/Summer Newsletter

Message from the President

Dr. Tasha Green Cruzat

Dear Friends,

It really does take a village to raise a child.

I’m writing to you from just outside Knoxville, Tennessee where I am attending a meeting of the Children’s Defense Fund this week and made a presentation on the needs of pregnant mothers and children up to age three.

Many of the participants at the meeting represent religious and community institutions around the country. It should remind us of the fact that in working for the benefit of our children, it is not just the government’s responsibility but the responsibility of everyone in the community including parents, guardians, neighbors, teachers, community program staff, and, of course, our elected officials.

Furthermore, community does not just include those living on the neighborhood block. In Illinois, our community includes children from Rockford in northern Illinois to Cairo in southern Illinois, from Quincy on our western border to Danville on our eastern border, and from large cities such as Chicago to small communities such as Valley City in Pike County (population 14 according to the 2020 census). It is our responsibility to see that each child in the state has the necessary health, educational, and economic resources to thrive.

To the last point, I am happy to report the 2024 Illinois spring legislative session ended with the creation of a state Child Tax Credit. This was a measure Children’s Advocates for Change and others worked hard on during the session. It will provided needed economic support to hundreds of thousands of Illinois households. More information about the credit’s structure is listed below.

In addition, the approved Fiscal Year 2025 (FY25) state budget continues to make additional investments in pre-school education and the K-12 system as well as Department of Children and Family Services staff. These were important steps in a difficult budget environment. Yet, the work continues.

Not only are there areas of the state still in need of quality early childhood programs, but the state needs to improve the level of access to those programs.

We need to get additional economic support to extremely low-income families to break the cycle of poverty.

While more than 96% of Illinois children have health insurance, access to health care services is still an issue for many families. Work is underway on the certification process for community health workers. The state needs to ensure there are robust community and public health care systems to mitigate any health issues children may face growing up.

Of course, it takes money but the rate of return is well worth it. The state enacted a series of revenue measures and fund transfers to put together the revenue for the FY25 budget. However, moving forward, with the items noted above as well as other issues such as transit funding, it’s important to take a hard look at the state’s income tax rates as well as sales tax structure and untaxed services.

It will be a busy time, and I welcome you to join us in our advocacy efforts. We have a responsibility to all the children in this state. With your resolve and determination, we can improve our statewide community with our attention to our children and their needs.

Tax Credit

As noted above, the state legislature approved a new state Child Tax Credit in the final days of the spring legislative session. This is a measure Children’s Advocates for Change (CAFC) has worked on for several years. As part of this year’s effort, we worked with a coalition of 50 organizations from across the state. Illinois now joins 14 other states with such a credit.

The credit will be effective for the current tax year (on taxes due next year), available to taxpayers who qualify for the state Earned Income Tax Credit, and have at least one qualifying child (as defined by the Internal Revenue Service) under the age of 12. The state Earned Income Tax Credit (EITC) is equal to 20% of the federal EITC.

The Illinois Department of Revenue estimates approximately 374,000 Illinois taxpayers that claimed the state EITC had at least one dependent under the age of 12. (The credit is per taxpayer not per child.)

For the tax year beginning on January 1, 2024, the credit will be equal to 20% of the value of the taxpayer’s available Illinois EITC.

For the tax year beginning on January 1, 2025, and each year thereafter, the credit will be equal to 40% of the value of the taxpayer’s available Illinois EITC.

The credit is refundable. If the amount of the credit exceeds the taxpayer’s income tax liability for the year, the state will refund the excess amount to the taxpayer. The actual credit amount received by a taxpayer will vary depending on the household income and number of children in the household.

As I noted in a

<[link removed]>

statement I released along with the President of Family Focus, the credit is ultimately built on the structure of the federal tax credit that is designed in a fashion that gets to the maximum credit level only after a taxpayer reaches an income level of approximately $11,750 for a single tax filer with one child and $16,500 for married filing jointly taxpayers with three or more children. Therefore, work remains to provide greater assistance to those below these income thresholds.

The state estimates the total value of child tax credits taken by all taxpayers for the current tax year will be $50 million and $100 million dollars in Tax Year 2025. We have more about the

<[link removed]>

credit on our website.

Fiscal Year 2025 Budget

A new budget for Illinois’ FY25 (which runs from July 1, 2024 to June 30, 2025) is in place after several votes in the Illinois House to secure additional revenue of approximately $1 billion to fund it.

Early Childhood

The budget contains an additional $75 million for the state’s early childhood block grant program. This amount is one element of the second year of the Governor’s Smart Start Program to improve the state’s early childhood education and care system. There is also:

$5 million to expand the home visiting program run by the Department of Human Services

a $36.5 million increase to the Child Care Assistance Program to handle an anticipated caseload increase

an additional $6 million for the early intervention services

$110 million for early childhood workforce compensation contracts (which includes staff wage increases) and

$14 million for start-up costs related to a new Department of Early Childhood. While it will be two years before transferring certain programs from the State Board of Education, Department of Human Services, and Department of Children and Family Services to the new agency, this funding allows the state to hire an initial staff, open office space, and hire consultants to help with the planning for that effort.

K12, Higher Education, and DCFS

The budget appropriates an additional $350 million for the K-12 evidence-based school funding formula and $45 million for the second year of a three-year pilot to fill teacher vacancies. The state’s public universities received an average increase of about 2% for operations. The budget also contains funding for an additional 392 staff positions.

You can read more in our

<[link removed]>

review of the new state budget on our blog.

Child Poverty Forum

CAFC is planning a policy forum on child poverty for this fall. The event will be held on September 10th in East St. Louis where the child poverty rate is an estimated 48%. We will be convening national, state, and local leaders to examine the data and discuss the best next steps forward.

The event will feature a “fireside” conversation between myself and the President of the Children’s Defense Fund, Rev. Dr. Starsky Wilson. Along with community input, there will also be panel discussions on health, education, and public policies to address poverty within the community and our state. The President of Family Focus, Dara Munson, will be joining us as one of our panel moderators. Keep an eye on our website for more information about registration.

Source: 2022 American Community Survey Five Year Estimates

Teen Advocacy Training

We continued our Youth Public Policy Leadership Committee Program this spring. Over the course of several weeks, we trained 35 students at Christ the King Jesuit College Prep in Chicago’s Austin neighborhood in communications and advocacy skills.

Very often the best advocates for policy issues impacting our youth are the youth themselves. In the final training session, Cook County Clerk Cedric Giles, representatives of his office, and other policymakers joined me in listening to student presentations and evaluating them. You can watch a video with photos of the event

<[link removed]>

here.

Join Us!

As you can see, we have been busy during the first half of the year and accomplished a great deal. However, there is more work ahead to see that we provide every Illinois child with the needed resources to thrive.

Join us in our efforts to secure those resources. Make a contribution today to Children’s Advocates for Change to help fund our research and advocacy work. Just go to our website,

<[link removed]>

[link removed] to make your donation. You can also scan the QR code on this page that will take you right to our site. Thank you!

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

© Children’s Advocates for Change 2024. All rights reserved.

Our mailing address is:

c/o Impact House 200 W. Madison Street, Suite 300 Chicago, IL 60606

<[link removed]>

Unsubscribe |

<[link removed]>

Manage Subscriptions

<[link removed]>

Message Analysis

- Sender: Children’s Advocates for Change

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailJet