| From | American Energy Alliance <[email protected]> |

| Subject | Divine Intervention |

| Date | July 15, 2024 2:47 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 07/15/2024

Subscribe Now ([link removed])

** Fight on.

------------------------------------------------------------

Washington Examiner ([link removed]) (7/15/24) reports: "The risk of political division at this week’s GOP convention is fading in the wake of the attempted assassination of Donald Trump on Saturday. Moments before the former president was shot at, with one bullet grazing his ear, Trump declared to a crowd of rallygoers that his nomination would be a moment of unity for the party...The party has largely coalesced around Trump since he clinched the delegates needed to secure the nomination in March, with even former foes making amends and getting behind his campaign. But the gravity of the shooting, which immediately drew parallels to the failed attempt to assassinate Ronald Reagan in 1981, will tower over the confab, energizing a base of supporters who already believed Trump to be a martyr for the conservative cause before Saturday’s events."

[link removed]

** "Thank you to everyone for your thoughts and prayers yesterday, as it was God alone who prevented the unthinkable from happening. We will FEAR NOT, but instead remain resilient in our Faith and Defiant in the face of Wickedness. Our love goes out to the other victims and their families. We pray for the recovery of those who were wounded, and hold in our hearts the memory of the citizen who was so horribly killed. In this moment, it is more important than ever that we stand United, and show our True Character as Americans, remaining Strong and Determined, and not allowing Evil to Win. I truly love our Country, and love you all, and look forward to speaking to our Great Nation this week from Wisconsin."

------------------------------------------------------------

– ([link removed]) Donald J. Trump ([link removed])

============================================================

Even the Chinese are getting burned by the ESG cult.

** Bloomberg ([link removed])

( 7/15/24) reports: "China’s property downturn is weighing on yet another corner of financial markets: ESG-labeled securitized debt. Chinese developers are issuing far fewer securities tied to climate or social objectives, resulting in only $2.8 billion being raised in Asia Pacific in the first half, data compiled by Bloomberg Intelligence show. That’s an 86% drop from a year earlier, and bucks a trend in both the US and the Europe, the Middle East and Africa region, which saw increases. “This is definitely a bit of a setback,” after large issuance in Asia in 2022 and 2023, said Trevor Allen, head of sustainability research at BNP Paribas SA. As the housing market has cooled in China, there have been fewer loans to roll up into green securitizations, he added...There have also been no sales by Chinese developers of commercial mortgage-backed securities with an ESG label in 2024, compared with a combined $4.3 billion over the past two years, BI data show. Chinese developers have typically

used the funding for energy-efficient commercial or residential buildings, although doubts have been raised about whether those projects end up being genuinely climate-friendly."

Lou is brining the heat to Secretary Jenny.

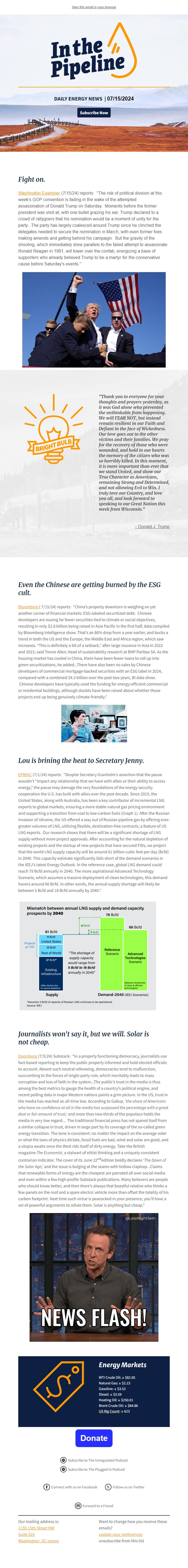

** EPRINC ([link removed])

(7/1/24) reports: "Despite Secretary Granholm’s assertion that the pause wouldn’t “impact any relationship that we have with allies or their ability to access energy,” the pause may damage the very foundations of the energy security cooperation the U.S. has built with allies over the past decade. Since 2015, the United States, along with Australia, has been a key contributor of incremental LNG exports to global markets, ensuring a more stable natural gas pricing environment and supporting a transition from coal to low-carbon fuels (Graph 1). After the Russian invasion of Ukraine, the US offered a way out of Russian pipeline gas by offering ever-greater volumes of LNG, utilizing flexible, destination-free contracts, a feature of US LNG exports. Our research shows that there will be a significant shortage of LNG supply without more project approvals. After accounting for the natural depletion of existing projects and the startup of new projects that have secured FIDs, we project that the

