Email

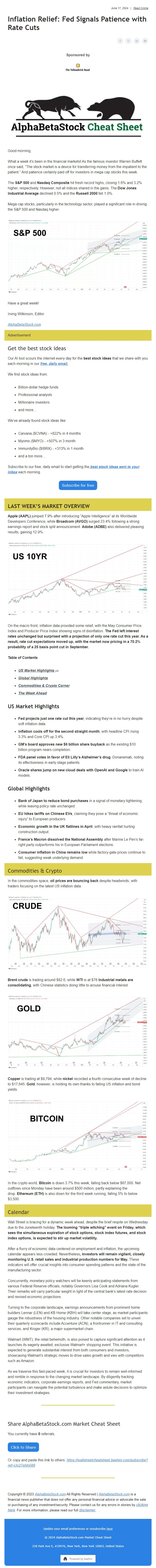

Inflation Relief: Fed Signals Patience with Rate Cuts

| From | Irving Wilkinson <[email protected]> |

| Subject | Inflation Relief: Fed Signals Patience with Rate Cuts |

| Date | June 17, 2024 2:27 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Follow image link: ([link removed])

Caption:

Good morning,

What a week it’s been in the financial markets! As the famous investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” And patience certainly paid off for investors in mega cap stocks this week.

The **S&P 500** and **Nasdaq Composite** hit fresh record highs, closing 1.6% and 3.2% higher, respectively. However, not all indices shared in the gains. The **Dow Jones Industrial Average** declined 0.5% and the **Russell 2000** fell 1.0%.

Mega cap stocks, particularly in the technology sector, played a significant role in driving the S&P 500 and Nasdaq higher.

View image: ([link removed])

Caption:

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

Advertisement

----------## Get the best stock ideas

Our AI tool scours the internet every day for the **best stock ideas **that we share with you each morning in our **[free, daily email.]([link removed])**

We find stock ideas from:

* Billion-dollar hedge funds

* Professional analysts

* Millionaire investors

* and more…

We’ve already found stock ideas like:

* Carvana ($CVNA) - +822% in 4 months

* Myomo ($MYO) - +507% in 3 month

* ImmunityBio ($IBRX) - +313% in 1 month

* and a ton more…

Subscribe to our free, daily email to start getting the[ ]([link removed])**[best stock ideas sent to your inbox]([link removed])** each morning.

Subscribe for free ([link removed])

----------

## **LAST WEEK’S MARKET OVERVIEW**

----------**Apple (AAPL)** jumped 7.9% after introducing “Apple Intelligence” at its Worldwide Developers Conference, while **Broadcom (AVGO)** surged 23.4% following a strong earnings report and stock split announcement. **Adobe (ADBE)** also delivered pleasing results, gaining 12.9%.

View image: ([link removed])

Caption:

On the macro front, inflation data provided some relief, with the May Consumer Price Index and Producer Price Index showing signs of disinflation. **The Fed left interest rates unchanged but surprised with a projection of only one rate cut this year. As a result, rate cut expectations moved up, with the market now pricing in a 70.2% probability of a 25 basis point cut in September.**

**Table of Contents**

* **[US Market Highlights ]([link removed])**🇺🇸

* **[Global Highlights]([link removed])**

* **[Commodities & Crypto Corner]([link removed])**

* **[The Week Ahead]([link removed])**

## **US Market Highlights**

* **Fed projects just one rate cut this year**, indicating they’re in no hurry despite soft inflation data.

* **Inflation cools off for the second straight month**, with headline CPI rising 3.3% and Core CPI up 3.4%.

* **GM’s board approves new $6 billion share buyback** as the existing $10 billion program nears completion.

* **FDA panel votes in favor of Eli Lilly’s Alzheimer’s drug**, Donanemab, noting its effectiveness in early-stage patients.

* **Oracle shares jump on new cloud deals with OpenAI and Google** to train AI models.

## **Global Highlights**

* **Bank of Japan to reduce bond purchases** in a signal of monetary tightening, while leaving policy rate unchanged.

* **EU hikes tariffs on Chinese EVs**, claiming they pose a “threat of economic injury” to European producers.

* **Economic growth in the UK flatlines in April**, with heavy rainfall hurting construction output.

* **France’s Macron dissolved the National Assembly** after Marine Le Pen’s far-right party outperforms his in European Parliament elections.

* **Consumer inflation in China remains low** while factory-gate prices continue to fall, suggesting weak underlying demand.

