|

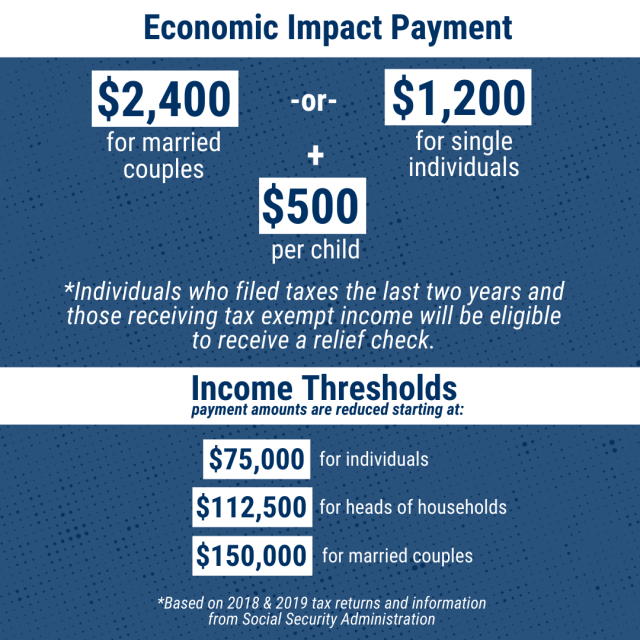

One of the many reasons I strongly supported the passage of the CARES Act is the direct payments it provides to North Carolinians who are going through a difficult time. Some North Carolinians have already received their payment this week through direct deposit if their account information is already on file with the IRS.

I want to make sure you have the information and resources available to you if you have questions about the direct payments.

The IRS has launched an updated site, including frequently asked questions, to help hardworking North Carolinians with their Economic Impact Payment. You can visit the website here.

Here are answers to some of the most frequently asked questions my office has been receiving:

Can I check the status of my direct payment?

If you filed your 2018 or 2019 tax return and have not yet received your direct payment, you can check the status of your Economic Impact Payment here.

If I didn’t file a tax return can I still receive a direct deposit?

If you are not required to file a 2018 or 2019 tax return, you can enter your payment information here for a direct deposit payment.

How will Social Security or Social Security-Disability recipients get their direct payments?

Anyone who receives a Social Security check or disability check will receive their payment consistent with how they already receive their check through direct deposit or a check in the mail. If you're a Social Security recipient who does not file a tax return, you do NOT need to take any action in order to receive your check. Click here to learn more.

What happens if there is an error with my direct payment?

The IRS plans to mail a letter to each taxpayer’s last known address within 15 days after the payment was made. The letter will contain information on how the amount was calculated, and it will include instructions on how to appeal if the amount was incorrect and how they can report a failure to receive a payment.

What kinds of scams should I be on the lookout for?

As North Carolinians begin receiving their Economic Impact Payment, expect to see an increase in coronavirus-related scams. If someone tells you they can get your check to you sooner, they are a lying and it is a scam. The IRS will not be asking anyone to send them their personal or financial information through emails, text messages, websites or social media. The one legitimate way to receive your payment faster is by visiting IRS.gov and using the Get My Payment portal to provide your direct deposit information. Click here to report scams to the IRS.

To continue my efforts to keep North Carolinians informed, I will be holding five more telephone town halls this upcoming week to discuss the response to coronavirus and efforts to protect the physical and economic health of North Carolinians.

You can live stream all telephone town halls here.

These times are subject to change so please follow my Facebook and Twitter account for updates.

Thank you for reading, and as always please reach out to my office if you have any questions or need help with a federal agency and please stay safe.

All the best,

|