world LNG supply capacity will be around 61 billion cubic feet per day (Bcfd) in 2040. This capacity estimate significantly falls short of the demand scenarios in the IEEJ’s latest Energy Outlook. In the reference case, global LNG demand could reach 79 Bcfd annually in 2040. The more aspirational Advanced Technology Scenario, which assumes a massive deployment of clean technologies, this demand hovers around 66 Bcfd. In other words, the annual supply shortage will likely be between 5 Bcfd and 18 Bcfd annually by 2040."

Journalists won't say it, but we will. Solar is not cheap.

** Doomberg ([link removed])

(7/5/24) Substack: "In a properly functioning democracy, journalists use fact-based reporting to keep the public properly informed and hold elected officials to account. Absent such neutral refereeing, democracies tend to malfunction, succumbing to the forces of single-party rule, which inevitably leads to mass corruption and loss of faith in the system...The public’s trust in the media is thus among the best metrics to gauge the health of a country’s political engine, and recent polling data in major Western nations paints a grim picture. In the US, trust in the media has reached an all-time low. According to Gallup, 'the share of Americans who have no confidence at all in the media has surpassed the percentage with a great deal or fair amount of trust,' and more than two-thirds of the populace holds the media in very low regard... The traditional financial press has not spared itself from a similar collapse in trust, driven in large part by its coverage of the so-called green energy

transition. The tone is consistent: no matter the impact on the average voter or what the laws of physics dictate, fossil fuels are bad, wind and solar are good, and a utopia awaits once the West rids itself of dirty energy. Take the British magazine The Economist, a stalwart of elitist thinking and a uniquely consistent contrarian indicator. The cover of its June 22^ndedition boldly declares 'The Dawn of the Solar Age,' and the issue is bulging at the seams with hollow claptrap...Claims that renewable forms of energy are the cheapest are parroted all over social media and even within a few high-profile Substack publications. Many believers are people who should know better, and then there’s always that boastful relative who thinks a few panels on the roof and a spare electric vehicle more than offset the totality of his carbon footprint. Next time such virtue is peacocked in your presence, you’ll have a set of powerful arguments to refute them. Solar is anything but cheap."

Energy Markets

WTI Crude Oil: ↓ $82.05

Natural Gas: ↓ $2.23

Gasoline: ↓ $3.52

Diesel: ↓ $3.59

Heating Oil: ↓ $250.01

Brent Crude Oil: ↓ $84.86

** US Rig Count ([link removed])

: ↓ 623

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

DAILY ENERGY NEWS | 07/15/2024

Subscribe Now ([link removed])

** Fight on.

------------------------------------------------------------

Washington Examiner ([link removed]) (7/15/24) reports: "The risk of political division at this week’s GOP convention is fading in the wake of the attempted assassination of Donald Trump on Saturday. Moments before the former president was shot at, with one bullet grazing his ear, Trump declared to a crowd of rallygoers that his nomination would be a moment of unity for the party...The party has largely coalesced around Trump since he clinched the delegates needed to secure the nomination in March, with even former foes making amends and getting behind his campaign. But the gravity of the shooting, which immediately drew parallels to the failed attempt to assassinate Ronald Reagan in 1981, will tower over the confab, energizing a base of supporters who already believed Trump to be a martyr for the conservative cause before Saturday’s events."

[link removed]

** "Thank you to everyone for your thoughts and prayers yesterday, as it was God alone who prevented the unthinkable from happening. We will FEAR NOT, but instead remain resilient in our Faith and Defiant in the face of Wickedness. Our love goes out to the other victims and their families. We pray for the recovery of those who were wounded, and hold in our hearts the memory of the citizen who was so horribly killed. In this moment, it is more important than ever that we stand United, and show our True Character as Americans, remaining Strong and Determined, and not allowing Evil to Win. I truly love our Country, and love you all, and look forward to speaking to our Great Nation this week from Wisconsin."

------------------------------------------------------------

– ([link removed]) Donald J. Trump ([link removed])

============================================================

Even the Chinese are getting burned by the ESG cult.