----------

## Commodities & Crypto

----------In the commodities space, **oil prices are bouncing back** despite headwinds, with traders focusing on the latest US inflation data.

View image: ([link removed])

Caption:

**Brent crude** is trading around $82.6, while **WTI** is at $78.**Industrial metals are consolidating**, with Chinese statistics doing little to arouse financial interest.

View image: ([link removed])

Caption:

**Copper** is trading at $9,794, while **nickel** recorded a fourth consecutive week of decline to $17,645. **Gold**, however, is holding its own thanks to falling US inflation and bond yields.

View image: ([link removed])

Caption:

In the crypto world, **Bitcoin** is down 3.7% this week, falling back below $67,000. Net outflows since Monday have been around $500 million, partly explaining the drop. **Ethereum (ETH)** is also down for the third week running, falling 5% to below $3,500.

----------

## Calendar

----------Wall Street is bracing for a dynamic week ahead, despite the brief respite on Wednesday due to the Juneteenth holiday. **The looming “triple witching” event on Friday, which sees the simultaneous expiration of stock options, stock index futures, and stock index options, is expected to stir up market volatility.**

After a flurry of economic data centered on employment and inflation, the upcoming calendar appears less crowded. Nevertheless**, investors will remain vigilant, closely monitoring U.S. retail sales and industrial production numbers for May.** These indicators will offer crucial insights into consumer spending patterns and the state of the manufacturing sector.

Concurrently, monetary policy watchers will be keenly anticipating statements from various Federal Reserve officials, notably Governors Lisa Cook and Adriana Kugler. Their remarks will carry particular weight in light of the central bank’s latest rate decision and revised economic projections.

Turning to the corporate landscape, earnings announcements from prominent home builders Lennar (LEN) and KB Home (KBH) will take center stage, as market participants gauge the robustness of the housing industry. Other notable companies set to unveil their quarterly scorecards include Accenture (ACN), a frontrunner in IT and consulting services, and Kroger (KR), a major supermarket chain.

Walmart (WMT), the retail behemoth, is also poised to capture significant attention as it launches its eagerly awaited, exclusive Walmart+ shopping event. This initiative is expected to generate substantial interest from both consumers and investors, showcasing Walmart’s strategic moves to drive sales growth and vies with competitors such as Amazon.

As we traverse this fast-paced week, it is crucial for investors to remain well-informed and nimble in response to the changing market landscape. By diligently tracking economic indicators, corporate earnings reports, and Fed commentary, market participants can navigate the potential turbulence and make astute decisions to optimize their investment strategies.

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Follow image link: ([link removed])

Caption:

Good morning,

What a week it’s been in the financial markets! As the famous investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” And patience certainly paid off for investors in mega cap stocks this week.

The **S&P 500** and **Nasdaq Composite** hit fresh record highs, closing 1.6% and 3.2% higher, respectively. However, not all indices shared in the gains. The **Dow Jones Industrial Average** declined 0.5% and the **Russell 2000** fell 1.0%.

Mega cap stocks, particularly in the technology sector, played a significant role in driving the S&P 500 and Nasdaq higher.

View image: ([link removed])

Caption:

Have a great week!

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

----------

Advertisement

----------## Get the best stock ideas

Our AI tool scours the internet every day for the **best stock ideas **that we share with you each morning in our **[free, daily email.]([link removed])**

We find stock ideas from:

* Billion-dollar hedge funds

* Professional analysts

* Millionaire investors

* and more…

We’ve already found stock ideas like:

* Carvana ($CVNA) - +822% in 4 months

* Myomo ($MYO) - +507% in 3 month

* ImmunityBio ($IBRX) - +313% in 1 month

* and a ton more…

Subscribe to our free, daily email to start getting the[ ]([link removed])**[best stock ideas sent to your inbox]([link removed])** each morning.

Subscribe for free ([link removed])

----------

## **LAST WEEK’S MARKET OVERVIEW**

----------**Apple (AAPL)** jumped 7.9% after introducing “Apple Intelligence” at its Worldwide Developers Conference, while **Broadcom (AVGO)** surged 23.4% following a strong earnings report and stock split announcement. **Adobe (ADBE)** also delivered pleasing results, gaining 12.9%.

