Email

Why is the S&P Down?

| From | Irving Wilkinson <[email protected]> |

| Subject | Why is the S&P Down? |

| Date | July 11, 2024 4:42 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good afternoon,

Many of you probably don’t know, but I trade S&P 500 Futures, so I am always watching the market. A few people ask me what is going on with S&P 500, so I thought I would pass on a few notes.

As of writing this email, the stock market is showing mixed performance today, with the S&P 500 and Nasdaq Composite down while the Dow Jones Industrial Average is slightly up.

[Dow]([link removed])

39,747.99

26.63

0.07%

[S&P 500]([link removed])

5,584.89

-49.02

-0.87%

[Nasdaq]([link removed])

18,317.95

-329.50

-1.77%

[VIX]([link removed])

13.06

0.21

1.63%

[Gold]([link removed])

2,420.90

41.20

1.73%

[Oil]([link removed])

82.52

0.42

0.51%

View image: ([link removed])

Caption:

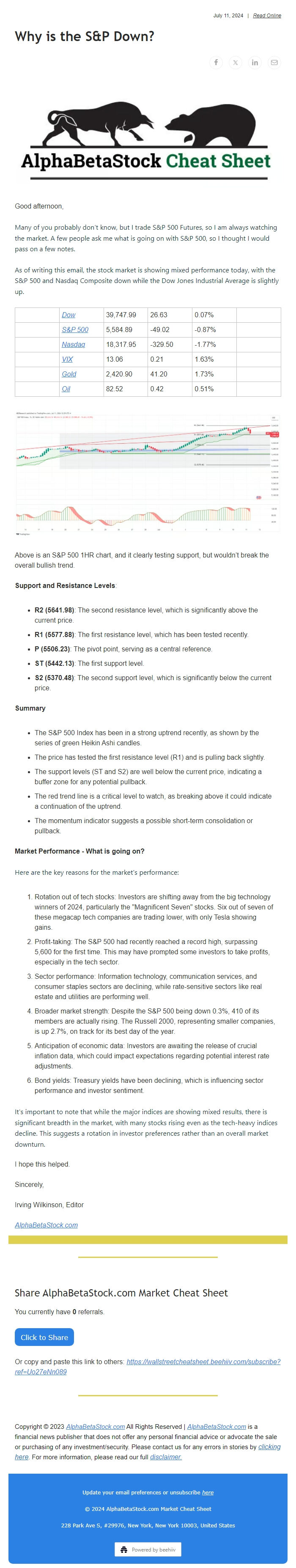

Above is an S&P 500 1HR chart, and it clearly testing support, but wouldn’t break the overall bullish trend.

**Support and Resistance Levels**:

* **R2 (5641.98)**: The second resistance level, which is significantly above the current price.

* **R1 (5577.88)**: The first resistance level, which has been tested recently.

* **P (5506.23)**: The pivot point, serving as a central reference.

* **ST (5442.13)**: The first support level.

* **S2 (5370.48)**: The second support level, which is significantly below the current price.

**Summary**

* The S&P 500 Index has been in a strong uptrend recently, as shown by the series of green Heikin Ashi candles.

* The price has tested the first resistance level (R1) and is pulling back slightly.

* The support levels (ST and S2) are well below the current price, indicating a buffer zone for any potential pullback.

* The red trend line is a critical level to watch, as breaking above it could indicate a continuation of the uptrend.

* The momentum indicator suggests a possible short-term consolidation or pullback.

**Market Performance - What is going on?**

Here are the key reasons for the market's performance:

1. Rotation out of tech stocks: Investors are shifting away from the big technology winners of 2024, particularly the "Magnificent Seven" stocks. Six out of seven of these megacap tech companies are trading lower, with only Tesla showing gains.

2. Profit-taking: The S&P 500 had recently reached a record high, surpassing 5,600 for the first time. This may have prompted some investors to take profits, especially in the tech sector.

3. Sector performance: Information technology, communication services, and consumer staples sectors are declining, while rate-sensitive sectors like real estate and utilities are performing well.

4. Broader market strength: Despite the S&P 500 being down 0.3%, 410 of its members are actually rising. The Russell 2000, representing smaller companies, is up 2.7%, on track for its best day of the year.

5. Anticipation of economic data: Investors are awaiting the release of crucial inflation data, which could impact expectations regarding potential interest rate adjustments.

6. Bond yields: Treasury yields have been declining, which is influencing sector performance and investor sentiment.

It's important to note that while the major indices are showing mixed results, there is significant breadth in the market, with many stocks rising even as the tech-heavy indices decline. This suggests a rotation in investor preferences rather than an overall market downturn.

I hope this helped.

Sincerely,

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

##

----------———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good afternoon,

Many of you probably don’t know, but I trade S&P 500 Futures, so I am always watching the market. A few people ask me what is going on with S&P 500, so I thought I would pass on a few notes.

As of writing this email, the stock market is showing mixed performance today, with the S&P 500 and Nasdaq Composite down while the Dow Jones Industrial Average is slightly up.

[Dow]([link removed])

39,747.99

26.63

0.07%

[S&P 500]([link removed])

5,584.89

-49.02

-0.87%

[Nasdaq]([link removed])

18,317.95

-329.50

-1.77%

[VIX]([link removed])

13.06

0.21

1.63%

[Gold]([link removed])

2,420.90

41.20

1.73%

[Oil]([link removed])

82.52

0.42

0.51%

View image: ([link removed])

Caption:

Above is an S&P 500 1HR chart, and it clearly testing support, but wouldn’t break the overall bullish trend.

**Support and Resistance Levels**:

* **R2 (5641.98)**: The second resistance level, which is significantly above the current price.

* **R1 (5577.88)**: The first resistance level, which has been tested recently.

* **P (5506.23)**: The pivot point, serving as a central reference.

* **ST (5442.13)**: The first support level.

* **S2 (5370.48)**: The second support level, which is significantly below the current price.

**Summary**

* The S&P 500 Index has been in a strong uptrend recently, as shown by the series of green Heikin Ashi candles.

* The price has tested the first resistance level (R1) and is pulling back slightly.

* The support levels (ST and S2) are well below the current price, indicating a buffer zone for any potential pullback.

* The red trend line is a critical level to watch, as breaking above it could indicate a continuation of the uptrend.

* The momentum indicator suggests a possible short-term consolidation or pullback.

**Market Performance - What is going on?**

Here are the key reasons for the market's performance:

1. Rotation out of tech stocks: Investors are shifting away from the big technology winners of 2024, particularly the "Magnificent Seven" stocks. Six out of seven of these megacap tech companies are trading lower, with only Tesla showing gains.

2. Profit-taking: The S&P 500 had recently reached a record high, surpassing 5,600 for the first time. This may have prompted some investors to take profits, especially in the tech sector.

3. Sector performance: Information technology, communication services, and consumer staples sectors are declining, while rate-sensitive sectors like real estate and utilities are performing well.

4. Broader market strength: Despite the S&P 500 being down 0.3%, 410 of its members are actually rising. The Russell 2000, representing smaller companies, is up 2.7%, on track for its best day of the year.

5. Anticipation of economic data: Investors are awaiting the release of crucial inflation data, which could impact expectations regarding potential interest rate adjustments.

6. Bond yields: Treasury yields have been declining, which is influencing sector performance and investor sentiment.

It's important to note that while the major indices are showing mixed results, there is significant breadth in the market, with many stocks rising even as the tech-heavy indices decline. This suggests a rotation in investor preferences rather than an overall market downturn.

I hope this helped.

Sincerely,

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

##

----------———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a