** Bloomberg ([link removed])

( 7/15/24) reports: "China’s property downturn is weighing on yet another corner of financial markets: ESG-labeled securitized debt. Chinese developers are issuing far fewer securities tied to climate or social objectives, resulting in only $2.8 billion being raised in Asia Pacific in the first half, data compiled by Bloomberg Intelligence show. That’s an 86% drop from a year earlier, and bucks a trend in both the US and the Europe, the Middle East and Africa region, which saw increases. “This is definitely a bit of a setback,” after large issuance in Asia in 2022 and 2023, said Trevor Allen, head of sustainability research at BNP Paribas SA. As the housing market has cooled in China, there have been fewer loans to roll up into green securitizations, he added...There have also been no sales by Chinese developers of commercial mortgage-backed securities with an ESG label in 2024, compared with a combined $4.3 billion over the past two years, BI data show. Chinese developers have typically

used the funding for energy-efficient commercial or residential buildings, although doubts have been raised about whether those projects end up being genuinely climate-friendly."

Lou is brining the heat to Secretary Jenny.

** EPRINC ([link removed])

(7/1/24) reports: "Despite Secretary Granholm’s assertion that the pause wouldn’t “impact any relationship that we have with allies or their ability to access energy,” the pause may damage the very foundations of the energy security cooperation the U.S. has built with allies over the past decade. Since 2015, the United States, along with Australia, has been a key contributor of incremental LNG exports to global markets, ensuring a more stable natural gas pricing environment and supporting a transition from coal to low-carbon fuels (Graph 1). After the Russian invasion of Ukraine, the US offered a way out of Russian pipeline gas by offering ever-greater volumes of LNG, utilizing flexible, destination-free contracts, a feature of US LNG exports. Our research shows that there will be a significant shortage of LNG supply without more project approvals. After accounting for the natural depletion of existing projects and the startup of new projects that have secured FIDs, we project that the

world LNG supply capacity will be around 61 billion cubic feet per day (Bcfd) in 2040. This capacity estimate significantly falls short of the demand scenarios in the IEEJ’s latest Energy Outlook. In the reference case, global LNG demand could reach 79 Bcfd annually in 2040. The more aspirational Advanced Technology Scenario, which assumes a massive deployment of clean technologies, this demand hovers around 66 Bcfd. In other words, the annual supply shortage will likely be between 5 Bcfd and 18 Bcfd annually by 2040."

Journalists won't say it, but we will. Solar is not cheap.

** Doomberg ([link removed])

(7/5/24) Substack: "In a properly functioning democracy, journalists use fact-based reporting to keep the public properly informed and hold elected officials to account. Absent such neutral refereeing, democracies tend to malfunction, succumbing to the forces of single-party rule, which inevitably leads to mass corruption and loss of faith in the system...The public’s trust in the media is thus among the best metrics to gauge the health of a country’s political engine, and recent polling data in major Western nations paints a grim picture. In the US, trust in the media has reached an all-time low. According to Gallup, 'the share of Americans who have no confidence at all in the media has surpassed the percentage with a great deal or fair amount of trust,' and more than two-thirds of the populace holds the media in very low regard... The traditional financial press has not spared itself from a similar collapse in trust, driven in large part by its coverage of the so-called green energy

transition. The tone is consistent: no matter the impact on the average voter or what the laws of physics dictate, fossil fuels are bad, wind and solar are good, and a utopia awaits once the West rids itself of dirty energy. Take the British magazine The Economist, a stalwart of elitist thinking and a uniquely consistent contrarian indicator. The cover of its June 22^ndedition boldly declares 'The Dawn of the Solar Age,' and the issue is bulging at the seams with hollow claptrap...Claims that renewable forms of energy are the cheapest are parroted all over social media and even within a few high-profile Substack publications. Many believers are people who should know better, and then there’s always that boastful relative who thinks a few panels on the roof and a spare electric vehicle more than offset the totality of his carbon footprint. Next time such virtue is peacocked in your presence, you’ll have a set of powerful arguments to refute them. Solar is anything but cheap."

Energy Markets

WTI Crude Oil: ↓ $82.05

Natural Gas: ↓ $2.23

Gasoline: ↓ $3.52

Diesel: ↓ $3.59

Heating Oil: ↓ $250.01

Brent Crude Oil: ↓ $84.86

** US Rig Count ([link removed])

: ↓ 623

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 525 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp