|

John,

Republicans are once again attacking the IRS in ways that benefit wealthy and corporate tax cheats at the expense of working Americans. Last week, the House Appropriations Committee voted to slash over $2 billion from the IRS's enforcement budget. This shortsighted move will make it easier for millionaires, billionaires, and large companies to cheat on their taxes and avoid paying what they owe.

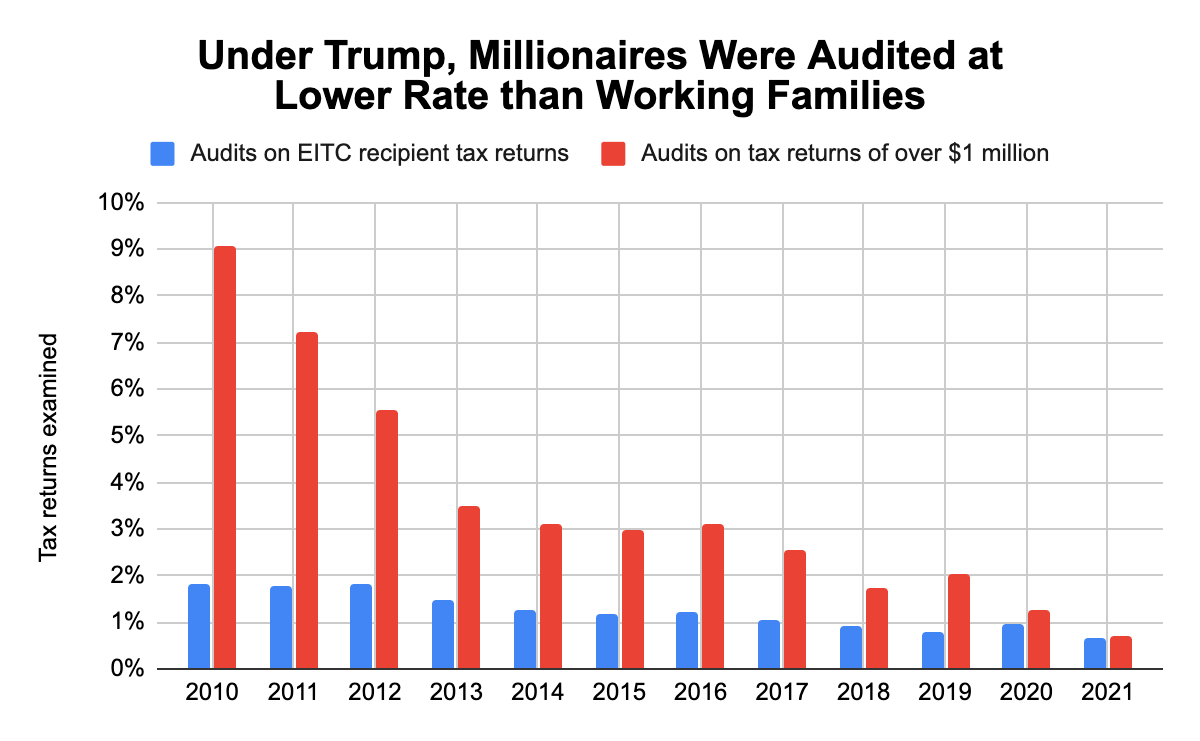

Defunding IRS enforcement overwhelmingly benefits the wealthiest Americans. In fact, under the Trump administration, millionaires were audited at a lower rate than lower-income working families receiving the Earned Income Tax Credit (EITC). Just look at this chart, which shows that as IRS funding eroded, so did enforcement of wealthy taxpayers:

At the same time, Republicans are now trying to block the IRS from implementing the Direct File program nationwide. Direct File would allow more Americans to file their taxes for free directly with the IRS, rather than being forced to use expensive private tax prep services like TurboTax and H&R Block.

By attempting to defund the IRS and stop Direct File, Republicans are protecting their wealthy tax-cheat donors and handing a massive financial gift to the tax-prep industry―while imposing unnecessary costs on working families.

Fight back against GOP efforts to defund tax enforcement and block Direct File. Make a contribution right now to power our campaign to protect the IRS from Republican sabotage.

These attacks on the IRS are nothing new for Republicans. For years, they have consistently worked to defund and undermine tax enforcement, allowing widespread cheating by wealthy taxpayers and corporations.

A well-funded IRS that can properly enforce the tax code is critical for a fairer economy that works for all Americans, not the privileged few.

When everyone, including the wealthy and corporations, pays what they rightfully owe in taxes, we can lower costs for working people on essentials like healthcare, childcare, nutrition, housing, and more.

Fight back against GOP efforts to defund tax enforcement and block Direct File. Make a donation right now to power our advocacy ensuring the wealthy pay what they owe and that working families can access free tax filing.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we can build an economy that puts people’s needs over corporate profits.

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

-- David's email --

John,

Last week, the House Appropriations Committee voted to slash more than $2 billion from IRS enforcement and block the IRS from implementing Direct File nationwide. These moves are deliberate attacks on economic fairness, giving wealthy individuals and big corporations a green light to continue cheating on their taxes, while depriving honest taxpayers of a cheaper and quicker way to make their annual filings.

Direct File, a free and secure IRS initiative allowing taxpayers to file their taxes online directly with the IRS, was a rousing success in its pilot phase this year. With more than 140,000 taxpayers across 12 states saving millions of dollars in tax preparation fees thanks to the new system, it's clear that Direct File is a game-changer for everyday taxpayers.

Between 2010 and 2020, Republicans deliberately starved the IRS of resources, undermining its ability to hold the wealthiest taxpayers accountable. Now, in response to the historic $80 billion ten-year investment in the agency, secured by President Biden and congressional Democrats two years ago, congressional Republicans are trying to do it again. And their latest attempt would also block the nationwide implementation of Direct File, which would perpetuate the massive handout to corporate tax preparers like TurboTax and H&R Block.

In fiscal year 2023, one year after Congress made its historic investment in the IRS, the Treasury Department reported that it had collected $86 billion through tougher tax enforcement, amounting to a return on investment of about 7-1.[1] And that enhanced enforcement is focused exclusively on upper-income households and big businesses.[2] This is money that can be used to lower costs for working people on everything from healthcare to childcare to nutrition to housing, and more.

Fight back against Republican attacks on the IRS. Donate today to power our campaign to defend the IRS and defend the national implementation of Direct File.

When the IRS is adequately funded, it has the resources to crack down on wealthy and corporate tax cheats and better-serve the American people.

By defending the IRS and promoting the implementation of Direct File, we are standing up for a tax system that is fair and just for all, while fighting back against right-wing attempts to protect rich and powerful tax cheats at the expense of working people.

With your help, we’re ensuring the wealthiest Americans contribute to the public services that benefit us all. So let's keep working to ensure that the wealthy pay what they owe, and that the IRS has the resources it needs to administer a fair and effective tax system.

Donate now to power our campaign to protect the IRS from GOP attacks.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we can counter these attacks and fight for a tax system that works for everyone, not just the wealthy few.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] https://x.com/josephzeballos/status/1798179524267360623

[2] IRS to Increase Number of Audits, Focus on Wealthy Taxpayers and Large Businesses

|