View image: ([link removed])

Caption:

On the macro front, inflation data provided some relief, with the May Consumer Price Index and Producer Price Index showing signs of disinflation. **The Fed left interest rates unchanged but surprised with a projection of only one rate cut this year. As a result, rate cut expectations moved up, with the market now pricing in a 70.2% probability of a 25 basis point cut in September.**

**Table of Contents**

* **[US Market Highlights ]([link removed])**🇺🇸

* **[Global Highlights]([link removed])**

* **[Commodities & Crypto Corner]([link removed])**

* **[The Week Ahead]([link removed])**

## **US Market Highlights**

* **Fed projects just one rate cut this year**, indicating they’re in no hurry despite soft inflation data.

* **Inflation cools off for the second straight month**, with headline CPI rising 3.3% and Core CPI up 3.4%.

* **GM’s board approves new $6 billion share buyback** as the existing $10 billion program nears completion.

* **FDA panel votes in favor of Eli Lilly’s Alzheimer’s drug**, Donanemab, noting its effectiveness in early-stage patients.

* **Oracle shares jump on new cloud deals with OpenAI and Google** to train AI models.

## **Global Highlights**

* **Bank of Japan to reduce bond purchases** in a signal of monetary tightening, while leaving policy rate unchanged.

* **EU hikes tariffs on Chinese EVs**, claiming they pose a “threat of economic injury” to European producers.

* **Economic growth in the UK flatlines in April**, with heavy rainfall hurting construction output.

* **France’s Macron dissolved the National Assembly** after Marine Le Pen’s far-right party outperforms his in European Parliament elections.

* **Consumer inflation in China remains low** while factory-gate prices continue to fall, suggesting weak underlying demand.

----------

## Commodities & Crypto

----------In the commodities space, **oil prices are bouncing back** despite headwinds, with traders focusing on the latest US inflation data.

View image: ([link removed])

Caption:

**Brent crude** is trading around $82.6, while **WTI** is at $78.**Industrial metals are consolidating**, with Chinese statistics doing little to arouse financial interest.

View image: ([link removed])

Caption:

**Copper** is trading at $9,794, while **nickel** recorded a fourth consecutive week of decline to $17,645. **Gold**, however, is holding its own thanks to falling US inflation and bond yields.

View image: ([link removed])

Caption:

In the crypto world, **Bitcoin** is down 3.7% this week, falling back below $67,000. Net outflows since Monday have been around $500 million, partly explaining the drop. **Ethereum (ETH)** is also down for the third week running, falling 5% to below $3,500.

----------

## Calendar

----------Wall Street is bracing for a dynamic week ahead, despite the brief respite on Wednesday due to the Juneteenth holiday. **The looming “triple witching” event on Friday, which sees the simultaneous expiration of stock options, stock index futures, and stock index options, is expected to stir up market volatility.**

After a flurry of economic data centered on employment and inflation, the upcoming calendar appears less crowded. Nevertheless**, investors will remain vigilant, closely monitoring U.S. retail sales and industrial production numbers for May.** These indicators will offer crucial insights into consumer spending patterns and the state of the manufacturing sector.

Concurrently, monetary policy watchers will be keenly anticipating statements from various Federal Reserve officials, notably Governors Lisa Cook and Adriana Kugler. Their remarks will carry particular weight in light of the central bank’s latest rate decision and revised economic projections.

Turning to the corporate landscape, earnings announcements from prominent home builders Lennar (LEN) and KB Home (KBH) will take center stage, as market participants gauge the robustness of the housing industry. Other notable companies set to unveil their quarterly scorecards include Accenture (ACN), a frontrunner in IT and consulting services, and Kroger (KR), a major supermarket chain.

Walmart (WMT), the retail behemoth, is also poised to capture significant attention as it launches its eagerly awaited, exclusive Walmart+ shopping event. This initiative is expected to generate substantial interest from both consumers and investors, showcasing Walmart’s strategic moves to drive sales growth and vies with competitors such as Amazon.

As we traverse this fast-paced week, it is crucial for investors to remain well-informed and nimble in response to the changing market landscape. By diligently tracking economic indicators, corporate earnings reports, and Fed commentary, market participants can navigate the potential turbulence and make astute decisions to optimize their investment strategies.

———————————————————————————

Share AlphaBetaStock.com Market Cheat Sheet

You currently have <strong>0</strong> referrals.

Or copy and paste this link to others: [link removed]

———————————————————————————

Copyright © 2023 [AlphaBetaStock.com]([link removed]) All Rights Reserved | [AlphaBetaStock.com]([link removed]) is a financial news publisher that does not offer any personal financial advice or advocate the sale or purchasing of any investment/security. Please contact us for any errors in stories by [clicking here]([link removed]). For more information, please read our full [disclaimer.]([link removed])

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a