| From | Fraser Institute <[email protected]> |

| Subject | Youth employment, Urban population density, and BC's sales tax |

| Date | June 29, 2024 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

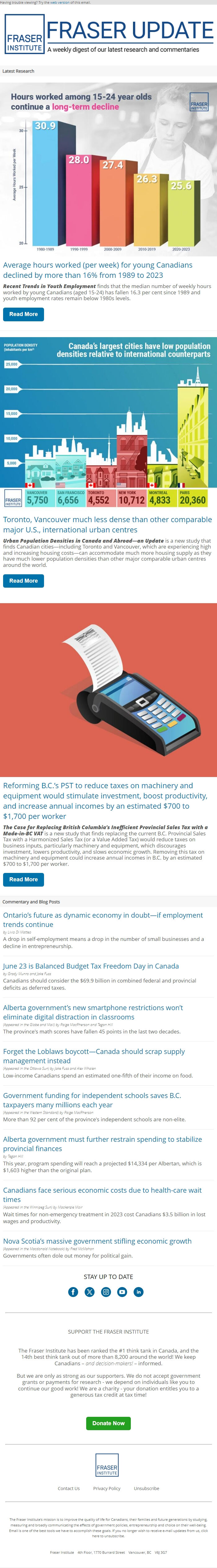

Having trouble viewing? Try the web version [link removed] of this email. Latest Research Average hours worked (per week) for young Canadians declined by more than 16% from 1989 to 2023 [[link removed]]

Recent Trends in Youth Employment finds that the median number of weekly hours worked by young Canadians (aged 15-24) has fallen 16.3 per cent since 1989 and youth employment rates remain below 1980s levels.

Read More [[link removed]] Toronto, Vancouver much less dense than other comparable major U.S., international urban centres [[link removed]]

Urban Population Densities in Canada and Abroad—an Update is a new study that finds Canadian cities—including Toronto and Vancouver, which are experiencing high and increasing housing costs—can accommodate much more housing supply as they have much lower population densities than other major comparable urban centres around the world.

Read More [[link removed]] [[link removed]] Reforming B.C.’s PST to reduce taxes on machinery and equipment would stimulate investment, boost productivity, and increase annual incomes by an estimated $700 to $1,700 per worker [[link removed]]

The Case for Replacing British Columbia’s Inefficient Provincial Sales Tax with a Made-in-BC VAT is a new study that finds replacing the current B.C. Provincial Sales Tax with a Harmonized Sales Tax (or a Value Added Tax) would reduce taxes on business inputs, particularly machinery and equipment, which discourages investment, lowers productivity, and slows economic growth. Removing this tax on machinery and equipment could increase annual incomes in B.C. by an estimated $700 to $1,700 per worker.

Read More [[link removed]] Commentary and Blog Posts Ontario’s future as dynamic economy in doubt—if employment trends continue [[link removed]] by Livio Di Matteo

A drop in self-employment means a drop in the number of small businesses and a decline in entrepreneurship.

June 23 is Balanced Budget Tax Freedom Day in Canada [[link removed]] by Grady Munro and Jake Fuss

Canadians should consider the $69.9 billion in combined federal and provincial deficits as deferred taxes.

Alberta government’s new smartphone restrictions won’t eliminate digital distraction in classrooms [[link removed]] (Appeared in the Globe and Mail) by Paige MacPherson and Tegan Hill

The province's math scores have fallen 45 points in the last two decades.

Forget the Loblaws boycott—Canada should scrap supply management instead [[link removed]] (Appeared in the Ottawa Sun) by Jake Fuss and Alex Whalen

Low-income Canadians spend an estimated one-fifth of their income on food.

Government funding for independent schools saves B.C. taxpayers many millions each year [[link removed]] (Appeared in the Western Standard) by Paige MacPherson

More than 92 per cent of the province's independent schools are non-elite.

Alberta government must further restrain spending to stabilize provincial finances [[link removed]] by Tegan Hill

This year, program spending will reach a projected $14,334 per Albertan, which is $1,603 higher than the original plan.

Canadians face serious economic costs due to health-care wait times [[link removed]] (Appeared in the Winnipeg Sun) by Mackenzie Moir

Wait times for non-emergency treatment in 2023 cost Canadians $3.5 billion in lost wages and productivity.

Nova Scotia’s massive government stifling economic growth [[link removed]] (Appeared in the Macdonald Notebook) by Fred McMahon

Governments often dole out money for political gain.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Recent Trends in Youth Employment finds that the median number of weekly hours worked by young Canadians (aged 15-24) has fallen 16.3 per cent since 1989 and youth employment rates remain below 1980s levels.

Read More [[link removed]] Toronto, Vancouver much less dense than other comparable major U.S., international urban centres [[link removed]]

Urban Population Densities in Canada and Abroad—an Update is a new study that finds Canadian cities—including Toronto and Vancouver, which are experiencing high and increasing housing costs—can accommodate much more housing supply as they have much lower population densities than other major comparable urban centres around the world.

Read More [[link removed]] [[link removed]] Reforming B.C.’s PST to reduce taxes on machinery and equipment would stimulate investment, boost productivity, and increase annual incomes by an estimated $700 to $1,700 per worker [[link removed]]

The Case for Replacing British Columbia’s Inefficient Provincial Sales Tax with a Made-in-BC VAT is a new study that finds replacing the current B.C. Provincial Sales Tax with a Harmonized Sales Tax (or a Value Added Tax) would reduce taxes on business inputs, particularly machinery and equipment, which discourages investment, lowers productivity, and slows economic growth. Removing this tax on machinery and equipment could increase annual incomes in B.C. by an estimated $700 to $1,700 per worker.

Read More [[link removed]] Commentary and Blog Posts Ontario’s future as dynamic economy in doubt—if employment trends continue [[link removed]] by Livio Di Matteo

A drop in self-employment means a drop in the number of small businesses and a decline in entrepreneurship.

June 23 is Balanced Budget Tax Freedom Day in Canada [[link removed]] by Grady Munro and Jake Fuss

Canadians should consider the $69.9 billion in combined federal and provincial deficits as deferred taxes.

Alberta government’s new smartphone restrictions won’t eliminate digital distraction in classrooms [[link removed]] (Appeared in the Globe and Mail) by Paige MacPherson and Tegan Hill

The province's math scores have fallen 45 points in the last two decades.

Forget the Loblaws boycott—Canada should scrap supply management instead [[link removed]] (Appeared in the Ottawa Sun) by Jake Fuss and Alex Whalen

Low-income Canadians spend an estimated one-fifth of their income on food.

Government funding for independent schools saves B.C. taxpayers many millions each year [[link removed]] (Appeared in the Western Standard) by Paige MacPherson

More than 92 per cent of the province's independent schools are non-elite.

Alberta government must further restrain spending to stabilize provincial finances [[link removed]] by Tegan Hill

This year, program spending will reach a projected $14,334 per Albertan, which is $1,603 higher than the original plan.

Canadians face serious economic costs due to health-care wait times [[link removed]] (Appeared in the Winnipeg Sun) by Mackenzie Moir

Wait times for non-emergency treatment in 2023 cost Canadians $3.5 billion in lost wages and productivity.

Nova Scotia’s massive government stifling economic growth [[link removed]] (Appeared in the Macdonald Notebook) by Fred McMahon

Governments often dole out money for political gain.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor