Email

Special Report: Analyzing High Earner Migration and its Impact on State Revenue

| From | Center for Jobs and the Economy <[email protected]> |

| Subject | Special Report: Analyzing High Earner Migration and its Impact on State Revenue |

| Date | June 28, 2024 12:03 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed]

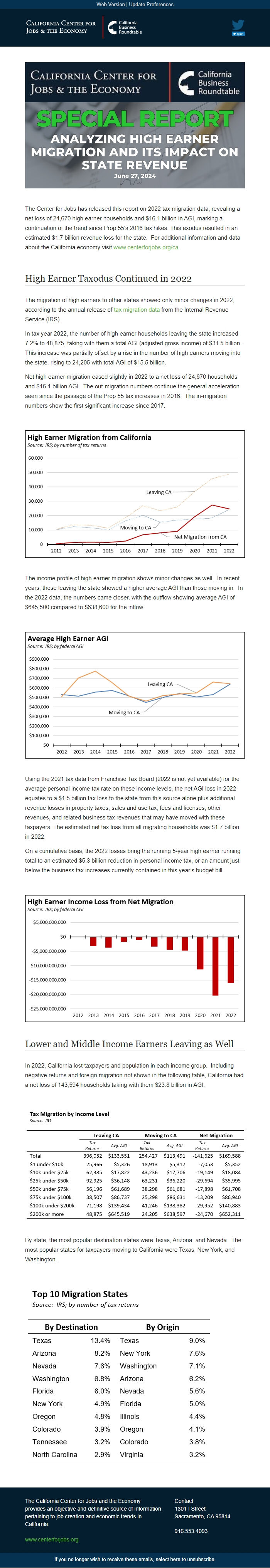

The Center for Jobs has released this report on 2022 tax migration data, revealing a net loss of 24,670 high earner households and $16.1 billion in AGI, marking a continuation of the trend since Prop 55's 2016 tax hikes. This exodus resulted in an estimated $1.7 billion revenue loss for the state. For additional information and data about the California economy visit www.centerforjobs.org/ca [[link removed]].

High Earner Taxodus Continued in 2022

The migration of high earners to other states showed only minor changes in 2022, according to the annual release of tax migration data [[link removed]] from the Internal Revenue Service (IRS).

In tax year 2022, the number of high earner households leaving the state increased 7.2% to 48,875, taking with them a total AGI (adjusted gross income) of $31.5 billion. This increase was partially offset by a rise in the number of high earners moving into the state, rising to 24,205 with total AGI of $15.5 billion.

Net high earner migration eased slightly in 2022 to a net loss of 24,670 households and $16.1 billion AGI. The out-migration numbers continue the general acceleration seen since the passage of the Prop 55 tax increases in 2016. The in-migration numbers show the first significant increase since 2017.

The income profile of high earner migration shows minor changes as well. In recent years, those leaving the state showed a higher average AGI than those moving in. In the 2022 data, the numbers came closer, with the outflow showing average AGI of $645,500 compared to $638,600 for the inflow.

Using the 2021 tax data from Franchise Tax Board (2022 is not yet available) for the average personal income tax rate on these income levels, the net AGI loss in 2022 equates to a $1.5 billion tax loss to the state from this source alone plus additional revenue losses in property taxes, sales and use tax, fees and licenses, other revenues, and related business tax revenues that may have moved with these taxpayers. The estimated net tax loss from all migrating households was $1.7 billion in 2022.

On a cumulative basis, the 2022 losses bring the running 5-year high earner running total to an estimated $5.3 billion reduction in personal income tax, or an amount just below the business tax increases currently contained in this year’s budget bill.

Lower and Middle Income Earners Leaving as Well

In 2022, California lost taxpayers and population in each income group. Including negative returns and foreign migration not shown in the following table, California had a net loss of 143,594 households taking with them $23.8 billion in AGI.

By state, the most popular destination states were Texas, Arizona, and Nevada. The most popular states for taxpayers moving to California were Texas, New York, and Washington.

The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

The Center for Jobs has released this report on 2022 tax migration data, revealing a net loss of 24,670 high earner households and $16.1 billion in AGI, marking a continuation of the trend since Prop 55's 2016 tax hikes. This exodus resulted in an estimated $1.7 billion revenue loss for the state. For additional information and data about the California economy visit www.centerforjobs.org/ca [[link removed]].

High Earner Taxodus Continued in 2022

The migration of high earners to other states showed only minor changes in 2022, according to the annual release of tax migration data [[link removed]] from the Internal Revenue Service (IRS).

In tax year 2022, the number of high earner households leaving the state increased 7.2% to 48,875, taking with them a total AGI (adjusted gross income) of $31.5 billion. This increase was partially offset by a rise in the number of high earners moving into the state, rising to 24,205 with total AGI of $15.5 billion.

Net high earner migration eased slightly in 2022 to a net loss of 24,670 households and $16.1 billion AGI. The out-migration numbers continue the general acceleration seen since the passage of the Prop 55 tax increases in 2016. The in-migration numbers show the first significant increase since 2017.

The income profile of high earner migration shows minor changes as well. In recent years, those leaving the state showed a higher average AGI than those moving in. In the 2022 data, the numbers came closer, with the outflow showing average AGI of $645,500 compared to $638,600 for the inflow.

Using the 2021 tax data from Franchise Tax Board (2022 is not yet available) for the average personal income tax rate on these income levels, the net AGI loss in 2022 equates to a $1.5 billion tax loss to the state from this source alone plus additional revenue losses in property taxes, sales and use tax, fees and licenses, other revenues, and related business tax revenues that may have moved with these taxpayers. The estimated net tax loss from all migrating households was $1.7 billion in 2022.

On a cumulative basis, the 2022 losses bring the running 5-year high earner running total to an estimated $5.3 billion reduction in personal income tax, or an amount just below the business tax increases currently contained in this year’s budget bill.

Lower and Middle Income Earners Leaving as Well

In 2022, California lost taxpayers and population in each income group. Including negative returns and foreign migration not shown in the following table, California had a net loss of 143,594 households taking with them $23.8 billion in AGI.

By state, the most popular destination states were Texas, Arizona, and Nevada. The most popular states for taxpayers moving to California were Texas, New York, and Washington.

The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor